November 7, 2024 nasdaq: axgn Corporate presentation

2 Safe harbor statement revolutionizing the science of nerve repair® This presentation contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include (1) the TAM for the targeted nerve markets, (2) 2024 financial guidance, including revenue range and gross margins, (3) growth drivers for the business, (4) expectations regarding the commercial performance of Avive+ Soft Tissue MatrixTM, (5) the expectation that the Axogen Processing Center will support our BLA filing, (6) our expectations regarding our potential for BLA approval in September 2025, (7) the expectation that a new (non-biosimilar) competitive processed nerve allograft would need to complete clinical testing and obtain BLA approval prior to clinical release, and that it would likely take 8 years to achieve this, (8) the expectation that Avance® would be designated as the reference product for any biosimilar nerve allograft product and the expectation that approval of such a biosimilar would not occur for at least 12 years from approval of our BLA, and (9) the expectation that RECONSM study topline results will support our BLA filing. Actual results or events could differ materially from those described in any forward-looking statements as a result of various factors, including, without limitation, statements related to potential disruptions caused by leadership transitions, global supply chain issues, record inflation, hospital staffing issues, product development, product potential, expected clinical enrollment timing and outcomes, regulatory process and approvals, financial performance, sales growth, surgeon and product adoption, market awareness of our products, data validation, our visibility at and sponsorship of conferences and educational events, global business disruption caused by Russia’s invasion of Ukraine and related sanctions, recent geopolitical conflicts in the Middle East, potential disruptions due to management transitions, as well as those risk factors described under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the most recently ended fiscal year. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements.

3 The Axogen platform for nerve repair revolutionizing the science of nerve repair® • Exclusively focused on peripheral nerve repair with a differentiated platform • 15+ years of demonstrated clinical outcome consistency • 275 peer-reviewed clinical publications • Over 100,000 Avance® nerve grafts implanted • Significant barriers to competitive entry • Patient activation and surgeon education capabilities

4 The function of nerves and injury types Nerves are like wires • Transfer signals across a network • If cut, data cannot be transferred • If crushed, short circuits and data corruption may occur The peripheral nervous system is a vast network from every organ to and from the brain • Sensory • Motor • Mixed Nerves can be injured in three ways: 1. Transection Traumatic nerve injuries e.g., motor vehicle accidents, power tool accidents, battlefield injuries, gunshot wounds, surgical injuries, neuroma-in- continuity 2. Compression Carpal, cubital, tarsal tunnel revisions, blunt trauma, previous surgeries 3. Stump Neuroma Amputations, mastectomies, previous surgeries revolutionizing the science of nerve repair®

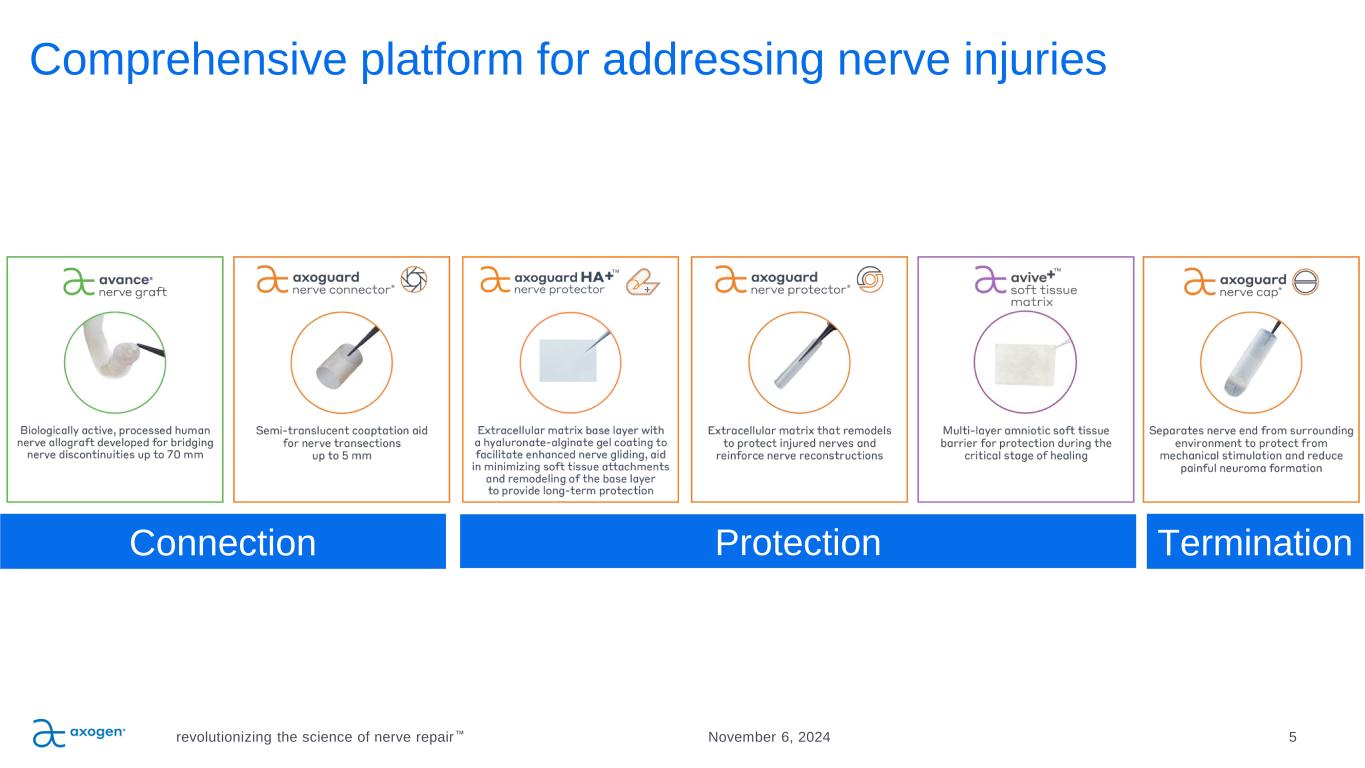

November 6, 2024revolutionizing the science of nerve repair 5 Comprehensive platform for addressing nerve injuries TerminationProtectionConnection

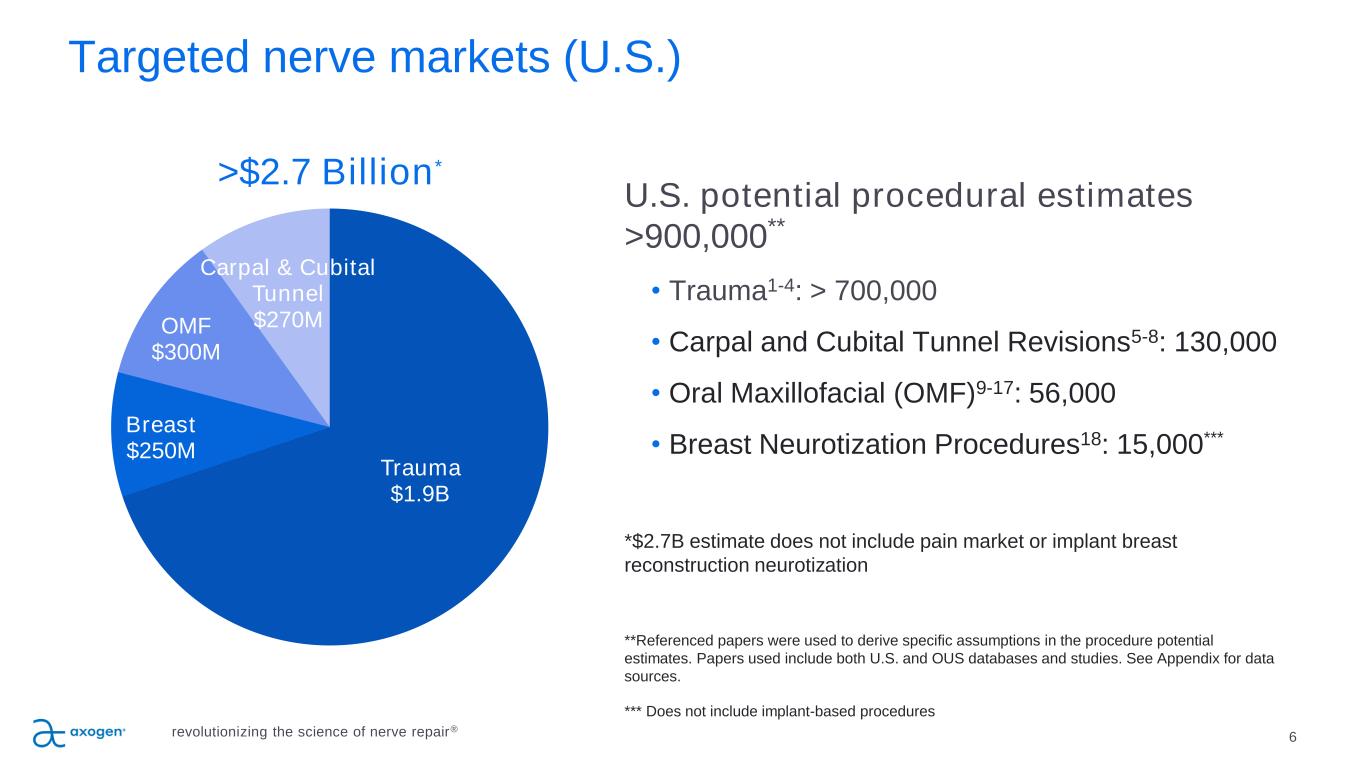

Targeted nerve markets (U.S.) 6 Trauma $1.9B Breast $250M OMF $300M Carpal & Cubital Tunnel $270M U.S. potential procedural estimates >900,000** • Trauma1-4: > 700,000 • Carpal and Cubital Tunnel Revisions5-8: 130,000 • Oral Maxillofacial (OMF)9-17: 56,000 • Breast Neurotization Procedures18: 15,000*** *$2.7B estimate does not include pain market or implant breast reconstruction neurotization **Referenced papers were used to derive specific assumptions in the procedure potential estimates. Papers used include both U.S. and OUS databases and studies. See Appendix for data sources. *** Does not include implant-based procedures >$2.7 Billion* revolutionizing the science of nerve repair®

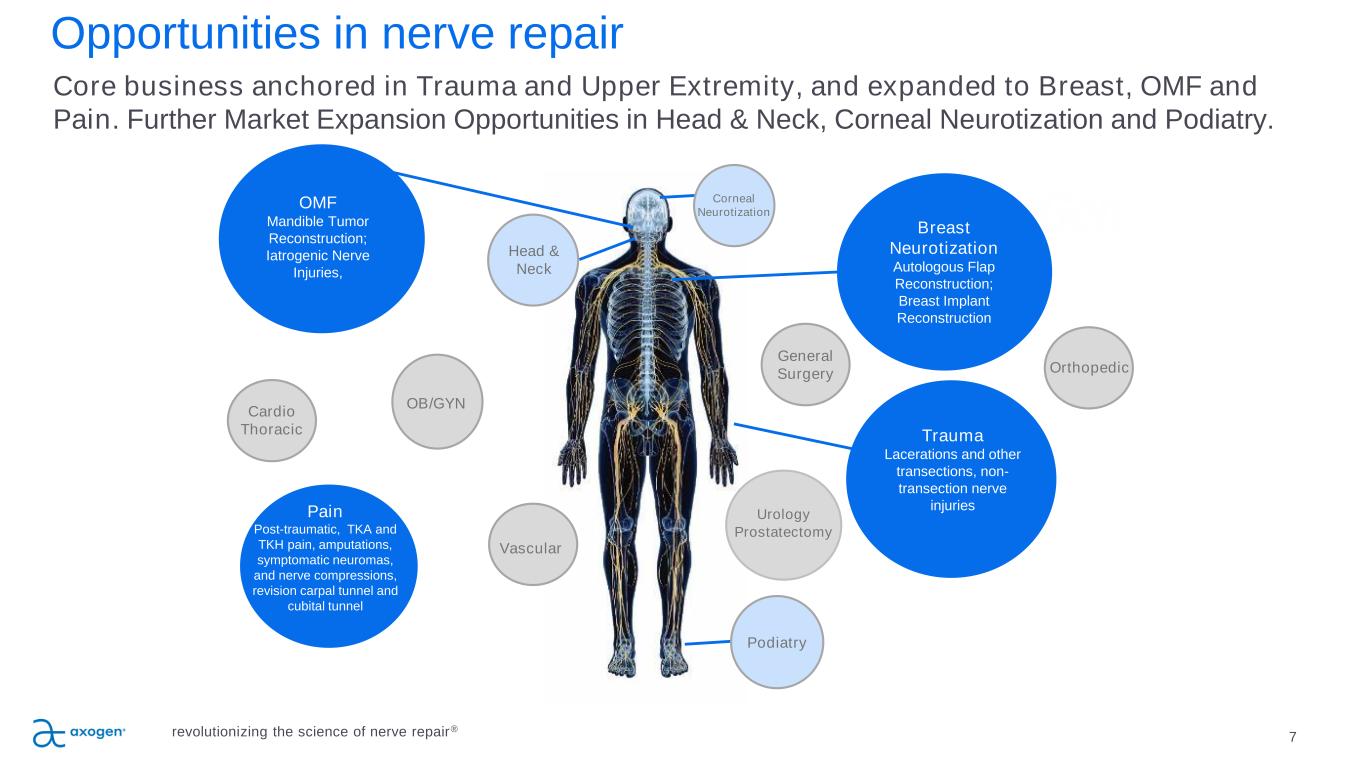

7 P IL L A R 5 Opportunities in nerve repair P IL L A R 4 P IL L A R 3 Pain Post-traumatic, TKA and TKH pain, amputations, symptomatic neuromas, and nerve compressions, revision carpal tunnel and cubital tunnel Core business anchored in Trauma and Upper Extremity, and expanded to Breast, OMF and Pain. Further Market Expansion Opportunities in Head & Neck, Corneal Neurotization and Podiatry. revolutionizing the science of nerve repair® Breast Neurotization Autologous Flap Reconstruction; Breast Implant Reconstruction Urology Prostatectomy OMF Mandible Tumor Reconstruction; Iatrogenic Nerve Injuries, Trauma Lacerations and other transections, non- transection nerve injuries Head & Neck OB/GYN General Surgery Cardio Thoracic Orthopedic Podiatry Vascular Corneal Neurotization

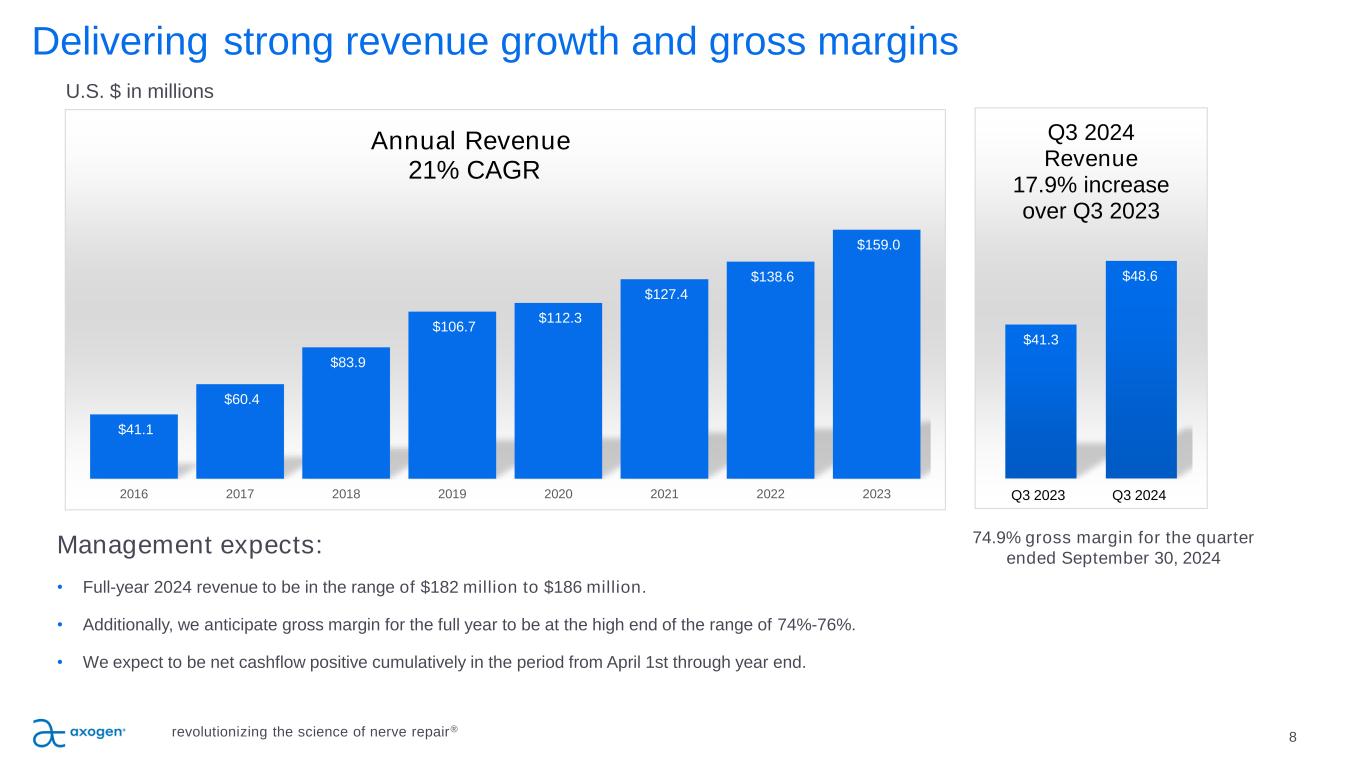

$41.1 $60.4 $83.9 $106.7 $112.3 $127.4 $138.6 $159.0 2016 2017 2018 2019 2020 2021 2022 2023 Annual Revenue 21% CAGR 8 Delivering strong revenue growth and gross margins U.S. $ in millions revolutionizing the science of nerve repair® Management expects: • Full-year 2024 revenue to be in the range of $182 million to $186 million. • Additionally, we anticipate gross margin for the full year to be at the high end of the range of 74%-76%. • We expect to be net cashflow positive cumulatively in the period from April 1st through year end. $41.3 $48.6 Q3 2024 Revenue 17.9% increase over Q3 2023 74.9% gross margin for the quarter ended September 30, 2024 Q3 2023 Q3 2024

