As filed with the Securities and Exchange Commission on July 29, 2013

Registration No. 333-188597

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AXOGEN, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 5047 | 41-1301878 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

13859 Progress Blvd., Suite 100

Alachua, Florida 32615

(386) 462-6800

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Karen Zaderej

Chief Executive Officer

AxoGen, Inc.

13859 Progress Blvd., Suite 100

Alachua, Florida 32615

(386) 462-6800

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Gregory G. Freitag

Chief Financial Officer and General Counsel

AxoGen, Inc.

13859 Progress Blvd., Suite 100

Alachua, Florida 32615

(386) 462-6800

| Fahd M.T. Riaz | Andrew D. Thorpe | |

| Emilio Ragosa | Orrick, Herrington & Sutcliffe LLP | |

| Morgan, Lewis & Bockius LLP | 405 Howard Street | |

| 1701 Market Street | San Francisco, CA 94105 | |

| Philadelphia, PA 19103 | Telephone: (415) 773-5700 | |

| (215) 963-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 29, 2013

Prospectus

3,658,536 Shares

AXOGEN, INC.

Common Shares

We are offering up to 3,658,536 common shares, par value $.01 per share. Our common shares currently trade on the OTCQB Marketplace, operated by OTC Markets Group, under the symbol “AXGN.” The last reported sale price of our common shares on the OTCQB Marketplace on July 26, 2013 was $4.10 per share. We have applied to list our common shares on and expect that, after the pricing of this offering, our common shares will trade on the under the symbol “ .”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” in this prospectus for a description of compensation payable to the underwriters. |

We have granted to the underwriters an option to purchase up to 548,780 additional common shares to cover over-allotments, if any, exercisable at any time until 30 days after the date of this prospectus. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares on or about , 2013.

JMP Securities

Ladenburg Thalmann & Co.

The date of this prospectus is , 2013.

| Page | ||||

| 1 | ||||

| 8 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

32 | |||

| 39 | ||||

| 69 | ||||

| 76 | ||||

| 83 | ||||

| 84 | ||||

| 86 | ||||

| 88 | ||||

| 90 | ||||

| 91 | ||||

| 92 | ||||

| F-1 | ||||

Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where, or to any person to whom, the offer or sale is not permitted. The information in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of our common shares. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

For investors outside the United States: neither we nor any of the underwriters has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

This prospectus includes estimates, statistics and other industry and market data that we obtained from industry publications, research, surveys and studies conducted by third parties and publicly available information. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. This prospectus also includes data based on our own internal estimates. We caution you not to give undue weight to such projections, assumptions and estimates.

i

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially the section entitled “Risk Factors” and our consolidated financial statements and related notes, before deciding to buy our securities. Unless otherwise stated, all references to “us,” “our,” “we,” “AxoGen,” the “Company” and similar designations refer to AxoGen, Inc. and its subsidiary AxoGen Corporation.

Company Overview

We are a leading regenerative medicine company dedicated to advancing the science and commercialization of peripheral nerve repair solutions. Peripheral nerves provide the pathways for both motor and sensory signals throughout the body and their damage can result in the loss of muscle function and/or feeling.

Nerves can be damaged in a number of ways. When a nerve is cut due to a traumatic injury or surgery, functionality of the nerve may be compromised, causing the nerve to no longer carry the signals to and from the brain to the muscles and skin. This type of injury generally requires a surgical repair. The traditional gold standard has been to either suture the nerve ends together directly without tension or to bridge the gap between the nerve ends with a less important nerve surgically removed from elsewhere in the patient’s own body referred to as nerve autograft. In addition, pressure on a nerve or blunt force trauma can cause nerve injuries that may require surgical intervention.

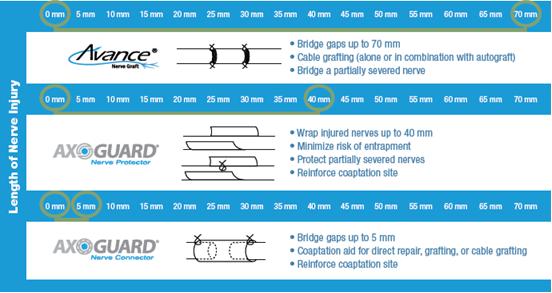

In order to improve the options available for the surgical repair and regeneration of peripheral nerves, we have developed and licensed patented and patent pending technologies. Our innovative approach to regenerative medicine has resulted in first-in-class products that we believe will define their product categories. Our products offer a full suite of surgical nerve repair solutions including Avance® Nerve Graft, the only off-the-shelf commercially available processed nerve allograft, human nerve tissue obtained from a donor, for bridging severed nerves without the comorbidities of an autograft second surgical site, such as loss of feeling where the nerve was removed and potential pain at the donor site. Our AxoGuard® line of products are a natural scaffold ExtraCellular Matrix, or ECM, derived from pig tissue. AxoGuard® Nerve Connector is used to facilitate the tensionless repair of severed nerves, and AxoGuard® Nerve Protector is used to wrap and protect injured peripheral nerves and reinforce the nerve reconstruction while preventing soft tissue attachments.

AxoGen’s products are used by surgeons during surgical interventions to repair a wide variety of traumatic nerve injuries ranging from a simple laceration of a finger to complex brachial plexus (an injury to the network of nerves that originate in the neck). The Avance® Nerve Graft provides surgeons with a three-dimensional structure of a natural nerve. This structure is essential and allows for bridging nerve gaps or discontinuities in the range of 5mm to 70mm.

The January 2012 edition of Microsurgery and November 2012 edition of The Journal of Hand Surgery each contain an article summarizing study results from patients included in our ongoing RANGER® study, an observational study of outcomes from the use of Avance® Nerve Graft. The most recent presentation of data from the RANGER® study found that in 113 nerve repairs, the use of Avance® Nerve Graft has been associated with meaningful motor and sensory recovery in 87% of nerve discontinuities between 5 and 50 mm. According to Brooks, et al., “outcomes of Avance® Nerve Graft compare favorably with those reported in the literature for nerve autograft and the processed nerve allograft returned a higher rate of meaningful functional recovery than those reported in the literature for nerve conduits.”1 Additionally, no implant related adverse events have been reported.

