1 Making Nerve Repair an Expected Standard of Care A commitment to restoring health, improving quality of life, and advancing peripheral nerve care for every patient. Michael Dale, President & CEO January 2026

Forward-looking statements This presentation contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “priorities,” “objectives,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding financial guidance, including revenue range, cash and gross margins; reimbursement expectations; anticipated regulatory approvals; international expansion; educational initiatives; patient activation strategies; and clinical trial plans, as well as market development opportunities and priorities for peripheral nerve products; TAM estimates; estimates of potential patients who may benefit from our products; strategic plan priorities, including projected multi-year revenue, revenue growth, CAGR, margins, market and growth drivers; strategic initiatives; expectations regarding commercial performance of our products; market opportunities for use with prostatectomy; innovation, including new products and indications; clinical evidence generation and its impact on adoption and societal support; Axogen Processing Center capabilities for manufacturing Avance®; and our expectation that Avance® will be designated as the reference product for any biosimilar nerve allograft product and provide market exclusivity. Actual results or events could differ materially from those described in any forward-looking statements as a result of various factors, including, without limitation, global supply chain issues, inflation, hospital staffing issues, product development timelines, product potential, expected clinical enrollment timing and outcomes, regulatory process and approvals, financial performance, sales growth, surgeon and product adoption, market awareness of our products, data validation, our visibility at and sponsorship of conferences and educational events, recent geopolitical conflicts, reimbursement trends, potential impact of recent government actions and policies, including the One Big Beautiful Bill Act on our business, tax position, and regulatory processes, as well as those risk factors described under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the most recently ended fiscal year. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements. About Non-GAAP Financial Measures To supplement our condensed consolidated financial statements, we use the non-GAAP financial measures of EBITDA, which measures earnings before interest, income taxes, depreciation and amortization, and Adjusted EBITDA which further excludes non-cash stock compensation expense. We also use the non-GAAP financial measures of Adjusted Net Income or Loss and Adjusted Net Income or Loss Per Common Share - basic and diluted which excludes non-cash stock compensation expense from Net Income or Loss and Net Income or Loss Per Common Share - basic and diluted, respectively. We also use the Operational Cashflow metric, which corresponds to Net increase (decrease) in cash, cash equivalents, restricted cash, and investments, less cashflow from issuance or repayment of long-term debt. These non-GAAP measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of the non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP should be carefully evaluated. We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. We believe these non-GAAP financial measures are useful to investors because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the performance of our business, the Company’s cash available for operations, and the Company’s ability to meet future capital expenditure and working capital requirements. 2

3 To restore health and improve quality of life by making restoration of peripheral nerve function an expected standard of care. Our Mission

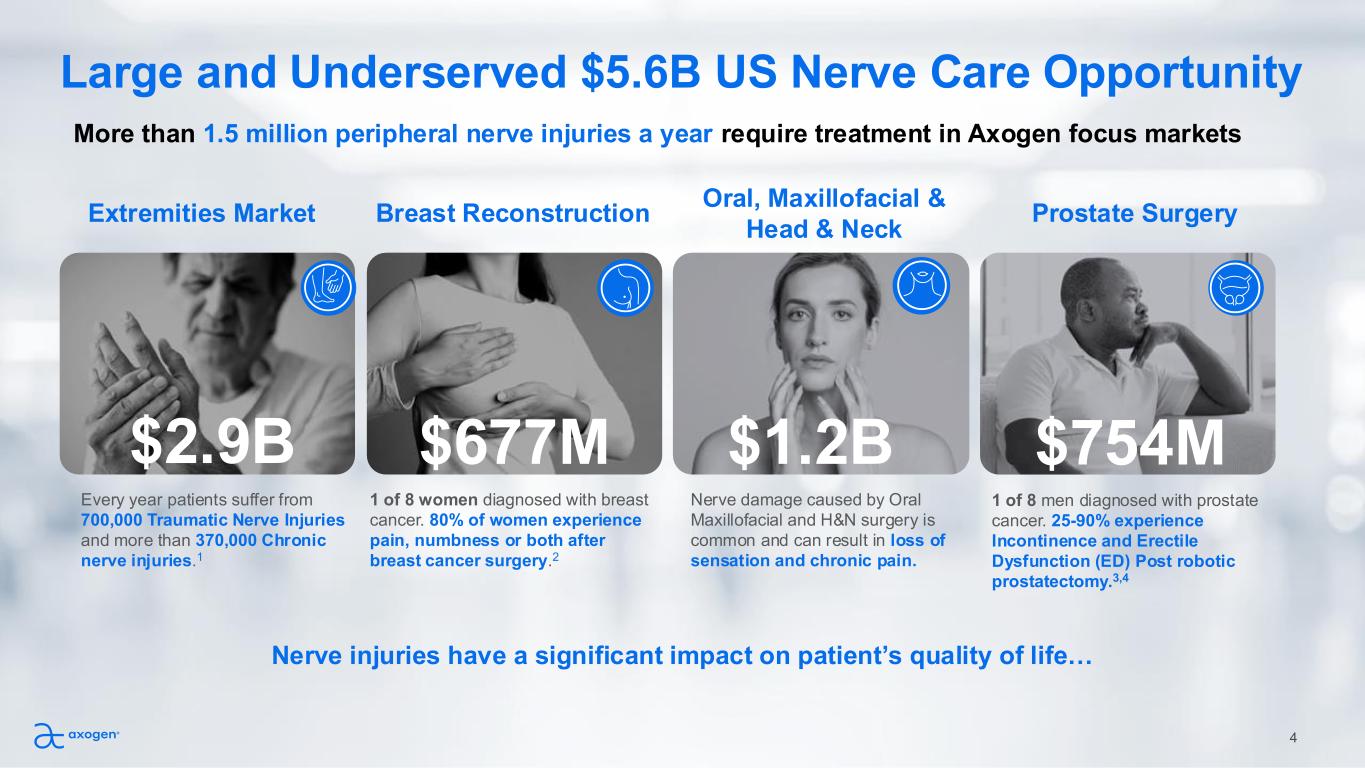

4 Large and Underserved $5.6B US Nerve Care Opportunity More than 1.5 million peripheral nerve injuries a year require treatment in Axogen focus markets Extremities Market Every year patients suffer from 700,000 Traumatic Nerve Injuries and more than 370,000 Chronic nerve injuries.1 Breast Reconstruction 1 of 8 women diagnosed with breast cancer. 80% of women experience pain, numbness or both after breast cancer surgery.2 Oral, Maxillofacial & Head & Neck Nerve damage caused by Oral Maxillofacial and H&N surgery is common and can result in loss of sensation and chronic pain. Prostate Surgery $1.2B$677M $754M Nerve injuries have a significant impact on patient’s quality of life… 1 of 8 men diagnosed with prostate cancer. 25-90% experience Incontinence and Erectile Dysfunction (ED) Post robotic prostatectomy.3,4 $2.9B