Growth drivers revolutionizing the science of nerve repair® 9 Clinical Data • Clinical data published supports increased adoption particularly with middle adopters – RECONSM 19 – Meta Analysis of clinical outcomes and Medicare Economic Data20 – Premier Economic Data21 – Cost–effectiveness analysis of Avance22 Innovation – New product launches in nerve protection: Axoguard HA+ Nerve Protector launched in Q2 2023, Avive+ Soft Tissue MatrixTM launched in Q2 2024 – Resensation® for breast neurotization expansion into implant-based reconstructions Sales Rep Productivity driving penetration in high-potential accounts Patient Activation Programs for breast neurotization, surgical treatment of pain, and OMF Surgeon Education across nerve repair applications

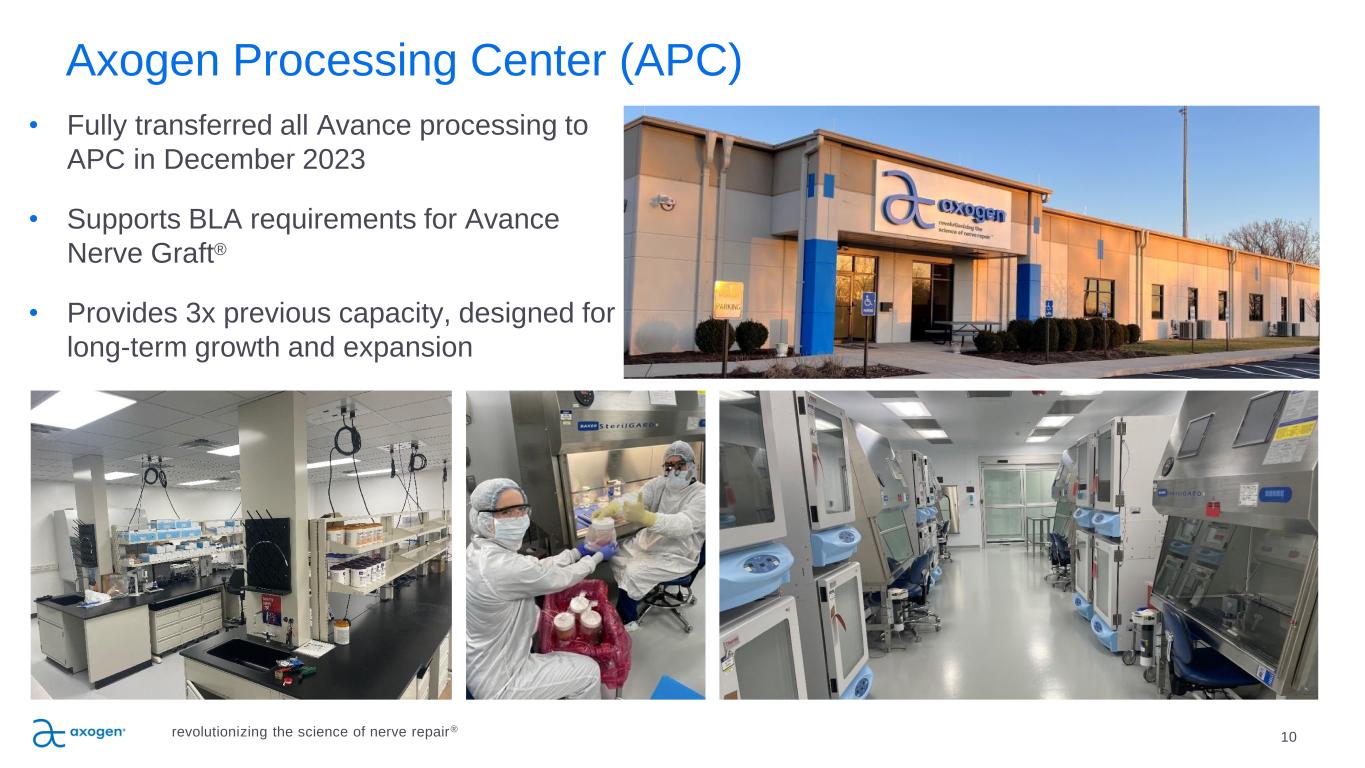

10 Axogen Processing Center (APC) • Fully transferred all Avance processing to APC in December 2023 • Supports BLA requirements for Avance Nerve Graft® • Provides 3x previous capacity, designed for long-term growth and expansion revolutionizing the science of nerve repair®

Product Portfolio revolutionizing the science of nerve repair® 11

Traditional Transection repair options are suboptimal 12 SUTURE Direct suture repair of no-gap injuries • Common repair method • May result in tension to the repair leading to ischemia • Concentrates sutures at the coaptation site AUTOGRAFT Traditional method despite several disadvantages • Secondary surgery • Loss of function and sensation at harvest site 23 • High complication rates including wound healing (7%) and chronic pain (23%) 23 • Limited availability of graft length and diameter SYNTHETIC CONDUITS Convenient off the shelf option; limited efficacy & use • Provides only gross direction for regrowth • Limited to small gaps • 34%-57% failure rate >5mm gaps 24, 25 • Semi-rigid and opaque material limits use and visualization • Repair reliant on fibrin clot formation revolutionizing the science of nerve repair®

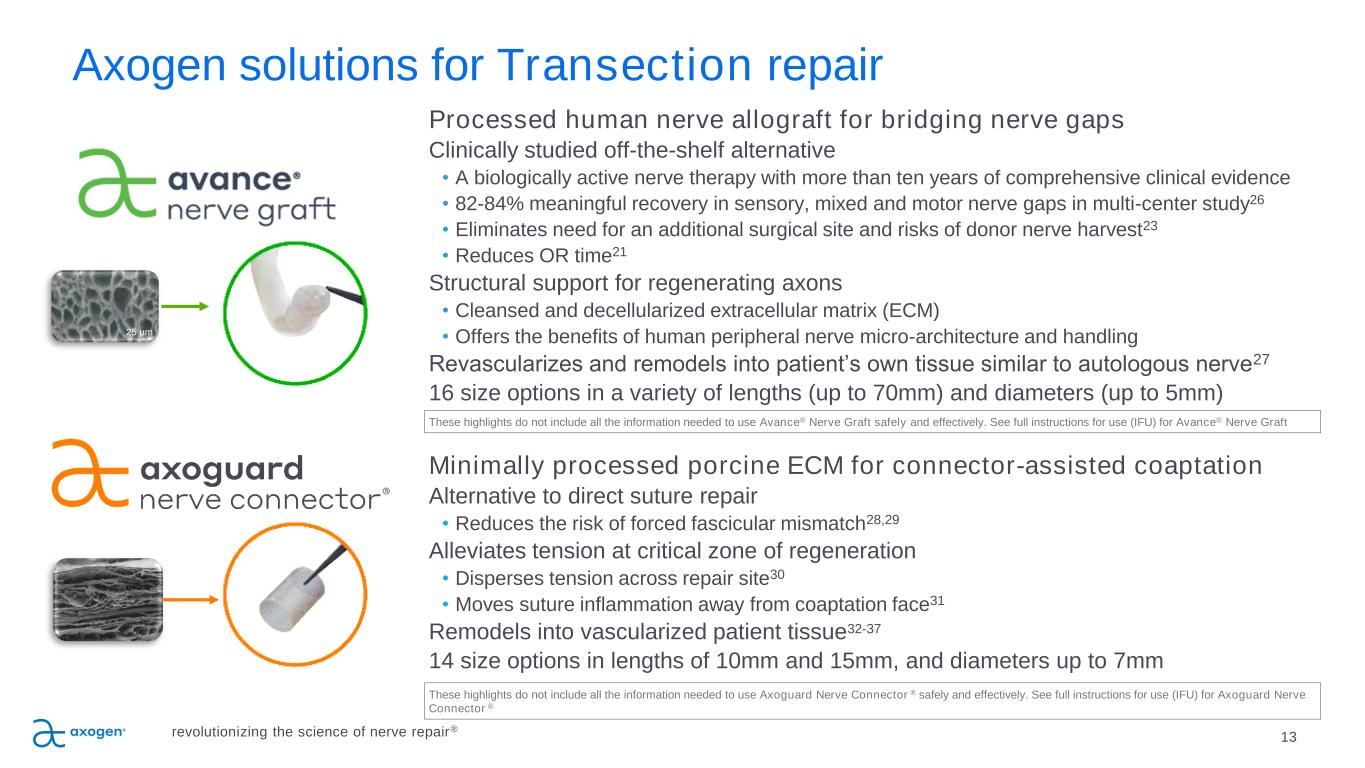

13 25 µm Processed human nerve allograft for bridging nerve gaps Clinically studied off-the-shelf alternative • A biologically active nerve therapy with more than ten years of comprehensive clinical evidence • 82-84% meaningful recovery in sensory, mixed and motor nerve gaps in multi-center study26 • Eliminates need for an additional surgical site and risks of donor nerve harvest23 • Reduces OR time21 Structural support for regenerating axons • Cleansed and decellularized extracellular matrix (ECM) • Offers the benefits of human peripheral nerve micro-architecture and handling Revascularizes and remodels into patient’s own tissue similar to autologous nerve27 16 size options in a variety of lengths (up to 70mm) and diameters (up to 5mm) Minimally processed porcine ECM for connector-assisted coaptation Alternative to direct suture repair • Reduces the risk of forced fascicular mismatch28,29 Alleviates tension at critical zone of regeneration • Disperses tension across repair site30 • Moves suture inflammation away from coaptation face31 Remodels into vascularized patient tissue32-37 14 size options in lengths of 10mm and 15mm, and diameters up to 7mm Axogen solutions for Transection repair revolutionizing the science of nerve repair® These highlights do not include all the information needed to use Axoguard Nerve Connector ® safely and effectively. See full instructions for use (IFU) for Axoguard Nerve Connector ® These highlights do not include all the information needed to use Avance® Nerve Graft safely and effectively. See full instructions for use (IFU) for Avance® Nerve Graft

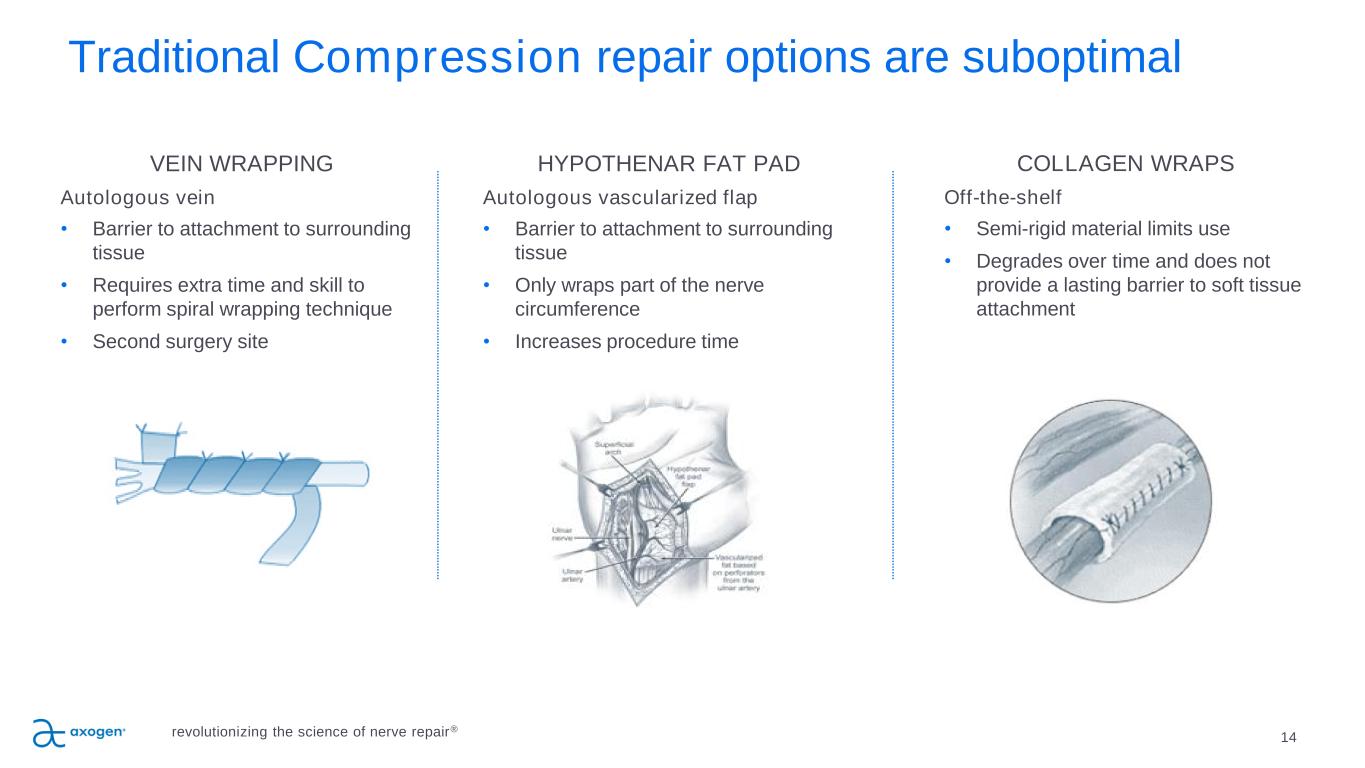

Traditional Compression repair options are suboptimal 14 VEIN WRAPPING Autologous vein • Barrier to attachment to surrounding tissue • Requires extra time and skill to perform spiral wrapping technique • Second surgery site HYPOTHENAR FAT PAD Autologous vascularized flap • Barrier to attachment to surrounding tissue • Only wraps part of the nerve circumference • Increases procedure time COLLAGEN WRAPS Off-the-shelf • Semi-rigid material limits use • Degrades over time and does not provide a lasting barrier to soft tissue attachment revolutionizing the science of nerve repair®

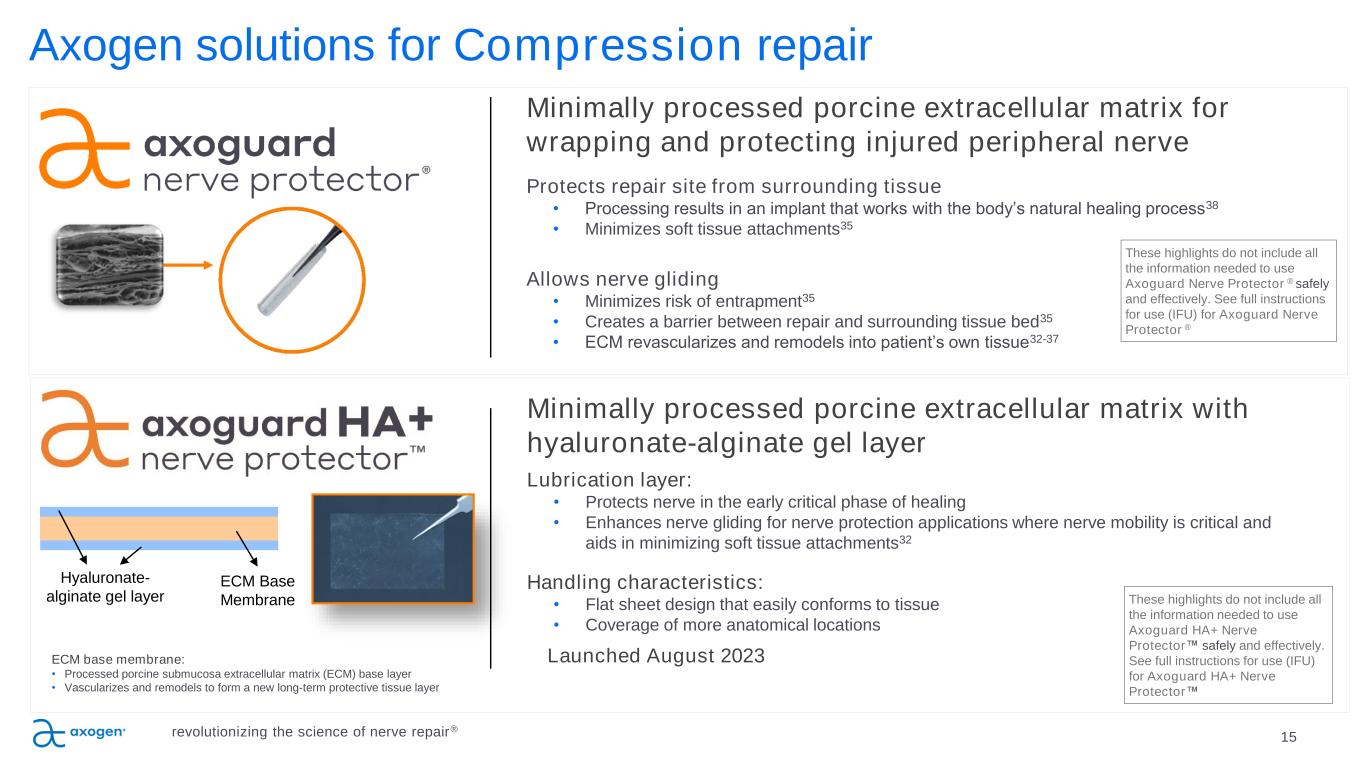

15 Axogen solutions for Compression repair Minimally processed porcine extracellular matrix for wrapping and protecting injured peripheral nerve Protects repair site from surrounding tissue • Processing results in an implant that works with the body’s natural healing process38 • Minimizes soft tissue attachments35 Allows nerve gliding • Minimizes risk of entrapment35 • Creates a barrier between repair and surrounding tissue bed35 • ECM revascularizes and remodels into patient’s own tissue32-37 revolutionizing the science of nerve repair® Hyaluronate- alginate gel layer ECM Base Membrane ECM base membrane: • Processed porcine submucosa extracellular matrix (ECM) base layer • Vascularizes and remodels to form a new long-term protective tissue layer Minimally processed porcine extracellular matrix with hyaluronate-alginate gel layer Lubrication layer: • Protects nerve in the early critical phase of healing • Enhances nerve gliding for nerve protection applications where nerve mobility is critical and aids in minimizing soft tissue attachments32 Handling characteristics: • Flat sheet design that easily conforms to tissue • Coverage of more anatomical locations Launched August 2023 These highlights do not include all the information needed to use Axoguard HA+ Nerve Protector safely and effectively. See full instructions for use (IFU) for Axoguard HA+ Nerve Protector These highlights do not include all the information needed to use Axoguard Nerve Protector ® safely and effectively. See full instructions for use (IFU) for Axoguard Nerve Protector ®