Our Avance® Nerve Graft has beneficial product and sales synergies with the AxoGuard® Nerve Protector and AxoGuard® Nerve Connector. Complementary to our Avance® Nerve Graft, our AxoGuard® Nerve Connector is used to align and connect nerves with less than a 5mm gap between the severed nerve ends. Our AxoGuard® Nerve Protector is designed to protect and isolate the nerve during the healing process after surgery. Furthermore, our AxoGuard® products provide the unique features of pliability, suturability, and translucence for visualization of the underlying nerve, while also allowing the patient’s own cells to incorporate into the product to remodel and form a tissue similar to the nerve epineurium.

| 1 | See “Business— Sales and Marketing — Avance® Nerve Graft Performance” for full citation information. |

1

Avance® Nerve Graft has been processed and distributed since 2007 as a human cell, tissue, and cellular and tissue-based product, hereafter referred herein as HCT/P, pursuant to section 361 of the Public Health Service Act and 21 CFR § 1271 controls, based on AxoGen’s good faith belief that the Avance Nerve Graft was a HCT/P tissue product. In 2010, the Food and Drug Administration, or FDA, determined that the Avance® Nerve Graft was a biological product that would be reviewed and regulated by the Center for Biologics Evaluation and Research, or CBER, under the biologics licensing provision of the Public Health Service, or PHS, Act. We subsequently agreed with the FDA on a transition plan for Avance® Nerve Graft from a HCT/P product to a licensed biological product. We are able to continue to sell Avance® Nerve Graft pursuant to a November 2010 letter from the FDA stating the agency’s intent to exercise enforcement discretion with respect to the introduction or delivery for introduction into interstate commerce of the Avance® Nerve Graft provided we meet the conditions for the transition specified in the letter. One such condition is that we conduct a phase 3 clinical trial to demonstrate the safety, purity and potency of the Avance® Nerve Graft under a Special Protocol Assessment, or SPA, and the FDA has subsequently agreed to our SPA. In accordance with FDA regulations in 21 CFR §312, we submitted an Investigational New Drug Application, or IND, to the FDA in April 2013 and we are currently responding to FDA comments regarding it. We expect that enrollment of patients into the phase 3 clinical trial will occur later this year following approval of the IND.

AxoGuard® products are manufactured by Cook Biotech Incorporated, referred to herein as Cook Biotech. Under the license agreement with Cook Biotech, we are the exclusive worldwide distributor of the AxoGuard® products for use in the peripheral and central nervous system, but excluding use of the AxoGuard® product in the oral cavity for endodontic and periodontal applications and oral and maxillofacial surgery solely as they relate to dental, soft or hard, tissue repair or reconstruction. The exclusion results in certain areas of AxoGen’s market expansion into the oral surgery market being limited to the Avance® Nerve Graft. The AxoGuard® products are Class II medical devices that FDA found substantially equivalent to class II predicate devices, and thus, cleared for marketing under FDA’s 510(k) program.

On October 5, 2012, we entered into a Revenue Interests Purchase Agreement, which we refer to as the Royalty Contract, with PDL BioPharma, Inc., or PDL, pursuant to which we sold to PDL the right to receive specified royalties on our Net Revenues, as defined in the Royalty Contract, generated by the sale, distribution or other use of our products Avance® Nerve Graft, AxoGuard® Nerve Connector and AxoGuard® Nerve Protector, referred to as the Assigned Interests. The Royalty Contract has a term of eight years. Under the Royalty Contract, PDL is to receive royalty payments based on a 9.95% royalty rate of our Net Revenues, as defined in the Royalty Contract, subject to certain agreed upon minimum payment requirements of approximately $1.3 to $2.5 million per quarter which begin in the fourth quarter of 2014 as provided in the Royalty Contract. The total consideration PDL paid to AxoGen was $20,800,000, or the Funded Amount. The Royalty Contract also contains certain call provisions, including a call right by PDL in connection with a change of control, is secured by our Net Revenues, restricts our ability to pay dividends and grants PDL a right to a designee on our Board of Directors. Further, on October 5, 2016, or in the event of the occurrence of a material adverse event, our transfer of revenue interest or substantially all of our interest in the products or our bankruptcy or material breach of the Royalty Contract, PDL may require us to repurchase the Assigned Interests, referred to herein as the Put, at the Put Price which is equal to the sum of (i) an amount that, when paid to PDL, would generate a 20% internal rate of return to PDL, called the Put Rate, on the Funded Amount, taking into consideration payments made to PDL by us, and (ii) any Delinquent Assigned Interests Payment, as defined in the Royalty Contract, we owed to PDL. The arrangement was entered into because we could not obtain debt financing under a traditional credit facility with a lender to the extent of the Funded Amount and we believed the cost of capital for an equity transaction at the time was prohibitive.

We currently promote, market and sell our family of products through our own direct sales force and independent sales representatives. Following the publication of results from our RANGER® study in 2012, we invested in expanding our commercial capabilities and implemented a number of sales initiatives which we believe position us to further build awareness and drive sales growth of our Avance® Nerve Graft and AxoGuard® products. For the three months ended March 31, 2013, our total revenue was approximately $2.1 million and our net loss was approximately $3.4 million, with a gross margin of approximately 74%. For the twelve months ended December 31, 2012, our total revenue was approximately $7.7 million and our net loss was approximately $9.4 million, with a gross margin of approximately 75%. For the year ended December 31, 2011, our total revenue was approximately $4.8 million, and our net loss was approximately $10.2 million, with a gross margin of approximately 50%.

2

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are described in more detail in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include the following:

| • | AxoGen has not experienced positive cash flow from its operations, and the ability to achieve positive cash flow from operations will depend on increasing sales of its products, which may not be achievable. |

| • | AxoGen’s revenue growth depends on its ability to expand its sales force and develop new customers, and there can be no assurance that these efforts will result in significant increase in sales. |

| • | AxoGen’s revenue depends solely on three products. |

| • | AxoGen is a party to the Royalty Contract with PDL which requires it to pay royalty fees that could materially adversely affect its financial position. |

| • | AxoGen’s business is subject to continuing regulatory compliance by the FDA and other authorities which is costly and could result in negative effects on its business. |

| • | Failure to protect AxoGen’s Intellectual Property rights could result in costly and time consuming litigation and its loss of any potential competitive advantage. |

| • | The price of AxoGen’s common shares could be highly volatile due to a number of factors, which could lead to losses by investors and costly securities litigation. |

Recent Developments

On July 11, 2013, we announced the following operating results for the quarter ended June 30, 2013. The following results have been prepared by, and are the responsibility of, management and have not been reviewed or audited by our independent registered public accounting firm. We believe the following results constitute a fair representation of the financial status of AxoGen. Our financial statements for the 2013 second quarter have not yet been finalized and therefore are not available at this time.

Revenue

Revenues for the second quarter 2013 were $2.86 million, up 42.2% compared to $2.01 million in the second quarter 2012, driven by an increase in the number of facilities utilizing our products and increased penetration of existing accounts.

Gross Profit

Gross profit for the second quarter 2013 was $2.23 million, up 47.6% compared to $1.51 million in the second quarter 2012. Gross profit margin for the second quarter 2013 was 77.9%, up 2.8% compared to 75.1% in the second quarter 2012. The year-over-year improvement in gross profit and gross margin was primarily attributable to revenue growth and a product price increase implemented during the first quarter 2013, respectively.

Operating Expenses

Total operating expenses in the second quarter 2013 were $4.42 million, up 42.8% compared to $3.10 million in the second quarter 2012. As a percentage of revenues, operating expenses were up 0.73% in the second quarter 2013 as compared to the same period in 2012.