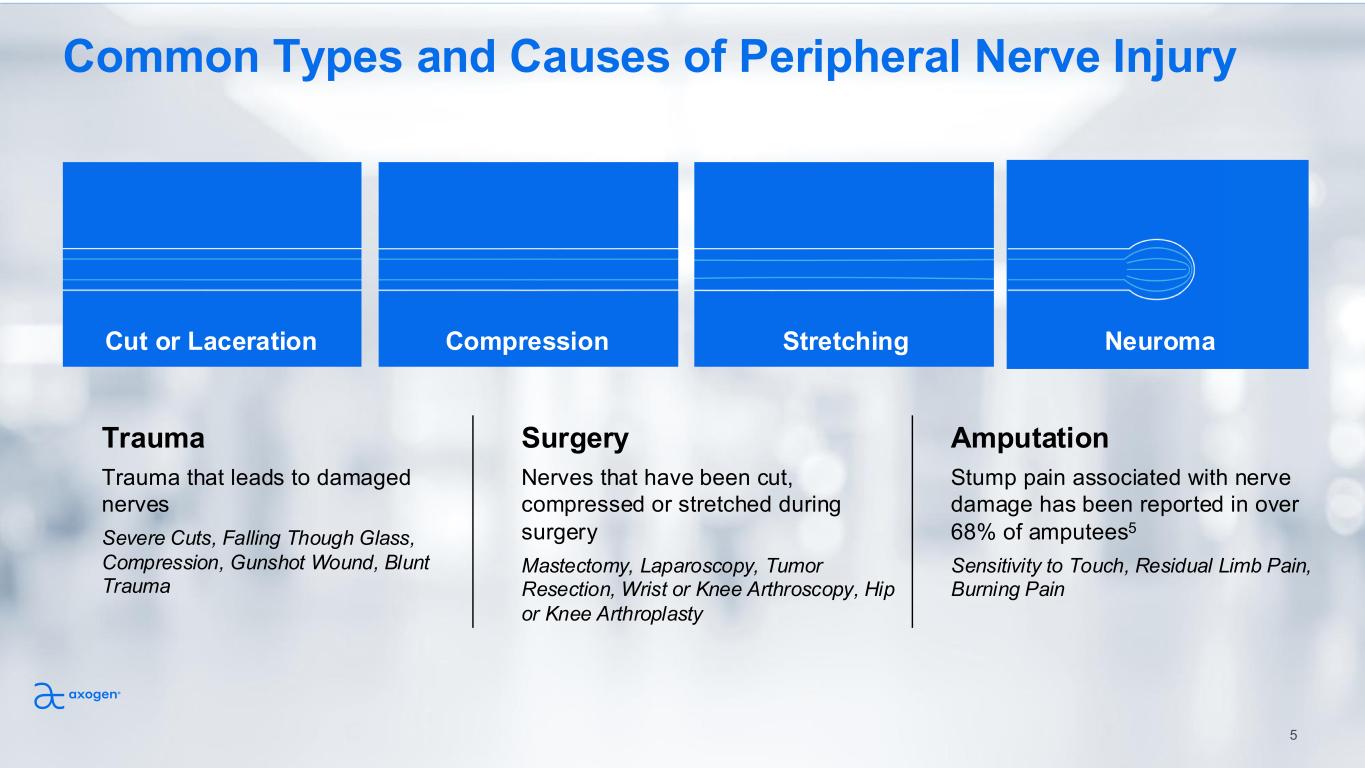

Common Types and Causes of Peripheral Nerve Injury Cut or Laceration Compression Stretching Neuroma Trauma Trauma that leads to damaged nerves Severe Cuts, Falling Though Glass, Compression, Gunshot Wound, Blunt Trauma Amputation Stump pain associated with nerve damage has been reported in over 68% of amputees5 Sensitivity to Touch, Residual Limb Pain, Burning Pain Surgery Nerves that have been cut, compressed or stretched during surgery Mastectomy, Laparoscopy, Tumor Resection, Wrist or Knee Arthroscopy, Hip or Knee Arthroplasty 5

