0000805928PRE 14Afalse00008059282023-01-012023-12-31iso4217:USDxbrli:pure00008059282022-01-012022-12-3100008059282021-01-012021-12-3100008059282020-01-012020-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:PeoMember2023-01-012023-12-310000805928axgn:InclusionOfEquityValuesMemberecd:PeoMember2023-01-012023-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000805928axgn:InclusionOfEquityValuesMemberecd:NonPeoNeoMember2023-01-012023-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:PeoMember2022-01-012022-12-310000805928axgn:InclusionOfEquityValuesMemberecd:PeoMember2022-01-012022-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000805928axgn:InclusionOfEquityValuesMemberecd:NonPeoNeoMember2022-01-012022-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:PeoMember2021-01-012021-12-310000805928axgn:InclusionOfEquityValuesMemberecd:PeoMember2021-01-012021-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000805928axgn:InclusionOfEquityValuesMemberecd:NonPeoNeoMember2021-01-012021-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:PeoMember2020-01-012020-12-310000805928axgn:InclusionOfEquityValuesMemberecd:PeoMember2020-01-012020-12-310000805928axgn:ExclusionOfStockAwardsAndOptionAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000805928axgn:InclusionOfEquityValuesMemberecd:NonPeoNeoMember2020-01-012020-12-310000805928ecd:PeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2023-01-012023-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:PeoMember2023-01-012023-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:PeoMember2023-01-012023-12-310000805928ecd:NonPeoNeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2023-01-012023-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:NonPeoNeoMember2023-01-012023-12-310000805928ecd:PeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2022-01-012022-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:PeoMember2022-01-012022-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:PeoMember2022-01-012022-12-310000805928ecd:NonPeoNeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2022-01-012022-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:NonPeoNeoMember2022-01-012022-12-310000805928ecd:PeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2021-01-012021-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:PeoMember2021-01-012021-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:PeoMember2021-01-012021-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:PeoMember2021-01-012021-12-310000805928ecd:NonPeoNeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2021-01-012021-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:NonPeoNeoMember2021-01-012021-12-310000805928ecd:PeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2020-01-012020-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:PeoMember2020-01-012020-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:PeoMember2020-01-012020-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:PeoMember2020-01-012020-12-310000805928ecd:NonPeoNeoMemberaxgn:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfTheYearMember2020-01-012020-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000805928axgn:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000805928axgn:FairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearOfNonPEONEOsMemberecd:NonPeoNeoMember2020-01-012020-12-31000080592812023-01-012023-12-31

Burkecover

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| x | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-12 |

AXOGEN, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

cover

letter

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

Dear Shareholder:

You are cordially invited to attend our 2024 Annual Meeting of Shareholders (the “Meeting”) of Axogen, Inc. (the “Company” or “Axogen”), which will be conducted via live audio webcast on Wednesday, June 5, 2024 beginning at 8:00 a.m. Eastern Time. The virtual format provides the opportunity for full and equal participation of all shareholders regardless of location. You can attend the Meeting via the Internet at www.virtualshareholdermeeting.com/axogen2024 by using the 16-digit control number that appears on your proxy card (printed in the box and marked by the arrow) or in the instructions that accompanied your proxy materials.

This booklet contains your official notice of the Meeting and a Proxy Statement that includes information about the matters to be acted upon at the Meeting. The notice of the Meeting and the Proxy Statement are first being distributed on or about April [ ], 2024.

I sincerely hope that you will be able to attend the Meeting. Whether or not you plan to attend, your vote is important, and we urge you to complete and return the enclosed proxy in the accompanying envelope.

| | | | | |

| |

| Sincerely, |

| |

| |

| |

| Karen Zaderej |

April [ ], 2024 | Chairman, Chief Executive Officer and President |

2024 Annual Meeting of Shareholders

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

Notice of 2024 Annual Meeting of Shareholders

You are cordially invited to attend our 2024 Annual Meeting of Shareholders (the “Meeting”) of Axogen, Inc. (the “Company”, “Axogen”, “we” or “our”) which will be held on Wednesday, June 5, 2024 at 8:00 a.m. Eastern Time. Shareholders may join a live audio webcast at www.virtualshareholdermeeting.com/axogen2024. At the Meeting, Shareholders will act on the following matters:

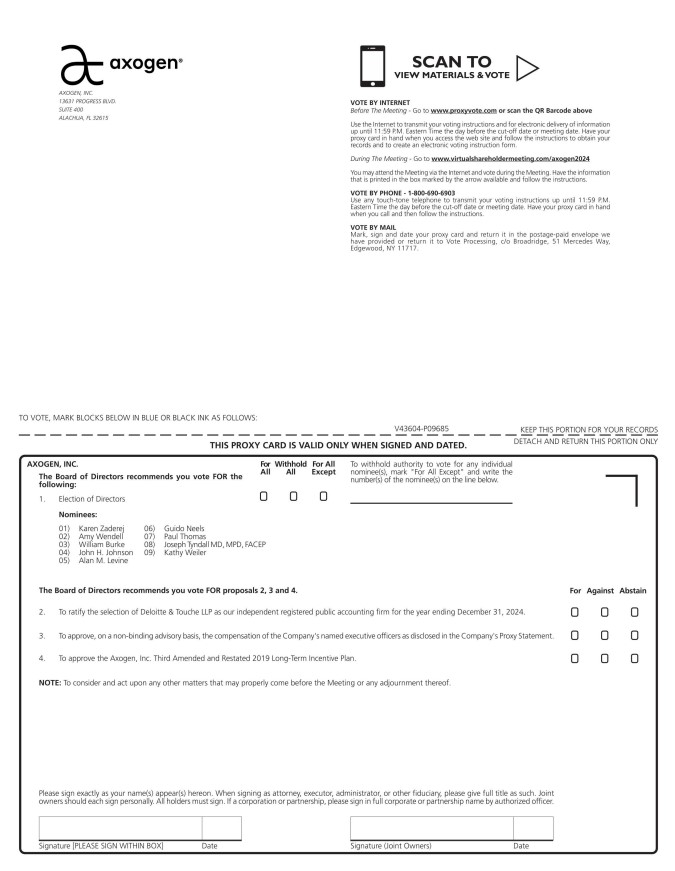

1. To elect nine members to our board of directors (the “Board of Directors”) to hold office for the ensuing year and until their successors are elected and qualified;

2. To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024;

3. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s Proxy Statement;

4. To approve the Axogen, Inc. Third Amended and Restated 2019 Long-Term Incentive Plan (the "A&R 2019 Plan") to increase the number of shares authorized for issuance thereunder from 8,000,000 to 10,500,000; and;

5. To consider and act upon any other matters that may properly come before the Meeting or any adjournment or postponement thereof.

Only holders of record of our common stock at the close of business on April 19, 2024, will be entitled to receive notice of and to vote at the Meeting. Our shareholders are not entitled to any appraisal or dissenters’ rights with respect to the matters to be acted upon at the Meeting.

You may vote your shares by telephone (1-800-690-6903) or internet (www.proxyvote.com) no later than 11:59 p.m. Eastern Time on Tuesday June 4, 2024 (as directed on the enclosed proxy card) or vote by completing, signing and promptly returning the enclosed proxy card by mail. If you choose to submit your proxy by mail, we have enclosed an envelope for your use, which is prepaid if mailed in the United States. You may also attend the Meeting, submit questions and vote online until voting is closed at www.virtualshareholdermeeting.com/axogen2024.

Your vote is important. Whether or not you plan to attend the Meeting, we urge you to complete and return the enclosed proxy in the accompanying envelope, vote online, or vote by telephone.

| | | | | |

| |

| By Order of the Board of Directors, |

| |

| |

| |

| Karen Zaderej |

| Alachua, Florida | Chairman, Chief Executive Officer and President |

April [ ], 2024 | |

LETTER FROM OUR COMPENSATION COMMITTEE CHAIRMAN

Dear Fellow Shareholders:

I am writing to you to update you on important activities of the Compensation Committee and to seek your support for two important voting items at our upcoming annual meeting:

•Our advisory vote on executive compensation (say on pay), and

•Our proposed third amendment and restatement of the Axogen, Inc. 2019 Long-Term Incentive Plan (the "A&R 2019 Plan").