Second quarter 2013 sales and marketing expense was $2.53 million, up 60.0% compared to $1.58 million in the second quarter 2012. The increase was primarily attributable to increased commissions due to higher sales and the expansion of the Company’s marketing efforts and direct sales force. Direct sales force personnel require time to become effective in the territory and new sales personnel hired during the first and second quarters of 2013 are not expected to contribute significantly to revenue in the third quarter of this year.

Second quarter 2013 general and administrative expense was $1.40 million, up 21.8% compared to $1.15 million in the second quarter 2012. The increase was primarily attributable to increased salary expense and benefits, travel and public company expenses.

Second quarter 2013 research and development expense was $0.50 million, up 35.7% compared to $0.37 million in the second quarter 2012. The increase was primarily attributable to costs associated with the Company’s investment in clinical studies that support the use and regulatory position of the Company’s products.

Loss from Operations and Net Loss

Operating loss in the second quarter 2013 was $2.20 million, compared to $1.59 million in the second quarter 2012. Net loss in the second quarter 2013 was $3.45 million, or ($0.31) per share, compared to net loss of $1.03 million, or ($0.09) per share, in the second quarter 2012.

3

Balance Sheet

As of June 30, 2013, the Company had $8.69 million in cash and cash equivalents and approximately $23.38 million in long-term note payable – revenue interest purchase agreement. AxoGen had working capital of approximately $12.22 million and a current ratio of 8.7 at June 30, 2013, compared to working capital of $16.82 million and a current ratio of 12.4 at December 31, 2012.

Corporate Information

We were incorporated under the laws of Minnesota in 1977. Our principal executive offices are located at 13859 Progress Blvd., Suite 100, Alachua, Florida 32615 and our telephone number is (386) 462-6800. Our website address is www.axogeninc.com. We have included our website address in this prospectus solely as an inactive textual reference. The information contained on, or that can be accessed through, our website is not part of this prospectus.

4

The Offering

| Common shares offered by us | 3,658,536 shares (or 4,207,316 shares if the underwriters’ over-allotment option is exercised in full) | |

| Common shares outstanding after this offering | 14,798,475 shares (or 15,347,255 shares if the underwriters’ over-allotment option is exercised in full) | |

| Use of proceeds | We estimate that the net proceeds to us from the sale of common shares in this offering will be approximately $13,490,000 or approximately $15,582,500 if the underwriters exercise their over-allotment option in full, in each case assuming a public offering price of $4.10 per common share and after deducting estimated underwriting discounts and commissions and offering expenses payable by us. We intend to use the net proceeds from this offering to continue our product commercialization and marketing efforts, development of our product pipeline, including product line extensions, and for general working capital purposes. See “Use of Proceeds.” | |

| Current trading on OTCQB Marketplace | Our common shares currently trade on the OTCQB Marketplace under the symbol “AXGN.” | |

| Anticipated Listing | In connection with this offering we intend to list our common shares on under the symbol “ .” | |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in our common shares. | |

| (1) | The number of our common shares outstanding after this offering is based on 11,139,939 common shares outstanding as of July 26, 2013 and assumes no exercise of the underwriter’s option to purchase an additional 548,780 shares to cover over-allotments, and excludes: |

| • | 1,986,276 common shares issuable upon the exercise of options outstanding as of July 26, 2013 at a weighted average exercise price of $2.67 per share; |

| • | 89,686 common shares issuable upon the exercise of warrants outstanding as of July 26, 2013 at an exercise price of $2.23 per share; and |

| • | 602,914 additional common shares available for future issuance as of July 26, 2013 under our AxoGen 2010 Stock Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or the warrants described above.

5

Summary Consolidated Financial Data

The summary financial data below as of and for the years ended December 31, 2012, 2011 and 2010 have been derived from our audited consolidated financial statements. Our audited consolidated financial statements as of December 31, 2012 and 2011 and for the years ended December 31, 2012 and 2011 are included elsewhere in this prospectus. Our audited consolidated financial statements as of December 31, 2010 and for the year ended December 31, 2010 are not included in this prospectus. The summary financial data as of March 31, 2013 and 2012 and for the three months ended March 31, 2013 and 2012 have been derived from our consolidated financial statements included elsewhere in this prospectus. You should read the summary financial data together with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition” and “Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

| Three months ended March 31, | Years ended December 31, | |||||||||||||||||||

| Statement of operations data: | 2013 | 2012 | 2012 | 2011 | 2010 | |||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Revenues |

$ | 2,143 | $ | 1,653 | $ | 7,692 | $ | 4,849 | $ | 3,004 | ||||||||||

| Cost of goods sold |

560 | 439 | 1,962 | 2,427 | 1,379 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross Profit |

1,583 | 1,214 | 5,730 | 2,422 | 1,625 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Sales and marketing |

1,894 | 1,629 | 6,884 | 4,379 | 3,007 | |||||||||||||||

| Research and development |

407 | 296 | 1,427 | 697 | 436 | |||||||||||||||

| General and administrative |

1,606 | 1,230 | 5,221 | 4,316 | 2,664 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Costs and Expenses |

3,907 | 3,155 | 13,532 | 9,392 | 6,107 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(2,324 | ) | (1,941 | ) | (7,802 | ) | (6,970 | ) | (4,482 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense) |

(1,114 | ) | (168 | ) | (2,354 | ) | (2,250 | ) | (942 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Loss |

(3,438 | ) | (2,109 | ) | (10,156 | ) | (9,220 | ) | (5,424 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss available to common shareholders |

$ | (3,438 | ) | $ | (2,109 | ) | $ | (9,418 | ) | $ | (10,248 | ) | $ | (6,990 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average basic and diluted common shares outstanding |

11,124,633 | 11,062,339 | 11,089,425 | 3,697,390 | 836,645 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss Per Common Share – basic and diluted |

$ | (0.31 | ) | $ | (0.19 | ) | $ | (0.85 | ) | $ | (2.77 | ) | $ | (8.35 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

6

| Three months ended March 31, | Years ended December 31, | |||||||||||||||||||

| Balance sheets data: | 2013 | 2012 | 2012 | 2011 | 2010 | |||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cash and Cash equivalents |

$ | 11,200 | $ | 5,642 | $ | 13,907 | $ | 8,191 | $ | 1,799 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 17,852 | $ | 10,477 | $ | 20,231 | $ | 12,495 | $ | 6,406 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

$ | 23,857 | $ | 6,357 | $ | 23,060 | $ | 6,424 | $ | 18,105 | ||||||||||

| Temporary equity |

— | — | — | — | 15,412 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity (deficit) |

$ | (6,005 | ) | $ | 4,120 | $ | (2,829 | ) | $ | 6,071 | $ | (27,111 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three months ended March 31, | Years ended December 31, | |||||||||||||||||||

| Statements of cash flows data: | 2013 | 2012 | 2012 | 2011 | 2010 | |||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net cash used for operating activities |

$ | (2,651 | ) | $ | (2,478 | ) | $ | (8,662 | ) | $ | (7,079 | ) | $ | (3,943 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash (used for) provided by investing activities |

(57 | ) | (71 | ) | (127 | ) | 7,112 | (72 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net cash provided by financing activities |

$ | 2 | $ | 0 | $ | 14,506 | $ | 6,359 | $ | 5,531 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7

Investing in our common shares involves a high degree of risk. Before you decide to invest in our securities, you should consider carefully the risks described below, as well as the other information contained in this prospectus. The risks described below are not the only ones facing us. Additional risks not presently known to us or that we currently deemed immaterial may also impair our business operations.