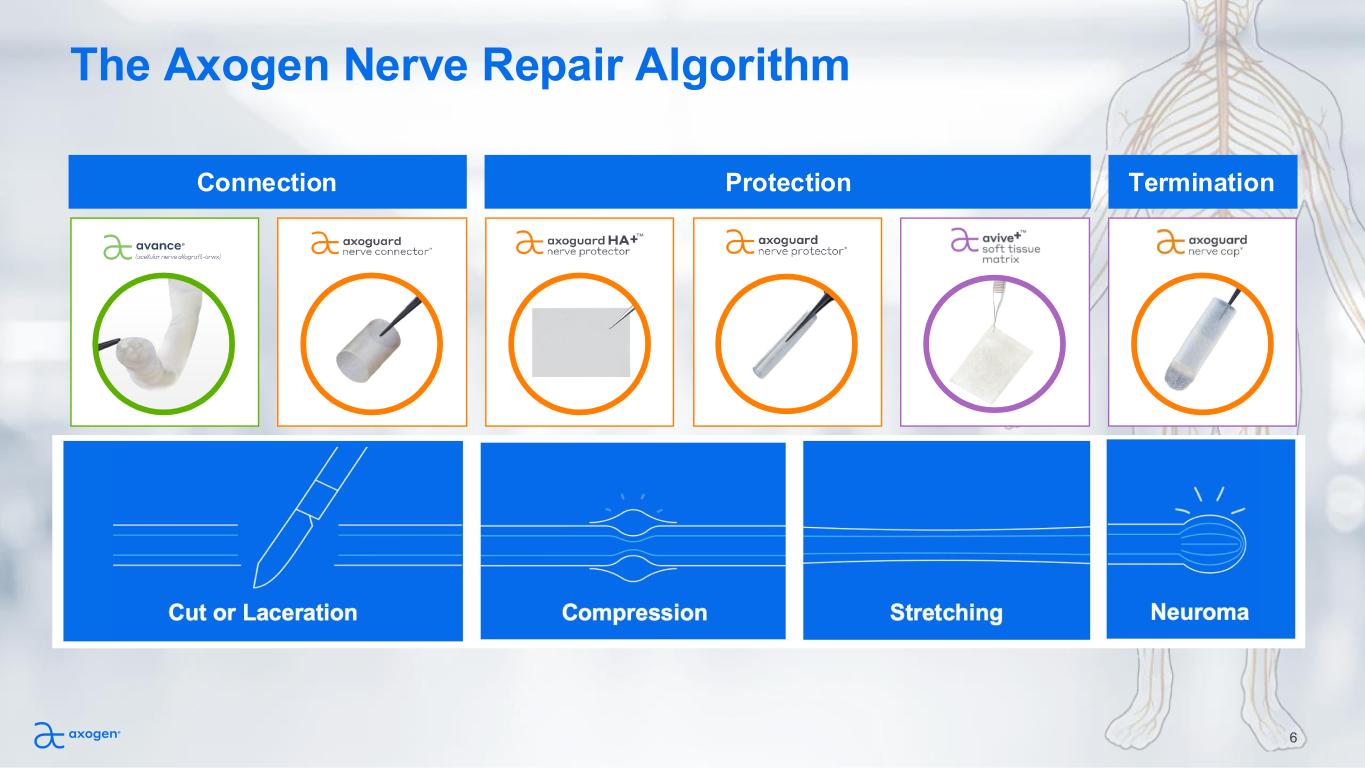

The Axogen Nerve Repair Algorithm 6 Connection Protection Termination

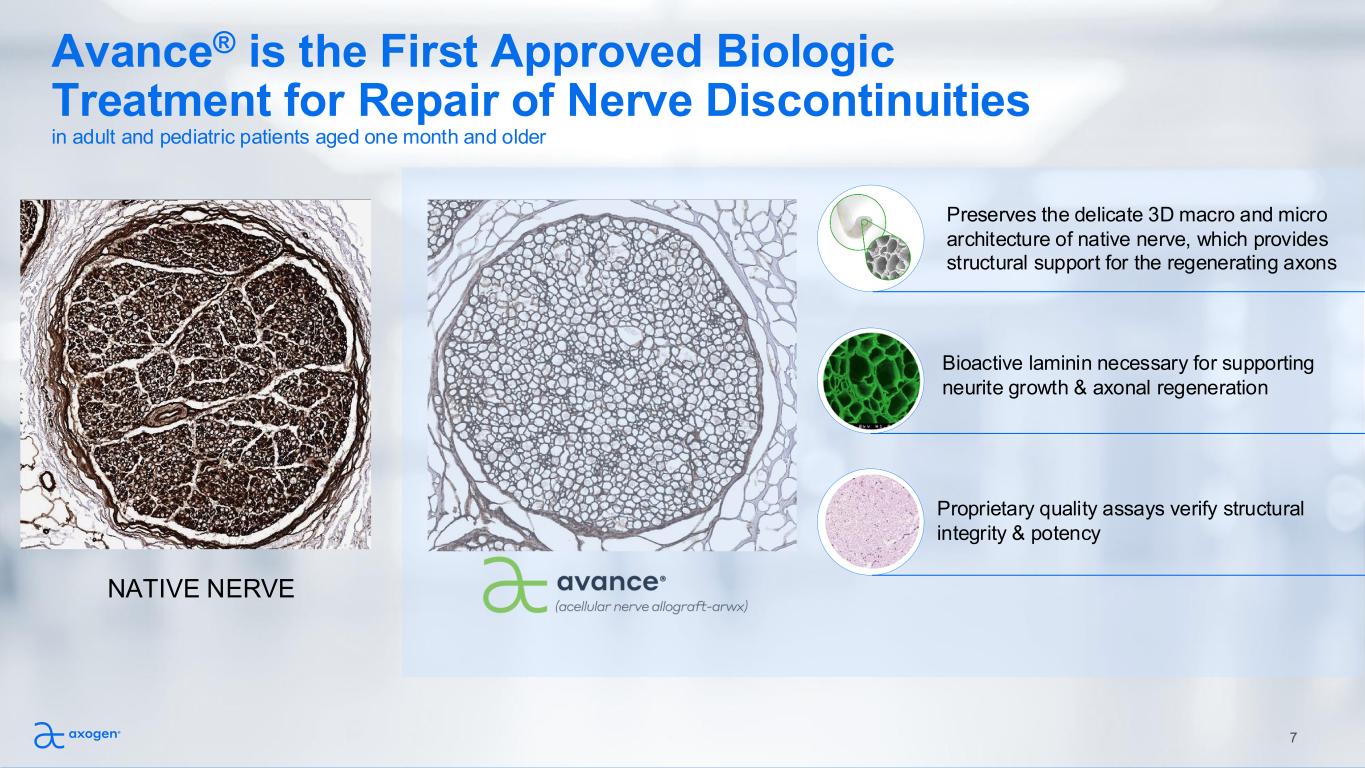

7 NATIVE NERVE Avance® is the First Approved Biologic Treatment for Repair of Nerve Discontinuities in adult and pediatric patients aged one month and older Preserves the delicate 3D macro and micro architecture of native nerve, which provides structural support for the regenerating axons Bioactive laminin necessary for supporting neurite growth & axonal regeneration Proprietary quality assays verify structural integrity & potency

8 • Care guidelines and standardized treatment algorithms are lagging and to be developed for certain care pathways Nerve Care is Not an Expected Standard of Care • Low patient and surgeon awareness of treatment options Awareness of Treatment Options • Approximately 60% of nerve injuries go undiagnosed prior to patient discharge6 Inefficient Patient Referral and Care Pathways • 35% of commercial lives remain uncovered1Coverage & Payment Our Key Market Development Opportunities

2025-2028 Strategic Plan Priorities Commercial infrastructure and salesforce expansion Continuous business model and customer creation process optimization by market Product development to drive better benefit versus risk profiles in nerve care Elective and planned procedure focus Prostate market development CAGR 15 - 20% Commercial Excellence Commercial Expansion Innovation MarketsGrowth Level 1 clinical evidence generation for societal support, standard of care & coverage requirements Standard of Care 9

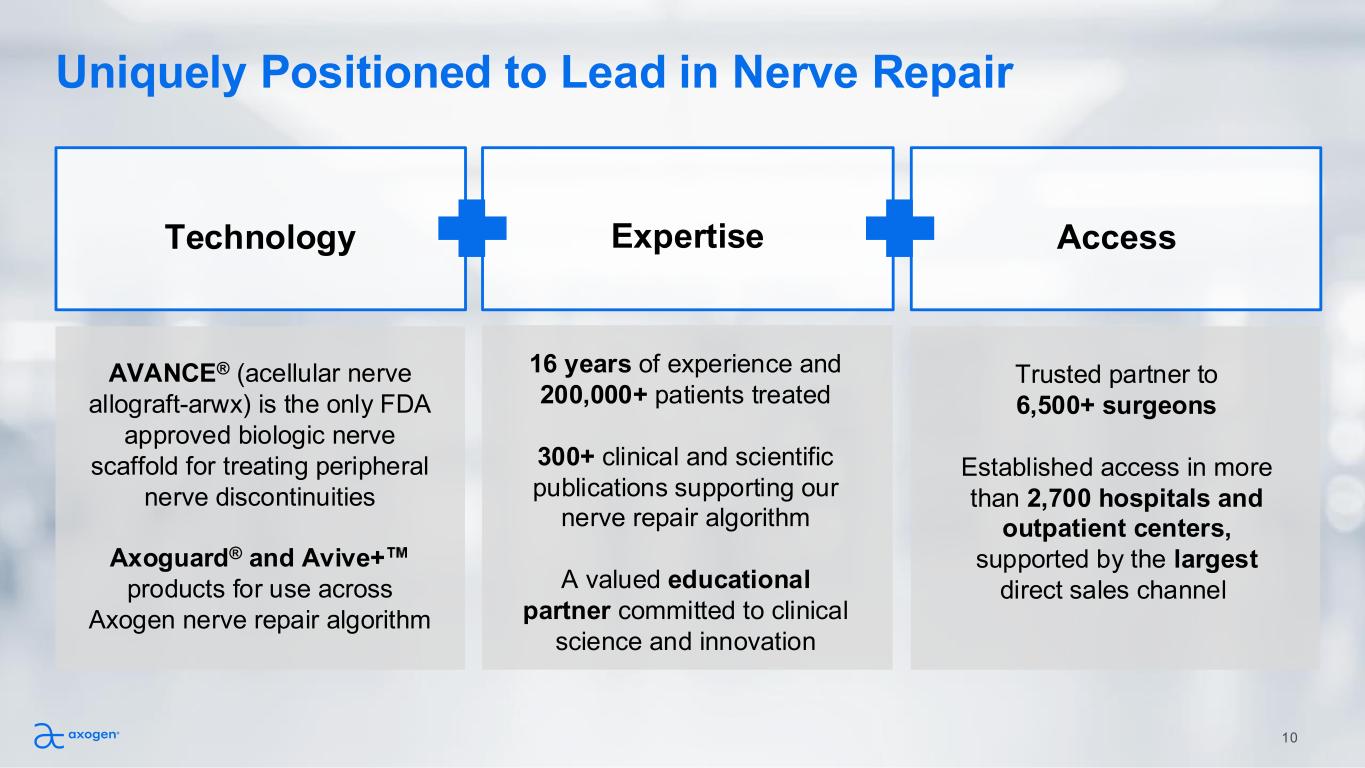

Uniquely Positioned to Lead in Nerve Repair AVANCE® (acellular nerve allograft-arwx) is the only FDA approved biologic nerve scaffold for treating peripheral nerve discontinuities Axoguard® and Avive+ products for use across Axogen nerve repair algorithm 16 years of experience and 200,000+ patients treated 300+ clinical and scientific publications supporting our nerve repair algorithm A valued educational partner committed to clinical science and innovation Trusted partner to 6,500+ surgeons Established access in more than 2,700 hospitals and outpatient centers, supported by the largest direct sales channel Technology Expertise Access 10

Elevating Nerve IQ Education & Training are Key to Market Development 11 75% of hand fellows trained 13 Professional education programs across our markets with more than 225 surgeons trained 117 Regional programs helping to enhance the micro surgical skills of surgeons Surgeons trained on Axogen’s nerve repair algorithm 55 Faculty educational partners of leading nerve repair thought leaders 2025 ACTIVITY 1400

