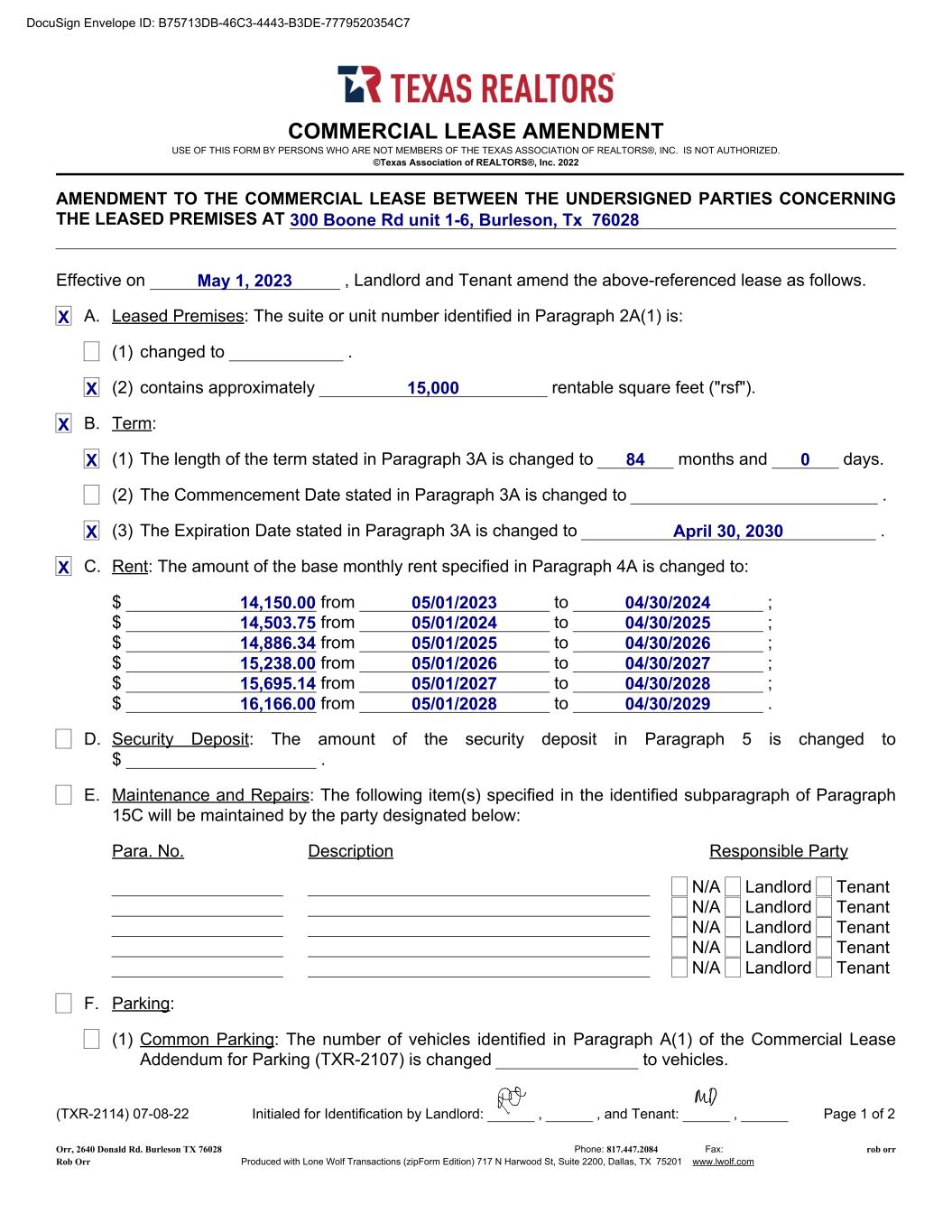

COMMERCIAL LEASE AMENDMENT USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2022 AMENDMENT TO THE COMMERCIAL LEASE BETWEEN THE UNDERSIGNED PARTIES CONCERNING THE LEASED PREMISES AT Effective on , Landlord and Tenant amend the above-referenced lease as follows. A. Leased Premises: The suite or unit number identified in Paragraph 2A(1) is: (1) changed to . (2) contains approximately rentable square feet ("rsf"). B. Term: (1) The length of the term stated in Paragraph 3A is changed to months and days. (2) The Commencement Date stated in Paragraph 3A is changed to . (3) The Expiration Date stated in Paragraph 3A is changed to . C. Rent: The amount of the base monthly rent specified in Paragraph 4A is changed to: $ from to ; $ from to ; $ from to ; $ from to ; $ from to ; $ from to . D. Security Deposit: The amount of the security deposit in Paragraph 5 is changed to $ . E. Maintenance and Repairs: The following item(s) specified in the identified subparagraph of Paragraph 15C will be maintained by the party designated below: Para. No. Description Responsible Party N/A Landlord Tenant N/A Landlord Tenant N/A Landlord Tenant N/A Landlord Tenant N/A Landlord Tenant F. Parking: (1) Common Parking: The number of vehicles identified in Paragraph A(1) of the Commercial Lease Addendum for Parking (TXR-2107) is changed to vehicles. (TXR-2114) 07-08-22 Initialed for Identification by Landlord: , , and Tenant: , Page 1 of 2 Phone: Fax: Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com 