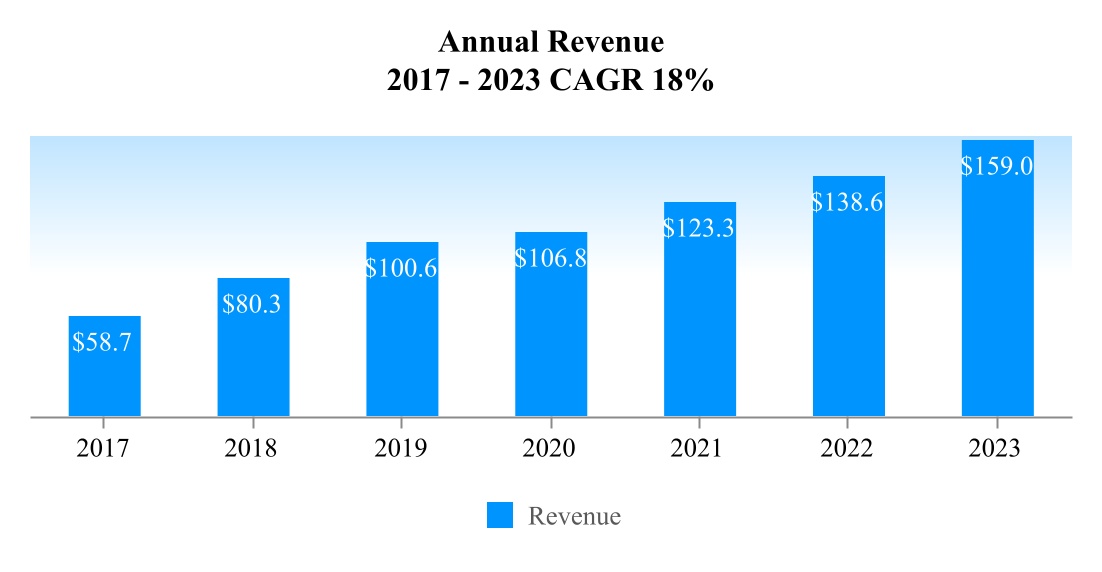

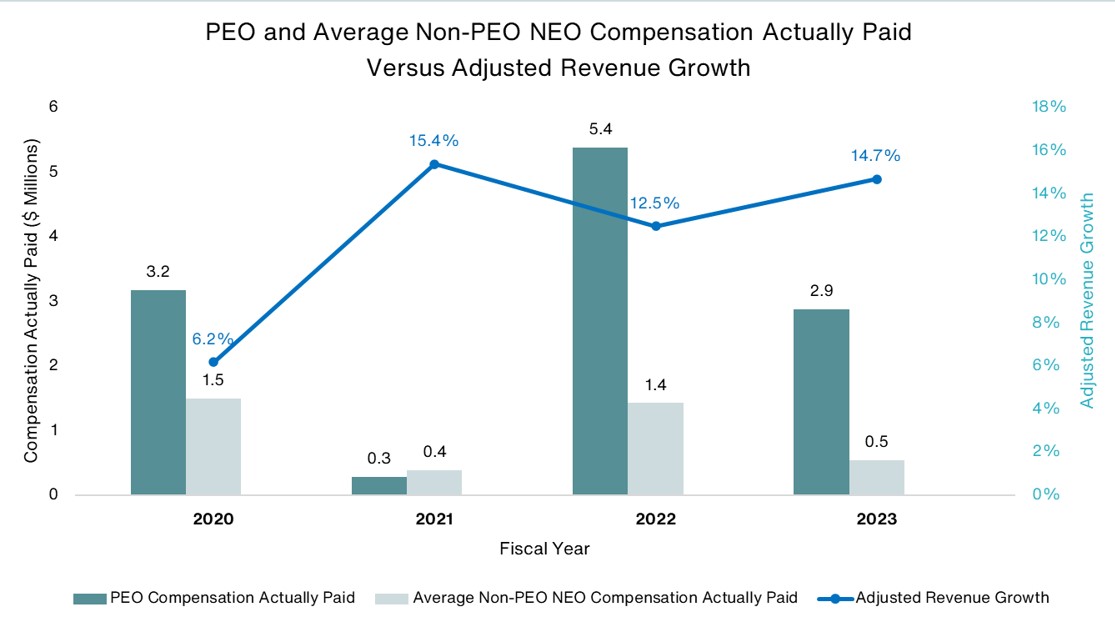

2023 and the early part of 2024 has been a time of much change at Axogen including the decision of our CEO to retire by January 4, 2025, the departure of our CFO and the retirement of other executives. Although financial and strategic performance improved, for example we grew revenue in 2023 by 14.7% compared with 2022 and made significant progress toward readying our Biologic License Application (“BLA”) for Avance® Nerve Graft, our stock price performance lagged. During our transition in leadership, and as we focus efforts to increase commercial performance, it is especially important to assure stability and retention of key employees by providing appropriate equity-based compensation that provides value only if we are successful. From a Compensation Committee perspective, we undertook significant efforts to align further the compensation of our executives and certain critical employees with the interests of our shareholders by using performance-based equity tied to improving long-term stock price performance and meeting near-term strategic regulatory objectives. For us to continue our efforts to maintain an exceptional team and bring in the talent necessary for future success it is important we have the compensation tools necessary that a positive vote will provide.

As you consider your vote on this important proposal, please take into consideration that:

•The Company has announced significant leadership changes in the last six-month period. In addition to the announcement of the CEO’s retirement and the departure of our former CFO in December 2023, the long tenured vice president of operations and the Chief R&D officer both retired in March 2024. During this period, it is important to minimize unwanted attrition among the Company’s senior leadership.

•To help ensure retention and stability of other key leaders during this leadership transition period, we enhanced severance and other benefits for key roles.

•The Company also focused retention efforts below the executive level, by providing equity and cash awards to employees who are critical to near-term strategic initiates, such as the filing of the BLA.

•Other than with respect to promotions, all equity granted to our executive officers in 2024, through April was entirely performance based, with the bulk of it tied to long term share price appreciation and a smaller percentage tied to key near-term regulatory objectives related to the BLA.

•Our equity awards in 2024 were reduced from prior years and were more performance focused.

The last 12 months have been eventful and marked by positive events. During this time, we were very pleased to have received strong support from our shareholders for our say-on-pay vote at our 2023 annual meeting. Even with strong support we continued our engagement activities with shareholders and the Compensation Committee continued to examine how we can best align our key compensation decisions and our incentive pay design to company performance. A key element of this philosophy is our ability to provide competitive equity grants to our leadership team and our critical employees.

Regarding equity compensation, we were disappointed that our shareholders did not approve an amendment to our A&R 2019 Plan, increasing the number of shares reserved under the A&R 2019 Plan by a modest amount, at the last annual meeting. Without these additional shares, we have been forced to limit equity participation in our 2024 annual grants and deliver less competitive value, which are important levers we use to retain key talent. Given this serious constraint, we are again asking our shareholders to approve a modest increase in the maximum number of shares that may be issued under the A&R 2019 Plan by 2.5 million shares, as more fully set forth in Proposal 4 in this proxy statement. Without these additional shares available for 2024, we would likely need to further limit equity

grants or increase the cash component of employee compensation to remain competitive in retaining and attracting top talent. Further, our ability to build a stable and incentivized leadership team becomes challenging without the benefits of sufficient equity that is both linked to the Company's performance and vests over multiple years. The proposed increase to the shares available under the 2019 Plan is of vital importance to our ability to continue to build long-term value for our shareholders.