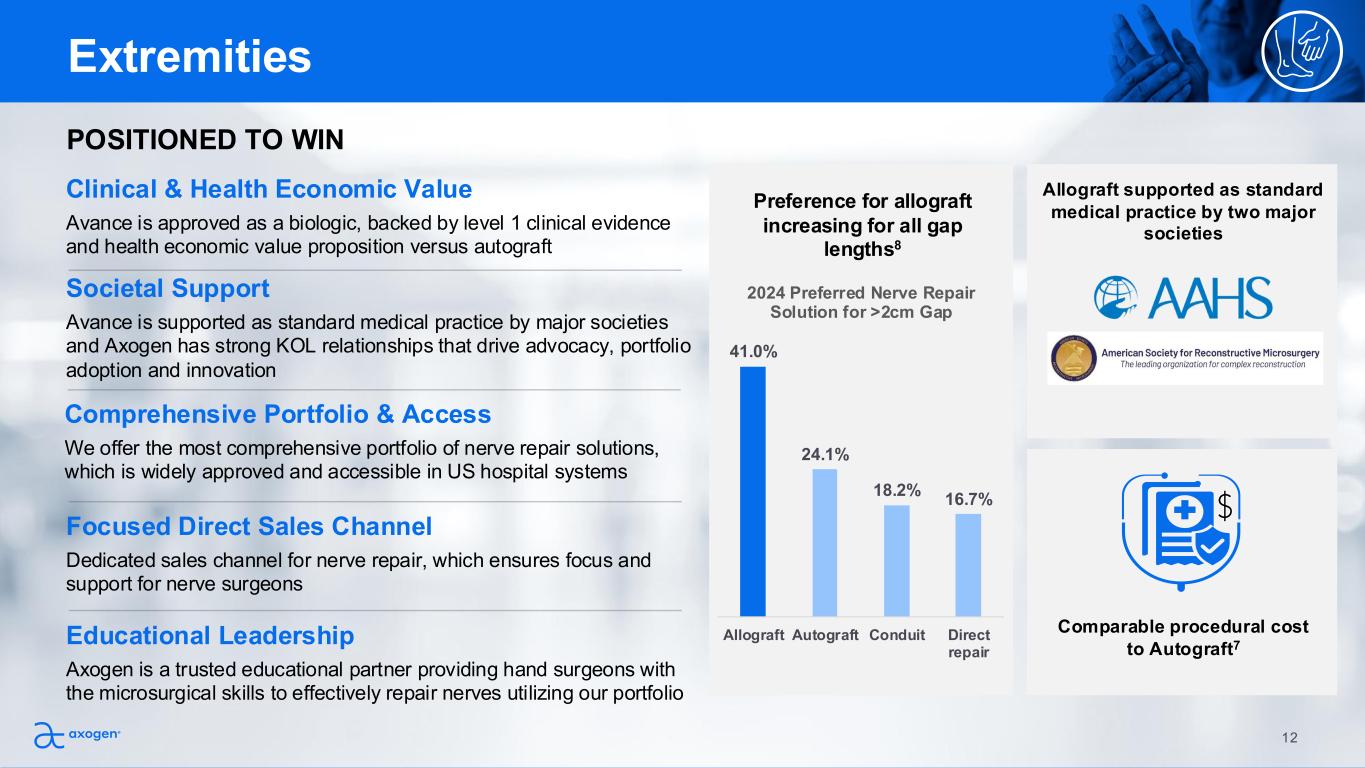

Societal Support Avance is supported as standard medical practice by major societies and Axogen has strong KOL relationships that drive advocacy, portfolio adoption and innovation POSITIONED TO WIN Preference for allograft increasing for all gap lengths8 Comparable procedural cost to Autograft7 Allograft supported as standard medical practice by two major societies Educational Leadership Axogen is a trusted educational partner providing hand surgeons with the microsurgical skills to effectively repair nerves utilizing our portfolio Comprehensive Portfolio & Access We offer the most comprehensive portfolio of nerve repair solutions, which is widely approved and accessible in US hospital systems Focused Direct Sales Channel Dedicated sales channel for nerve repair, which ensures focus and support for nerve surgeons Clinical & Health Economic Value Avance is approved as a biologic, backed by level 1 clinical evidence and health economic value proposition versus autograft Extremities 41.0% 24.1% 18.2% 16.7% Allograft Autograft Conduit Direct repair 2024 Preferred Nerve Repair Solution for >2cm Gap 12

POSITIONED TO WIN Growing body of evidence supporting the benefits or nerve reconstruction Grow presence in H&N oncologic procedures Opportunity to build patient and surgeon awareness of the patient QoL impact Expand educational capacity & programs Societal Support OMF societal support for nerve repair and included in AAOMS ParCare Guidelines can be leveraged to influence H&N societies Clinical Education Leadership Axogen has developed and executed on high quality national attending level professional education programs with proven post program adoption Clinical Evidence Independent clinical evidence with strong outcome data in benign mandible reconstruction and lingual nerve repair Direct Sales Channel Axogen has a large direct sales channel to service the highly concentrated market Oral Maxillofacial and Head & Neck 13

POSITIONED TO WIN Specialized Sales & Marketing Dedicated, deeply knowledgeable sales team enables effective surgeon development, support and market penetration Marketing expertise in the creation of strategies, tactics, tools, and resources support the sales process Established, predictable customer creation process Proven Patient Activation Strategy Axogen’s marketing team excels at translating complex medical information into patient-friendly content, raising awareness and driving demand for Resensation® 25K+ monthly website visitors 3K+ monthly visitors to surgeon locator Clinical Education Leadership A collaborative approach to training has resulted in surgeon advocacy, high adoption rates and strong customer loyalty Standardized, branded procedure 80%+ surgeon adoption after training Breast 14