If any of the following risks actually occurs, our business, financial condition, results of operations and future growth prospects would likely be materially and adversely affected. In these circumstances, the market price of our common shares could decline, and you may lose all or part of your investment.

Risk Related To Company

AxoGen has not experienced positive cash flow from its operations, and the ability to achieve positive cash flow from operations will depend on increasing sales of its products, which may not be achievable.

AxoGen has historically operated with negative cash flow from its operations. As of March 31, 2013, AxoGen had an accumulated deficit of approximately $61.0 million. If AxoGen product sales do not increase as anticipated, then it will continue to experience negative cash flows and adverse operating conditions. AxoGen’s continuing capital needs and other factors, could cause the Company to raise additional funds through public or private equity offerings, debt financings or from other sources. The sale of additional equity may result in dilution to AxoGen’s shareholders. There is no assurance that AxoGen will be able to secure funding on terms acceptable to it, or at all.

AxoGen’s revenue growth depends on its ability to expand its sales force and develop new customers, and there can be no assurance that these efforts will result in significant increase in sales.

AxoGen is in the process of investing in its sales channel composed of a combination of its direct sales force and independent distributors to allow it to reach new customers. There can be no assurance that these efforts will be successful in expanding AxoGen’s product sales. AxoGen currently sells products directly through its employees and indirectly through distributor relationships. AxoGen is engaged in a major initiative to build and further expand sales and marketing capabilities. The incurrence of these expenses impacts AxoGen’s operating results, and there can be no assurance of their effectiveness. If AxoGen is unable to develop its sales force and new customers, or increase sales to existing customers, it may not be able to grow revenue or maintain its current level of revenue generation.

AxoGen’s revenue depends solely on three products.

All of AxoGen’s revenue is currently derived from only three products, the Avance® Nerve Graft, AxoGuard® Nerve Protector and AxoGuard® Nerve Connector, for the treatment of peripheral nerve damage. Its ability to generate revenue is dependent on the success of these products. Accordingly, any disruption in AxoGen’s ability to generate revenue from the sale of these products will have a material adverse impact on its business, results of operations, financial condition and growth prospects. In addition, AxoGen’s expenditures for research and development are minimal and funding to develop, or increase efforts to find collaboration or licensing opportunities to obtain, additional products will be necessary.

The AxoGuard® products are only available through an exclusive distribution agreement with Cook Biotech. Such contract is for an initial seven year term and following such initial term, the agreement automatically renews for an additional seven (7) year period provided that the parties agree to meet at least ninety (90) days before the end of such initial term to review whether the purchase price of the products obtained from Cook Biotech need to be adjusted and reasonably agree to such adjustment in writing, where such agreement shall not be unreasonably withheld. However, there are conditions for continuation of the agreement, including payment terms and minimum purchase requirements, that if breached could result in an earlier termination of the agreement; except that through mutual agreement the parties have not established such minimums and to date have not enforce such minimum purchase provision. Additionally, in the event that AxoGen and Cook Biotech were to fail to reach an agreement as to minimum purchase

8

quantities, Cook Biotech could terminate the agreement if it was deemed that AxoGen had failed to generate commercially reasonable sales of AxoGuard® as measured by sales similar to a competitive product at the same stage in its commercial launch as verified by a mutually acceptable third-party. Although there are products that AxoGen believes it could develop or obtain that would replace the AxoGuard® products, the loss of the ability to sell the AxoGuard® products could have a material adverse effect on AxoGen’s business until other replacement products are available.

AxoGen’s success will be dependent on continued acceptance of its products by the medical community.

Continued market acceptance of AxoGen’s products will depend on its ability to demonstrate that its products are an attractive alternative to existing nerve reconstruction treatment options. Its ability to do so will depend on surgeons’ evaluations of clinical safety, efficacy, ease of use, reliability, and cost-effectiveness of AxoGen’s nerve repair products. For example, although AxoGen’s Avance® Nerve Graft follows stringent safety standards, including sterilization by gamma irradiation, AxoGen believes that a small portion of the medical community has lingering concerns over the risk of disease transmission through the use of allografts in general. Furthermore, AxoGen believes that even if its products receive general acceptance within the medical community, acceptance and clinical recommendations by influential surgeons will be important to the commercial success of AxoGen’s products.

Negative publicity concerning methods of donating human tissue and screening of donated tissue, in the industry in which AxoGen operates, may reduce demand for its Avance Nerve Graft product and negatively impact the supply of available donor tissue.

AxoGen is highly dependent on its ability to recover cadaveric nerves from tissue donors for its Avance® Nerve Graft product. The availability of acceptable donors is relatively limited, and this availability is impacted by regulatory changes, general public opinion of the donation process and AxoGen’s reputation for its handling of the donation process. Media reports or other negative publicity concerning both improper methods of tissue recovery from donors and disease transmission from donated cadaver tissue (allografts) including bones, tendon, etc. may limit widespread acceptance of AxoGen’s Avance® Nerve Graft. Unfavorable reports of improper or illegal tissue recovery practices, both in the U.S. and internationally, as well as incidents of improperly processed tissue leading to transmission of disease, may broadly affect the rate of future tissue donation and market acceptance of allograft technologies. Potential patients may not be able to distinguish AxoGen products, technologies, and tissue recovery and processing procedures from others engaged in tissue recovery. In addition, unfavorable reports could make families of potential donors from whom AxoGen is required to obtain consent before processing tissue reluctant to agree to donate tissue to for-profit tissue processors. Any disruption in the supply could have negative consequences for AxoGen’s revenue, operating results and continued operations.

AxoGen is highly dependent on the continued availability of its facilities and could be harmed if the facilities are unavailable for any prolonged period of time.

Any failure in the physical infrastructure of AxoGen’s facilities, including the facility it leases from LifeNet Health, could lead to significant costs and disruptions that could reduce its revenues and harm its business reputation and financial results. Any natural or man-made event that impacts AxoGen’s ability to utilize its facilities could have a significant impact on its operating results, reputation and ability to continue operations. This includes termination of the LifeNet Health facility lease which can occur upon six months’ notice from either party. Although AxoGen believes it can find and make operational a new facility in less than six months, the regulatory process for approval of facilities is time-consuming and unpredictable. AxoGen’s ability to rebuild or find acceptable lease facilities would take a considerable amount of time and expense and could cause a significant disruption in service to its customers. Although AxoGen has business interruption insurance which would, in instances other than lease termination, cover certain costs, it may not cover all costs nor help to regain AxoGen’s standing in the market.