Going forward, as we did in early 2024, we plan to be even more targeted and focused on the use of performance-based equity to drive results and I will work together with the Compensation Committee of our Board of Directors to that end.

Thank you for your consideration and anticipated support.

Respectfully,

Paul Thomas, Chair of the Compensation Committee

PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

Employment Agreements | |

| |

| |

| |

| |

| |

| |

| |

PROPOSALS FOR OUR 2025 ANNUAL MEETING | |

| |

| |

| |

| |

Axogen, Inc.

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

PROXY STATEMENT

2024 Annual Meeting of Shareholders

TO BE HELD ON JUNE 5, 2024

The board of directors (the “Board of Directors”) of Axogen, Inc. (the “Company”, “Axogen”, “we” or “our”) is soliciting proxies for use at our 2024 Annual Meeting of Shareholders (the “Meeting”) which will be conducted via live audio webcast and accessible at www.virtualshareholdermeeting.com/axogen2024 on June 5, 2024, at 8:00 a.m. Eastern time and at any adjournment or postponement thereof. This Proxy Statement and the enclosed proxy card are first being mailed to shareholders on or about April [ ], 2024.

Our Board of Directors has set Friday, April 19, 2024, as the record date for the Meeting. Each shareholder of record at the close of business on Friday, April 19, 2024, will be entitled to vote at the Meeting. As of the record date, [ ] shares of our common stock were issued and outstanding and, therefore, eligible to vote at the Meeting. Holders of our common stock are entitled to one vote per share. Therefore, a total of [ ] votes are entitled to be cast at the Meeting. There is no cumulative voting in the election of our directors.

Shareholders who sign and return a proxy may revoke it at any time before it is voted at the Meeting by giving written notice to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, Re: Axogen, Inc., by submitting a duly executed proxy with a later date or by attending the Meeting by internet and withdrawing your proxy. If your shares are held in the name of a bank or brokerage firm, you must obtain a proxy, executed in your favor, from the bank or broker, to be able to vote at the Meeting.

Expenses in connection with this solicitation of proxies will be paid by us. Proxies are being solicited primarily by mail. We have retained the services of Alliance Advisor, a professional proxy solicitation firm, to aid in the solicitation of proxies for an estimated fee of $20,000 plus expenses. The proxy solicitor may conduct this proxy solicitation by mail, telephone, facsimile, e-mail, other electronic channels of communication, or otherwise. In addition, our officers and directors, who will receive no extra compensation for their services, may solicit proxies by telephone or personally. We also will request that brokers or other nominees who hold shares of our common stock in their names for the benefit of others forward proxy materials to, and obtain voting instructions from, the beneficial owners of such stock at our expense.

Proxies that are completed, signed and returned to us prior to the Meeting will be voted as specified. If no direction is given, the proxy will be voted FOR the election of the nominees for director named in this Proxy Statement, FOR the ratification, on an advisory basis, of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the year ending December 31, 2024, FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement, and FOR the approval of the A&R 2019 Plan, which increases the number of shares authorized for issuance thereunder by 2,500,000 shares.

If a shareholder affirmatively abstains from voting as to any matter (or indicates a “withhold vote for” as to directors), then the shares held by such shareholder shall be deemed present at our Meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter but shall not be deemed to have been voted in favor of such matter. Votes withheld from one or more director nominees will have no effect on the election of any director from whom votes are withheld.

If on the Record Date your shares were held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization maintaining your account is considered the shareholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Meeting. However, since you are not the shareholder of record,

you may not vote your shares in person at the Meeting unless you request and obtain a valid proxy from your broker or other agent. If you plan to attend the Meeting, you will need to have a valid proxy from the organization maintaining your account to vote your shares at the Meeting.

If you hold your shares in street name, and do not provide instructions, your shares may constitute “broker non-votes” on certain proposals. Generally, broker non-votes occur on a non-routine proposal where a broker is not permitted to vote on that proposal without instructions from the beneficial owner. Broker non-votes are counted as present for purposes of determining whether there is a quorum but are not counted for purposes of determining whether a matter has been approved. If you properly submit a proxy card to the organization maintaining your account, but do not provide voting instructions, that organization will be able to vote your shares on Proposal 2, which is a non-binding advisory vote; however, that organization will not be permitted to vote your shares on Proposal 1, Proposal 3, or Proposal 4. As a result, if you do not provide voting instructions to the organization maintaining your account, your shares will have no effect on the outcome of the election of directors, the approval of the advisory vote to approve the compensation of our named executive officers, or the approval of the A&R 2019 Plan. As a result, if you hold shares in a brokerage account and wish to vote those shares on these proposals, we strongly encourage you to submit your voting instructions and exercise your right to vote as a shareholder.

Directors are elected by a plurality vote of the votes cast by the shareholders entitled to vote at the Meeting. A plurality vote means that the directors who receive the most votes in an election, though not necessarily a majority, will be elected. However, our Corporate Governance Guidelines provide that directors who receive more “withhold” votes than “for” votes will be required to tender their resignation, which the Board of Directors will be required to consider. If the Board determines not to accept the resignation, the Board’s decision and reasons for rejecting the resignation will be reported on a Form 8-K. If you affirmatively abstain from voting, it will have no impact on the outcome of the vote for the proposal. Similarly, broker non-votes will have no impact on the outcome of the vote for the proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the non-binding ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal. Because this proposal is a routine matter, broker non-votes will not occur with respect to this proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the non-binding advisory approval of the compensation of our named executive officers. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal. Broker non-votes will have no impact on the outcome of the vote for the proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the A&R 2019 Plan. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal. Broker non-votes will have no impact on the outcome of the vote for the proposal.

Our shareholders are not entitled to any appraisal or dissenters’ rights with respect to the matters to be acted upon at the Meeting.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on June 5, 2024:

This Proxy Statement, the accompanying Notice of the Meeting and proxy card are available on our website at http://www.axogeninc.com/proxy-statement.html, and our Annual Report on Form 10-K is available in the “Investors” section of our website at https://www.axogeninc.com.

PROPOSAL 1 – ELECTION OF DIRECTORS

At the Meeting, shareholders will vote on the election of nine director nominees: Karen Zaderej, Amy Wendell, William Burke, John H. Johnson, Alan Levine, Guido Neels, Paul Thomas, Dr. Joseph Tyndall, and Kathy Weiler. Following a review of the composition of the Board of Directors, the Governance, Nominating, and Sustainability Committee of the Board of Directors has determined not to re-nominate Gregory Freitag for re-election to our Board of Directors. Following the Meeting, the size of the Board of Directors will be reduced from ten to nine directors. Our Corporate Governance Guidelines provide that directors who have reached 75 years of age volunteer to not stand for re-election. In compliance with this policy, Mr. Neels volunteered not to stand for re-election. However, the Board of Directors determined that it is desirable and in the best interest of the Company to have Mr. Neels continue to serve on the Board of Directors due to his skills and expertise and in consideration of Board of Directors continuity. Our Board of Directors has nominated each continuing director to serve a one-year term commencing at the Meeting and until each director’s successor is duly elected and qualified. Ms. Weiler was appointed as a director on December 20, 2023. In the event that any nominee becomes unable or unwilling to serve as a director for any reason, the persons named in the enclosed proxy will vote for a substitute nominee in accordance with their best judgment. Our Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve as a director if elected.

Proxies cannot be voted for a greater number of persons than the number of nominees named.

Biographical information for each director nominee is included below. Included at the end of each director’s biography is a description of the particular experience, qualifications, attributes or skills that led our Board of Directors to conclude that each of these director nominees should serve as a member of our Board of Directors.