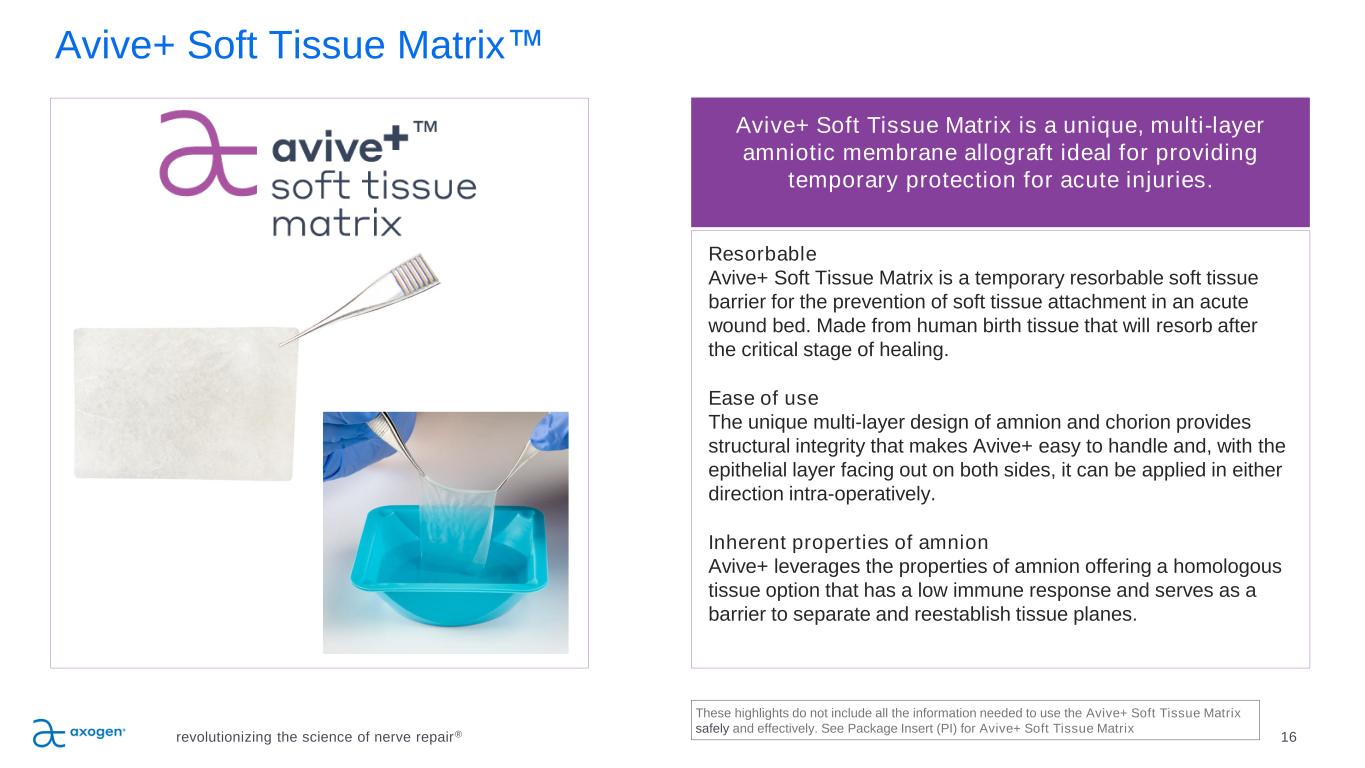

revolutionizing the science of nerve repair® 16 Avive+ Soft Tissue Matrix Resorbable Avive+ Soft Tissue Matrix is a temporary resorbable soft tissue barrier for the prevention of soft tissue attachment in an acute wound bed. Made from human birth tissue that will resorb after the critical stage of healing. Ease of use The unique multi-layer design of amnion and chorion provides structural integrity that makes Avive+ easy to handle and, with the epithelial layer facing out on both sides, it can be applied in either direction intra-operatively. Inherent properties of amnion Avive+ leverages the properties of amnion offering a homologous tissue option that has a low immune response and serves as a barrier to separate and reestablish tissue planes. These highlights do not include all the information needed to use the Avive+ Soft Tissue Matrix safely and effectively. See Package Insert (PI) for Avive+ Soft Tissue Matrix Avive+ Soft Tissue Matrix is a unique, multi-layer amniotic membrane allograft ideal for providing temporary protection for acute injuries.

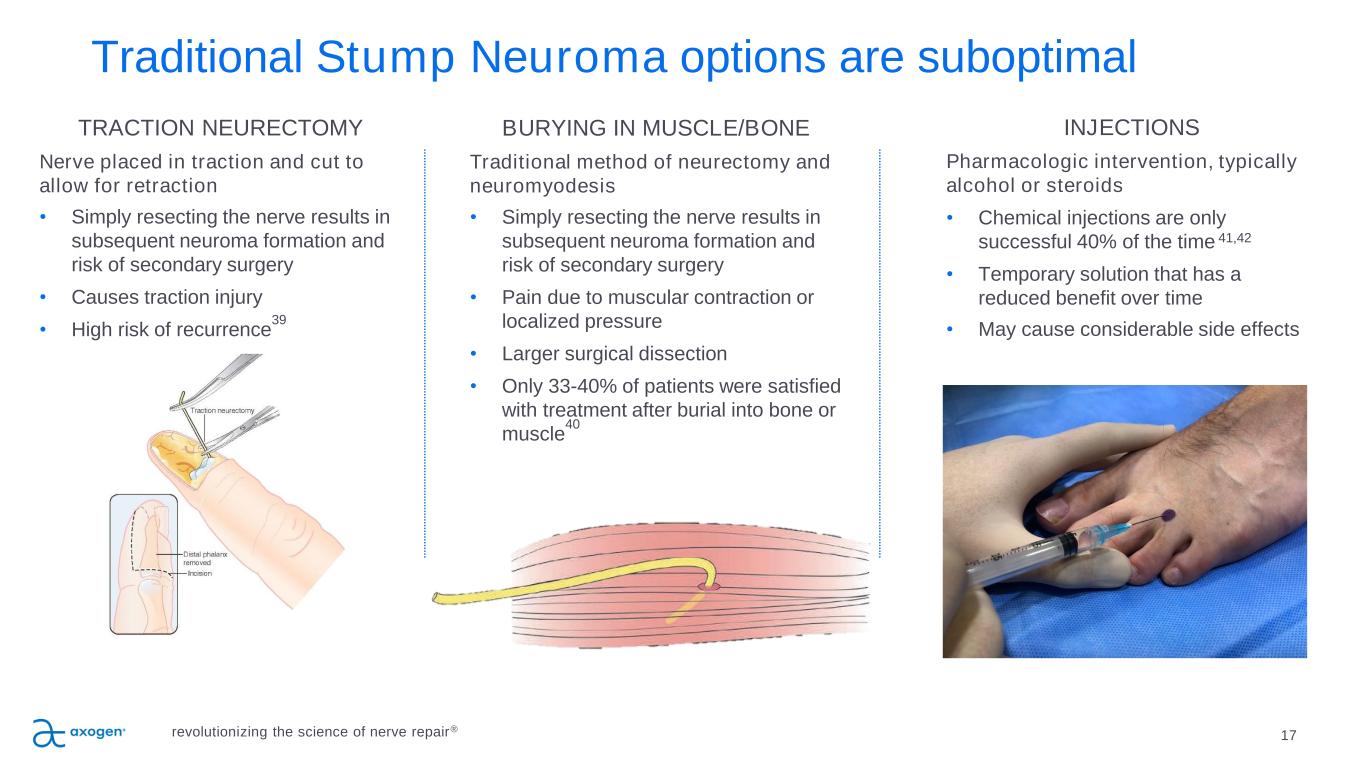

Traditional Stump Neuroma options are suboptimal 17 TRACTION NEURECTOMY Nerve placed in traction and cut to allow for retraction • Simply resecting the nerve results in subsequent neuroma formation and risk of secondary surgery • Causes traction injury • High risk of recurrence 39 BURYING IN MUSCLE/BONE Traditional method of neurectomy and neuromyodesis • Simply resecting the nerve results in subsequent neuroma formation and risk of secondary surgery • Pain due to muscular contraction or localized pressure • Larger surgical dissection • Only 33-40% of patients were satisfied with treatment after burial into bone or muscle 40 INJECTIONS Pharmacologic intervention, typically alcohol or steroids • Chemical injections are only successful 40% of the time 41,42 • Temporary solution that has a reduced benefit over time • May cause considerable side effects revolutionizing the science of nerve repair®

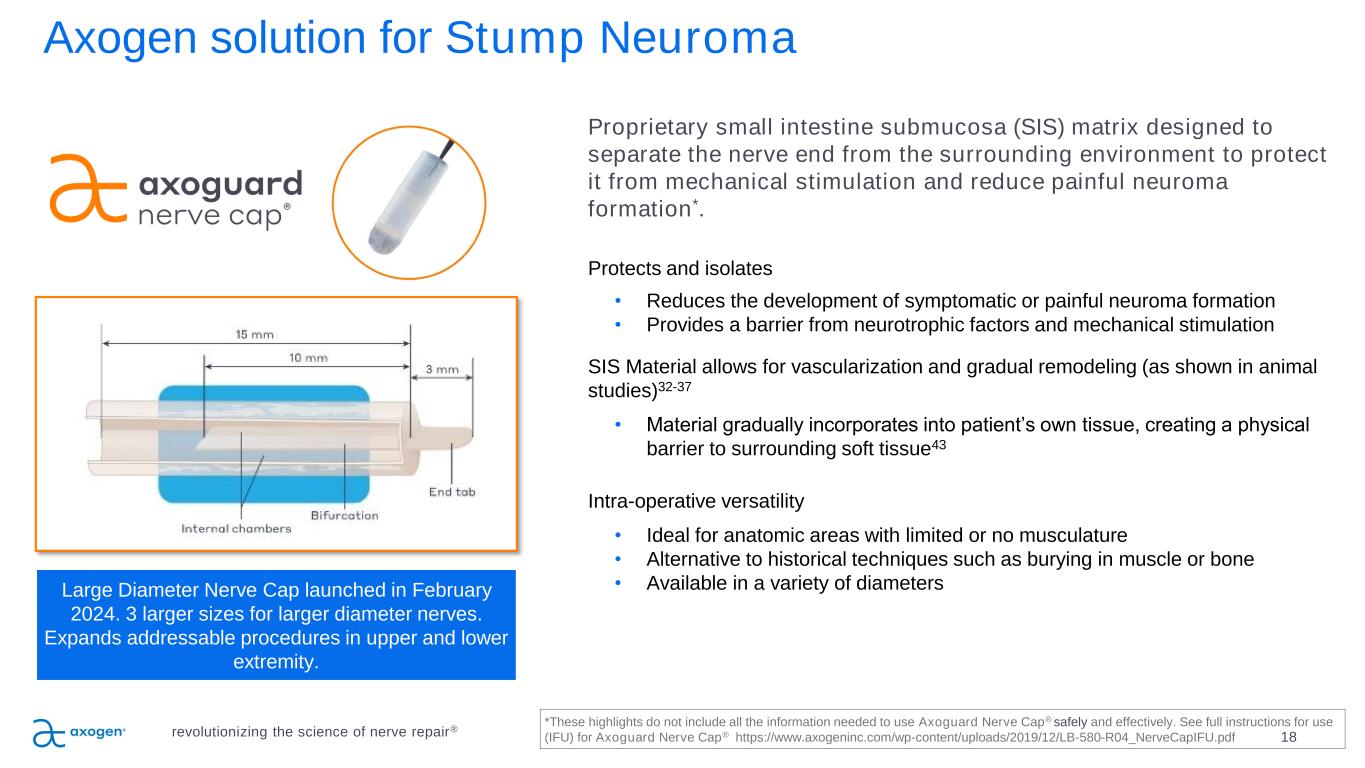

18 Axogen solution for Stump Neuroma Proprietary small intestine submucosa (SIS) matrix designed to separate the nerve end from the surrounding environment to protect it from mechanical stimulation and reduce painful neuroma formation*. Protects and isolates • Reduces the development of symptomatic or painful neuroma formation • Provides a barrier from neurotrophic factors and mechanical stimulation SIS Material allows for vascularization and gradual remodeling (as shown in animal studies)32-37 • Material gradually incorporates into patient’s own tissue, creating a physical barrier to surrounding soft tissue43 Intra-operative versatility • Ideal for anatomic areas with limited or no musculature • Alternative to historical techniques such as burying in muscle or bone • Available in a variety of diameters revolutionizing the science of nerve repair® Large Diameter Nerve Cap launched in February 2024. 3 larger sizes for larger diameter nerves. Expands addressable procedures in upper and lower extremity. *These highlights do not include all the information needed to use Axoguard Nerve Cap® safely and effectively. See full instructions for use (IFU) for Axoguard Nerve Cap® https://www.axogeninc.com/wp-content/uploads/2019/12/LB-580-R04_NerveCapIFU.pdf

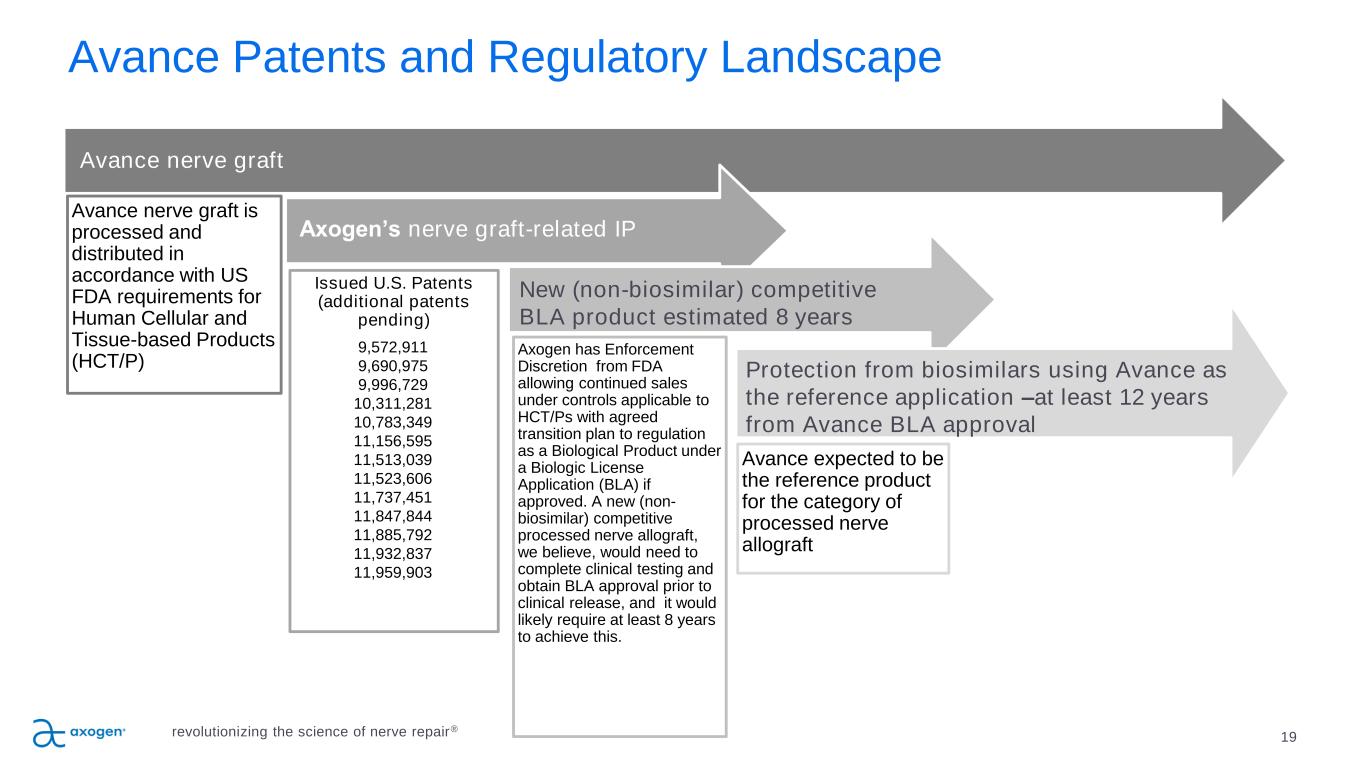

19 Avance Patents and Regulatory Landscape Avance nerve graft is processed and distributed in accordance with US FDA requirements for Human Cellular and Tissue-based Products (HCT/P) Issued U.S. Patents (additional patents pending) Axogen has Enforcement Discretion from FDA allowing continued sales under controls applicable to HCT/Ps with agreed transition plan to regulation as a Biological Product under a Biologic License Application (BLA) if approved. A new (non- biosimilar) competitive processed nerve allograft, we believe, would need to complete clinical testing and obtain BLA approval prior to clinical release, and it would likely require at least 8 years to achieve this. Avance expected to be the reference product for the category of processed nerve allograft Avance nerve graft Axogen’s nerve graft-related IP New (non-biosimilar) competitive BLA product estimated 8 years Protection from biosimilars using Avance as the reference application –at least 12 years from Avance BLA approval 9,572,911 9,690,975 9,996,729 10,311,281 10,783,349 11,156,595 11,513,039 11,523,606 11,737,451 11,847,844 11,885,792 11,932,837 11,959,903 revolutionizing the science of nerve repair®

20 Market development strategy B u il d M a rk e t A w a re n e s s G ro w B o d y o f C li n ic a l E v id e n c e E x e c u te S a le s P la n E x p a n d P ro d u c t P ip e li n e + A p p li c a ti o n s revolutionizing the science of nerve repair® E d u c a te S u rg e o n s , D e v e lo p A d v o c a te s