9

AxoGen must maintain high quality manufacturing and processing.

AxoGen’s Avance® Nerve Graft is processed through its Avance® Process which requires careful calibration and precise, high-quality processing and manufacturing. Achieving precision and quality control requires skill and diligence by its personnel. If it fails to achieve and maintain these high quality controls, processing and manufacturing standards, including avoidance of manufacturing errors, defects or product failures, AxoGen could experience recalls or withdrawals of its product, delays in delivery, cost overruns or other problems that would adversely affect its business. AxoGen cannot completely eliminate the risk of errors, defects or failures. In addition, AxoGen may experience difficulties in scaling-up manufacturing of its Avance® product, including problems related to yields, quality control and assurance, tissue availability, adequacy of control policies and procedures, and lack of skilled personnel. If AxoGen is unable to process and produce its allografts on a timely basis, at acceptable quality and costs, and in sufficient quantities, or if it experiences unanticipated technological problems or delays in production, its business would be adversely affected.

AxoGen relies on third-party suppliers, some of which are currently the only source for the respective components or materials they supply to it.

Most of the raw materials used in the Avance® Process for the production of Avance® Nerve Graft are available from more than one supplier. However, one of the chemicals AxoGen uses in the manufacture of Avance® Nerve Graft is no longer provided by the original single source provider. AxoGen has inventory of such chemical which it believes provides more than one year of production. AxoGen is currently evaluating a new supplier of the chemical. In addition, some of the test results, packaging and reagents/chemicals AxoGen uses in its manufacturing process are also obtained from single suppliers. We do not have written contracts with any of our single source suppliers, and at any time they could stop supplying our orders. FDA approval of a new supplier may be required if these materials become unavailable from AxoGen’s current suppliers. Although there may be other suppliers that have equivalent materials that would be available to AxoGen, FDA approval of any alternate suppliers if required could take several months or years to obtain, if able to be obtained at all. Any delay, interruption or cessation of production by AxoGen’s third-party suppliers of important materials, or any delay in qualifying new materials, if necessary, would prevent or delay AxoGen’s ability to manufacture products. In addition, an uncorrected impurity, a supplier’s variation in a raw material or testing, either unknown to AxoGen or incompatible with its manufacturing process, or any other problem with AxoGen’s materials, testing or components, would prevent or delay its ability to manufacture products. These delays may limit AxoGen’s ability to meet demand for its products and delay its clinical trial, which would have a material adverse impact on its business, results of operations and financial condition.

AxoGen relies on third parties to perform many necessary services for the commercialization of Avance® Nerve Graft, including services related to the recovery, distribution, storage and transportation.

AxoGen relies upon third parties for certain recovery, distribution, and transportation services. In accordance with product specifications, these third parties ship Avance® Nerve Graft in specially validated shipping containers at frozen temperatures. If any of the third parties that AxoGen relies upon in its recovery, distribution, storage or transportation process fail to comply with applicable laws and regulations, fail to meet expected deadlines, or otherwise do not carry out their contractual duties to AxoGen, or encounter physical damage or natural disaster at their facilities, AxoGen’s ability to deliver product to meet commercial demand may be significantly impaired.

AxoGen is dependent on its relationships with distributors to generate revenue.

AxoGen derives material revenues through its relationships with distributors. If such distributor relationships were terminated for any reason, it could materially and adversely affect AxoGen’s ability to generate revenues and profits. AxoGen intends to obtain the assistance of additional distributors to continue its sales growth. It may not be able to find additional distributors who will agree to market and distribute its products on commercially reasonable terms, if at all. If it is unable to establish new distribution relationships or renew current distribution agreements on commercially acceptable terms, operating results could suffer.

10

Loss of key members of management, who it needs to succeed, could adversely affect its business.

AxoGen’s future success depends on the continued efforts of the members of its senior management team. Competition for experienced management personnel in the healthcare industry is intense. If one or more of AxoGen’s senior executives or other key personnel are unable or unwilling to continue in their present positions, or if AxoGen is unable to attract and retain high quality senior executives or key personnel in the future, its business may be adversely affected.

AxoGen’s operating results will be harmed if it is unable to effectively manage and sustain its future growth.

There can be no assurance that AxoGen will be able to manage its future growth efficiently or profitably. Its business is unproven on a large scale and actual revenue and operating margins, or revenue and margin growth, may be less than expected. If AxoGen is unable to scale its production capabilities efficiently, it may fail to achieve expected operating margins, which would have a material and adverse effect on its operating results. Growth may also stress AxoGen’s ability to adequately manage its operations, quality of products, safety and regulatory compliance. If growth significantly decreases AxoGen’s cash reserves, it may be required to obtain additional financing, which may increase indebtedness or result in dilution to shareholders. Further, there can be no assurance that AxoGen would be able to obtain additional financing on acceptable terms if all at.

There may be significant fluctuations in AxoGen’s operating results.

Significant quarterly fluctuations in AxoGen’s results of operations may be caused by, among other factors, its volume of revenues, seasonal changes in nerve repair activity, timing of sales force expansion and general economic conditions. There can be no assurance that the level of revenues and profits, if any, achieved by AxoGen in any particular fiscal period, will not be significantly lower than in other comparable fiscal periods. AxoGen’s expense levels are based, in part, on its expectations as to future revenues. As a result, if future revenues are below expectations, net income or loss may be disproportionately affected by a reduction in revenues, as any corresponding reduction in expenses may not be proportionate to the reduction in revenues.

AxoGen’s revenues depend upon prompt and adequate reimbursement from public and private insurers and national health systems.

Political, economic and regulatory influences are subjecting the healthcare industry in the U.S. to fundamental change. The ability of hospitals to pay fees for AxoGen’s products depends in part on the extent to which reimbursement for the costs of such materials and related treatments will continue to be available from governmental health administration authorities, private health coverage insurers and other organizations. Major third-party payers of hospital services and hospital outpatient services, including Medicare, Medicaid and private healthcare insurers, annually revise their payment methodologies, which can result in stricter standards for reimbursement of hospital charges for certain medical procedures or the elimination of reimbursement. Further, Medicare, Medicaid and private healthcare insurer cutbacks could create downward price pressure on AxoGen’s products.

AxoGen may be subject to future product liability litigation that could be expensive and its insurance coverage may not be adequate.

Although AxoGen is not currently subject to any product liability proceedings, and it has no reserves for product liability disbursements, it may incur material liabilities relating to product liability claims in the future, including product liability claims arising out of the usage of AxoGen products. AxoGen currently carries product liability insurance in an amount consistent with industry averages, however, its insurance coverage and any reserves it may maintain in the future for product related liabilities may not be adequate and AxoGen’s business could suffer material adverse consequences.