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Karen Zaderej | | 62 | | | Chairman, Chief Executive Officer and President |

| Amy Wendell | | 63 | | | Director |

| William Burke | | 55 | | | Director |

| | | | |

| John H. Johnson | | 66 | | | Director |

| Alan Levine | | 56 | | | Director |

| Guido Neels | | 75 | | | Director |

| Paul Thomas | | 68 | | | Director |

| Joseph Tyndall, MD, MPH, FACEP | | 55 | | | Director |

| Kathy Weiler | | 54 | | | Director |

Karen Zaderej joined Axogen Corporation in May 2006. Ms. Zaderej has served as Axogen’s President, Chief Executive Officer (“CEO”), and a member of our Board of Directors since September 2011 and the Chairman of our Board of Directors since May 2018. Ms. Zaderej intends to retire from her role as the Chief Executive Officer by January 2025. Since May 2010, she has served as the Chief Executive Officer of Axogen’s wholly owned subsidiary, Axogen Corporation, and a member of the Board of Directors of Axogen Corporation. Ms. Zaderej joined Axogen Corporation in May 2006 and served as Vice President of Marketing and Sales from May 2006 to October 2007 and as Chief Operating Officer from October 2007 to May 2010. From October 2004 to May 2006, Ms. Zaderej worked for Zaderej Medical Consulting, a consulting firm she founded, which assisted medical device companies in building and executing successful commercialization plans. From 1987 to 2004, Ms. Zaderej worked at Ethicon, Inc., a Johnson & Johnson company, where she held senior positions in marketing, business development, research & development, as well as ran a manufacturing business. Ms. Zaderej is a member of the University of Tampa Board of Trustees and serves on the Board of Directors for EyePoint Pharmaceuticals, Inc. (NASDAQ: EYPT). Ms. Zaderej has an M.B.A. from the Kellogg Graduate School of Business and a B.S. in Chemical Engineering from Purdue University. Ms. Zaderej’s qualifications to serve on our Board of Directors

include her leadership and depth of knowledge about the nerve repair market, her extensive experience in the medical device industry, and her financial and management expertise.

Amy Wendell has served as a member of our Board of Directors since September 2016 and Lead Director since May 2018. She was a senior advisor for the healthcare investment banking practice of Perella Weinberg Partners (“PWP”) from January 2016 through April 2019. Her scope of responsibilities involved providing guidance and advice with respect to mergers and acquisitions and divestitures for clients and assisting PWP in connection with firm-level transactions. From 2015 until October 2018, Ms. Wendell served as a senior advisor for McKinsey and Company’s (“McKinsey”) strategy and corporate finance practice and as a member of McKinsey’s transactions advisory board to help define trends in mergers and acquisitions, as well as help shape McKinsey’s knowledge agenda. From 1986 until January 2015, Ms. Wendell held various roles of increasing responsibility at Covidien plc (“Covidien”) (including its predecessors, Tyco Healthcare and Kendall Healthcare Products), including in engineering, product management and business development. Most recently, from December 2006 until Covidien’s acquisition by Medtronic plc in January 2015, Ms. Wendell served as Covidien’s Senior Vice President of Strategy and Business Development, where she managed all business development, including acquisitions, equity investments, divestitures and licensing/distribution, and led Covidien’s strategy and portfolio management initiatives. Ms. Wendell is a member of the board of directors of Hologic, Inc. (Nasdaq: HOLX), a leading developer, manufacturer and supplier of premium diagnostic products, medical imaging systems and surgical products with a strong position in women’s health, Baxter International, Inc. (NYSE: BAX), a leading global medical products company, and Solventum Corp. (NASDAQ SOLV) the recent healthcare spin-off of 3M. Ms. Wendell holds a M.S. in biomedical engineering from the University of Illinois and a B.S. in mechanical engineering from Lawrence Institute of Technology (n/k/a Lawrence Technological University). Ms. Wendell’s qualifications to serve on our Board of Directors include her broad healthcare management and governance experience, her knowledge of healthcare policy.

William Burke has served as a member of our Board of Directors since July 2022. Mr. Burke was the Chief Financial Officer from January 2023 to May 2023 for ViewRay, Inc. (NASDAQ: VRAY), which filed Chapter 11 bankruptcy in July 2023, and Chapter 7 in October 2023. Previously, Mr. Burke, was the Executive Vice President, Chief Financial Officer of Haemonetics Corp. from August 2016 to June 2022 and was responsible for the global finance organization including investor relations. From July 2014 to July 2016, Mr. Burke served as Chief Integration Officer and Vice President, Integration for Medtronic plc (NYSE: MDT), a global healthcare products company, and was a member of its Executive Committee. In that role, Mr. Burke was responsible for ensuring the successful integration of Medtronic with Covidien plc, a global healthcare company, following its acquisition by Medtronic. Prior to joining Medtronic, Mr. Burke spent more than 20 years in finance and business development leadership roles at Covidien, including Chief Financial Officer for Covidien Europe based in Zurich, Vice President of Corporate Strategy and Portfolio Management and Vice President of Financial Planning and Analysis. Previously, Mr. Burke also held key positions within Tyco Healthcare, including the Financial Controller of Valleylab, Managing Director of the Covidien Group in Switzerland, and International Controller. He also recently served as a member of the Board of Directors of MiroMatrix (NASDAQ CM: MIRO) until December 2023. He began his career as an auditor with KPMG. Mr. Burke received a Bachelor of Science degree in Business Administration from Bryant College. Mr. Burke’s qualifications to serve on our Board of Directors include his extensive executive leadership and finance experience, his experience as a director of publicly traded companies and expertise in financial reporting oversight.

John H. Johnson has served as a member of our Board of Directors since July 2021. He currently serves as Chief Executive Officer and Board Director of Reaction Biology, and has served as the Chief Executive Officer of Strongbridge Biopharma plc., a company focused on building a portfolio of vertical, therapeutically-aligned rare disease franchises, from July 2020 to October 2021, when it was sold to Xeris Biopharma Holdings, Inc. (NASDAQ: XERS). He also served as Strongbridge Biopharma's Executive Chairman from March 2015 to November 2019. Mr. Johnson previously served as the Chief Executive Officer of Melinta Therapeutics, a commercial stage company developing and commercializing novel antibiotics, from 2018 to 2020. He served as Chairman and Chief Executive Officer of Dendreon Corporation from 2012 to 2014. Mr. Johnson previously held various senior positions with Eli Lilly & Company, ImClone Systems, Inc., Johnson & Johnson, and Centocor Ortho Biotech. Mr. Johnson currently on the Board of Directors of Xeris (NASDAQ: XERS) and Verastem (NASDAQ:

VSTM).Mr. Johnson resigned from his role as the non-executive chairman of the Board of Directors for Autolus Therapeutics plc., effective April 1, 2024. Mr. Johnson received his B.S. from University of Pennsylvania East Stroudsburg. Mr. Johnson's qualifications to serve on our Board of Directors include his considerable leadership experience and specific knowledge of the healthcare industry.

Alan Levine has served as a member of our Board of Directors since May 2019. Since February 2018, Mr. Levine has been the Chairman, President, and Chief Executive Officer of Ballad Health, an integrated healthcare delivery system. From January 2014 to January 2018, he served as the President and Chief Executive Officer of Mountain States Health Alliance, the largest health system in upper east Tennessee and southwest Virginia. He served as a Senior Advisor to the Board of Directors, President of the Florida Group and Corporate Senior Vice President during his tenure from July 2010 to January 2014 at Health Management Associates, a hospital and healthcare facilities operator. From January 2008 to July 2010, Mr. Levine served as Senior Health Policy Advisor to Louisiana Governor Bobby Jindal, and as the Secretary of the Louisiana Department of Health and Hospitals on the Governor’s cabinet. He was the President and Chief Executive Officer of the North Broward Hospital District, one of the largest public health and hospital systems in the nation, from July 2006 to January 2008. He also served as the Secretary of the Florida Agency for Health Care Administration, the health planning and regulatory agency for the State of Florida with responsibility for the oversight of more than 30,000 healthcare facilities, and the $17 billion state Medicaid program, from June 2004 to July 2006. Mr. Levine served as the Deputy Chief of Staff and Senior Health Policy Advisor to Governor Jeb Bush from January 2003 to June 2004. Mr. Levine holds an M.B.A., M.S. in Health Science, and B.S. in Health Education/Community Health from the University of Florida. Mr. Levine currently serves on the Board of Governors of the State University System of Florida, where he has served as Chair of the Audit and Compliance Committee, Chair of the Research and Academic Excellence, Committee and Chair of the Select Committee on 2+2 Education Attainment. Mr. Levine also served as Chair of the State of Florida Higher Education Coordinating Council, a policy-setting body composed of all education entities from K-Post Secondary. Mr. Levine’s qualifications to serve on our Board of Directors include his broad healthcare management, policy and regulation and patient care delivery knowledge, executive level experience with integrated healthcare delivery systems and his knowledge as to budgeting and financial reporting.