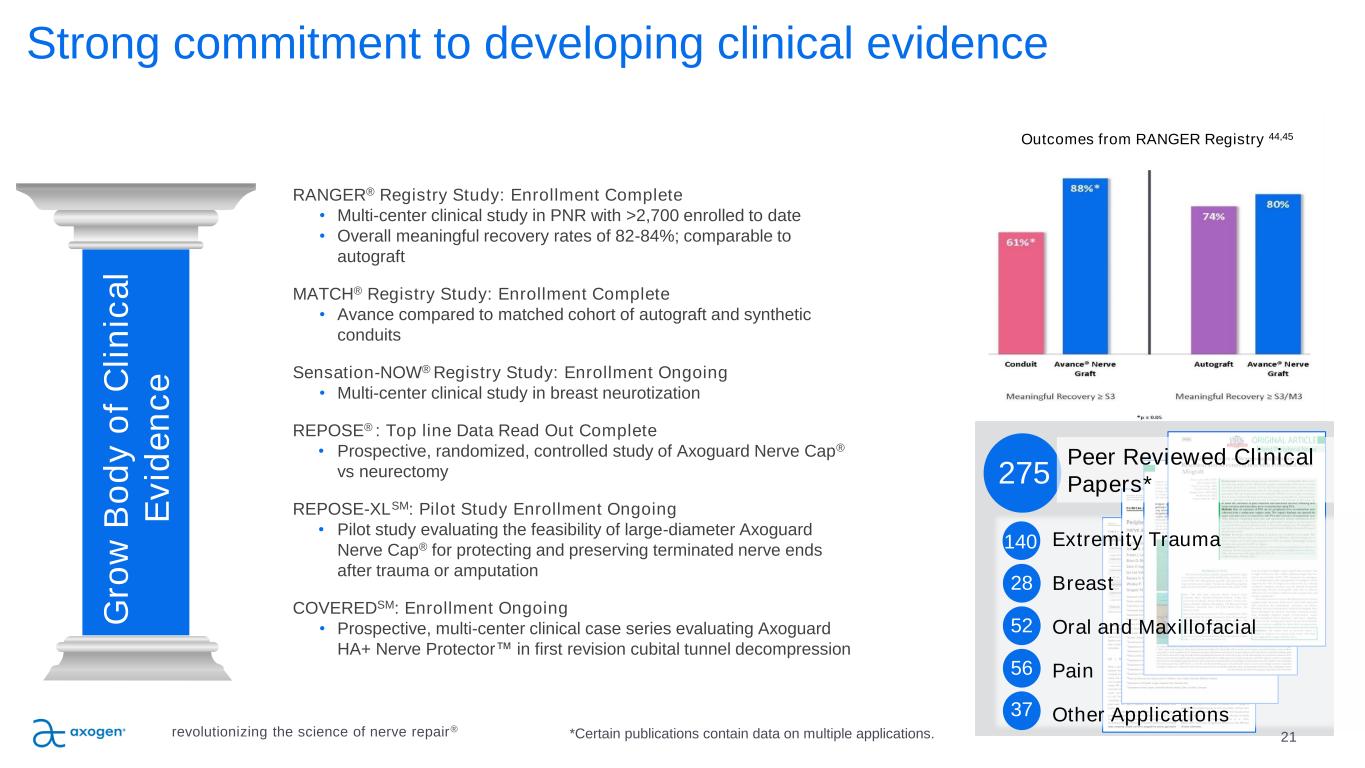

Outcomes from RANGER Registry 44,45 21 P IL L A R 3 Strong commitment to developing clinical evidence RANGER® Registry Study: Enrollment Complete • Multi-center clinical study in PNR with >2,700 enrolled to date • Overall meaningful recovery rates of 82-84%; comparable to autograft MATCH® Registry Study: Enrollment Complete • Avance compared to matched cohort of autograft and synthetic conduits Sensation-NOW® Registry Study: Enrollment Ongoing • Multi-center clinical study in breast neurotization REPOSE® : Top line Data Read Out Complete • Prospective, randomized, controlled study of Axoguard Nerve Cap® vs neurectomy REPOSE-XLSM: Pilot Study Enrollment Ongoing • Pilot study evaluating the feasibility of large-diameter Axoguard Nerve Cap® for protecting and preserving terminated nerve ends after trauma or amputation COVEREDSM: Enrollment Ongoing • Prospective, multi-center clinical case series evaluating Axoguard HA+ Nerve Protector in first revision cubital tunnel decompression G ro w B o d y o f C li n ic a l E v id e n c e Extremity Trauma Breast Oral and Maxillofacial Pain Other Applications 140 28 52 56 37 275 *Certain publications contain data on multiple applications.revolutionizing the science of nerve repair® Peer Reviewed Clinical Papers*

RECON : A Multicenter, Prospective, Randomized, Subject & Evaluator Blinded Comparative Study of Nerve Cuffs & Avance Nerve Graft Evaluating Recovery Outcomes for the Repair of Nerve Discontinuities 22 Safety & efficacy non- inferiority comparison of Avance vs conduit Evaluated upper extremity digital nerve repair for nerve gaps 5-25mm 220 subjects from up to 25 U.S. centers stratified into gap lengths with two-thirds in the 5-14mm group and one- third in the 15-25mm group revolutionizing the science of nerve repair® SM

revolutionizing the science of nerve repair® RECON Study Topline Results 23 Statistical superiority demonstrated at increasing gap lengths ✓ Avance demonstrated statistical superiority for return of sensory function (measured by static two-point discrimination) as compared to conduits in gaps greater than 12 mm (p-value 0.021).19 ✓ Avance demonstrated statistical superiority for time to recovery of static two-point discrimination as compared to conduits, returning normal sensation* up to 3 months earlier in gaps greater than 10 mm (p-value 0.037).32 The safety profile was consistent with previously published data ✓ Conduit repairs were observed to have an increased likelihood of persistent and unresolved nerve pain with an incidence of 9 (8%) conduit subjects as compared to 2 (2%) Avance subjects.32 *Normal Sensation is defined by the Medical Research Council Classification (MRCC) score as S4 or return of static two-point discrimination outcomes of ≤ 6mm. Primary Endpoint Achieved • This phase three pivotal study met its primary endpoint for the return of sensory function as measured by static two-point discrimination, and the safety profile was consistent with previously published data • The data will support the company’s Biologics License Application (BLA) with a potential for approval in September 2025.

REPOSE Study Top Line Results revolutionizing the science of nerve repair 24November 6, 2024 Statistical superiority demonstrated in Reduction of Total Pain ✓ Axoguard Nerve Cap demonstrated statistical superiority vs. standard-of-care neurectomy in the Reduction of Total Pain reported by participants over the full 12-month course of follow-up (p-value <0.05) REPOSE is a post-market, randomized, comparative clinical study of standard-of-care neurectomy followed by reconstruction of the nerve end with Axoguard Nerve Cap, evaluating recovery outcomes for the treatment of symptomatic neuroma. Study Details: • Multicenter, prospective, randomized, subject blinded trial • 86 randomized participants • 12-month follow-up • Pain, medication, Quality of Life questionnaires, recurrence of neuroma endpoints Primary Endpoint Achieved REPOSE met primary endpoint of non-inferiority between the Month 12 pain visual analog scale scores for neurectomy with Axoguard Nerve Cap vs. standard-of-care neurectomy alone (p-value <0.05).

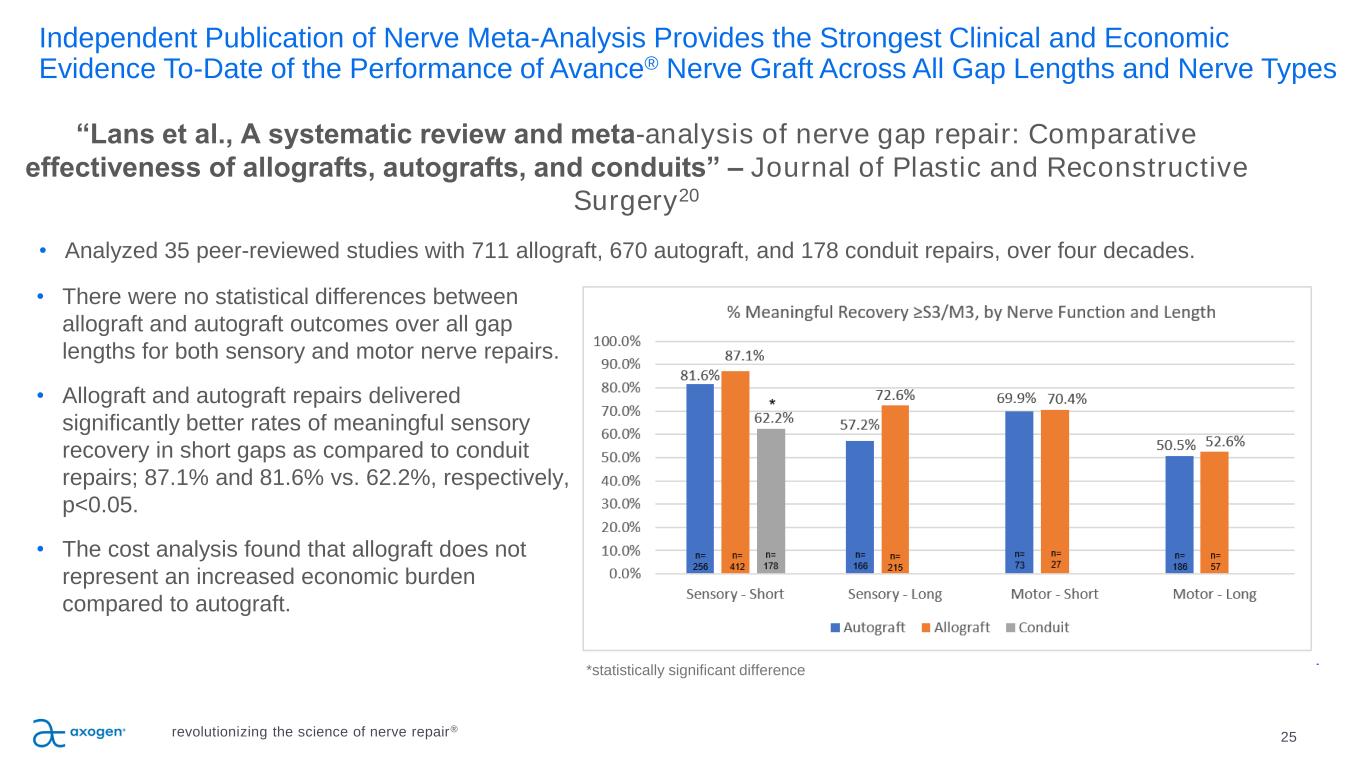

Independent Publication of Nerve Meta-Analysis Provides the Strongest Clinical and Economic Evidence To-Date of the Performance of Avance® Nerve Graft Across All Gap Lengths and Nerve Types 25 • Analyzed 35 peer-reviewed studies with 711 allograft, 670 autograft, and 178 conduit repairs, over four decades. “Lans et al., A systematic review and meta-analysis of nerve gap repair: Comparative effectiveness of allografts, autografts, and conduits” – Journal of Plastic and Reconstructive Surgery20 revolutionizing the science of nerve repair® • There were no statistical differences between allograft and autograft outcomes over all gap lengths for both sensory and motor nerve repairs. • Allograft and autograft repairs delivered significantly better rates of meaningful sensory recovery in short gaps as compared to conduit repairs; 87.1% and 81.6% vs. 62.2%, respectively, p<0.05. • The cost analysis found that allograft does not represent an increased economic burden compared to autograft. *statistically significant difference

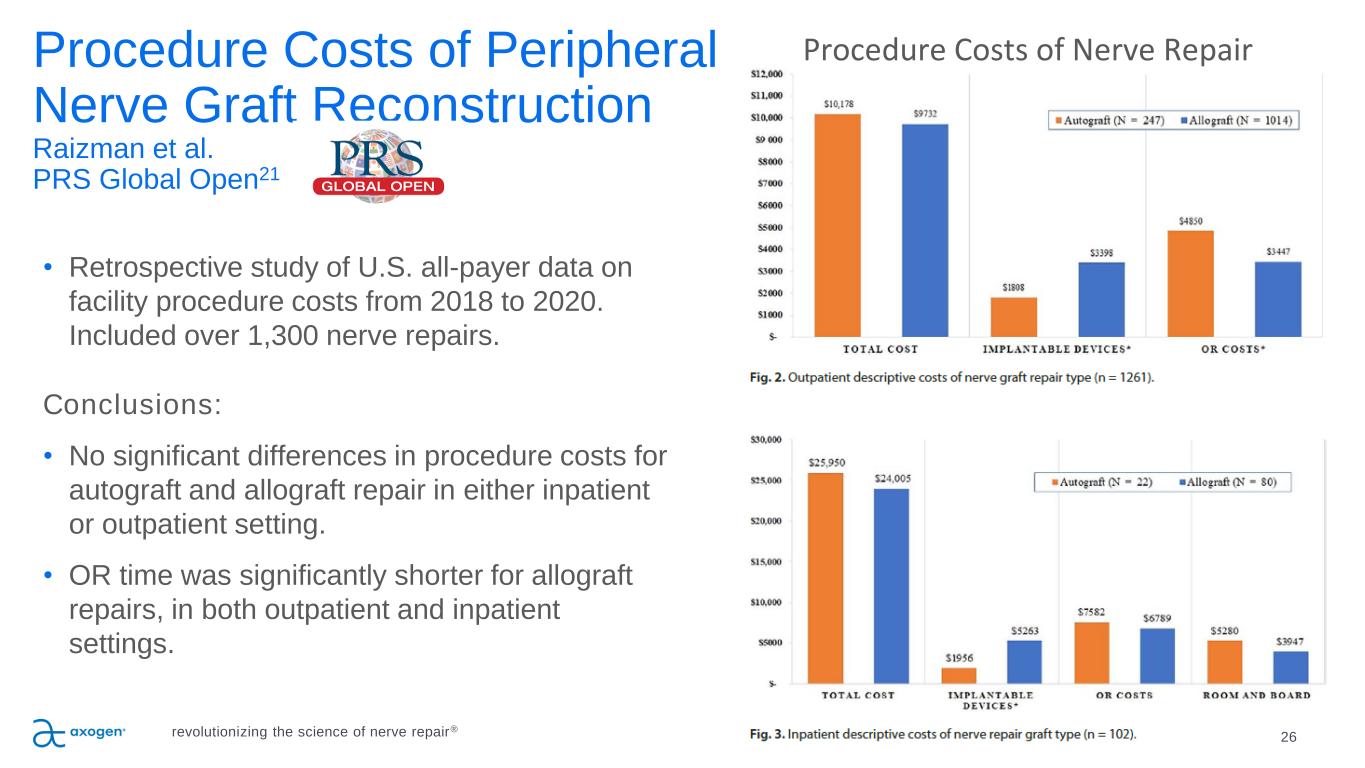

Procedure Costs of Peripheral Nerve Graft Reconstruction Raizman et al. PRS Global Open21 26revolutionizing the science of nerve repair® • Retrospective study of U.S. all-payer data on facility procedure costs from 2018 to 2020. Included over 1,300 nerve repairs. Conclusions: • No significant differences in procedure costs for autograft and allograft repair in either inpatient or outpatient setting. • OR time was significantly shorter for allograft repairs, in both outpatient and inpatient settings. Procedure Costs of Nerve Repair

27 Focus on building awareness among clinicians and patients • Increasing omnichannel engagement with clinicians and patients • Continuing clinical conference participation both virtually and in-person as appropriate • Ongoing patient ambassador program • Garnering positive media attention • Growing social media presenceB u il d M a rk e t A w a re n e s s resensation.com rethink-pain.comrevolutionizing the science of nerve repair®

Knowledge is power: continued education and advocacy efforts with patients, clinicians and key legislators elevates the problems associated with numbness.

29 P IL L A R 2 Emphasis on education • In-person and virtual national education programs • Customized multimodal learning programs to specific surgeon groups for advanced learning • Ongoing interactive webinar series covering the principles of nerve repair • Emphasis on training hand and micro- surgery fellows E d u c a te S u rg e o n s , D e v e lo p A d v o c a te s revolutionizing the science of nerve repair®

30 P IL L A R 4 Focused sales execution, increasing market penetration P IL L A R 3 E x e c u te S a le s P la n Sales execution focused on driving results • Continue driving penetration in High-Potential Accounts Broad sales reach • U.S. direct sales team • Supplemented by independent agencies revolutionizing the science of nerve repair®

Committed to our patients, the communities we serve, and our pursuit of advancing the science of nerve repair in ethical and sustainable ways Diversity, Equity, and Inclusion - Being the Company where exceptional people want to work Cybersecurity – Data Privacy, Training, and Policies Compliance – Quality Management System, Regulatory, and Good Manufacturing Practices Governance – Framework for Ethics Codes and Accountability Environment – Responsible, Sustainable Operations People Sustainability Business revolutionizing the science of nerve repair®

Executive team 32 Doris Quackenbush VP, Sales Convatec revolutionizing the science of nerve repair® Erick DeVinney Chief Innovation Officer Angiotech, PRA Intl Todd Puckett VP, Operations NuVasive, Zimmer Ivica Ducic, M.D., Ph.D. Chief Medical Officer Washington Nerve Institute Jens Schroeder Kemp Chief Marketing Officer Ambu, Pera International Marc Began Executive Vice President, General Counsel Abiomed, Boehringer Ingelheim, Novo Nordisk Michael Dale Chief Executive Officer & Board Director Abbot Laboratories Effective. 8.9.2024 Nir Naor Chief Financial Officer Arbor Pharmaceuticals, Mölnlycke Healthcare, UCB Stacy Arnold VP, Product Development and Clinical Research Artivion (CryoLife) Al Jacks VP, Quality Assurance VERO Biotech, Alimera Sciences

Appendix • Key clinical data • CMS outpatient and ASC reimbursement rates • Total addressable market • Cash, debt, and capital structure • Axogen product portfolio and indications for use 33revolutionizing the science of nerve repair®