11

Technological change could reduce demand for AxoGen’s products.

The medical technology industry is intensely competitive. AxoGen competes with both U.S. and international companies that engage in the development and production of medical technologies and processes including:

| • | biotechnology, orthopedic, pharmaceutical, biomaterial, chemical and other companies; |

| • | academic and scientific institutions; and |

| • | public and private research organizations. |

AxoGen products compete with autograft and hollow-tube conduits, as well as with alternative medical procedures. For the foreseeable future, AxoGen believes a significant number of surgeons will continue to choose to perform autograft procedures when feasible, despite the necessity of performing a second operation and its drawbacks. In addition, many members of the medical community will continue to prefer the use of hollow-tube conduits due in part to their familiarity with these products and the procedures required for their use. Also, steady improvements have been made in synthetic human tissue substitutes, which could compete with AxoGen’s products. Unlike allografts, synthetic tissue technologies are not dependent on the availability of human or animal tissue. Although AxoGen’s growth strategy contemplates the introduction of new technologies, the development of these technologies is a complex and uncertain process, requiring a high level of innovation, as well as the ability to accurately predict future technology and market trends. AxoGen may not be able to respond effectively to technological changes and emerging industry standards, or to successfully identify, develop or support new technologies or enhancements to existing products in a timely and cost effective manner, if at all. Finally, there can be no assurance that in the future AxoGen’s competitors will not develop products that have superior performance or are less expensive relative to its products rendering them obsolete or noncompetitive.

AxoGen may be unsuccessful in commercializing its products outside the U.S.

To date, AxoGen has focused its commercialization efforts in the U.S., except for minor revenues from the Avance® Nerve Graft in the United Kingdom, the Netherlands, Switzerland, Italy, Austria and Canada. It intends to expand sales beyond these countries outside the U.S. and will need to comply with applicable foreign regulatory requirements, including obtaining the requisite approvals to do so. Additionally, AxoGen will need to either enter into distribution agreements with third parties or develop a direct sales force in these foreign markets. If it does not obtain adequate levels of reimbursement from third-party payers outside of the U.S., it may be unable to develop and grow its product sales internationally. Outside of the U.S., reimbursement systems vary significantly by country. Many foreign markets have government-managed healthcare systems that govern reimbursement for medical devices and procedures. Additionally, some foreign reimbursement systems provide for limited payments in a given period and therefore result in extended payment periods. If AxoGen is unable to successfully commercialize its products internationally, its long term growth prospects may be limited.

If AxoGen does not manage tissue and tissue donation in an effective and efficient manner, it could adversely affect its business.

Many factors affect the supply, quantity and timing of donor medical releases, such as effectiveness of donor screening (currently performed by donor recovery groups), the effective recovery of tissue, the timely receipt, recording and review of required medical documentation, and employee loss and turnover in AxoGen’s and its contractor’s recovery department. AxoGen can provide no assurance that tissue recovery or donor medical releases will occur at levels that will maximize processing efficiency and minimize AxoGen’s cost per allograft processed.

12

If AxoGen does not manage product inventory in an effective and efficient manner, it could adversely affect profitability.

Many factors affect the efficient use and planning of product inventory, such as effectiveness of predicting demand, effectiveness of preparing manufacturing to meet demand, efficiently meeting product mix and product demand requirements and product expiration. AxoGen may be unable to manage its inventory efficiently, keep inventory within expected budget goals, keep its work-in-process inventory on hand or manage it efficiently, or keep sufficient product on hand to meet demand, and AxoGen can provide no assurance that it can keep inventory costs within its target levels. Failing to do so may require AxoGen to raise additional cash resources or may harm long term growth prospects.

AxoGen is a party to a Royalty Contract which requires it to pay royalty fees that could materially adversely affect its financial position.

On October 5, 2012, AxoGen entered into a Royalty Contract with PDL, pursuant to which AxoGen sold to PDL the right to receive specified royalties on AxoGen’s Net Revenues generated by the sale, distribution or other use of AxoGen’s products Avance® Nerve Graft, AxoGuard® Nerve Protector and AxoGuard® Nerve Connector (the Assigned Interests as defined in the Royalty Contract). The Royalty Contract has a term of eight years. Under the Royalty Contract, PDL is to receive royalty payments, currently paid weekly, based on a 9.95% royalty rate of AxoGen’s Net Revenues, subject to certain agreed upon minimum guaranteed quarterly payment amounts of approximately $1.3 to $2.5 million per quarter that commence in the quarter ending December 31, 2014. The minimum annual payment amounts are as follows: 2014—$1,250,805, 2015—$6,781,440, 2016—$9,232,642, 2017 and 2018—$9,000,000, 2019—$9,063,000 and 2020—$6,939,000. Further, on October 5, 2016, or in the event of the occurrence of a material adverse event, our transfer of revenue interest or substantially all of our interest in the products or AxoGen’s bankruptcy or material breach of the Royalty Contract, PDL may require AxoGen to repurchase the Assigned Interests (the “Put”) at the Put Price (as defined in the Royalty Contract). The Put Price is equal to the sum of (i) an amount that, when paid to PDL, would generate a 20% internal rate of return to PDL (the “Put Rate”) on the Funded Amount, taking into consideration payments made to PDL by AxoGen, and (ii) any “Delinquent Assigned Interests Payment” (as defined in the Royalty Contract) AxoGen owed to PDL. For purposes of estimating the effective interest rate of the Royalty Contract, we considered that the effective rate of 20% (currently the Put Rate) is currently slightly higher than the implicit rate of return and, as a result, we assume for accounting purposes that PDL will exercise its put option in order to receive the higher rate of return. However we have no actual knowledge or other indications of PDL’s intent to do so.

During 2012, AxoGen’s monthly expenses exceeded its revenues and thus it operated at a cash loss. Royalty payments to PDL are owed without consideration to any negative affect it has on AxoGen’s cash or loss position. In addition, minimum payments under the Royalty Contract start in October 2014 and if AxoGen is required to pay an amount greater than the royalty fee, AxoGen would have an even greater cash burden. Finally, there is no assurance that AxoGen will have sufficient capital to pay the Put Price if it was exercised. If AxoGen does not have sufficient cash to pay PDL, AxoGen would need to raise additional capital. The sale of additional equity to further finance the company may result in dilution to AxoGen’s shareholders. There is no assurance that if AxoGen is required to secure funding it can do so on terms acceptable to it, or at all. The increasing need for capital as the PDL transaction matures could also make it more difficult to obtain funding through either equity or debt. See “Notes to Consolidated Financial Statements – Footnote 7 Long-Term Debt/Note Payable.”

PDL Royalty Contract has Change of Control provision that could have material impact on price received by AxoGen shareholders in the event of a Change of Control.