Guido Neels has served as a member of our Board of Directors since August 2015. Mr. Neels has been an operating partner of EW Healthcare Partners L.P. (“EW”) since February 2013. Mr. Neels joined EW as a Partner in August 2006, was promoted to Managing Director in 2008 and served in that position until being appointed to Operating Partner. From May 2004 until retiring in November 2005, Mr. Neels served as Chief Operating Officer of Guidant Corporation (“Guidant”), a world leader in the development of cardiovascular medical products, where he was responsible for the global operations of Guidant’s four operating units – Cardiac Rhythm Management, Vascular Intervention, Cardiac Surgery, and Endovascular Solutions. From December 2002 to May 2004, Mr. Neels was Group Chairman, Office of the President at Guidant, responsible for worldwide sales operations, corporate communications, corporate marketing, investor relations and government relations. From January 2000 to December 2002, Mr. Neels was President of Guidant for Europe, Middle East, Africa and Canada. Mr. Neels previously served as Vice President of Global Marketing for Vascular Intervention and as Managing Director for German and Central European operations. From 1982 to 1994, until Guidant was spun off as an independent public company from Eli Lilly and Co., Mr. Neels held general management, sales and marketing positions at Eli Lilly in the United States and Europe. From 1972 to 1980, he held positions in information technology, finance and manufacturing at Raychem Corporation in Belgium and the United States. Mr. Neels currently serves on the board of directors of Bioventus LLC, a portfolio company of Essex Woodlands. In addition, Mr. Neels also serves on the board of directors for Christel House International and Amici Lovanienses, both not-for-profit organizations. Mr. Neels holds an M.B.A. from Stanford University and a business engineering degree from the University of Leuven in Belgium. Mr. Neels’ qualifications to serve on our Board of Directors include his extensive leadership experience in the medical device and biotechnology industries and his expertise in the commercialization of medical devices, corporate governance and the financial markets.

Paul Thomas has served as a member of our Board of Directors since September 2020. Mr. Thomas has more than 30 years of experience in the medtech industry and currently serves as the CEO and Co-Founder of Prominex, Inc. Mr. Thomas also served as the CEO of Roka Bioscience from 2009 to 2017. Prior to that, Mr. Thomas served as Chairman and CEO of LifeCell Corporation from 1998 until it was acquired by KCI in 2008 in a transaction valued

at $1.8 billion. He also held various senior positions, including President of the Pharmaceutical Products Division, during his tenure of 15 years with Ohmeda, Inc. Mr. Thomas served on the Board of Directors of Abiomed,Inc. from June 2011 to December 2023. He also served on the Board of Directors on Surgalign Spine Technologies, Inc. including its predecessor company, RTI, from May 2016 to September 2023. Mr. Thomas received his Master of Business Administration degree from Columbia University Graduate School of Business and completed his post graduate studies in Chemistry at the University of Georgia Graduate School of Arts and Science. He received his Bachelor of Science degree in Chemistry from St. Michael’s College. Mr. Thomas’ qualifications to serve on our Board of Directors include his extensive executive leadership and financial experience, particularly in connection with rapid growth technology businesses, and his experience as a director of publicly traded companies.

Dr. Joseph Tyndall has served as a member of our Board of Directors since December 2022. Since July 1, 2021, Dr. Tyndall has been a professor, Executive Vice President for Health Affairs and Dean at the Morehouse School of Medicine. Prior to Morehouse School of Medicine, Dr. Tyndall served as professor and chair of the Department of Emergency Medicine at the University of Florida College of Medicine from 2008 until his departure from UF in 2021. During his tenure at UF, Dr. Tyndall was appointed interim dean of the College of Medicine from August 2018 to January 2021 and was subsequently appointed to the position of associate vice president for strategic and academic affairs for UF Health in Gainesville, Florida, before his recruitment to Morehouse School of Medicine. Dr. Tyndall served on the Board of Directors of UF Health Shands Hospital at the University of Florida from 2010 to 2021 and was chair of the Board of Trustees for the UF Health Proton Therapy Institute during his tenure as interim dean. Dr. Tyndall served on the Board of Directors of the Florida College of Emergency Physicians from 2011 to 2021, serving as the society's president from 2018 to 2019. Dr. Tyndall is currently a member of the Board of Directors of Grady Health System in Atlanta, Georgia. Also, Dr. Tyndall is a trustee and immediate past president of the Society for Academic Emergency Medicine Foundation, which is emergency medicine’s national foundation supporting education and research in emergency care. Dr. Tyndall is a graduate of the University of Maryland School of Medicine and the emergency medicine residency program at the University of Maryland Medical System, where he served as Chief Resident. Dr. Tyndall received his master's degree in Health Services Management and Health Policy from Columbia University and a bachelor's degree in Chemistry from The George Washington University. Dr. Tyndall is an elected member of the Alpha Omega Alpha Honor Society and the Gold Humanism Honor Society. Dr. Tyndall is the current president of the Society for Academic Emergency Medicine Foundation and was also recently elected to serve a two-year term on the administrative board of the Council of Deans of the Association of American Medical College. Dr. Tyndall has published and lectured extensively nationally and internationally in emergency medicine and has active research interests in acute brain injury. Dr. Tyndall is an editor of the 10th edition of a leading textbook in emergency medicine, Rosen’s Emergency Medicine; Concepts and Clinical Practice. Dr. Tyndall's qualifications to serve on our Board of Directors include his extensive experience with the field of emergency medicine, knowledge of the healthcare industry and medical systems, considerable leadership experience, and deep engagement with topics within health services research.

Kathy Weiler has served as a member of our Board of Directors since December 2023. Ms. Weiler has served as the Executive Vice President, Chief Commercial and Growth Officer of Amwell (NYSE: AMWL) since June 2023 and oversees Amwell’s growth strategy, driving strategic initiatives and leading business development, sales and account management, commercial enablement, marketing, and strategic and channel partnership teams. Prior to Amwell, Ms. Weiler served as Chief Consumer Officer at Optum, where she led consumerism across the enterprise. Preceding that, Ms. Weiler was Chief Consumer Strategy Officer at UnitedHealth Group and the Chief Marketing and Experience Officer of Optum Health, leading marketing efforts for Optum Care and Optum’s Population Health Solutions, Complex Care Management, Medical Benefits Management, Behavioral Health, Prevention and Financial Services businesses. Ms. Weiler also served as Chief Marketing and Product Officer at Blue Cross and Blue Shield of Massachusetts, where she drove strategic growth and retention business objectives. Ms. Weiler spent her earlier career with multiple financial services organizations. Ms. Weiler was Chief Marketing Officer of Fidelity Investments FAS business and held senior marketing leadership roles at BNY Mellon/Pershing and The Hartford. Ms. Weiler holds a B.A. from Bowdoin College and an M.A. in International Economics and Finance from Brandeis University. Ms. Weiler's qualifications to serve on our Board of Directors include her extensive experience in marketing in the healthcare industry and considerable leadership experience.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NINE DIRECTOR NOMINEES, WHICH IS DESIGNATED AS PROPOSAL NO. 1.