300 Boone Rd unit 1-6, Burleson, Tx 76028 May 1, 2023 X X 15,000 X X 84 0 X April 30, 2030 X 14,150.00 05/01/2023 04/30/2024 14,503.75 05/01/2024 04/30/2025 14,886.34 05/01/2025 04/30/2026 15,238.00 05/01/2026 04/30/2027 15,695.14 05/01/2027 04/30/2028 16,166.00 05/01/2028 04/30/2029 Orr, 2640 Donald Rd. Burleson TX 76028 817.447.2084 rob orr Rob Orr DocuSign Envelope ID: B75713DB-46C3-4443-B3DE-7779520354C7

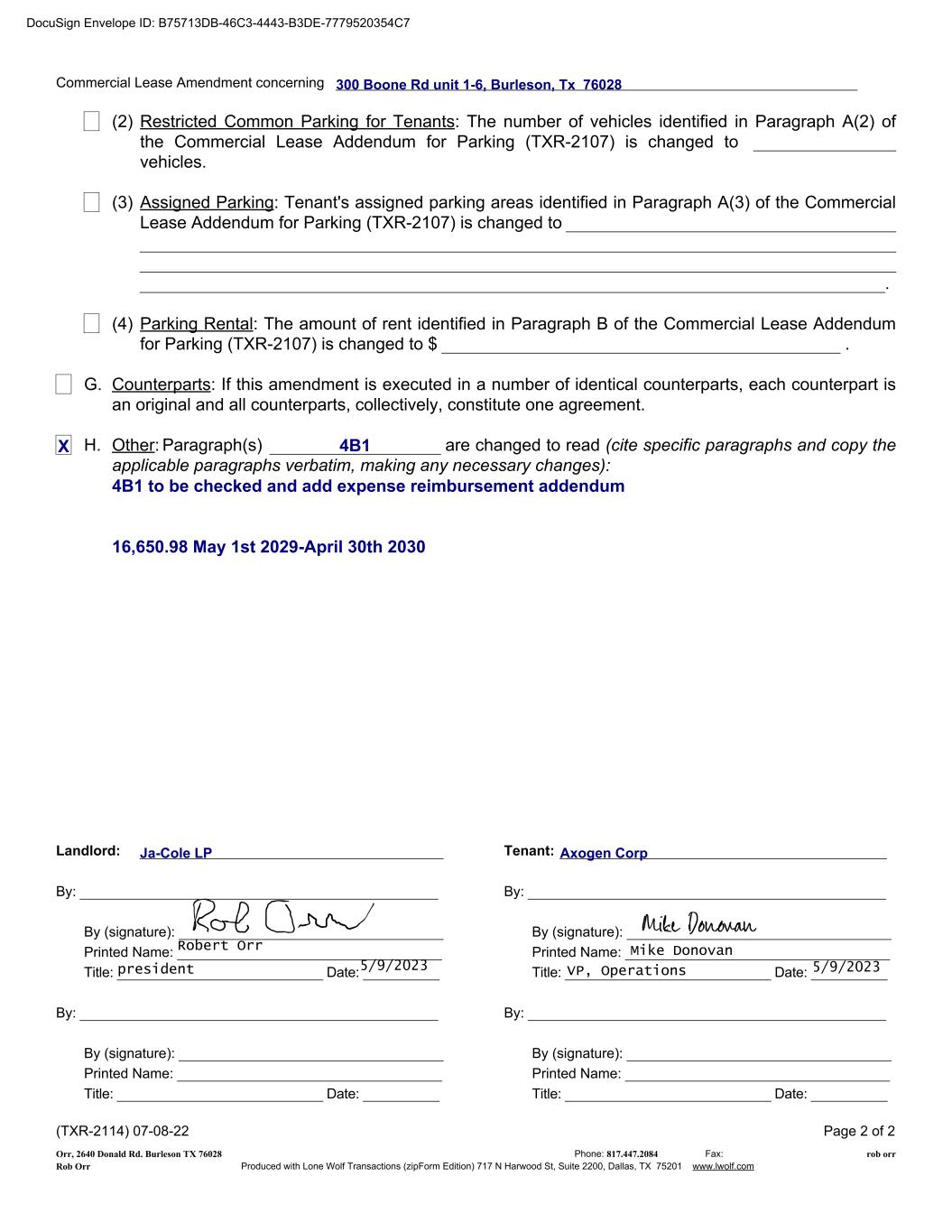

Commercial Lease Amendment concerning (2) Restricted Common Parking for Tenants: The number of vehicles identified in Paragraph A(2) of the Commercial Lease Addendum for Parking (TXR-2107) is changed to vehicles. (3) Assigned Parking: Tenant's assigned parking areas identified in Paragraph A(3) of the Commercial Lease Addendum for Parking (TXR-2107) is changed to . (4) Parking Rental: The amount of rent identified in Paragraph B of the Commercial Lease Addendum for Parking (TXR-2107) is changed to $ . G. Counterparts: If this amendment is executed in a number of identical counterparts, each counterpart is an original and all counterparts, collectively, constitute one agreement. H. Other: Paragraph(s) are changed to read (cite specific paragraphs and copy the applicable paragraphs verbatim, making any necessary changes): Landlord: By: By (signature): Printed Name: Title: Date: By: By (signature): Printed Name: Title: Date: Tenant: By: By (signature): Printed Name: Title: Date: By: By (signature): Printed Name: Title: Date: (TXR-2114) 07-08-22 Page 2 of 2 Phone: Fax: Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com 300 Boone Rd unit 1-6, Burleson, Tx 76028 X 4B1 4B1 to be checked and add expense reimbursement addendum 16,650.98 May 1st 2029-April 30th 2030 Ja-Cole LP Axogen Corp Orr, 2640 Donald Rd. Burleson TX 76028 817.447.2084 rob orr Rob Orr DocuSign Envelope ID: B75713DB-46C3-4443-B3DE-7779520354C7 5/9/2023VP, Operations Mike Donovan 5/9/2023president Robert Orr

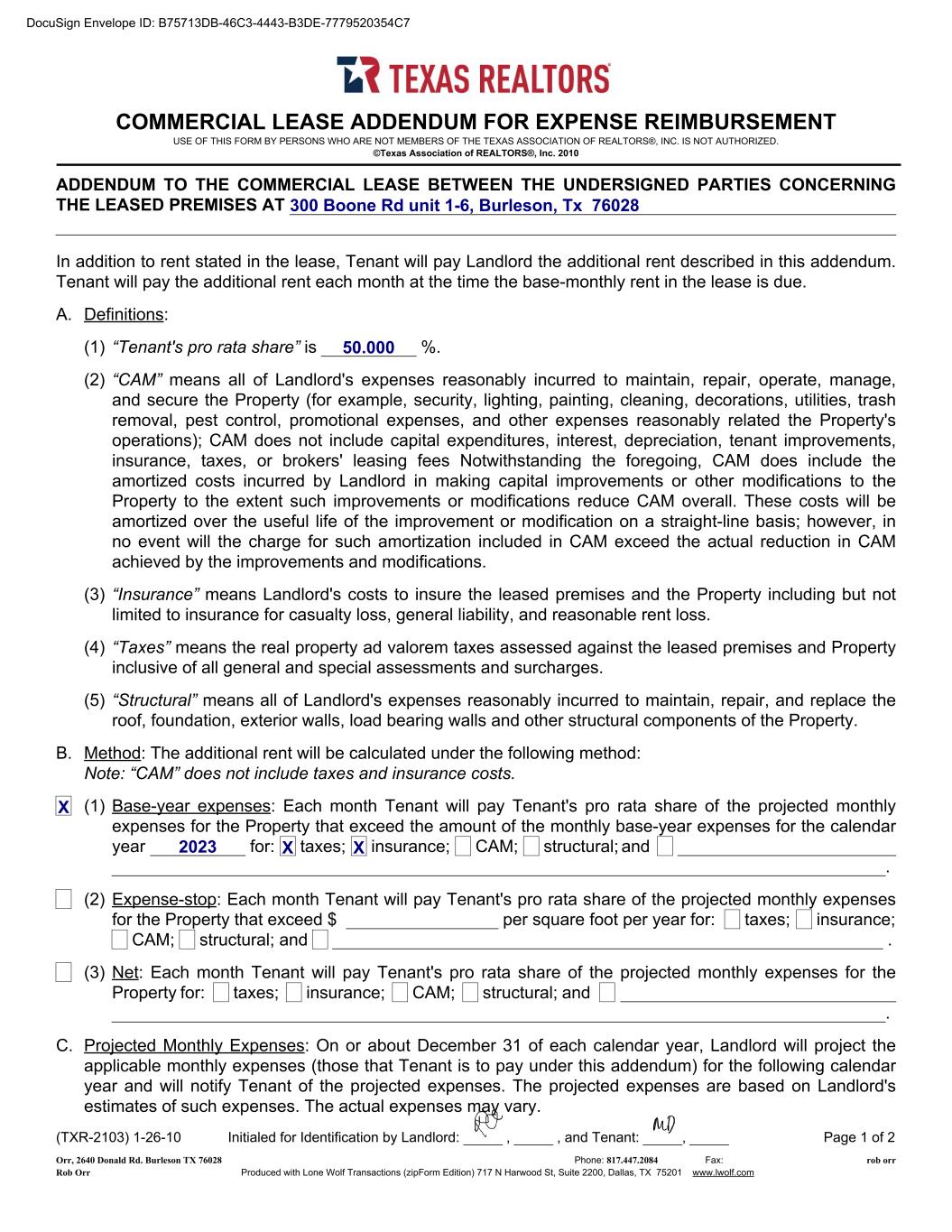

COMMERCIAL LEASE ADDENDUM FOR EXPENSE REIMBURSEMENT USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2010 ADDENDUM TO THE COMMERCIAL LEASE BETWEEN THE UNDERSIGNED PARTIES CONCERNING THE LEASED PREMISES AT In addition to rent stated in the lease, Tenant will pay Landlord the additional rent described in this addendum. Tenant will pay the additional rent each month at the time the base-monthly rent in the lease is due. A. Definitions: (1) “Tenant's pro rata share” is %. (2) “CAM” means all of Landlord's expenses reasonably incurred to maintain, repair, operate, manage, and secure the Property (for example, security, lighting, painting, cleaning, decorations, utilities, trash removal, pest control, promotional expenses, and other expenses reasonably related the Property's operations); CAM does not include capital expenditures, interest, depreciation, tenant improvements, insurance, taxes, or brokers' leasing fees Notwithstanding the foregoing, CAM does include the amortized costs incurred by Landlord in making capital improvements or other modifications