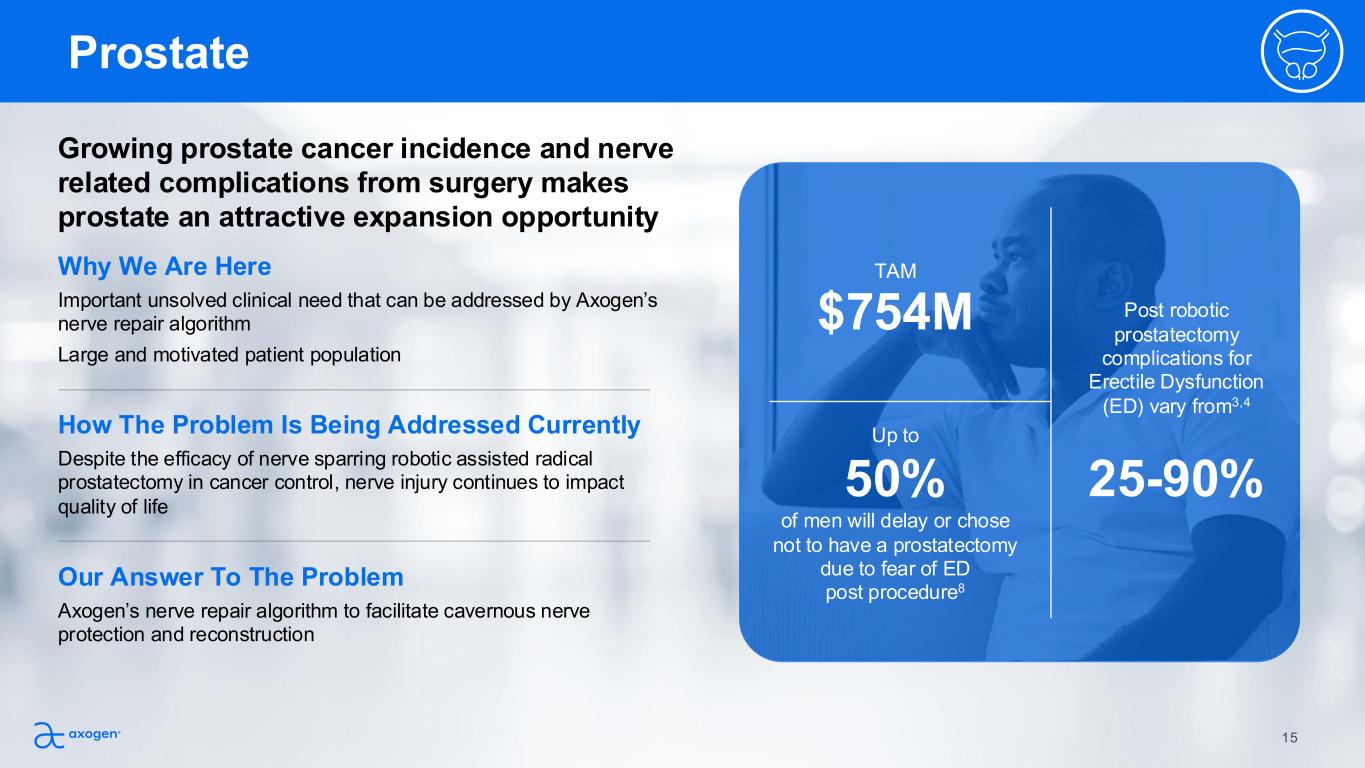

Oral Maxillofacial and Head & Neck $754M TAM of men will delay or chose not to have a prostatectomy due to fear of ED post procedure8 Prostate 50% Up to Post robotic prostatectomy complications for Erectile Dysfunction (ED) vary from3,4 25-90% Why We Are Here Important unsolved clinical need that can be addressed by Axogen’s nerve repair algorithm Large and motivated patient population Our Answer To The Problem Axogen’s nerve repair algorithm to facilitate cavernous nerve protection and reconstruction How The Problem Is Being Addressed Currently Despite the efficacy of nerve sparring robotic assisted radical prostatectomy in cancer control, nerve injury continues to impact quality of life Growing prostate cancer incidence and nerve related complications from surgery makes prostate an attractive expansion opportunity 15

POSITIONED TO WIN Clinical Education Leadership Extensive expertise in developing standardized surgical techniques and building comprehensive training courses to equip surgeons with the necessary skills and knowledge to successfully perform the procedures Nerve Repair Portfolio Axogen’s nerve repair portfolio has the potential to help surgeons address nerve protection and reconstruction needs in robotic assisted radical prostatectomy Avance Nerve Graft provides better size matching than a sural nerve autograft and Axogen has the broadest portfolio for nerve protection. 9,10,11 Patient Awareness & Activation Marketing team excels at executing campaigns that raise awareness of clinical problems and drives patient demand for new treatments 16 Prostate

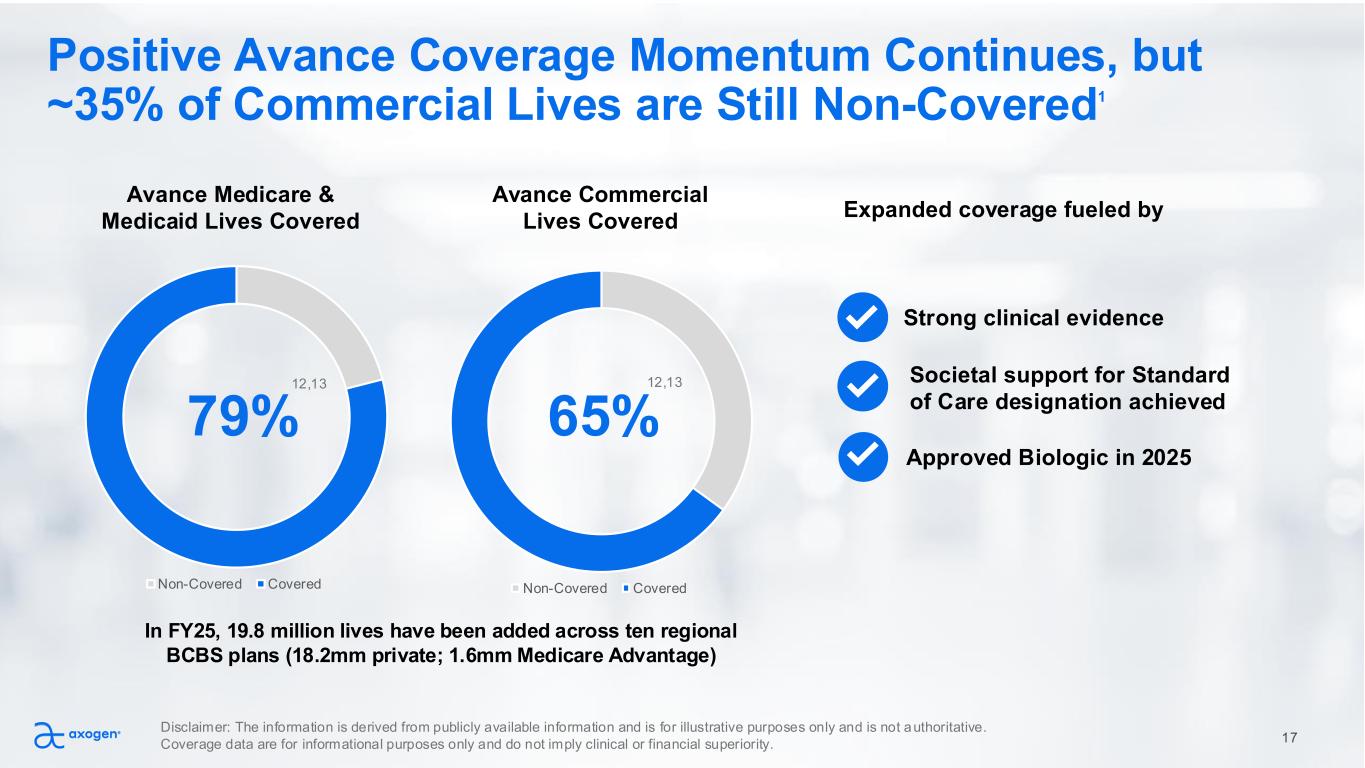

Non-Covered Covered Societal support for Standard of Care designation achieved Non-Covered Covered Positive Avance Coverage Momentum Continues, but ~35% of Commercial Lives are Still Non-Covered1 79% 65% Expanded coverage fueled by Approved Biologic in 2025 Strong clinical evidence Avance Medicare & Medicaid Lives Covered Avance Commercial Lives Covered In FY25, 19.8 million lives have been added across ten regional BCBS plans (18.2mm private; 1.6mm Medicare Advantage) 17 Disclaimer: The information is derived from publicly available information and is for illustrative purposes only and is not authoritative. Coverage data are for informational purposes only and do not imply clinical or financial superiority. 12,13 12,13