CORPORATE GOVERNANCE

Director Independence

Our Board of Directors currently consists of ten directors: Karen Zaderej, Gregory Freitag, John H. Johnson, Alan Levine, Guido Neels, Paul Thomas, Amy Wendell, William Burke, Dr. Joseph Tyndall and Kathy Weiler. Mr. Freitag has not been nominated for re-election at the Meeting and, following the Meeting, the size of our Board of Directors will be reduced from ten to nine directors.

In determining whether our directors and director nominees are independent, we use the definition of independence provided in Rule 5605(a)(2) of the Nasdaq Stock Market’s (“Nasdaq”) Marketplace Rules. Under this definition of independence, we determined that Messrs. Burke, Johnson, Levine, Thomas and Neels, and Mses. Wendell and Weiler, and Dr. Tyndall are independent. Ms. Zaderej is not independent because she serves as an executive officer of the Company. Each member of our Audit Committee, Compensation Committee and Governance, Nominating and Sustainability Committee also meets the heightened independence standards under the applicable Nasdaq independence rules.

Attendance at Meetings

Our Board of Directors met seven times during 2023, either in person or by teleconference, and acted by written consent on nine occasions. Each of our then current directors attended at least 98% of the aggregate total meetings of the Board and committees of which he or she served during the related period of service in 2023. We expect our directors to attend the annual meeting of shareholders in accordance with our Corporate Governance Guidelines. In 2023, all of our then current directors were in attendance telephonically at the 2023 Annual Meeting of Shareholders.

Board Leadership Structure

Our Board of Directors is responsible for overseeing the business, property and affairs of Axogen. Members of our Board of Directors are kept informed of our business through discussions with our CEO and other officers, by reviewing materials provided to them and by participating in meetings of our Board of Directors and its committees.

Karen Zaderej, our CEO and President, also serves as our Chairman and Amy Wendell, serves as the Lead Director. Our Board of Directors does not have a policy regarding the separation of the roles of Chairman of our Board of Directors and CEO because our Board of Directors believes that the determination of whether to separate the roles depends largely upon the identity of the CEO and the members of our Board of Directors, there is no single best organizational model that is the most effective in all circumstances and that the shareholders’ interests are best served by allowing our Board of Directors to retain the flexibility to determine the optimal organizational structure for Axogen at a given time. At this time, we believe that we are best served by having the same individual serve as our CEO and Chairman of our Board of Directors.

Ms. Wendell, as Lead Director, facilitates the functioning of the Board of Directors independently of the Company's management and provides independent leadership to the Board of Directors. The Lead Director had the following responsibilities:

•providing leadership to ensure that the Board functions independently of management of the Company and other non-independent directors;

•providing leadership to foster the effectiveness of the Board;

•working with the Chair to ensure that the appropriate committee structure is in place and assisting the Governance, Nominating and Sustainability Committee in making recommendations for appointment to such committees;

•recommending to the Chair items for consideration on the agenda for each meeting of the Board;

•commenting to the Chair on the quality, quantity and timeliness of information provided by management to the independent director; and

•in the absence of the Chair, chairing Board meetings, including, providing adequate time for discussion of issues, facilitating consensus, encouraging full participation and discussion by individual directors and confirming that clarity regarding decision-making is reached and accurately recorded; in addition, chairing each Board meeting at which only outside directors or independent directors are present; consulting and meeting with any or all of the independent directors, at the discretion of either party and with or without the attendance of the Chair, and representing such directors, where necessary, in discussions with management of the Company on corporate governance issues and other matters; and working with the Chair and the Chief Executive Officer to ensure that the Board is provided with the resources, including external advisers and consultants to the Board as considered appropriate, to permit it to carry out its responsibilities and bringing to the attention of the Chair and the Chief Executive Officer any issues that are preventing the Board from being able to carry out its responsibilities.

Risk Oversight by our Board of Directors

Our Board of Directors takes an active role in risk oversight related to Axogen and primarily administers its role during Board of Directors and committee meetings. During regular meetings of our Board of Directors, members of our Board of Directors discuss the operating results for each fiscal quarter. These meetings allow the members of our Board of Directors to analyze any significant financial, operational, competitive, economic, regulatory and legal risks of our business model, as well as how effectively we implement our goals, including our ESG and sustainability goals. During regular Audit Committee meetings, Audit Committee members discuss the financial results for the most recent fiscal quarter with our independent auditors and our Chief Financial Officer (“CFO”). Our Audit Committee also meets with, and provides guidance to, our independent auditors outside the presence of management and oversees and reviews with management the liquidity, capital needs and allocation of our capital, our funding needs and other finance matters. In addition, our Audit Committee reviews our healthcare compliance, information technology and disaster recovery capabilities, risk management programs and treatment of whistleblower complaints regarding internal accounting, accounting controls or audit matters. Our Audit Committee also oversees the management of risks from cybersecurity threats, including the policies, standards, processes and practices that the Company's management implements to address the risks from cybersecurity threats. These discussions and processes allow the members of our Audit Committee to analyze any significant risks that could materially impact the financial health of our business.

In furtherance of its risk oversight responsibilities, our Compensation Committee has oversight of the Company’s culture and human capital management, including diversity, equity and inclusion with respect to the Company’s employees and has evaluated our overall compensation policies and practices for our employees to determine whether such policies and practices create incentives that could reasonably be expected to affect the risks faced by us and our management has concluded that the risks arising from our policies and practices are not reasonably likely to have a material adverse effect on the Company.

Our Governance, Nominating, and Sustainability Committee is charged with helping the Board of Directors ensure that we are adopting good governance practices, which help minimize business risks and promote shareholder value by ensuring that our Board is sufficiently diverse and possesses the right skills for our business. In addition to governance oversight, our Governance, Nominating, and Sustainability Committee also oversees the Company's efforts to minimize environmental risk and help ensure that the Company has the proper focus on sustainability.

Additionally, given the nature of our business, our Quality, Compliance and Portfolio Management Committee has oversight over quality, and regulatory compliance matters, and innovative portfolio management. Our Quality, Compliance, and Portfolio Management Committee has primary oversight over our regulatory compliance with the FDA and other governing bodies.

Board Committees

The standing committees of Axogen’s Board of Directors include an Audit Committee, a Compensation Committee, a Governance, Nominating and Sustainability Committee, and a Quality, Compliance and Portfolio Management Committee. Messrs. Burke (Chairman), and Levine and Ms. Wendell are members of the Audit Committee. Messrs. Thomas (Chairman), Levine Neels, and Johnson are members of the Compensation Committee. Messrs. Neels (Chairman) and Thomas and Mss. Wendell and Weiler are members of the Governance, Nominating and Sustainability Committee. Messrs. Johnson (Chairman) and Freitag, Dr. Tyndall, and Ms. Weiler are members of the Quality, Compliance and Portfolio Management Committee. The Charters of each of the Audit Committee, the Compensation Committee, the Governance, Nominating and Sustainability Committee, and the Quality, Compliance and Portfolio Management Committee are posted on our website at http://ir.axogeninc.com/governance-docs. The information contained on our website, or on other websites linked to our website, is not part of this document. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors.

Audit Committee

The Audit Committee was established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934 as amended ("the Exchange Act"). In the opinion of the Board of Directors, each of the members of the Audit Committee has both business experience and an understanding of accounting principles generally accepted in the United States (“GAAP”) and financial statements enabling them to effectively discharge their responsibilities as members of the Audit Committee. The members of our Audit Committee meet the independence requirements under Nasdaq and SEC rules. Moreover, the Board of Directors has determined that each of Messrs. Burke and Levine and Ms. Wendell is an “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the U.S. Securities Exchange Commission (the "SEC"), as amended. The Audit Committee is primarily focused on the integrity of our financial statements, systems of internal accounting controls, the internal and external audit process and the process of monitoring compliance with laws and regulations (including cybersecurity matters).