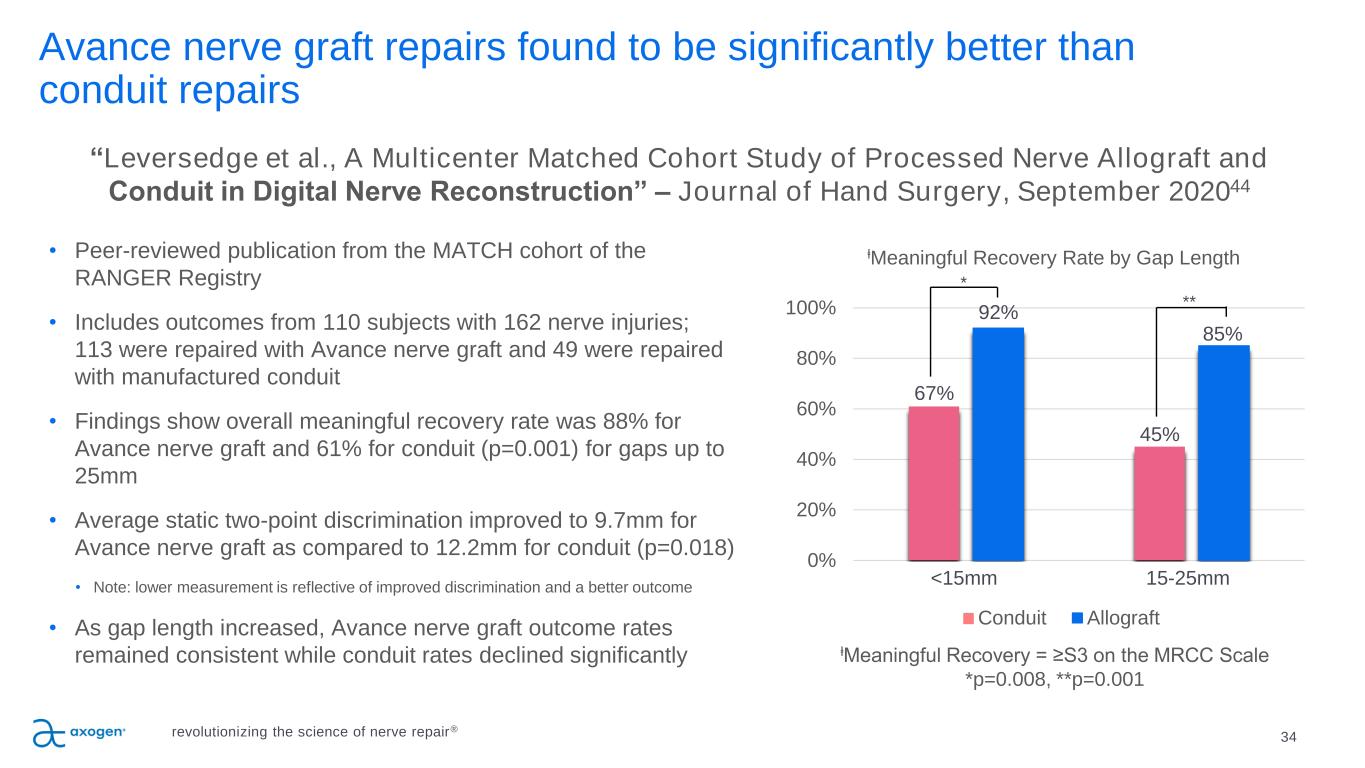

Avance nerve graft repairs found to be significantly better than conduit repairs 34 • Peer-reviewed publication from the MATCH cohort of the RANGER Registry • Includes outcomes from 110 subjects with 162 nerve injuries; 113 were repaired with Avance nerve graft and 49 were repaired with manufactured conduit • Findings show overall meaningful recovery rate was 88% for Avance nerve graft and 61% for conduit (p=0.001) for gaps up to 25mm • Average static two-point discrimination improved to 9.7mm for Avance nerve graft as compared to 12.2mm for conduit (p=0.018) • Note: lower measurement is reflective of improved discrimination and a better outcome • As gap length increased, Avance nerve graft outcome rates remained consistent while conduit rates declined significantly “Leversedge et al., A Multicenter Matched Cohort Study of Processed Nerve Allograft and Conduit in Digital Nerve Reconstruction” – Journal of Hand Surgery, September 202044 0% 20% 40% 60% 80% 100% Meaningful Recovery Rate by Gap Length Conduit Allograft <15mm 15-25mm Meaningful Recovery = ≥S3 on the MRCC Scale *p=0.008, **p=0.001 67% 92% 45% 85% * ** revolutionizing the science of nerve repair®

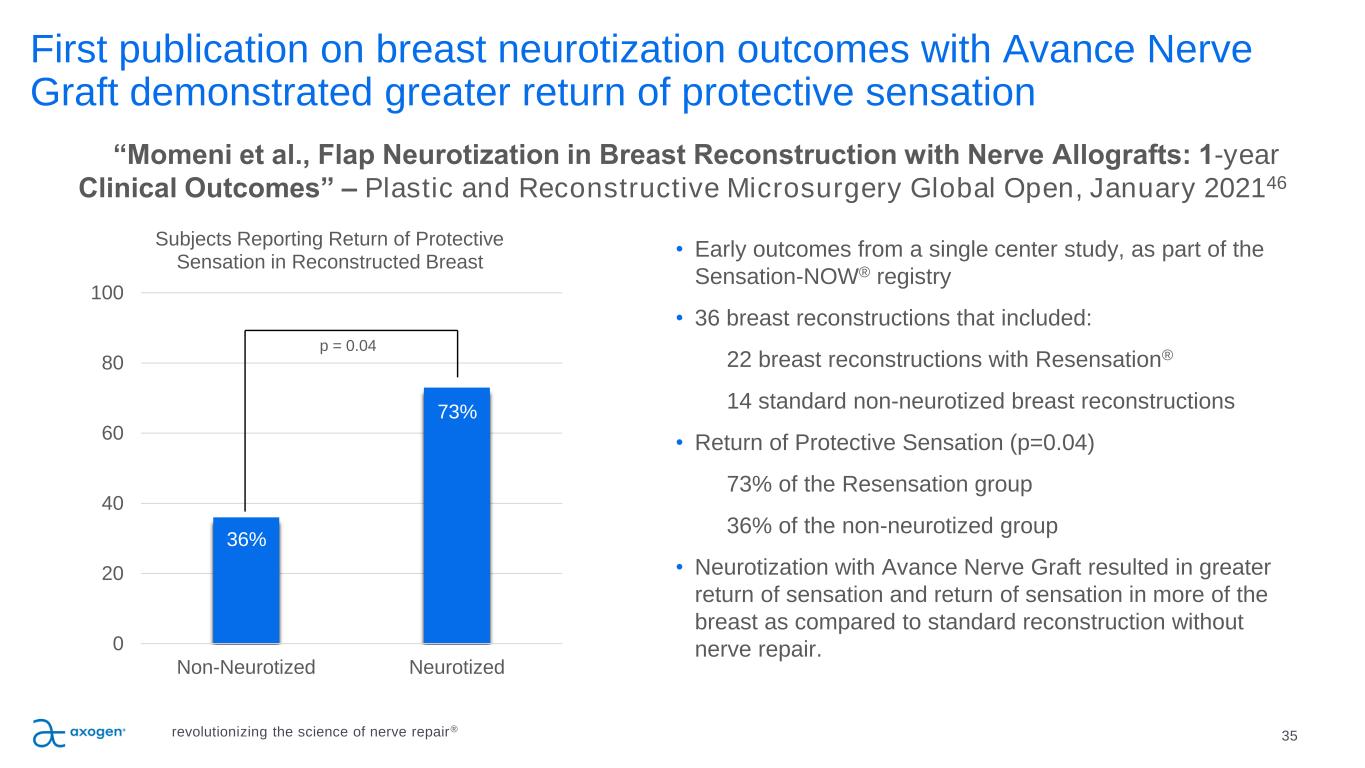

First publication on breast neurotization outcomes with Avance Nerve Graft demonstrated greater return of protective sensation 35 • Early outcomes from a single center study, as part of the Sensation-NOW® registry • 36 breast reconstructions that included: 22 breast reconstructions with Resensation® 14 standard non-neurotized breast reconstructions • Return of Protective Sensation (p=0.04) 73% of the Resensation group 36% of the non-neurotized group • Neurotization with Avance Nerve Graft resulted in greater return of sensation and return of sensation in more of the breast as compared to standard reconstruction without nerve repair. “Momeni et al., Flap Neurotization in Breast Reconstruction with Nerve Allografts: 1-year Clinical Outcomes” – Plastic and Reconstructive Microsurgery Global Open, January 202146 36% 73% 0 20 40 60 80 100 Non-Neurotized Neurotized Subjects Reporting Return of Protective Sensation in Reconstructed Breast p = 0.04 revolutionizing the science of nerve repair®

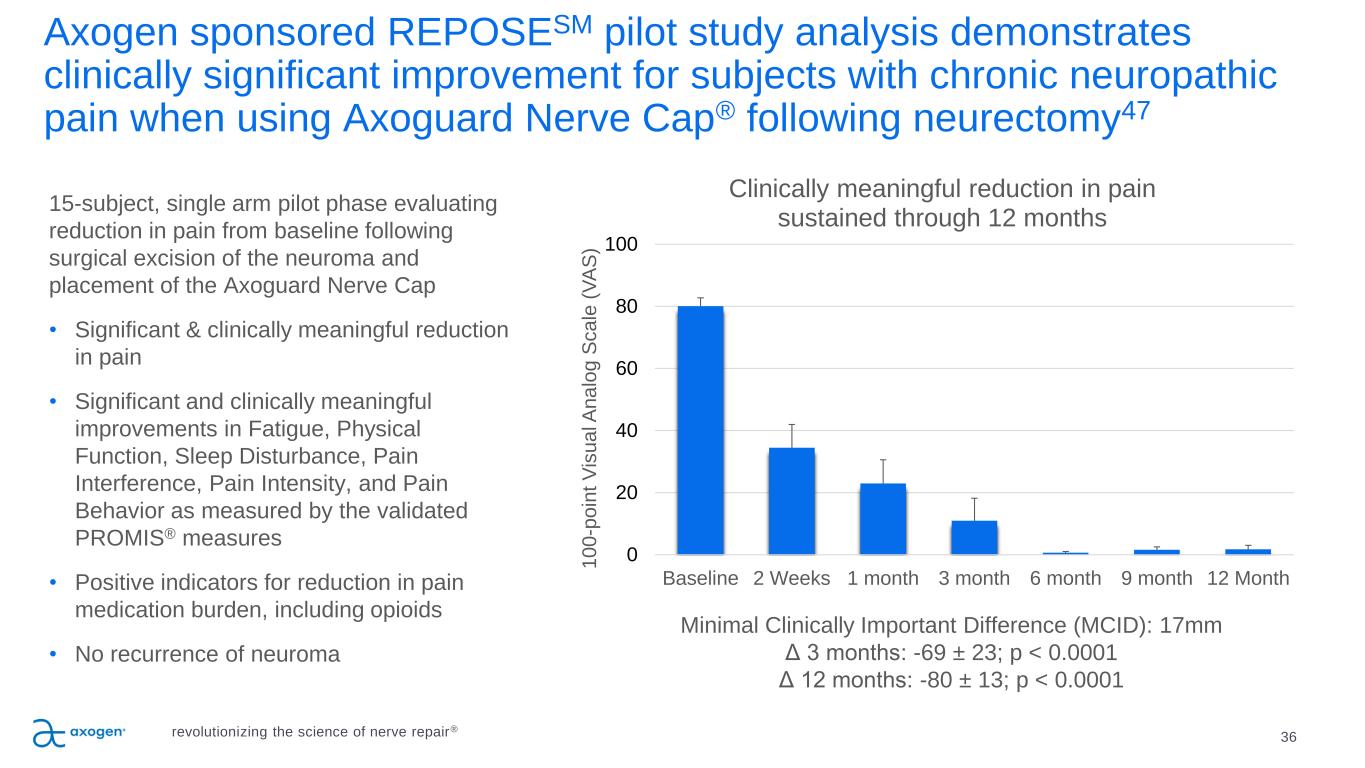

Axogen sponsored REPOSESM pilot study analysis demonstrates clinically significant improvement for subjects with chronic neuropathic pain when using Axoguard Nerve Cap® following neurectomy47 36 15-subject, single arm pilot phase evaluating reduction in pain from baseline following surgical excision of the neuroma and placement of the Axoguard Nerve Cap • Significant & clinically meaningful reduction in pain • Significant and clinically meaningful improvements in Fatigue, Physical Function, Sleep Disturbance, Pain Interference, Pain Intensity, and Pain Behavior as measured by the validated PROMIS® measures • Positive indicators for reduction in pain medication burden, including opioids • No recurrence of neuroma 0 20 40 60 80 100 Baseline 2 Weeks 1 month 3 month 6 month 9 month 12 Month 1 0 0 -p o in t V is u a l A n a lo g S c a le ( V A S ) Clinically meaningful reduction in pain sustained through 12 months Minimal Clinically Important Difference (MCID): 17mm Δ 3 months: -69 ± 23; p < 0.0001 Δ 12 months: -80 ± 13; p < 0.0001 revolutionizing the science of nerve repair®

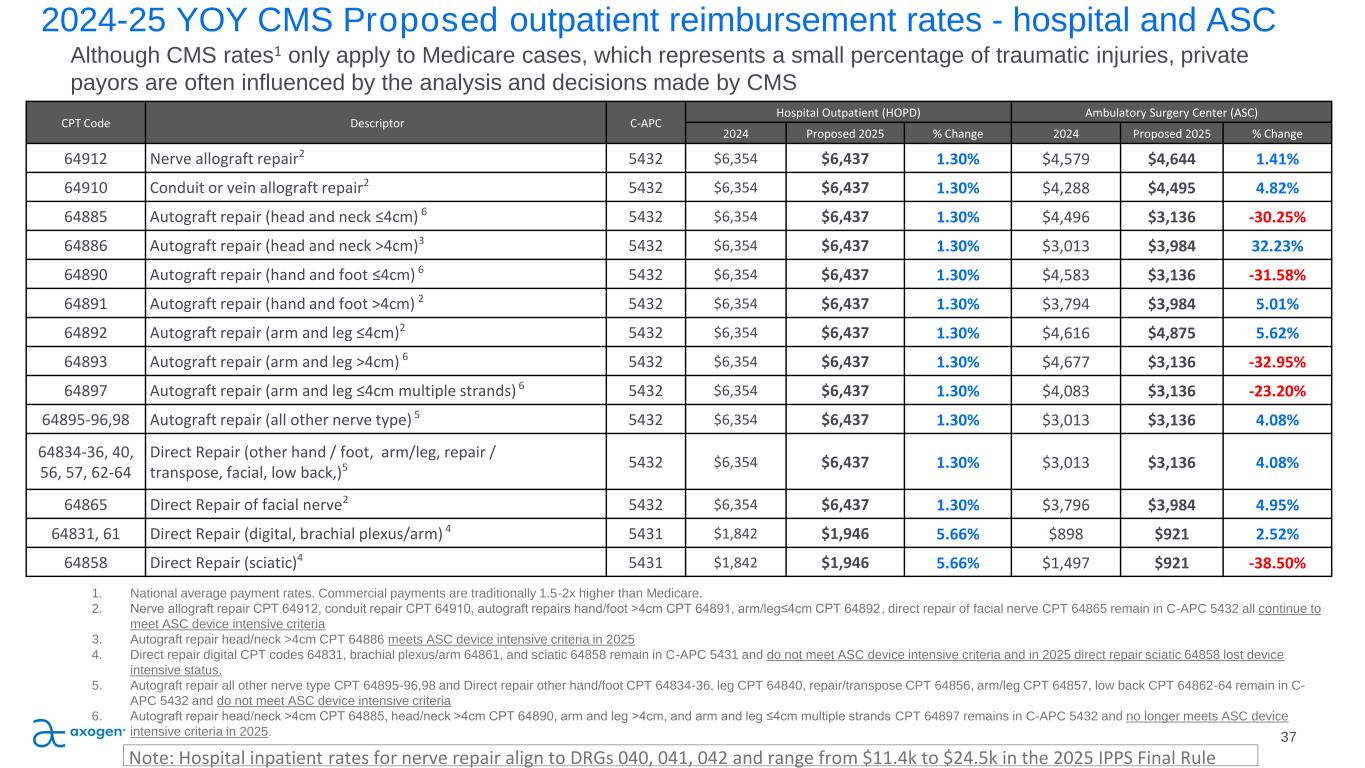

CPT Code Descriptor C-APC Hospital Outpatient (HOPD) Ambulatory Surgery Center (ASC) 2024 Proposed 2025 % Change 2024 Proposed 2025 % Change 64912 Nerve allograft repair2 5432 $6,354 $6,437 1.30% $4,579 $4,644 1.41% 64910 Conduit or vein allograft repair2 5432 $6,354 $6,437 1.30% $4,288 $4,495 4.82% 64885 Autograft repair (head and neck ≤4cm) 6 5432 $6,354 $6,437 1.30% $4,496 $3,136 -30.25% 64886 Autograft repair (head and neck >4cm)3 5432 $6,354 $6,437 1.30% $3,013 $3,984 32.23% 64890 Autograft repair (hand and foot ≤4cm) 6 5432 $6,354 $6,437 1.30% $4,583 $3,136 -31.58% 64891 Autograft repair (hand and foot >4cm) 2 5432 $6,354 $6,437 1.30% $3,794 $3,984 5.01% 64892 Autograft repair (arm and leg ≤4cm)2 5432 $6,354 $6,437 1.30% $4,616 $4,875 5.62% 64893 Autograft repair (arm and leg >4cm) 6 5432 $6,354 $6,437 1.30% $4,677 $3,136 -32.95% 64897 Autograft repair (arm and leg ≤4cm multiple strands) 6 5432 $6,354 $6,437 1.30% $4,083 $3,136 -23.20% 64895-96,98 Autograft repair (all other nerve type) 5 5432 $6,354 $6,437 1.30% $3,013 $3,136 4.08% 64834-36, 40, 56, 57, 62-64 Direct Repair (other hand / foot, arm/leg, repair / transpose, facial, low back,)5 5432 $6,354 $6,437 1.30% $3,013 $3,136 4.08% 64865 Direct Repair of facial nerve2 5432 $6,354 $6,437 1.30% $3,796 $3,984 4.95% 64831, 61 Direct Repair (digital, brachial plexus/arm) 4 5431 $1,842 $1,946 5.66% $898 $921 2.52% 64858 Direct Repair (sciatic)4 5431 $1,842 $1,946 5.66% $1,497 $921 -38.50% 2024-25 YOY CMS Proposed outpatient reimbursement rates - hospital and ASC 37 Although CMS rates1 only apply to Medicare cases, which represents a small percentage of traumatic injuries, private payors are often influenced by the analysis and decisions made by CMS 1. National average payment rates. Commercial payments are traditionally 1.5-2x higher than Medicare. 2. Nerve allograft repair CPT 64912, conduit repair CPT 64910, autograft repairs hand/foot >4cm CPT 64891, arm/leg≤4cm CPT 64892, direct repair of facial nerve CPT 64865 remain in C-APC 5432 all continue to meet ASC device intensive criteria 3. Autograft repair head/neck >4cm CPT 64886 meets ASC device intensive criteria in 2025 4. Direct repair digital CPT codes 64831, brachial plexus/arm 64861, and sciatic 64858 remain in C-APC 5431 and do not meet ASC device intensive criteria and in 2025 direct repair sciatic 64858 lost device intensive status. 5. Autograft repair all other nerve type CPT 64895-96,98 and Direct repair other hand/foot CPT 64834-36, leg CPT 64840, repair/transpose CPT 64856, arm/leg CPT 64857, low back CPT 64862-64 remain in C- APC 5432 and do not meet ASC device intensive criteria 6. Autograft repair head/neck >4cm CPT 64885, head/neck >4cm CPT 64890, arm and leg >4cm, and arm and leg ≤4cm multiple strands CPT 64897 remains in C-APC 5432 and no longer meets ASC device intensive criteria in 2025. Note: Hospital inpatient rates for nerve repair align to DRGs 040, 041, 042 and range from $11.4k to $24.5k in the 2025 IPPS Final Rule