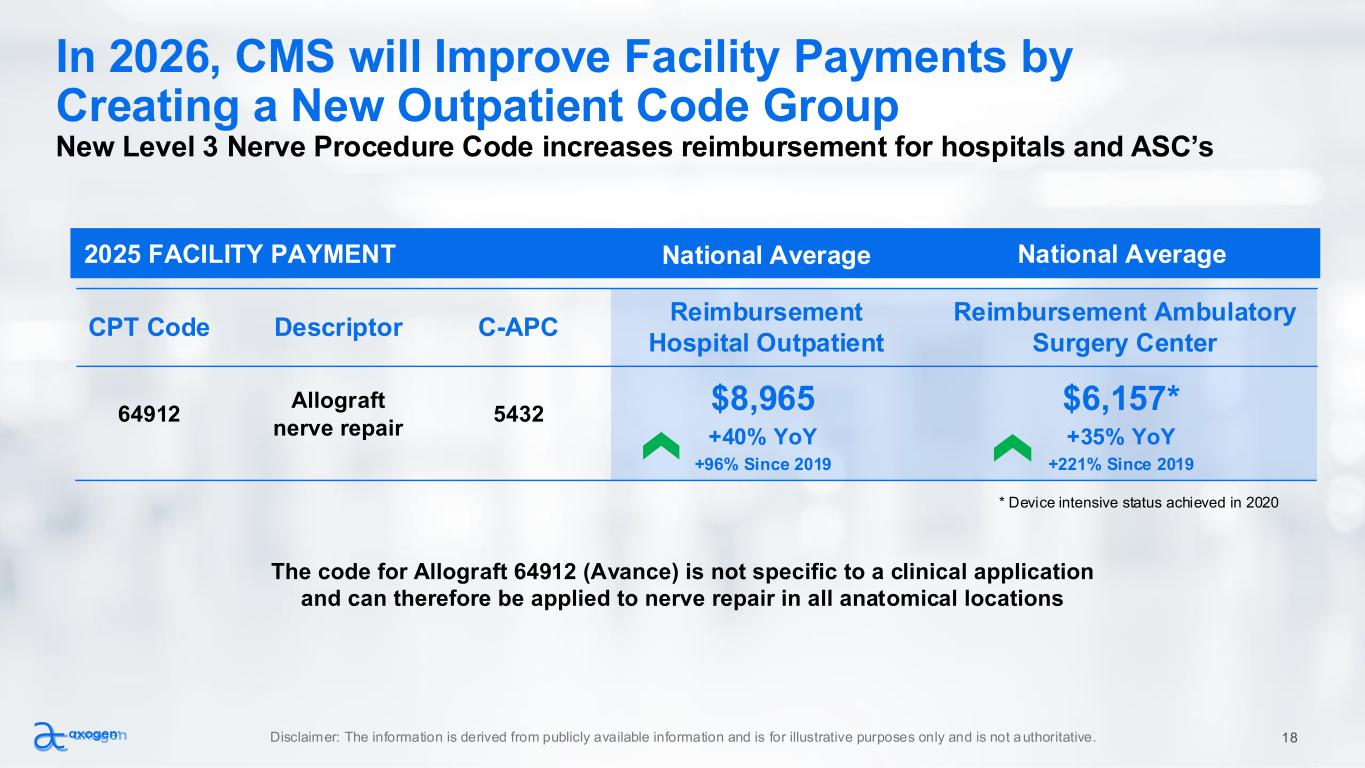

National Average2025 FACILITY PAYMENT In 2026, CMS will Improve Facility Payments by Creating a New Outpatient Code Group New Level 3 Nerve Procedure Code increases reimbursement for hospitals and ASC’s The code for Allograft 64912 (Avance) is not specific to a clinical application and can therefore be applied to nerve repair in all anatomical locations CPT Code Descriptor C-APC Reimbursement Hospital Outpatient Reimbursement Ambulatory Surgery Center 64912 Allograft nerve repair 5432 $8,965 $6,157* +40% YoY +96% Since 2019 +35% YoY +221% Since 2019 National Average Disclaimer: The information is derived from publicly available information and is for illustrative purposes only and is not authoritative. 18 * Device intensive status achieved in 2020

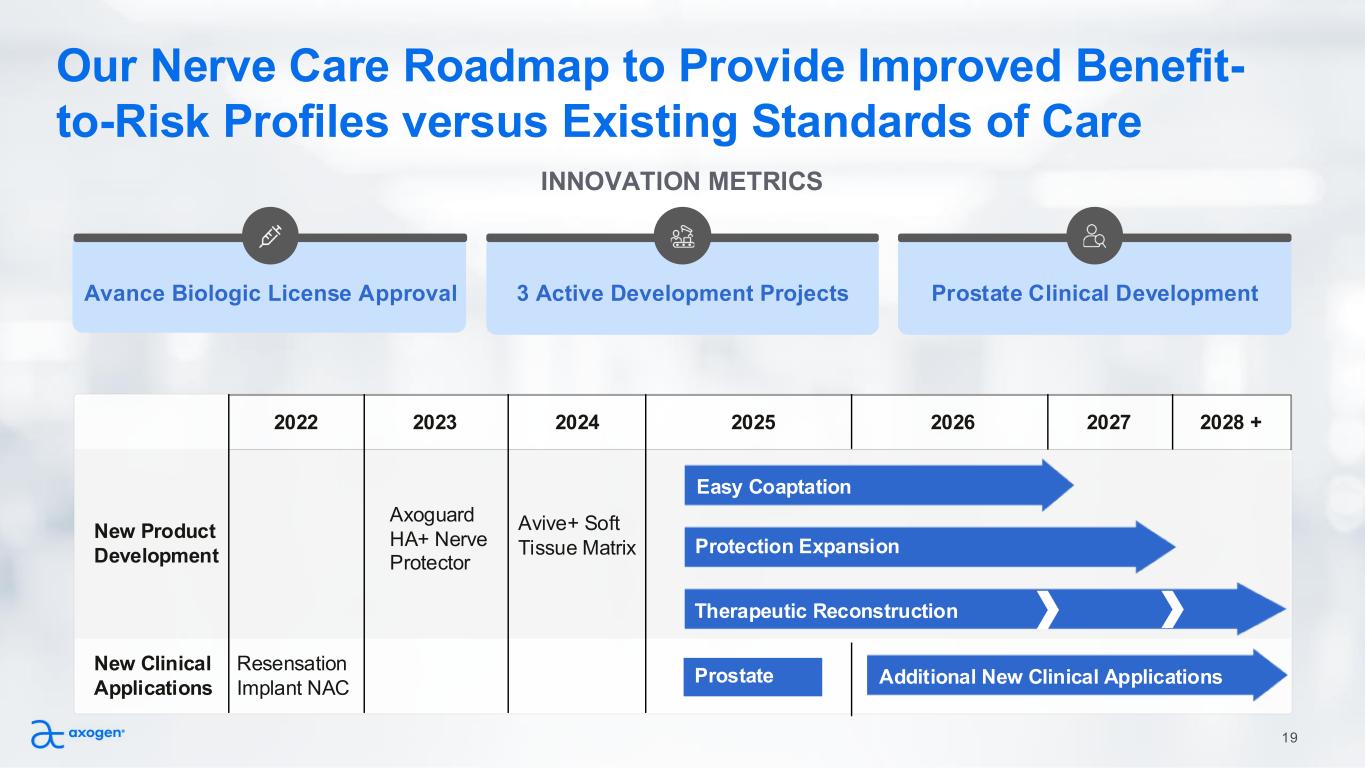

19 INNOVATION METRICS Avance Biologic License Approval 3 Active Development Projects Prostate Clinical Development 2022 2023 2024 2025 2026 2027 2028 + New Product Development Axoguard HA+ Nerve Protector Avive+ Soft Tissue Matrix New Clinical Applications Resensation Implant NAC Prostate Additional New Clinical Applications Our Nerve Care Roadmap to Provide Improved Benefit- to-Risk Profiles versus Existing Standards of Care Protection Expansion Easy Coaptation Therapeutic Reconstruction