The Audit Committee is responsible for, among other things:

•Overseeing the risks relating to the accounting and financial reporting process of the Company and the audits of the Company's financial statements;

•Meeting regularly with management to review and discuss the financial risks management processes, including compliance with Sarbanes-Oxley and related internal controls and procedures, disclosure controls and procedures and accounting and reporting compliance as well as other compliance matters;

•Overseeing the assessment and effectiveness of the Company's internal control environment and the internal audit function, including the annual internal audit plan;

•Providing oversight for the Company's compliance programs which include healthcare, legal, information technology, data privacy and disaster recovery capabilities;

•Providing oversight for the Company's cybersecurity policies, standards, processes and practices; and

•Reviewing the results of Company management's investigation into any noncompliance with healthcare, legal, technology and regulatory matters.

Our Audit Committee held five meetings and acted by written consent three times during 2023.

Compensation Committee

Our Compensation Committee determines and periodically evaluates the various levels and methods of compensation for our directors, officers and employees, and is responsible for establishing executive compensation and administering the Axogen, Inc. Amended and Restated 2019 Long-Term Incentive Plan (the “ 2019 Plan”) and the Axogen, Inc. Amended and Restated 2017 Employee Stock Purchase Plan (the “2017 ESPP”).

Our Compensation Committee is responsible for, among other things:

•periodic review of our compensation philosophy and the design of our compensation programs;

•establishing and overseeing our incentive and stock-based compensation plans;

•reviewing and approving the compensation of directors and executive officers;

•at least annually, establishing and reviewing our CEO’s management objectives, conducting the CEO’s performance evaluation and communicating the outcomes to our Board of Directors;

•reviewing and approving payouts to participants as proposed by our CEO under our compensation plans;

•reviewing and approving, for our CEO and our other executive officers, when and if appropriate, employment agreements, severance agreements, change in control provisions/agreements and any severance or similar termination payments proposed to be made to any of our current or former executive officers; in consultation with senior management, overseeing regulatory compliance with respect to compensation matters; preparing the annual report on executive compensation required to be included in our annual proxy statement; and reviewing and discussing with management human capital management matters and assist the Board of Directors in its oversight of the Company's policies relating to culture, human capital management, diversity, equity and inclusion, and ESG matters that relate to management of human capital.

Our Board of Directors, with recommendations from our Compensation Committee and with the participation of our executive officers and employees, has overseen the adoption of our Affirmative Action Plan, which continues our commitment to equal employment opportunity to ensure the rights of each person in all actions, including recruitment, selection, training, development, compensation and promotion In furtherance of this policy, we (i) partnered with a third-party vendor to ensure that our opportunities are posted and available on each state’s veteran and diversity job boards; (ii) audited existing job postings, advertisements and candidate communications for gender coding; (iii) created custom sourcing filters to target diverse candidates; (iv) trained leaders on issues related to discrimination and harassment and what they can do to identify it and resolve it; (v) ensured recruitment marketing material illustrates our authentic diversity; (vi) promoted Axogen with members of targeted candidate groups (Women in Tech, veteran groups, Historically Black Colleges and Universities, Hispanic Groups, African American Groups); (vii) initiated and maintained communication with organizations having special interests in the recruitment of and job accommodations for protected veterans and individuals with disabilities; (viii) implemented interview scorecards to ensure equitable consideration and discussion during new employee selection process; and (ix) encouraged employee resource groups devoted to development and support of potentially under-represented groups.

The Compensation Committee may delegate its powers under the 2019 Plan to one or more directors (including a director who is also one of our officers) and may authorize one or more officers to grant awards under the 2019 Plan, except that the Compensation Committee may not delegate its powers to grant awards to executive officers or directors who are subject to Section 16 of the Exchange Act. The Compensation Committee’s ability to delegate its powers is also limited by the rules of the Nasdaq Stock Market on which Axogen’s shares of common stock are listed. In February 2023, the Compensation Committee adopted a resolution delegating to each of the Company’s CEO, Chief Financial Officer ("CFO"), and General Counsel ("GC"), the authority to grant Awards to, and exercise discretion with respect to, individuals who are not Eligible Individuals that are officers under Section 16 of the Exchange Act (as defined in the 2019 Plan) pursuant to the terms of the forms of agreements under the 2019 Plan, with no further action by the Compensation Committee.

Since May 2016, our Compensation Committee has engaged Aon's Human Capital Solutions practice, a division of Aon plc, ("Aon") as its compensation consultant, for the purpose of advising upon executive and director compensation. The Compensation Committee has reviewed the independence of Aon’s advisory role relative to the six consultant independence factors adopted by the SEC to guide listed companies in determining the independence of their compensation consultants, legal counsel and other advisors. Following its review, the Compensation Committee concluded that Aon did not have any conflicts of interest and provided the Compensation Committee with objective and independent executive compensation advisory services.

Aon was engaged in 2023 to provide the Compensation Committee with an analysis of Axogen’s executive officers, officers, and director compensation, focusing on all compensation components including base salary,

bonus, equity, director retainers and fees and committee fees. Aon conducted a thorough review of Axogen’s most relevant comparative companies, and analyzed base salary, bonus, equity, retainers, and all other compensation components in relation to Axogen’s peer group.

Our Compensation Committee held five meetings and acted by written consent three times during 2023.

Governance, Nominating and Sustainability Committee

The Governance, Nominating and Sustainability Committee is responsible for providing oversight in relation to the corporate governance of the Company and also identifies director nominees for election to fill vacancies on our Board of Directors. Nominees are approved by the Board of Directors on recommendation of the Governance, Nominating and Sustainability Committee. In evaluating nominees, the Governance, Nominating and Sustainability Committee particularly seeks candidates of high ethical character with significant business experience at the senior management level who have the time and energy to attend to board responsibilities. Candidates should also satisfy such other particular requirements that the Governance, Nominating and Sustainability Committee may consider important to our business at the time. When a vacancy occurs on the Board of Directors, the Governance, Nominating and Sustainability Committee will consider nominees from all sources, including shareholders, nominees recommended by other parties, and candidates known to the directors or our management. The best candidate from all evaluated will be recommended to the Board of Directors to consider for nomination. No material changes have been made to the procedures by which shareholders may recommend nominees to our Board of Directors.

The Governance, Nominating and Sustainability Committee is responsible for, among other things:

•reviewing and making recommendations to the Board of Directors, regarding the Company’s policy and performance in relation to sustainability-related matters, including:

a) the environment;

b) climate change;

c) human rights;

d) heritage and land access;

e) security and emergency management; and

f) community relations;

•assisting in setting annual sustainability performance goals and assessing achievement of such goals if requested by the Compensation Committee.

To be a good corporate steward and citizen, our Board of Directors believes in a long-term approach, including certain key environmental, social and corporate governance ("ESG") objectives. Our Board of Directors, with recommendations from our Governance, Nominating and Sustainability Committee with the participation of our executive officers and employees, has overseen the implementation of several policy and operational improvements, including:

•the adoption of our Anti-Human Trafficking Policy, which is our commitment to an environment free from human trafficking, prohibits our employees or anyone who provides services to us from engaging in any form of human trafficking and provides a reporting website and hotline for actual or suspected violations of the policy;

•the implementation of recycling programs in our all of our facilities as well as investing in new purified water systems, sanitation systems, LED lighting, hydronic HVAC systems and energy efficient freezers, all with the goal of reducing our environmental footprint; and

•the adoption of our Environmental, Social and Governance report (the "ESG Report"), which illustrates our commitment to running an ethical, transparent and responsible business and highlights our recent ESG-related accomplishments, including: (i) advancing our innovation pipeline with new products in development and clinical studies to expand our treatment algorithms; (ii) initiating programs in Diversity, Equity, and

Inclusion ("DEI") and launching our first two Employee Resource Groups to broaden our reach to talent; (iii) renovating and developing facilities with improved sustainability measures; (iv) improving data security; and (v) supporting charitable organizations at all locations.