In the event of a “Change of Control” (as defined in the Royalty Contract), AxoGen must repurchase the Assigned Interests from PDL for a repurchase price equal to the “Change of Control Price” on or prior to the third business day after the occurrence of the Change of Control. The Change of Control Price is the sum of (i) an amount that, when paid to PDL, would generate an internal rate of return to PDL of

13

thirty-two and one half percent (32.5%) on all payments made by PDL pursuant to the Royalty Contract as of the date of the Change of Control Payment (as defined in the Royalty Contract), taking into account the amount and timing of all payments made by AxoGen to PDL (and retained by PDL) prior to and as of the date of payment of the Change of Control Payment, plus (ii) any Delinquent Assigned Interests Payment owed. For purposes of example only, the Change of Control payment at March 31, 2013 would have been $23,439,186. Payment of the Change of Control Price could materially reduce the consideration to be received by AxoGen shareholders if the Change of Control event was in conjunction with the acquisition of the Company.

AxoGen incurs costs as a result of operating as a public company, and its management is required to devote substantial time to compliance initiatives.

As a public company, AxoGen incurs legal, accounting and other expenses to comply with relevant securities laws and regulations, including, without limitation, the requirement of establishment and maintenance of effective disclosure and financial controls and corporate governance practices. AxoGen’s management devotes substantial time and financial resources to these compliance initiatives. Failure to comply with public company requirements could have a material adverse effect on AxoGen’s business.

Our Business and Stock Price May Be Adversely Affected if Our Internal Controls Are Not Effective.

Section 404 of the Sarbanes-Oxley Act of 2002 requires companies to conduct a comprehensive evaluation of their internal control over financial reporting. To comply with this statute, each year we are required to document and test our internal control over financial reporting and our management is required to assess and issue a report concerning our internal control over financial reporting.

In our annual report for the period ended December 31, 2011, we reported a material weakness in our internal control over financial reporting, which related to an instance in which the accounting for a contract was inappropriately treated as an expense as opposed to a prepaid asset. Specifically, an effective control was not operating to ensure that accounting for the contract was completely and accurately recorded during the 4th quarter of 2011. This control deficiency could have resulted in misstatement of net loss that would not have been prevented or detected. Accordingly, we determined that this control deficiency constituted a material weakness. During the first quarter of 2012, in response to the conclusion reached by our Chief Executive and Chief Financial Officers that, as of December 31, 2011, our disclosure controls and procedures were not effective, we implemented a control procedure whereby all significant contracts will be reviewed by the Chief Financial Officer, and at the end of each quarter, the Chief Financial Officer will then review the accounting with the Company’s corporate controller prior to the recording of all such contracts. Based on its most recent evaluation, management concluded that internal control over financial reporting was effective as of December 31, 2012.

Although we believe we took appropriate actions to remediate the control deficiencies we identified and to strengthen our internal control over financial reporting, we cannot assure you that we will not discover other material weaknesses in the future or that no material weakness will result from any difficulties, errors, delays or disruptions while we implement and transition to new internal systems. The existence of one or more material weaknesses could result in errors in our financial statements, and substantial costs and resources may be required to rectify these or other internal control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our common stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business, and our business and financial condition could be harmed.

14

Risks Related to the Regulatory Environment in which AxoGen Operates

AxoGen’s business is subject to continuing regulatory compliance by the FDA and other authorities which is costly and could result in negative effects on its business.

AxoGen is subject to extensive regulation. Its products are subject to regulation by the FDA in the U.S., the Center for Medicare Services of the U.S. Department of Health and Human Services and other federal governmental agencies and, in some jurisdictions, by state and foreign governmental authorities. The FDA regulates the development, clinical testing, marketing, distribution, manufacturing, labeling, and promotion of biological products, such as that of AxoGen’s Avance® Nerve Graft product. The FDA also regulates medical devices, such as the AxoGuard® products. The FDA requires the approval of a biological product, such as the Avance® Nerve Graft product, through a biological license application, or BLA, prior to marketing. Although the Avance® Nerve Graft product has not yet been approved by FDA through a BLA, FDA is permitting the product to be sold pursuant to a transition plan while AxoGen performs clinical testing and prepares a BLA submission for the Avance® Nerve Graft. See “Business — Government Regulations — U.S. Government Regulation Review.” The FDA also regulates medical devices and requires that certain medical devices, such as the AxoGuard® products, be cleared through the 510(k) premarket notification process prior to marketing. The FDA’s premarket review process for new and modified existing devices that precedes product marketing can be time consuming and expensive. Some of the future products and enhancements to such products that AxoGen expects to develop and market may require marketing clearance or approval from the FDA. There can be no assurance, however, that clearance or approval will be granted with respect to any of AxoGen’s products or enhancements or that FDA review will not involve delays that would adversely affect AxoGen’s ability to market such products or enhancements. In addition, there can be no assurance that AxoGen products, including the Avance® Nerve Graft, or enhancements will not be subject to a lengthy and expensive approval process with the FDA.

It is possible that if regulatory clearances or approvals to market a product are obtained from the FDA, the clearances or approvals may contain limitations on the indicated uses of such product and other uses may be prohibited. Product approvals by the FDA can also be withdrawn due to failure to comply with regulatory standards or the occurrence of unforeseen problems following initial approval. Also, the FDA could limit or prevent the distribution of AxoGen products and has the power to require the recall of such products. FDA regulations depend heavily on administrative interpretation, and there can be no assurance that future interpretations made by the FDA or other regulatory bodies will not adversely affect AxoGen’s operations. AxoGen, and its facilities, may be inspected by the FDA from time to time to determine whether it is in compliance with various regulations relating to specification, development, documentation, validation, testing, quality control, and product labeling. A determination that AxoGen is in violation of such regulations could lead to imposition of civil penalties, including fines, product recalls or product seizures and, in certain cases, criminal sanctions.

The use, misuse or off-label use of AxoGen’s products may harm its reputation or the image of its products in the marketplace, or result in injuries that lead to product liability suits, which could be costly to AxoGen’s business or result in FDA sanctions if the company is deemed to have engaged in off-label promotion. AxoGen is seeking a biologics license through the BLA process for specific uses of Avance® Nerve Graft under specific circumstances. Its promotional materials and training methods must comply with FDA requirements and other applicable laws and regulations, including the prohibition against off-label promotion. AxoGen’s promotion of the AxoGuard® products, which are regulated as medical devices, also must comply with FDA’s requirements and must only use labeling that is consistent with the specific indication(s) for use included in FDA’s substantial equivalence order that results in marketing the devices. The FDA does not restrict or regulate a physician’s use of a medical product within the practice of medicine, and AxoGen cannot prevent a physician from using its products for an off-label use. However, the Federal Food, Drug, and Cosmetic Act, referred to herein as the FD&C Act, and the FDA’s regulations restrict the kind of promotional communications that may be made about AxoGen’s products and if the

15

FDA determines that AxoGen’s promotional or training materials constitute the unlawful promotion of an off-label use, it could request that AxoGen modify its training or promotional materials and/or subject the Company to regulatory or enforcement actions, including the issuance of an untitled letter, a warning letter, civil money penalties, or criminal fines and penalties. Other federal, state or foreign governmental authorities might also take action if they consider AxoGen promotion or training materials to constitute promotion of an uncleared or unapproved use, which could result in significant fines or penalties under other statutory authorities, such as laws prohibiting false claims for reimbursement, or exclusion from participation in federal health programs. In that event, AxoGen’s reputation could be damaged and the use of its products in the marketplace could be impaired.