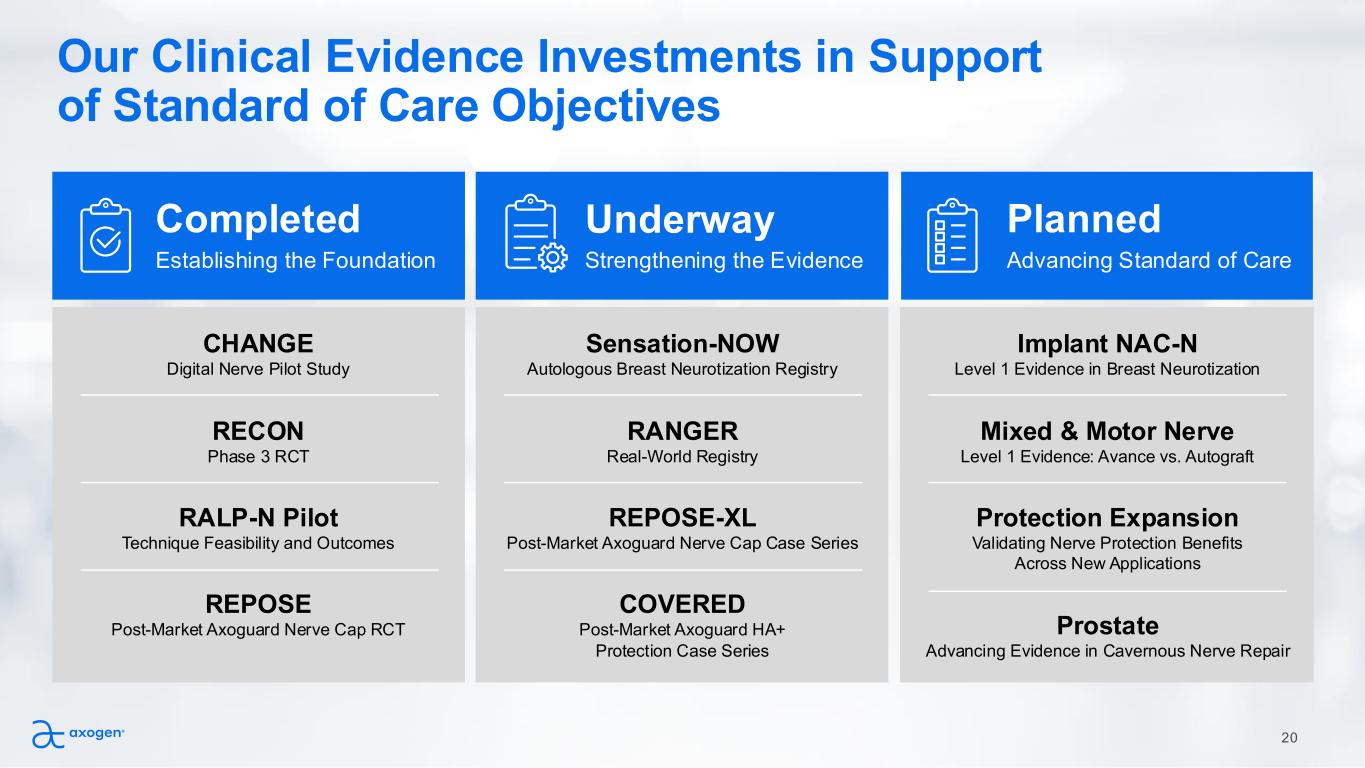

Our Clinical Evidence Investments in Support of Standard of Care Objectives Completed CHANGE Digital Nerve Pilot Study RECON Phase 3 RCT RALP-N Pilot Technique Feasibility and Outcomes REPOSE Post-Market Axoguard Nerve Cap RCT Underway Planned Establishing the Foundation Strengthening the Evidence Advancing Standard of Care Sensation-NOW Autologous Breast Neurotization Registry RANGER Real-World Registry REPOSE-XL Post-Market Axoguard Nerve Cap Case Series COVERED Post-Market Axoguard HA+ Protection Case Series Implant NAC-N Level 1 Evidence in Breast Neurotization Mixed & Motor Nerve Level 1 Evidence: Avance vs. Autograft Protection Expansion Validating Nerve Protection Benefits Across New Applications Prostate Advancing Evidence in Cavernous Nerve Repair 20

Management Team with a Track Record of Success Michael Dale Chief Executive Officer and Board Director Marc Began Executive Vice President and General Counsel Lindsey Hartley Chief Financial Officer Erick DeVinney Chief Innovation Officer Jens Schroeder Kemp Chief Marketing Officer Ivica Ducic, M.D. Chief Medical Officer Craig Swandal Vice President, Operations Stacy Arnold Vice President of Product Development and Clinical Research Al Jacks Vice President of Quality Rick Ditto Vice President, Global Health Economics, Reimbursement & Policy Doris Quackenbush Vice President of Sales Jesse Bishop Vice President, Regulatory Prior Roles Include 21

Financial Overview 22

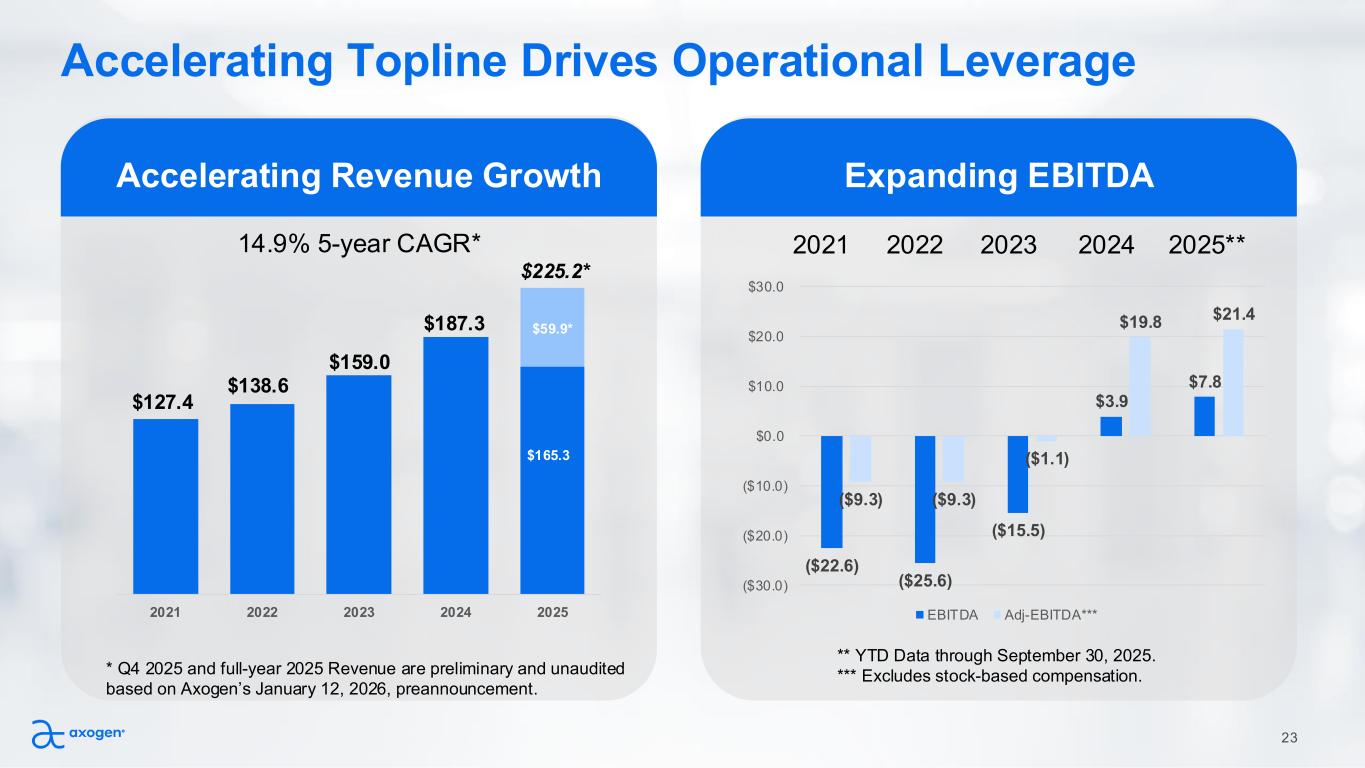

Accelerating Topline Drives Operational Leverage Accelerating Revenue Growth 23 Expanding EBITDA $59.9* 2021 2022 2023 2024 2025 $127.4 $138.6 $159.0 $187.3 $225.2* $165.3 * Q4 2025 and full-year 2025 Revenue are preliminary and unaudited based on Axogen’s January 12, 2026, preannouncement. ($22.6) ($25.6) ($15.5) $3.9 $7.8 ($9.3) ($9.3) ($1.1) $19.8 $21.4 ($30.0) ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 EBITDA Adj-EBITDA*** 2021 2022 2023 2024 2025** ** YTD Data through September 30, 2025. *** Excludes stock-based compensation. 14.9% 5-year CAGR*