to the Property to the extent such improvements or modifications reduce CAM overall. These costs will be amortized over the useful life of the improvement or modification on a straight-line basis; however, in no event will the charge for such amortization included in CAM exceed the actual reduction in CAM achieved by the improvements and modifications. (3) “Insurance” means Landlord's costs to insure the leased premises and the Property including but not limited to insurance for casualty loss, general liability, and reasonable rent loss. (4) “Taxes” means the real property ad valorem taxes assessed against the leased premises and Property inclusive of all general and special assessments and surcharges. (5) “Structural” means all of Landlord's expenses reasonably incurred to maintain, repair, and replace the roof, foundation, exterior walls, load bearing walls and other structural components of the Property. B. Method: The additional rent will be calculated under the following method: Note: “CAM” does not include taxes and insurance costs. (1) Base-year expenses: Each month Tenant will pay Tenant's pro rata share of the projected monthly expenses for the Property that exceed the amount of the monthly base-year expenses for the calendar year for: taxes; insurance; CAM; structural; and . (2) Expense-stop: Each month Tenant will pay Tenant's pro rata share of the projected monthly expenses for the Property that exceed $ per square foot per year for: taxes; insurance; CAM; structural; and . (3) Net: Each month Tenant will pay Tenant's pro rata share of the projected monthly expenses for the Property for: taxes; insurance; CAM; structural; and . C. Projected Monthly Expenses: On or about December 31 of each calendar year, Landlord will project the applicable monthly expenses (those that Tenant is to pay under this addendum) for the following calendar year and will notify Tenant of the projected expenses. The projected expenses are based on Landlord's estimates of such expenses. The actual expenses may vary. (TXR-2103) 1-26-10 Initialed for Identification by Landlord: , , and Tenant: , Page 1 of 2 Phone: Fax: Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com 300 Boone Rd unit 1-6, Burleson, Tx 76028 50.000 X 2023 X X Orr, 2640 Donald Rd. Burleson TX 76028 817.447.2084 rob orr Rob Orr DocuSign Envelope ID: B75713DB-46C3-4443-B3DE-7779520354C7

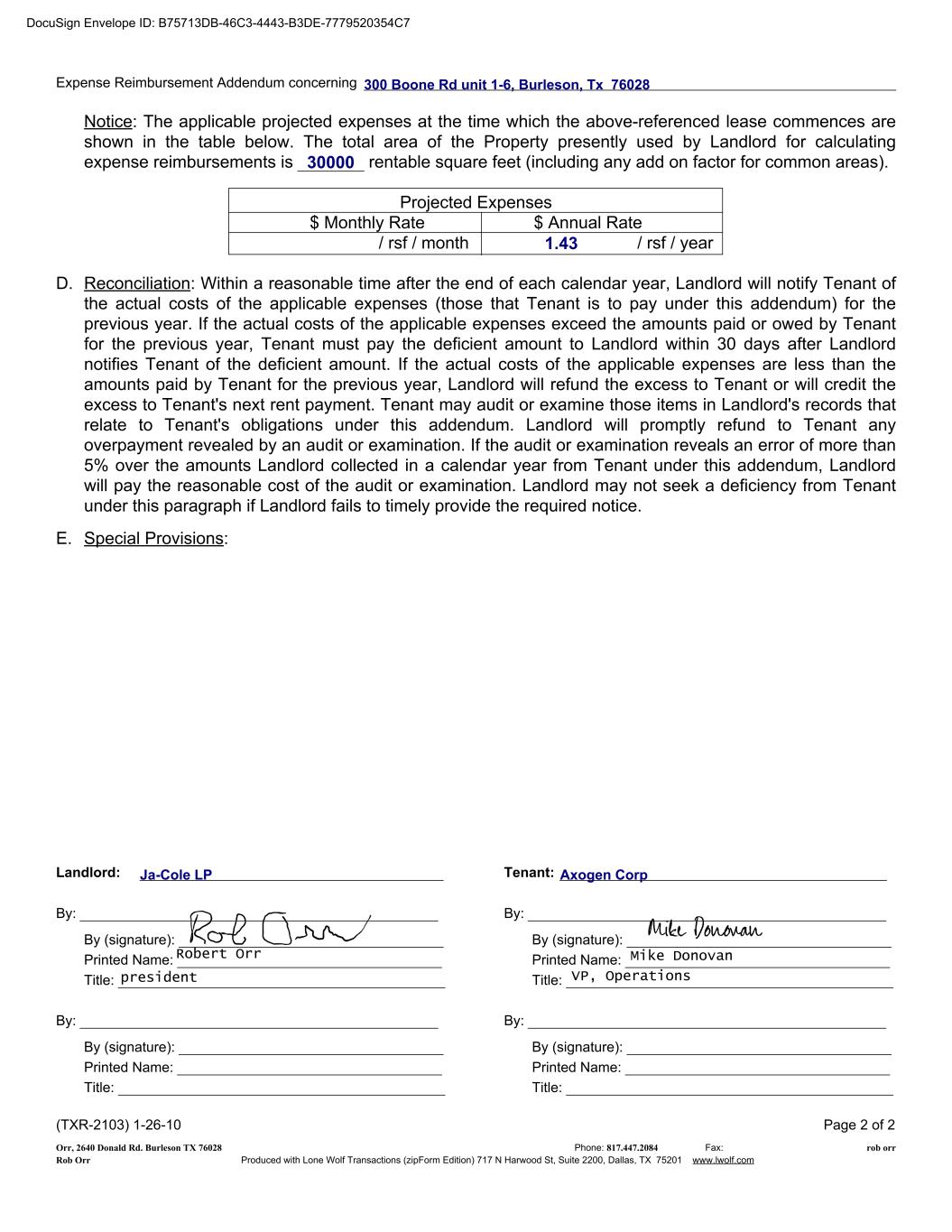

Expense Reimbursement Addendum concerning Notice: The applicable projected expenses at the time which the above-referenced lease commences are shown in the table below. The total area of the Property presently used by Landlord for calculating expense reimbursements is rentable square feet (including any add on factor for common areas). Projected Expenses $ Monthly Rate $ Annual Rate / rsf / month / rsf / year D. Reconciliation: Within a reasonable time after the end of each calendar year, Landlord will notify Tenant of the actual costs of the applicable expenses (those that Tenant is to pay under this addendum) for the previous year. If the