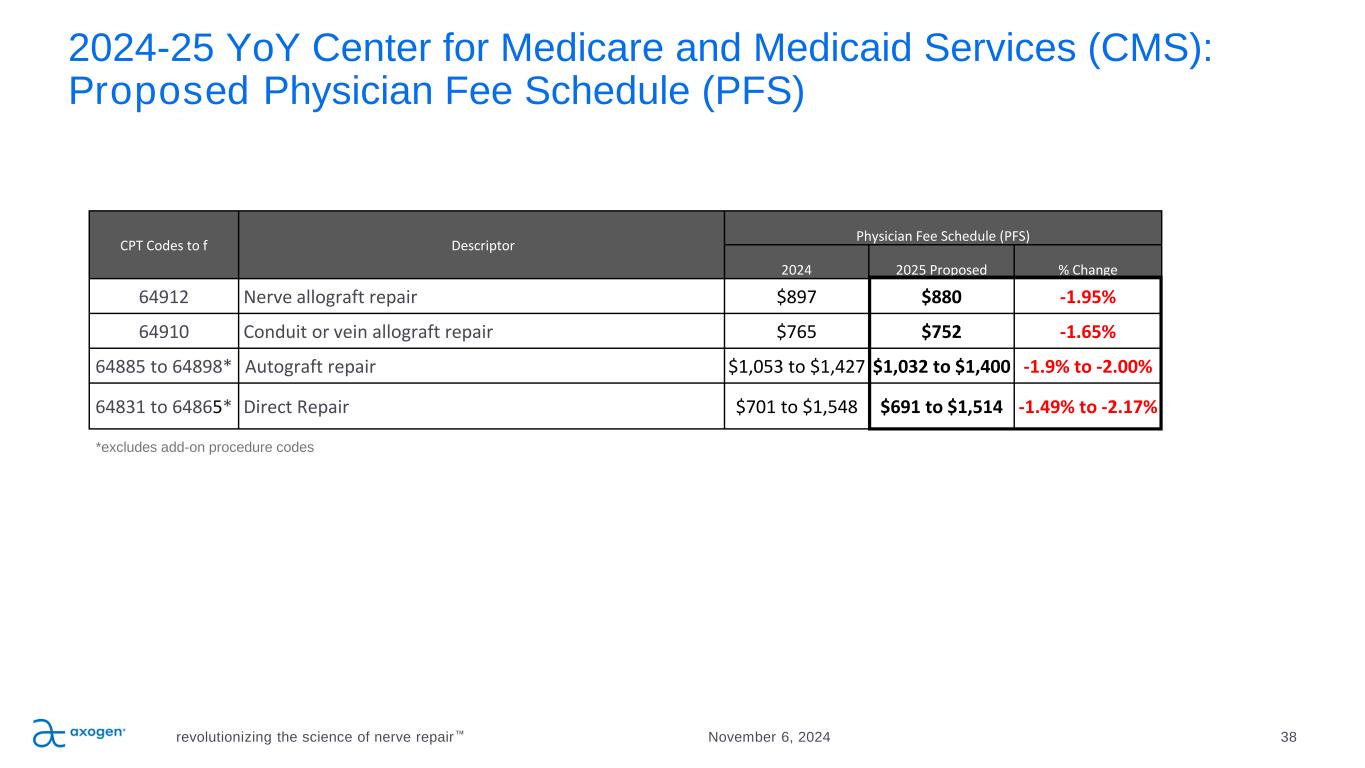

2024-25 YoY Center for Medicare and Medicaid Services (CMS): Proposed Physician Fee Schedule (PFS) revolutionizing the science of nerve repair 38November 6, 2024 CPT Codes to f Descriptor Physician Fee Schedule (PFS) 2024 2025 Proposed % Change 64912 Nerve allograft repair $897 $880 -1.95% 64910 Conduit or vein allograft repair $765 $752 -1.65% 64885 to 64898* Autograft repair $1,053 to $1,427 $1,032 to $1,400 -1.9% to -2.00% 64831 to 64865* Direct Repair $701 to $1,548 $691 to $1,514 -1.49% to -2.17% *excludes add-on procedure codes

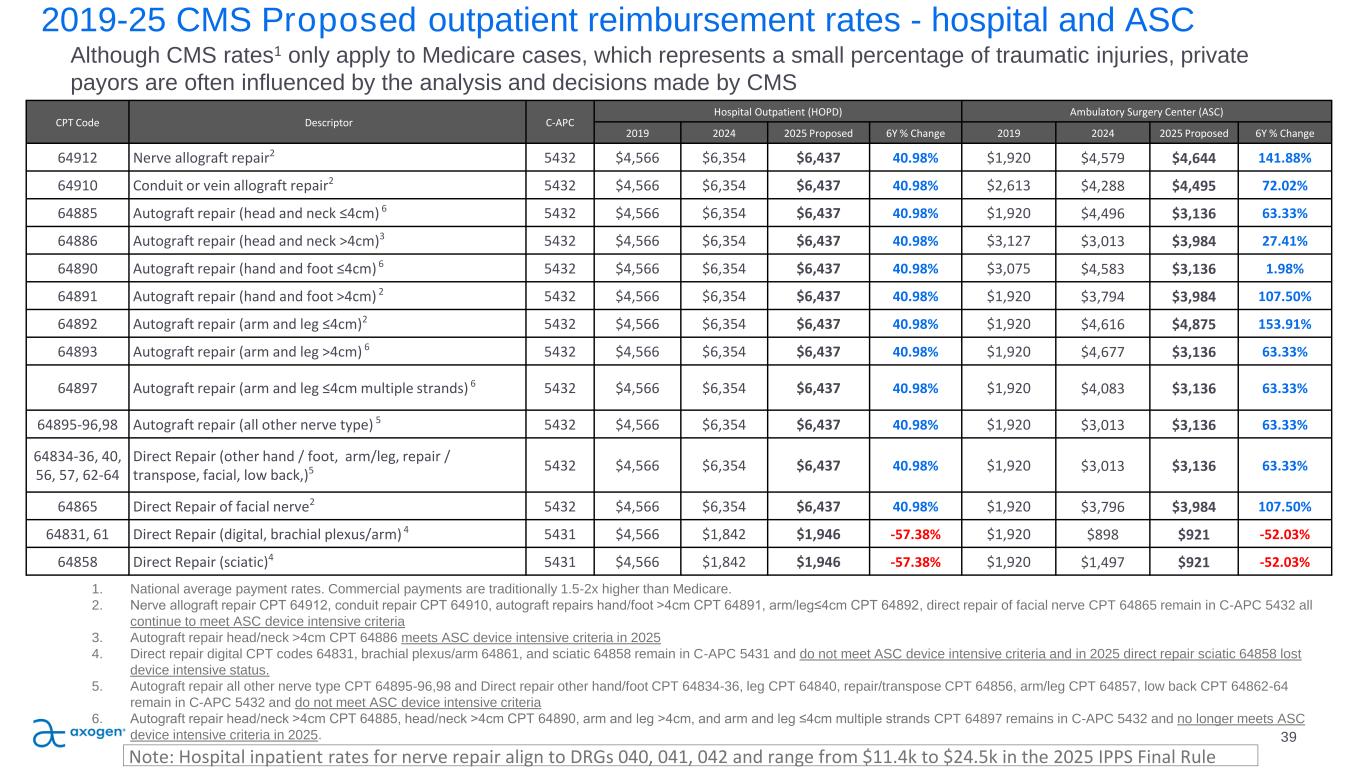

CPT Code Descriptor C-APC Hospital Outpatient (HOPD) Ambulatory Surgery Center (ASC) 2019 2024 2025 Proposed 6Y % Change 2019 2024 2025 Proposed 6Y % Change 64912 Nerve allograft repair2 5432 $4,566 $6,354 $6,437 40.98% $1,920 $4,579 $4,644 141.88% 64910 Conduit or vein allograft repair2 5432 $4,566 $6,354 $6,437 40.98% $2,613 $4,288 $4,495 72.02% 64885 Autograft repair (head and neck ≤4cm) 6 5432 $4,566 $6,354 $6,437 40.98% $1,920 $4,496 $3,136 63.33% 64886 Autograft repair (head and neck >4cm)3 5432 $4,566 $6,354 $6,437 40.98% $3,127 $3,013 $3,984 27.41% 64890 Autograft repair (hand and foot ≤4cm) 6 5432 $4,566 $6,354 $6,437 40.98% $3,075 $4,583 $3,136 1.98% 64891 Autograft repair (hand and foot >4cm) 2 5432 $4,566 $6,354 $6,437 40.98% $1,920 $3,794 $3,984 107.50% 64892 Autograft repair (arm and leg ≤4cm)2 5432 $4,566 $6,354 $6,437 40.98% $1,920 $4,616 $4,875 153.91% 64893 Autograft repair (arm and leg >4cm) 6 5432 $4,566 $6,354 $6,437 40.98% $1,920 $4,677 $3,136 63.33% 64897 Autograft repair (arm and leg ≤4cm multiple strands) 6 5432 $4,566 $6,354 $6,437 40.98% $1,920 $4,083 $3,136 63.33% 64895-96,98 Autograft repair (all other nerve type) 5 5432 $4,566 $6,354 $6,437 40.98% $1,920 $3,013 $3,136 63.33% 64834-36, 40, 56, 57, 62-64 Direct Repair (other hand / foot, arm/leg, repair / transpose, facial, low back,)5 5432 $4,566 $6,354 $6,437 40.98% $1,920 $3,013 $3,136 63.33% 64865 Direct Repair of facial nerve2 5432 $4,566 $6,354 $6,437 40.98% $1,920 $3,796 $3,984 107.50% 64831, 61 Direct Repair (digital, brachial plexus/arm) 4 5431 $4,566 $1,842 $1,946 -57.38% $1,920 $898 $921 -52.03% 64858 Direct Repair (sciatic)4 5431 $4,566 $1,842 $1,946 -57.38% $1,920 $1,497 $921 -52.03% 2019-25 CMS Proposed outpatient reimbursement rates - hospital and ASC 39 Although CMS rates1 only apply to Medicare cases, which represents a small percentage of traumatic injuries, private payors are often influenced by the analysis and decisions made by CMS 1. National average payment rates. Commercial payments are traditionally 1.5-2x higher than Medicare. 2. Nerve allograft repair CPT 64912, conduit repair CPT 64910, autograft repairs hand/foot >4cm CPT 64891, arm/leg≤4cm CPT 64892, direct repair of facial nerve CPT 64865 remain in C-APC 5432 all continue to meet ASC device intensive criteria 3. Autograft repair head/neck >4cm CPT 64886 meets ASC device intensive criteria in 2025 4. Direct repair digital CPT codes 64831, brachial plexus/arm 64861, and sciatic 64858 remain in C-APC 5431 and do not meet ASC device intensive criteria and in 2025 direct repair sciatic 64858 lost device intensive status. 5. Autograft repair all other nerve type CPT 64895-96,98 and Direct repair other hand/foot CPT 64834-36, leg CPT 64840, repair/transpose CPT 64856, arm/leg CPT 64857, low back CPT 64862-64 remain in C-APC 5432 and do not meet ASC device intensive criteria 6. Autograft repair head/neck >4cm CPT 64885, head/neck >4cm CPT 64890, arm and leg >4cm, and arm and leg ≤4cm multiple strands CPT 64897 remains in C-APC 5432 and no longer meets ASC device intensive criteria in 2025. Note: Hospital inpatient rates for nerve repair align to DRGs 040, 041, 042 and range from $11.4k to $24.5k in the 2025 IPPS Final Rule

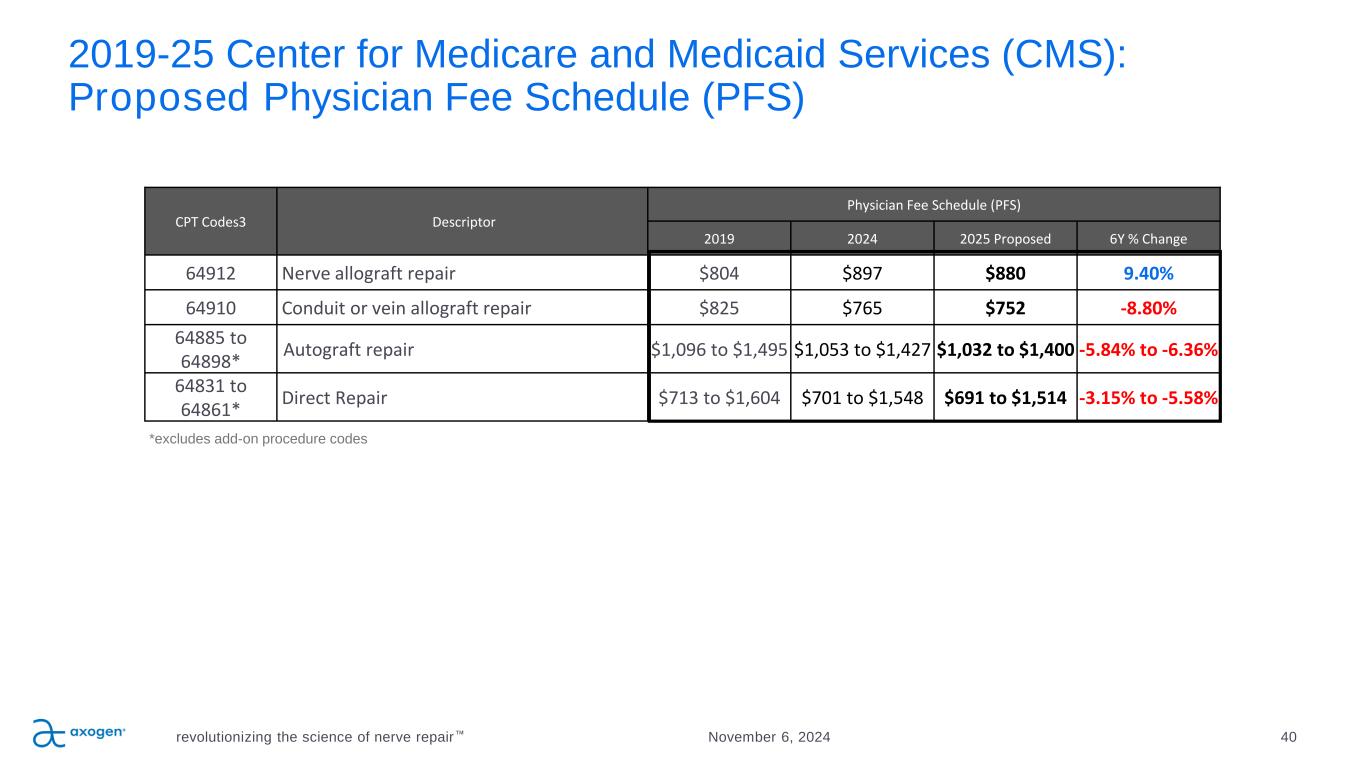

2019-25 Center for Medicare and Medicaid Services (CMS): Proposed Physician Fee Schedule (PFS) revolutionizing the science of nerve repair 40November 6, 2024 CPT Codes3 Descriptor Physician Fee Schedule (PFS) 2019 2024 2025 Proposed 6Y % Change 64912 Nerve allograft repair $804 $897 $880 9.40% 64910 Conduit or vein allograft repair $825 $765 $752 -8.80% 64885 to 64898* Autograft repair $1,096 to $1,495 $1,053 to $1,427 $1,032 to $1,400 -5.84% to -6.36% 64831 to 64861* Direct Repair $713 to $1,604 $701 to $1,548 $691 to $1,514 -3.15% to -5.58% *excludes add-on procedure codes