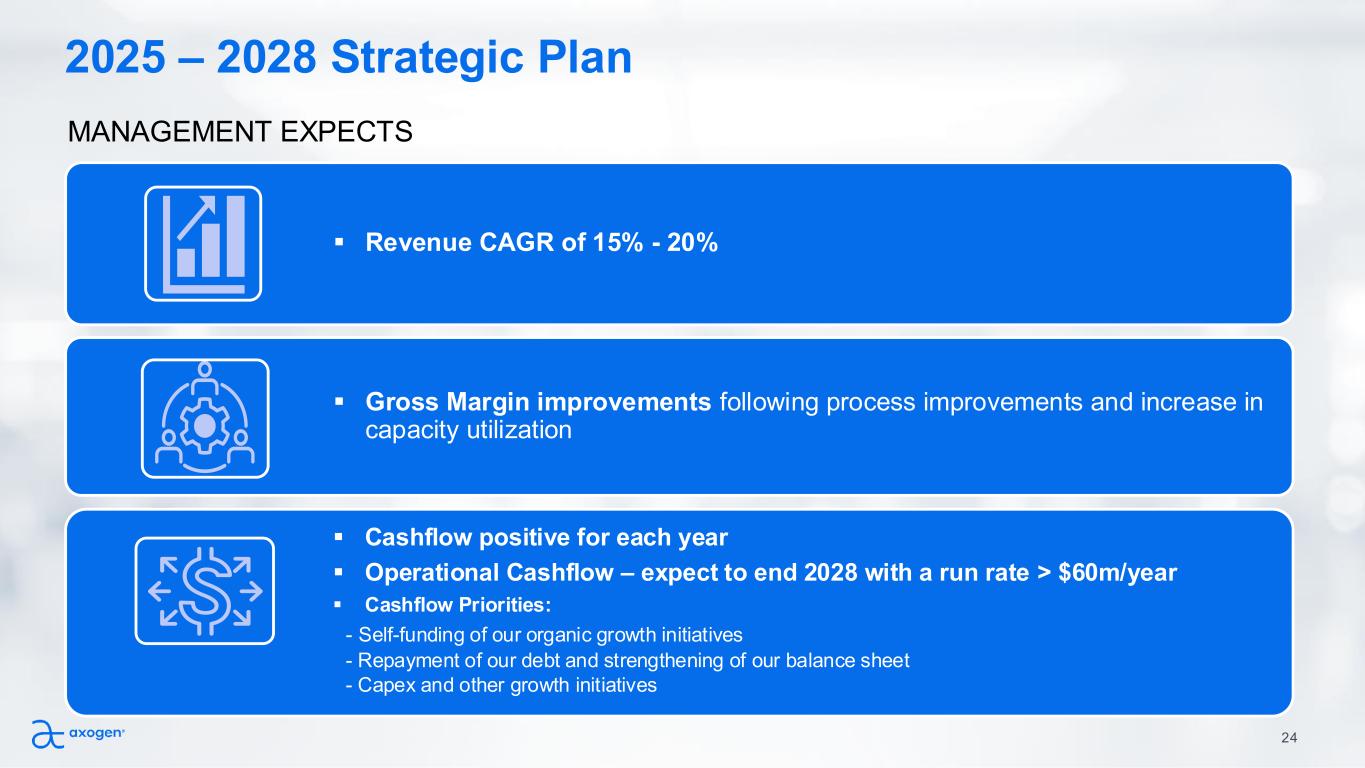

2025 – 2028 Strategic Plan MANAGEMENT EXPECTS 24 ▪ Revenue CAGR of 15% - 20% ▪ Gross Margin improvements following process improvements and increase in capacity utilization ▪ Cashflow positive for each year ▪ Operational Cashflow – expect to end 2028 with a run rate > $60m/year ▪ Cashflow Priorities: - Self-funding of our organic growth initiatives - Repayment of our debt and strengthening of our balance sheet - Capex and other growth initiatives

Investment Highlights Big Market Opportunity $5.6B TAM with minimal current penetration 25 Clinical Leadership Unique comprehensive solution with strong evidence Multiple Growth Catalysts Four distinct market opportunities at different stages Reimbursement Tailwinds Expanding coverage and improving payment rates Scalable Infrastructure Proven commercial model ready to capture market share Financial Inflection Point Positive cashflow, expanding margins, accelerating growth

nasdaq: axgn Thank You

References 1. Axogen. Data on File 2. Flowers KM, Beck M, Colebaugh C, Haroutounian S, Edwards RR, Schreiber KL. Pain, numbness, or both? Distinguishing the longitudinal course and predictors o f positive, painful neuropathic features vs numbness after breast cancer surgery. Pain Rep. 2021;6(4):e976. Published 2021 Nov 22. doi:10.1097/PR9.0000000000000976 3. Resnick MJ, et al. Resnick MJ, Koyama T, Fan KH, Albertsen PC, Goodman M, Hamilton AS, Hoffman RM, Potosky AL, Stanford JL, S troup AM, Van Horn RL, Penson DF. Long-term functional outcomes after treatment for localized prostate cancer. N Engl J Med. 2013;368(5):436–445. doi: 10.1056/NEJMoa1209978 4. Moretti TB, Magna, LA 3, Reis, LO. Erectile dysfunction criteria of 131,350 patients after open, laparoscopic, and robotic radical prostatectomy. Andrology 2024 Nov;12(8):1865-1871. doi: 10.1111 5. Ephraim PL, Wegener ST, MacKenzie EJ, Dillingham TR, Pezzin LE. Phantom pain, residual limb pain, and back pain in amputees: results of a national survey. Arch Phys Med Rehabil. 2005;86(10):1910-1919. doi:10.1016/j.apmr.2005.03.031 6. Padovano WM, Dengler J, Patterson MM, et al. Incidence of Nerve Injury After Extremity Trauma in the United States. Hand (N Y). 2022;17(4):615-623. doi:10.1177/1558944720963895 7. Lans J, Eberlin KR, Evans PJ, Mercer D, Greenberg JA, Styron JF. A Systematic Review and Meta-Analysis of Nerve Gap Repair: Comparative Effectiveness of Allografts, Autografts, and Conduits. Plast Reconstr Surg. 2023;151(5):814e-827e. doi:10.1097/PRS.0000000000010088 8. Nancy P Mendenhall NP, Osian SM, Bryant CM, Hoppe BS, Morris CG. What men want: Results from a national survey on decision making for prostate cancer treatment and research participation. Clin Transl Sci. 2021 Aug 11;14(6):2314–2326. doi: 10.1111/cts.13090 9. Leversedge FJ, Safa B, Lin WC, Iorio ML, Merced-O'Neill O, Tajdaran K Histologic Comparison of the Fascicular Area of Processed Nerve Allograft Versus Cabled Sural Nerve Autograft. Plastic and Reconstructive surgery. Global Open, 17 Aug 2023, 11(8):e5201 10. Kung, TA, Waljee JF, Curtin, CM, Wei, JT, Montie, JE, Cederna PS., Interpositional Nerve Grafting of the Prostatic Plexus after Radical Prostatectomy, Plast Reconstr Surg Glob Open . 2015 Aug 10;3(7):e452. And Kwon, T et al, 11. Neurovascular bundle size measured on 3.0-T magnetic resonance imaging is associated with the recovery of erectile function after robot-assisted radical prostatectomy. 2017 Sep;35(9):542.e11-542.e17.doi: 10.1016/j.urolonc.2016.11.011. Epub 2017 Jun 23. 12. PolicyReporter online portal for medical policy information [Dec 2025] 13. Health plan enrollment data provided by Managed Markets Insight & Technology, LLC [Sept 2025] 27