actual costs of the applicable expenses exceed the amounts paid or owed by Tenant for the previous year, Tenant must pay the deficient amount to Landlord within 30 days after Landlord notifies Tenant of the deficient amount. If the actual costs of the applicable expenses are less than the amounts paid by Tenant for the previous year, Landlord will refund the excess to Tenant or will credit the excess to Tenant's next rent payment. Tenant may audit or examine those items in Landlord's records that relate to Tenant's obligations under this addendum. Landlord will promptly refund to Tenant any overpayment revealed by an audit or examination. If the audit or examination reveals an error of more than 5% over the amounts Landlord collected in a calendar year from Tenant under this addendum, Landlord will pay the reasonable cost of the audit or examination. Landlord may not seek a deficiency from Tenant under this paragraph if Landlord fails to timely provide the required notice. E. Special Provisions: Landlord: By: By (signature): Printed Name: Title: By: By (signature): Printed Name: Title: Tenant: By: By (signature): Printed Name: Title: By: By (signature): Printed Name: Title: (TXR-2103) 1-26-10 Page 2 of 2 Phone: Fax: Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com 300 Boone Rd unit 1-6, Burleson, Tx 76028 30000 1.43 Ja-Cole LP Axogen Corp Orr, 2640 Donald Rd. Burleson TX 76028 817.447.2084 rob orr Rob Orr DocuSign Envelope ID: B75713DB-46C3-4443-B3DE-7779520354C7 Mike Donovan VP, Operationspresident Robert Orr