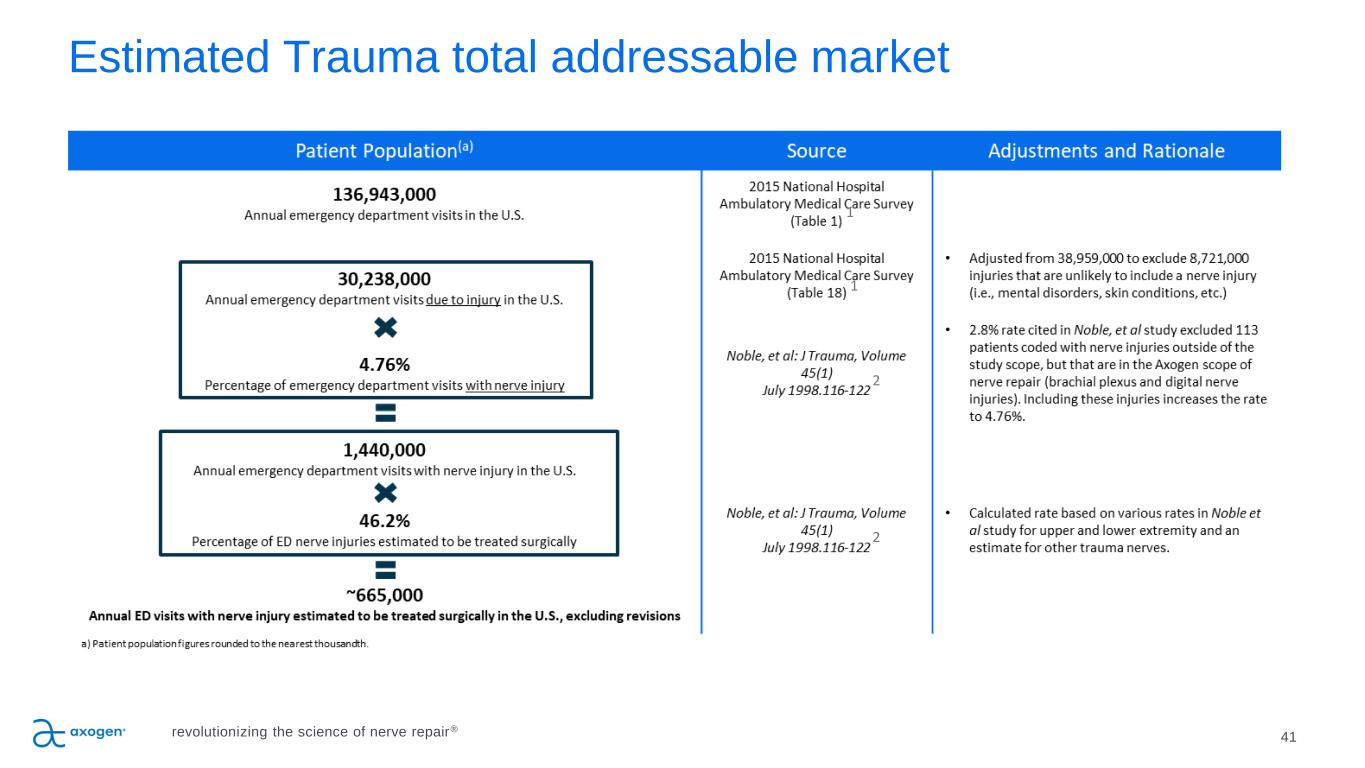

41 Estimated Trauma total addressable market revolutionizing the science of nerve repair® 1 1 2 2

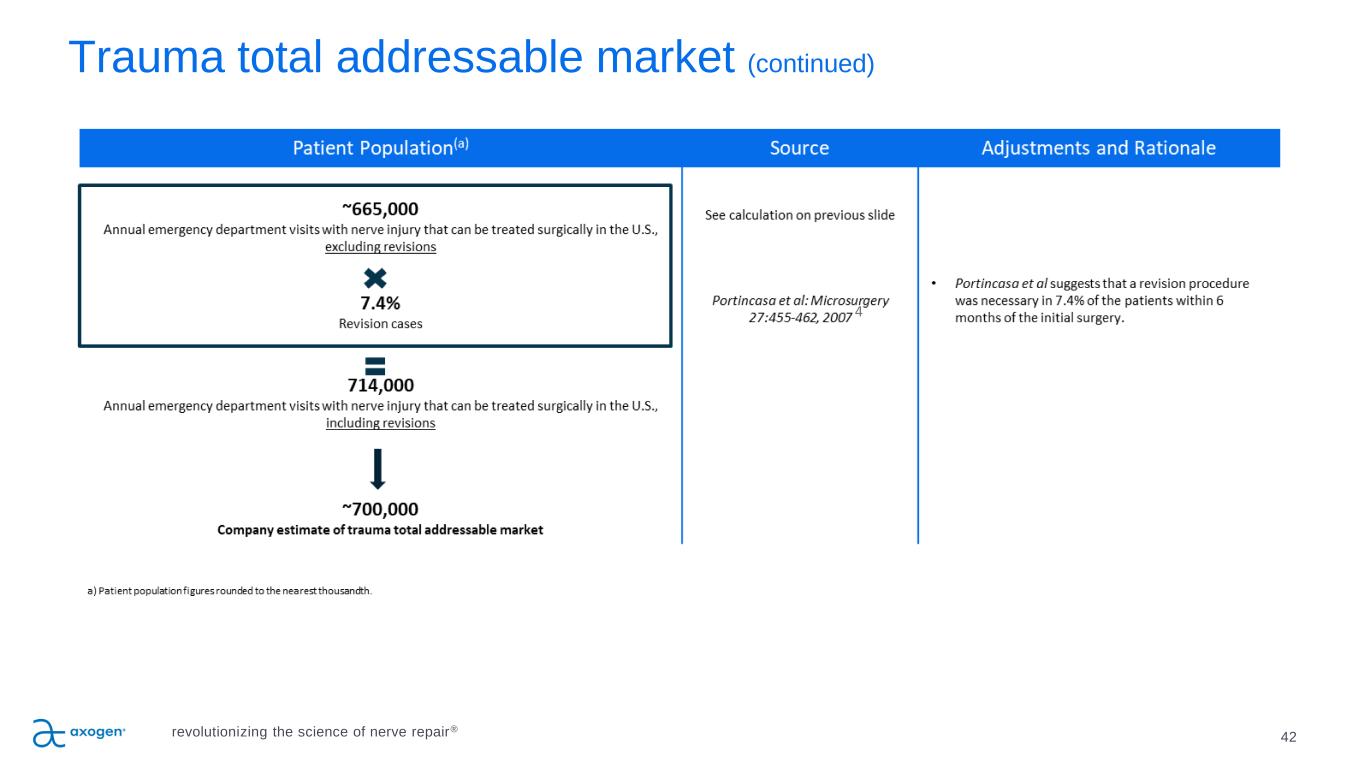

Trauma total addressable market (continued) 42revolutionizing the science of nerve repair® 4

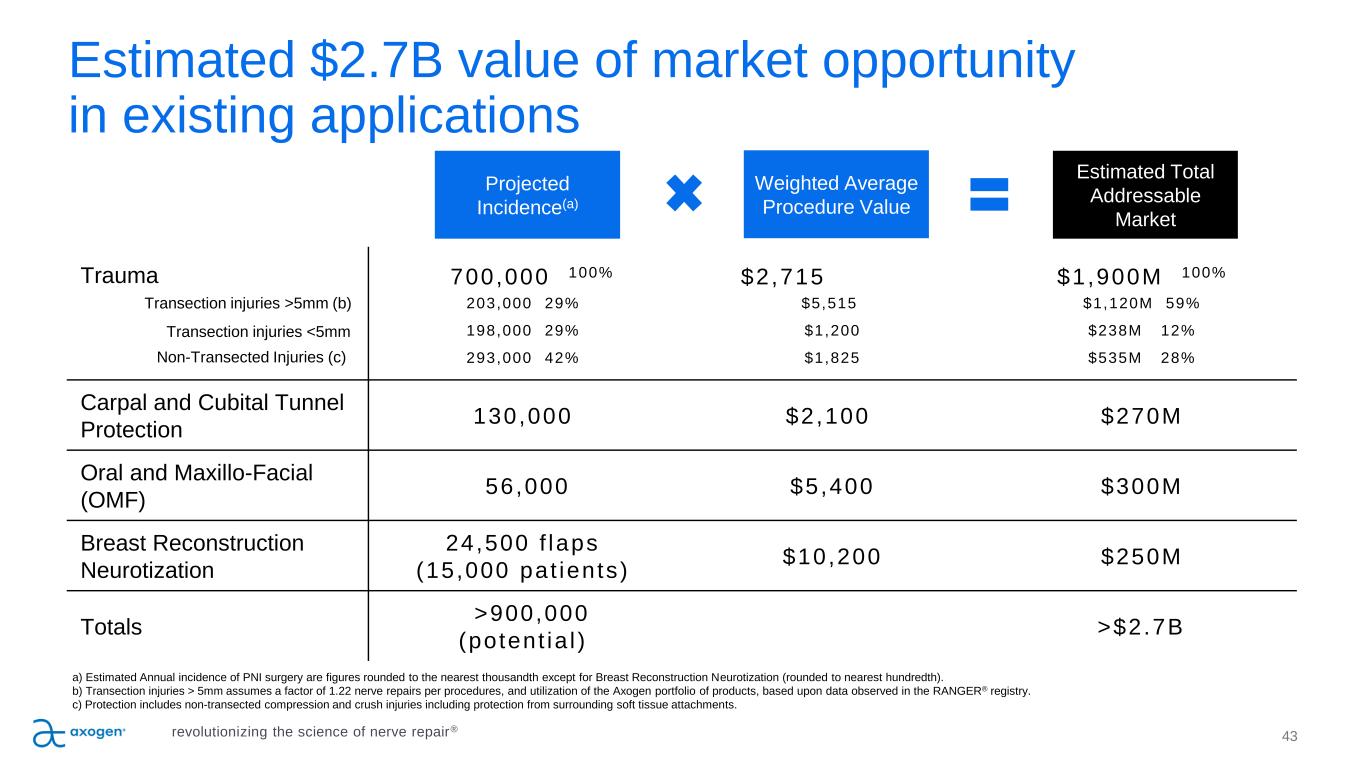

Projected Incidence(a) Weighted Average Procedure Value Estimated Total Addressable Market Trauma Transection injuries >5mm (b) Transection injuries <5mm Non-Transected Injuries (c) 700,000 100% 203,000 29% 198,000 29% 293,000 42% $2,715 $5,515 $1,200 $1,825 $1,900M 100% $1,120M 59% $238M 12% $535M 28% Carpal and Cubital Tunnel Protection 130,000 $2,100 $270M Oral and Maxillo-Facial (OMF) 56,000 $5,400 $300M Breast Reconstruction Neurotization 24,500 f laps (15,000 pat ients) $10,200 $250M Totals >900,000 (potent ia l ) >$2.7B a) Estimated Annual incidence of PNI surgery are figures rounded to the nearest thousandth except for Breast Reconstruction Neurotization (rounded to nearest hundredth). b) Transection injuries > 5mm assumes a factor of 1.22 nerve repairs per procedures, and utilization of the Axogen portfolio of products, based upon data observed in the RANGER® registry. c) Protection includes non-transected compression and crush injuries including protection from surrounding soft tissue attachments. 43 Estimated $2.7B value of market opportunity in existing applications revolutionizing the science of nerve repair®

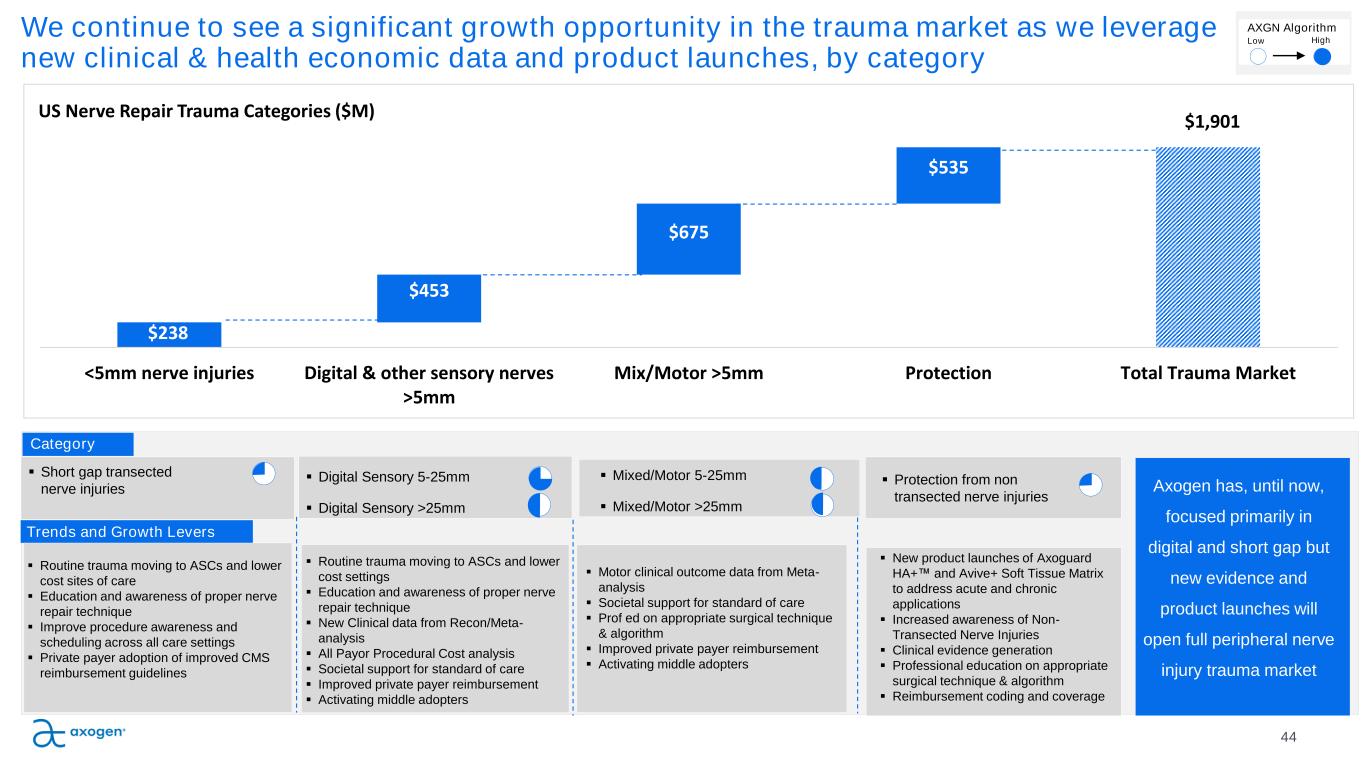

$238 $1,901 $453 $675 $535 <5mm nerve injuries Digital & other sensory nerves >5mm Mix/Motor >5mm Protection Total Trauma Market US Nerve Repair Trauma Categories ($M) We continue to see a significant growth opportunity in the trauma market as we leverage new clinical & health economic data and product launches, by category 44 ▪ Digital Sensory 5-25mm ▪ Digital Sensory >25mm ▪ Protection from non transected nerve injuries ▪ Short gap transected nerve injuries Category Trends and Growth Levers ▪ Routine trauma moving to ASCs and lower cost settings ▪ Education and awareness of proper nerve repair technique ▪ New Clinical data from Recon/Meta- analysis ▪ All Payor Procedural Cost analysis ▪ Societal support for standard of care ▪ Improved private payer reimbursement ▪ Activating middle adopters ▪ Mixed/Motor 5-25mm ▪ Mixed/Motor >25mm ▪ Motor clinical outcome data from Meta- analysis ▪ Societal support for standard of care ▪ Prof ed on appropriate surgical technique & algorithm ▪ Improved private payer reimbursement ▪ Activating middle adopters ▪ New product launches of Axoguard HA+ and Avive+ Soft Tissue Matrix to address acute and chronic applications ▪ Increased awareness of Non- Transected Nerve Injuries ▪ Clinical evidence generation ▪ Professional education on appropriate surgical technique & algorithm ▪ Reimbursement coding and coverage ▪ Routine trauma moving to ASCs and lower cost sites of care ▪ Education and awareness of proper nerve repair technique ▪ Improve procedure awareness and scheduling across all care settings ▪ Private payer adoption of improved CMS reimbursement guidelines Axogen has, until now, focused primarily in digital and short gap but new evidence and product launches will open full peripheral nerve injury trauma market AXGN Algorithm HighLow

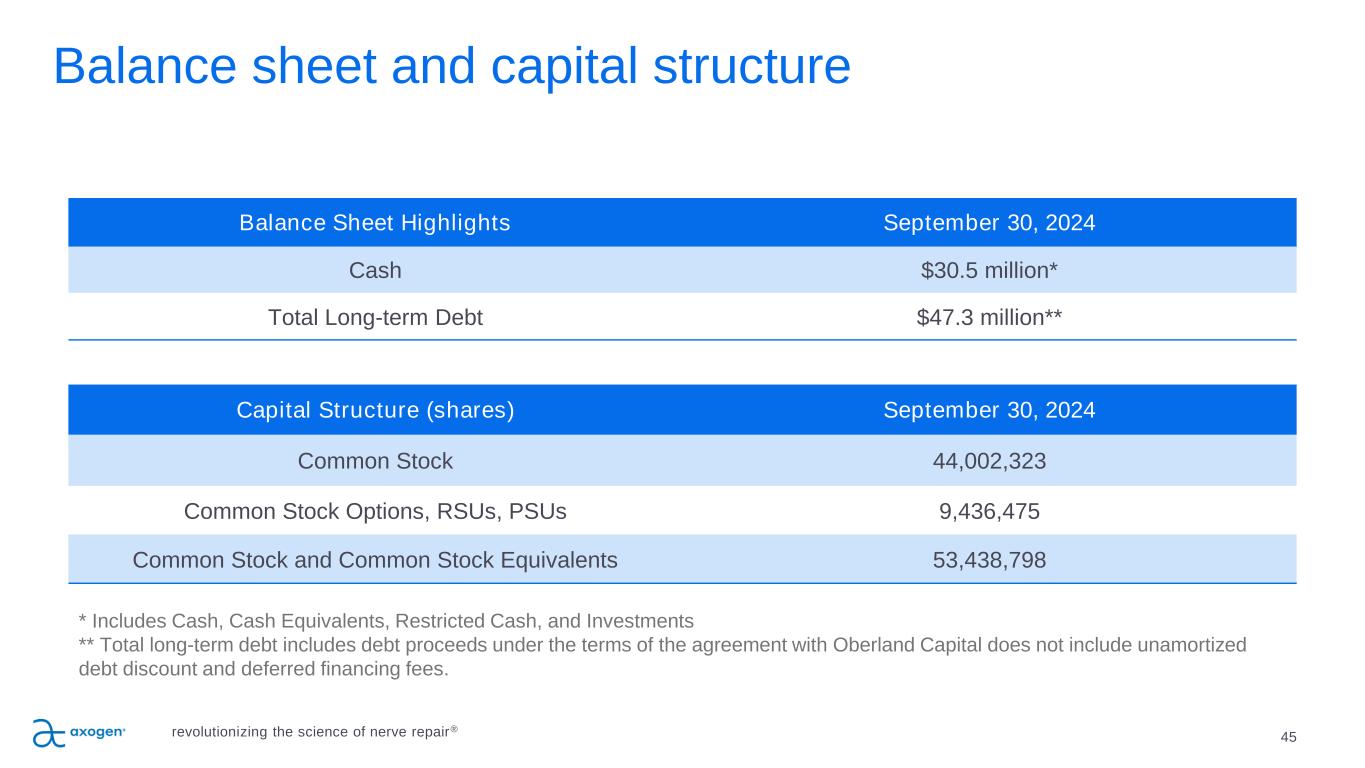

45 Balance Sheet Highlights September 30, 2024 Cash $30.5 million* Total Long-term Debt $47.3 million** Capital Structure (shares) September 30, 2024 Common Stock 44,002,323 Common Stock Options, RSUs, PSUs 9,436,475 Common Stock and Common Stock Equivalents 53,438,798 Balance sheet and capital structure * Includes Cash, Cash Equivalents, Restricted Cash, and Investments ** Total long-term debt includes debt proceeds under the terms of the agreement with Oberland Capital does not include unamortized debt discount and deferred financing fees. revolutionizing the science of nerve repair®