Our Governance, Nominating and Sustainability Committee held four meetings and acted by written consent twice during 2023.

Quality, Compliance and Portfolio Management Committee

The Quality, Compliance and Portfolio Management Committee assists the Board in fulfilling its oversight responsibilities with respect to quality, and regulatory compliance matters, and portfolio management.

The Quality, Compliance and Portfolio Management Committee oversees the following:

•risk management in the areas of product quality and safety, including but not limited to, reviewing the adequacy and effectiveness of the Company’s strategies for compliance with laws and regulations, the safety and quality of the Company’s products, and the impact of changes in global regulatory requirements;

•coordinating with the Audit Committee on its oversight of quality and compliance issues and has primary oversight responsibility for areas of non-financial, regulatory compliance (including compliance with the Company’s Code of Business Conduct and Ethics as well as cybersecurity and other information technology issues as they relate to Axogen product and service development); and

•overseeing the Company’s innovation portfolio, including implementation of portfolio management, oversight of grants both to the Company and from the Company to third parties, review of the competitive position of the Company’s portfolio, and review of the Company’s response to any identified technological vulnerabilities involving its products and services.

Our Quality, Compliance and Portfolio Management Committee held four meeting and did not act by written consent during 2023.

Environmental, Sustainability and Corporate Social Responsibility

Corporate responsibility and sustainability are important to us and guide our actions as a company. We have always focused on delivering strong financial results, but we are committed to doing so in a way that respects the communities and environments in which we operate. The Governance, Nominating and Sustainability Committee, and the Compensation Committee provide oversight of ESG matters. In 2021, we published our inaugural ESG report highlighting our commitment to the patients who drive our mission, the communities we serve, and our pursuit of advancing the science of nerve repair in ethical and sustainable ways. The ESG report was inspired by the Sustainability Accounting Standards Board’s (“SASB”) topics for disclosures, and we plan to expand our alignment with SASB and other reporting frameworks and endeavor to report on our progress on various ESG initiatives biannually. Our ESG report for 2022 can be found under the news/events section of the investors section of our website at https://ir.axogeninc.com/.

Corporate Governance Guidelines

Our Board of Directors adopted and approved a set of Corporate Governance Guidelines. The guidelines set forth the practices our Board follows with respect to, among other things, the composition of the Board and Board committees, director responsibilities, director continuing education, and performance evaluation of the Board. The guidelines are posted on our website at http://ir.axogeninc.com/governance-docs.

Some of the governance practices included in the Corporate Governance Guidelines are as follows:

Protections Against Overboarding

To ensure that our directors are not over committed and have sufficient time to fulfill their duties and responsibilities on our Board of Directors effectively, directors are required to limit the number of other public company boards on which they serve in consideration of ISS, Glass Lewis, and other relevant constituents’ guidelines, so that they are able to devote adequate time to their duties to the Company, including preparing for and attending meetings. Prior to accepting or resigning from any position on the board of directors of any organization, whether for-profit or not-for-profit, current directors are required to notify the Governance, Nominating, and Sustainability Committee, such as the recent notification from Mr. Johnson of his resignation as the non-executive chairman of the Board of Directors for Autolus Therapeutics plc., effective April 1, 2024. The Governance, Nominating, and Sustainability Committee may take into account the nature of, and time involved in a director’s service on other boards and/or committees in evaluating the suitability of a director’s service on the Board of Directors.

Resignation Offered at Age 75

Longer serving directors have valuable insight about our business, operations, history, policies and objectives. Our Board of Directors does not currently believe that a mandatory retirement age for directors is appropriate, and that continued service by a particular director may be in the best interests of the Company and our shareholders. However, as set forth in the Governance, Nominating and Sustainability Committee charter, when a director reaches the age of 75 years, such director should volunteer to not stand for re-election and, in the event that such director remains on the Board of Directors, such director should continue to volunteer to not stand for re-election in each and every year following the attainment of the age of 75. In compliance with this policy, Mr. Neels volunteered not to stand for re-election at the Meeting. However, due to his skills and expertise, and in consideration of Board of Directors continuity, the Board of Directors determined that it is desirable and in the best interest of the Company to have Mr. Neels continue to serve on the Board of Directors.

Director Approval

Our directors are elected by a plurality vote, votes cast by the shareholders entitled to vote at the Meeting. A plurality vote means that the directors who receive the most votes in an election, though not necessarily a majority, will be elected. However, pursuant to our Corporate Governance Guidelines, directors who receive more “withhold” votes than “for” votes will be required to tender their resignation, which the Board will be required to consider. The Board will consider the resignation and determine within sixty (60) days of the certification of the shareholder vote whether to accept such resignation. If the Board determines not to accept the resignation, the Board’s determination and reasons for not accepting the resignation will be reported on a Form 8-K.

Director Nominations

Director nominees are approved by our Board of Directors on recommendation of our Governance, Nominating and Sustainability Committee. In evaluating nominees, our Governance, Nominating and Sustainability Committee particularly seeks candidates of high ethical character with significant business experience at the senior management level who have the time and energy to attend to board responsibilities. Candidates should also satisfy such other particular requirements that our Governance, Nominating and Sustainability Committee may consider important to our business at the time. In accordance with our Governance, Nominating and Sustainability Committee charter and policies included therein, characteristics expected of all directors should include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to our Board of Directors. In evaluating the suitability of individual directors, our Board of Directors takes into account many factors, including: (i) general understanding of marketing, finance, and other disciplines relevant to the success of a small publicly traded medical device company in today’s business environment; (ii) understanding of the Company’s business and technology; (iii) educational and professional background; (iv) personal accomplishment; and (v) geographic, gender, age, and ethnic diversity. Our Board of Directors evaluates each individual in the context of our Board of Directors as a whole, with the objective of recommending a group that can best perpetuate the success of the Company’s business and represent shareholder interests through the exercise of sound judgment, using its diversity of experience.

In addition, in accordance with our Governance, Nominating and Sustainability Committee charter and policies included therein, when a vacancy occurs on our Board of Directors, our Governance, Nominating and Sustainability Committee will consider nominees from all sources, including shareholders, nominees recommended by other parties, and candidates known to our directors or our management. The best candidate(s) from all evaluated will be recommended to our Board of Directors to consider for nomination.

Shareholders wishing to recommend a director nominee to our Governance, Nominating and Sustainability Committee may do so by sending to our Governance, Nominating and Sustainability Committee, on or before January 1 of each year, the following information: (i) name of the candidate and a brief biographical sketch and resume; (ii) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and (iii) a signed statement as to the submitting shareholder’s current status as a shareholder and the number of shares currently held. No candidates for director nominations were submitted to our Governance, Nominating and Sustainability Committee by any shareholder in connection with the Meeting. Such recommendation should be addressed to Governance, Nominating and Sustainability Committee, c/o General Counsel, Axogen, Inc., 13631 Progress Blvd., Suite 400, Alachua, FL 32615.

Board Skills and Experience Matrix

Our Board of Directors has taken a thoughtful approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the Company and that enable them to provide oversight of management to ensure accountability to our shareholders. The Board of Directors and the Governance, Nominating and Sustainability Committee believe the skills, qualities, attributes, experience and diversity of backgrounds of our directors provide us with a diverse range of perspectives to effectively address our evolving needs and represent the best interests of our shareholders.

The following is a summary of relevant skills and qualifications of our existing directors:

| | | | | | | | |

| Finance & SOX Compliance | Quality Assurance | Human Capital Management |

| Risk Management | Regulatory and Compliance | Public Board |

| Healthcare Sales and Marketing | Innovation | Payer/Provider |

| Global | Technology | Clinician/Physician |

| Strategy | Clinical Trials | Corporate Governance |

| Mergers and Acquisitions | Senior Leadership | |

| Public Policy and Government Relations | Business Continuity and Manufacturing | |

Diversity Policy Statement