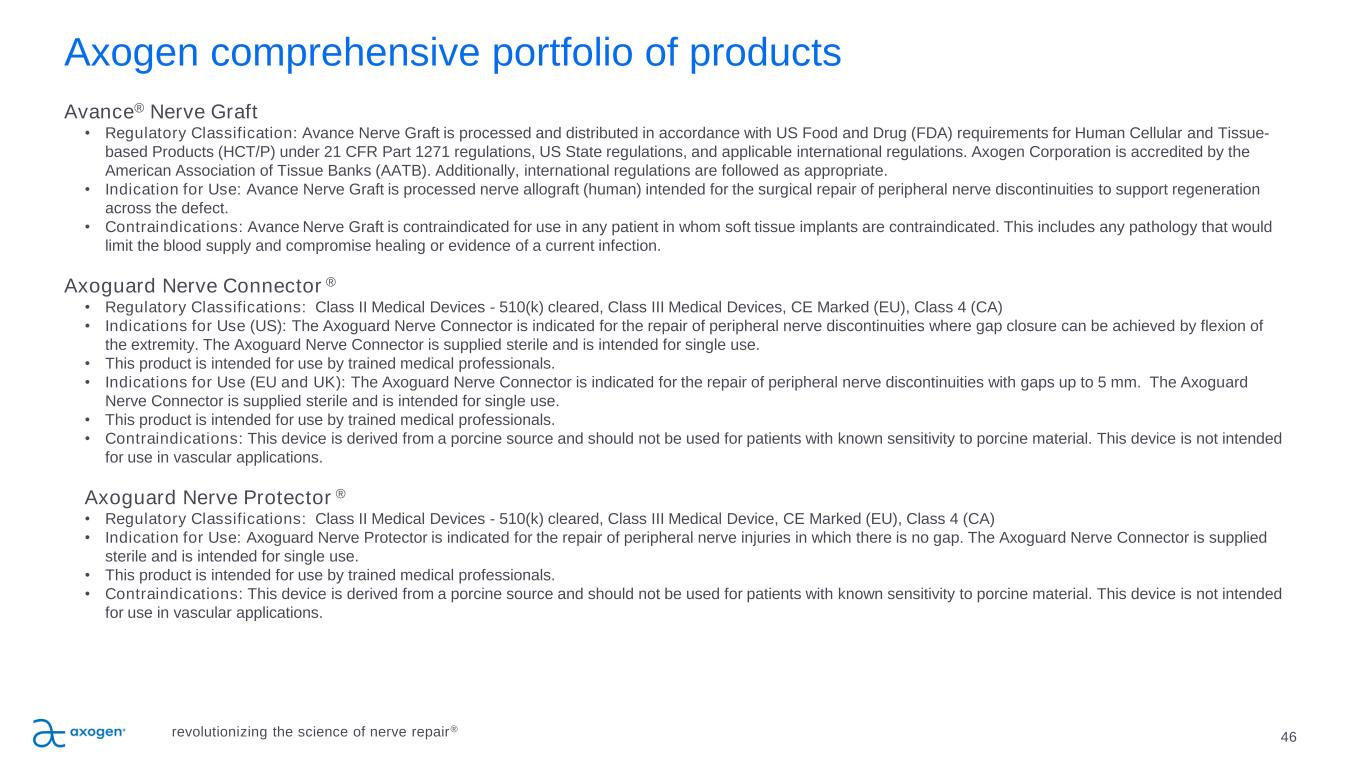

Axogen comprehensive portfolio of products Avance® Nerve Graft • Regulatory Classification: Avance Nerve Graft is processed and distributed in accordance with US Food and Drug (FDA) requirements for Human Cellular and Tissue- based Products (HCT/P) under 21 CFR Part 1271 regulations, US State regulations, and applicable international regulations. Axogen Corporation is accredited by the American Association of Tissue Banks (AATB). Additionally, international regulations are followed as appropriate. • Indication for Use: Avance Nerve Graft is processed nerve allograft (human) intended for the surgical repair of peripheral nerve discontinuities to support regeneration across the defect. • Contraindications: Avance Nerve Graft is contraindicated for use in any patient in whom soft tissue implants are contraindicated. This includes any pathology that would limit the blood supply and compromise healing or evidence of a current infection. Axoguard Nerve Connector ® • Regulatory Classifications: Class II Medical Devices - 510(k) cleared, Class III Medical Devices, CE Marked (EU), Class 4 (CA) • Indications for Use (US): The Axoguard Nerve Connector is indicated for the repair of peripheral nerve discontinuities where gap closure can be achieved by flexion of the extremity. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • This product is intended for use by trained medical professionals. • Indications for Use (EU and UK): The Axoguard Nerve Connector is indicated for the repair of peripheral nerve discontinuities with gaps up to 5 mm. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • This product is intended for use by trained medical professionals. • Contraindications: This device is derived from a porcine source and should not be used for patients with known sensitivity to porcine material. This device is not intended for use in vascular applications. Axoguard Nerve Protector ® • Regulatory Classifications: Class II Medical Devices - 510(k) cleared, Class III Medical Device, CE Marked (EU), Class 4 (CA) • Indication for Use: Axoguard Nerve Protector is indicated for the repair of peripheral nerve injuries in which there is no gap. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • This product is intended for use by trained medical professionals. • Contraindications: This device is derived from a porcine source and should not be used for patients with known sensitivity to porcine material. This device is not intended for use in vascular applications. 46revolutionizing the science of nerve repair®

Axogen comprehensive portfolio of products (Cont’d) revolutionizing the science of nerve repair® 47 Axoguard Nerve Cap® • Regulatory Classification: Class II Medical Device – 510(k) cleared • Indications for Use: Axoguard Nerve Cap is indicated to protect a peripheral nerve end and to separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma. • This product is intended for use by trained medical professionals. • Contraindications: Axoguard Nerve Cap is derived from a porcine source and should not be used for patients with known sensitivity to porcine derived materials. Axoguard Nerve Cap is contraindicated for use in any patient for whom soft tissue implants are contraindicated; this includes any pathology that would limit the blood supply and compromise healing, or evidence of a current infection. Axoguard Nerve Cap should not be implanted directly under the skin. This device is not intended for use in vascular applications. • Axoguard HA+ Nerve Protector • Regulatory Classifications: Class II Medical Devices - 510(k) cleared (K223640) • Indication for Use: Axoguard HA+ Nerve Protector is indicated for the management of peripheral nerve injuries where there is no gap. • This product is intended for use by trained medical professionals. • Contraindications: Axoguard HA+ Nerve Protector base membrane is derived from a porcine source and the lubricant coating is composed of sodium hyaluronate and sodium alginate. The Axoguard HA+ Nerve Protector should not be used for patients with known sensitivity to porcine, alginate, or hyaluronate materials. This device is not intended for use in vascular applications. • Axoguard HA+ Nerve Protector • Regulatory Classifications: Class II Medical Devices - 510(k) cleared ( K231708) • Indication for Use: Axoguard HA+ Nerve Protector is indicated for the management of peripheral nerve injuries where there is no gap, or following closure of the gap. • This product is intended for use by trained medical professionals. • Contraindications: Axoguard HA+ Nerve Protector base membrane is derived from a porcine source and the lubricant coating is composed of sodium hyaluronate and sodium alginate. The Axoguard HA+ Nerve Protector should not be used for patients with known sensitivity to porcine, alginate, or hyaluronate materials. This device is not intended for use in vascular applications.

Axogen comprehensive portfolio of products (Cont’d) revolutionizing the science of nerve repair 48 Avive+ Soft Tissue MatrixTM • Regulatory Classification: Avive+ Soft Tissue Matrix is processed and distributed in accordance with US Food and Drug (FDA) requirements for Human Cellular and Tissue-based Products (HCT/P) under 21 CFR Part 1271 regulations, and US State regulations. Axogen Corporation is accredited by the American Association of Tissue Banks (AATB). • Intended Use: Avive+ Soft Tissue Matrix is processed amniotic membrane intended for use as a soft tissue barrier. • This product is intended for use by trained medical professionals. • Contraindications: Avive+ Soft Tissue Matrix is contraindicated for use in any patient in whom soft tissue implants are contraindicated. This includes any pathology that would limit the blood supply and compromise healing or evidence of a current infection.

49 Footnotes revolutionizing the science of nerve repair® 1. National Hospital Ambulatory Medical Care Survey: 2015 Emergency Department Summary Tables – Table 18. https://www.cdc.gov/nchs/data/nhamcs/web_tables/2015_ed_web_tables.pdf 2. Noble, et al.. Analysis of upper and lower extremity peripheral nerve injuries in a population of patients with multiple injuries. J Trauma. 1998; 45(1): 116-122. 3. Uzun, et al., Traumatic peripheral nerve injuries: demographic and electrophysiologic findings of 802 patients from a developing country. J Clin Neuromusc Dis. 2006; 7(3): 97–103. 4. Portincasa, et al. Microsurgical treatment of injury to peripheral nerves in upper and lower limbs: a critical review of the last 8 years. Microsurgery. 2007; 27(5): 455–462. 5. Medicare National HCPS Aggregate Summary Table CY2016. https://data.cms.gov/Medicare-Physician-Supplier/Medicare-National-HCPCS-Aggregate-Summary-Table-CY/jtra-d83c/data 6. Sotereanos, et al. Vein wrapping for the treatment of recurrent carpal tunnel syndrome. Tech Hand Up Extrem Surg.1997; 1(1):35-40. 7. Seradge, et al. Cubital tunnel release with medial epicondylectomy factors influencing the outcome. J Hand Surg Am. 1998; 23(3): 483-491. 8. Papatheodorou, et al. Preliminary results of recurrent cubital tunnel syndrome treated with neurolysis and porcine extracellular matrix nerve wrap. J Hand Surg Am. 2015; 40(5): 987-992 9. Lin, et al. Systematic review and meta-analysis on incidence of altered sensation of mandibular implant surgery - PLoS One. 2016; 11(4): e0154082. 10. Hussaini. Procedure frequency in the jaws related to implant location. Dent Oral Craniofac Res. 2016; 2(2): 230-233. 11. Nguyen, et al. Risk factors for permanent injury of inferior alveolar and lingual nerves during third molar surgery. J Oral Maxillofac Surg. 2014; 72(12): 2394-2401. 12. Cheung, et al. Incidence of neurosensory deficits and recovery after lower third molar surgery: a prospective clinical study of 4338 cases. Int J Oral Maxillofac Surg. 2010; 39(4): 320–326. 13. Dental Implants Market (Product - Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants; Material - Titanium Implants, Zirconium Implants; End User - Hospitals, Dental Clinics, and Academic & Research Institutes) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2017 – 2025. https://www.transparencymarketresearch.com/dental-implants-market.html 14. Cha, et al. Frequency of bone graft in implant surgery. Maxillofac Plast and Reconstr Surg. 2016; 38(1): 19. 15. Miloro, M (ed). Trigeminal Nerve Injuries. Springer; 2013. 16. Pogrel et al. Permanent nerve involvement resulting: From inferior alveolar nerve blocks. J Am Dent Assoc. 2000; 131(7): 901-907. 17. Agbaje, et al. Systematic review of the incidence of inferior alveolar nerve injury in bilateral sagittal split osteotomy and the assessment of neurosensory disturbances. Int. J Oral Maxillofac. Surg. 2015; 44(4): 447-451. 18. ASPS 2017– Plastic Surgery Statistics Report. www.plasticsurgery.org/documents/News/Statistics/2017/plastic-surgery-statistics-full-report-2017.pdf 19. Isaacs J, Nydick JA, Means KR, Merrell GA, Ilyas A, Levin LS; RECON study group. A multicenter prospective randomized comparison of conduits versus decellularized nerve allograft for digital nerve repairs. J Hand Surg Am. 2023;48(9):904-913. 20. Lans J, Eberlin KR, Evans PJ, Mercer D, Greenberg JA, Styron JF. A systematic review and meta-analysis of nerve gap repair: Comparative effectiveness of allografts, autografts, and conduits. Plast Reconstr Surg. 2023 May 1;151(5):814e-827e. 21. Raizman NM, Endress RD, Styron JS, Emont S, Zhun Cao, Z, Park L, Greenberg JA. Procedure costs of peripheral nerve graft reconstruction. Plast Reconstr Surg Glob Open. 2023 Apr 10;11(4):e4908. 22. Ansaripour A, Thompson A, Styron J, Javanbakht M. Cost-effectiveness analysis of Avance® allograft for the treatment of peripheral nerve injuries in the USA. J Comp Eff Res . 2024 Jan;13(1):e230113. 23. Ducic I, Yoon J, Buncke G. Chronic postoperative complications and donor site morbidity after sural nerve autograft harvest or biopsy. Microsurgery. 2020;40(6):710-716. 24. Weber, et al. A randomized prospective study of polyglycolic acid conduits for digital nerve reconstruction in humans. Plast Reconstr Surg. 2000; 106(5): 1036-1045. 25. Wangensteen, et al. Collagen tube conduits in peripheral nerve repair: A retrospective analysis. Hand. 2010; 5(3): 273-277. 26. Safa B, Jain S, Desai MJ, Greenberg JA, Niacaris TR, Nydick JA, Leversedge FJ, Megee DM, Zoldos J, Rinker BD, McKee DM, MacKay BJ, Ingari JV, Nesti LJ, Cho M, Valerio IL, Kao DS, El-Sheikh Y, Weber RV, Shores JT, Styron JF, Thayer WP, Przylecki WH, Hoyen HA, Buncke GM. Peripheral nerve repair throughout the body with processed nerve allografts: Results from a large multicenter study. Microsurgery. 2020 Jul;40(5):527-537. 27. Bedar M, Saffari TM, Johnson AJ, Shin AY. The effect of mesenchymal stem cells and surgical angiogenesis on immune response and revascularization of acellular nerve allografts in a rat sciatic defect model. J Plast Reconstr Aesthet Surg. 2022;75(8):2809-2820. 28. Boeckstyns, et al. Collagen conduit versus microsurgical neurorrhaphy: 2-year follow-up of a prospective, blinded clinical and electrophysiological multicenter randomized, controlled trial. J hand Surg Am. 2013; 38(12): 2405-2411. 29. Isaacs J, Safa B, Evans PJ, Greenberg J. Technical assessment of connector-assisted nerve repair. J Hand Surg Am. 2016;41(7):760-766. 30. Schmidhammer, et al. Alleviated tension at the repair site enhances functional regeneration: The effect of full range of motion mobilization on the regeneration of peripheral nerves--histologic, electrophysiologic, and functional results in a rat model. J Trauma. 2004; 56(3): 571-584 31. Tang, et al. The optimal number and location of sutures in conduit-assisted primary digital nerve repair. J Hand Surg Eur Vol. 2018; 43(6): 621-625. 32. Data on file at Axogen 33. Badylak SF, Park K, Peppas N, McCabe G, Yoder M. Marrow-derived cells populate scaffolds composed of xenogeneic extracellular matrix. Exp Hematol. 2001;29(11):1310-1318. 34. Zhukauskas et al., Comparative study of porcine small intestine submucosa and cross-linked bovine type I collagen as a nerve conduit. JHS GO 3(5), 282-288 Sep 2021 35. Kokkalis, et al. Assessment of processed porcine extracellular matrix as a protective barrier in a rabbit nerve wrap model. J Recon MicroSurg. 2011; 27(1): 19-28. 36. Badylak S, Kokini K, Tullius B, Simmons-Byrd A, Morff R. Morphologic study of small intestinal submucosa as a body wall repair device. J Surg Res. 2002;103(2):190-202.

50 Footnotes 37. Nihsen, et al. Bioactivity of small intestinal submucosa and oxidized regenerated cellulose/collagen. Adv Skin Wound Care. 2008; 21(10): 479-486. 38. Hodde, et al. Vascular endothelial growth factor in porcine-derived extracellular matrix. Endothelium. 2001; 8(1): 11-24. 39. Pet MA, Ko JH, Friedly JL, Smith DG. Traction neurectomy for treatment of painful residual limb neuroma in lower extremity amputees. J Orthop Trauma. 2015; 29 (9), e321-5. 40. Stokvis A, van der Avoort DJC, van Neck JW, Hovius SER, Coert JH. Surgical management of neuroma pain: a prospective follow-up study. Pain. 2010;151(3):862-869. 41. Gruber H, et al. Practical experience with sonographically guided phenol instillation of stump neuroma: predictors of effects, success, and outcome. Am J Roentgenol. 2008;190(5):1263-1269. 42. Fallat L. Cryosurgery or sclerosing injections: which is better for neuromas. Podiatry Today. 2004;17(6):58-66. 43. Tork S, Faleris J, Engemann A, Deister C, DeVinney E, Valerio IL. Application of a Porcine Small Intestine Submucosa Nerve Cap for Prevention of Neuromas and Associated Pain. Tissue Eng Part A. 2020;26(9-10):503-511. 44. Leversedge FJ, Zoldos J, Nydick J, Kao DS, Thayer W, MacKay B, McKee D, Hoyen H, Safa B, Buncke GM. A Multicenter Matched Cohort Study of Processed Nerve Allograft and Conduit in Digital Nerve Reconstruction. J Hand Surg Am. 2020 Dec;45(12):1148-1156. 45. Safa B, Power D, Liu A, Thayer WP, et al. A Propensity Matched Cohort Study on Outcomes from Processed Nerve Allograft and Nerve Autograft in Upper Extremity Nerve Repairs. In: The 75th Annual Meeting of the ASSH. Virtual Annual Meeting, October 1-2, 2020. 46. Momeni A, Meyer S, Shefren K, Januszyk M. Flap Neurotization in Breast Reconstruction with Nerve Allografts: 1-year Clinical Outcomes. Plast Reconstr Surg Glob Open. 2021 Jan 12;9(1):e3328. 47. Pereira R, Dauphinee D, Frania S, Garrett A, Martin C, Van Gils C, Thomajan C. Clinical evaluation of an innovative nerve termination cap for treatment and prevention of stump neuroma pain: Results from a prospective pilot clinical study. Fastrac. 2022; 2(2): 100179. © 2024 Axogen Corporation. The stylized “a” logo, Avance Nerve Graft and Axoguard are registered trademarks of Axogen Corporation. Avive+ is a trademark of Axogen Corporation. Axoguard Nerve Connector and Axoguard Nerve Protector are manufactured in the United States by Cook Biotech Incorporated, West Lafayette, Indiana, and are distributed exclusively by Axogen Corporation. LB-0588 revolutionizing the science of nerve repair®

nasdaq: axgn 51revolutionizing the science of nerve repair®