In addition, there may be increased risk of injury if physicians or others attempt to use AxoGen products off-label. Furthermore, the use of AxoGen’s product for indications other than those for which its products have been approved, cleared or licensed by the FDA may not effectively treat the conditions not referenced in product indications, which could harm AxoGen’s reputation in the marketplace among physicians and patients. Physicians may also misuse AxoGen’s product or use improper techniques if they are not adequately trained in the particular use, potentially leading to injury and an increased risk of product liability. Product liability claims are expensive to defend and could divert management’s attention from its primary business and result in substantial damage awards against AxoGen. Any of these events could harm AxoGen’s business, results of operations and financial condition.

AxoGen’s Avance® Nerve Graft product is currently allowed to be sold pursuant to a transition plan with the FDA and a change in position by the FDA regarding its use of enforcement discretion to permit the sale of Avance would have a material adverse effect on AxoGen.

The FDA considers the AxoGen’s Avance® Nerve Graft product to be a biological product, subject to BLA approval requirements. Although the Avance® Nerve Graft product has not yet been approved by FDA through a BLA, AxoGen’s Avance® Nerve Graft product is currently sold under the controls applicable to a HCT/P pursuant to section 361 of the Public Health Service Act and 21 CFR Part 1271 of FDA’s regulations, in accordance with a transition plan with the FDA in which the agency will monitor AxoGen’s compliance with 21 CFR Part 1271. See “Business — Government Regulations — U.S. Government Regulation Review.” AxoGen has continued to communicate with FDA’s CBER since the acceptance of the transition plan on clinical trial design and Chemistry, Manufacturing, and Controls (“CMC”) for the Avance® Nerve Graft. AxoGen can commercially distribute the Avance® Nerve Graft subject to the controls HCT/Ps until FDA makes a final determination on an Avance® Nerve Graft BLA submission, assuming AxoGen remains in compliance with the transition plan. In the event that the FDA becomes dissatisfied with AxoGen’s progress or actions with respect to the transition plan or FDA otherwise changes its position regarding its use of enforcement discretion to permit AxoGen to provide the Avance® Nerve Graft product in accordance with the transition plan, AxoGen would no longer be able to sell the Avance® Nerve Graft product, which would have a material adverse effect on AxoGen’s operations and financial viability. In addition, if AxoGen does not meet the conditions for the transition plan, fails to comply with applicable regulatory requirements or fails to comply with the ongoing requirements of the premarket submission to transition to a biological product, the FDA could deny approval of the premarket application, or impose civil penalties, including fines, product seizures, injunctions or product recalls and, in certain cases, criminal sanctions.

AxoGen’s AxoGuard products are subject to FDA and other regulatory requirements.

AxoGen’s AxoGuard® product line is regulated as a medical device under the FD&C Act and subject to premarket notification and clearance requirements under section 510(k) of the FD&C Act, 21 CFR Part 820 (Quality System Regulation) and other FDA regulations. AxoGen distributes for Cook Biotech Incorporated the AxoGuard® product line and Cook Biotech is responsible for the regulatory compliance of the AxoGuard® product line. Cook Biotech has obtained a 510(k) premarket clearance from the FDA for porcine small intestine submucosa for the repair of peripheral nerve discontinuities where gap closure can

16

be achieved by flexion of the extremity. If AxoGen or Cook Biotech Incorporated fails to comply with applicable regulatory requirements the FDA could deny or withdraw 510(k) clearance for the AxoGuard® products, or impose civil penalties, including fines, product seizures or product recalls and, in certain cases, criminal sanctions.

Defective AxoGen product could lead to recall or other negative business conditions.

If AxoGen’s products are defective or otherwise pose safety risks, the FDA could require their recall, or AxoGen may initiate a voluntary recall of its products. The FDA may require recall of a marketed medical device product, such as the AxoGuard® products, in the event that it determines that due to material deficiencies or defects that use of the medical device product would pose a reasonable probability of serious adverse health consequences or death. However, FDA does not have authority to require most device recalls because they do not rise to this level of health significance. FDA may request, but not require, the recall of a biological product, such as the Avance® Nerve Graft. However, if a company does not comply with an FDA request for a recall, FDA can pursue other enforcement actions, such as product seizure. In addition, manufacturers may, on their own initiative, recall a product to remove or correct a deficiency or to remedy a violation of the Federal Food, Drug, and Cosmetic Act that may pose a risk to health. A government-mandated, government-requested or voluntary recall could occur as a result of an unacceptable risk to health, reports of safety issues, failures, manufacturing errors, design or labeling defects or other deficiencies and issues. Recalls and other field corrections for any of AxoGen’s products would divert managerial and financial resources and have an adverse effect on its business, results of operations and financial condition. A recall could harm AxoGen’s reputation with customers and negatively affect its sales. AxoGen may initiate recalls involving some of its products in the future that it determines do not require notification of the FDA. If the FDA were to disagree with AxoGen’s determinations, it could request that it report those actions as recalls, and take regulatory or enforcement action against AxoGen or the product.

If AxoGen’s products cause or contribute to a death, a serious injury or any adverse reaction involving a communicable disease related to its products, or malfunction in certain ways, it will be subject to reporting regulations, which can result in voluntary corrective actions or agency enforcement actions. See “Business — Regulation — Education Grants, U.S. Anti-kickback, False Claims and Other Healthcare Fraud and Abuse Laws — Pervasive and Continuing Regulation.” If AxoGen fails to report these events to the FDA within the required timeframes, or at all, the FDA could take regulatory or enforcement action against AxoGen. Any adverse event involving AxoGen’s products could result in future voluntary corrective actions, such as recalls or customer notifications, or agency action, such as inspection, mandatory recall or other enforcement action. Any corrective action, whether voluntary or involuntary, as well as AxoGen defending itself in a lawsuit, would require the dedication of time and capital, distract management from operating its business, and may harm AxoGen’s reputation, business, results of operations and financial condition.

AxoGen’s manufacturing operations must comply with FDA and other governmental requirements.

AxoGen’s manufacturing operations require it to comply with the FDA’s and other governmental authorities’ laws and regulations regarding the manufacture and production of medical products, which is costly and could subject AxoGen to enforcement action. See Business — Government Regulations — Education Grants, U.S. Anti-kickback, False Claims and Other Healthcare Fraud and Abuse Laws — Pervasive and Continuing Regulation. Any of these actions could impair AxoGen’s ability to produce its products in a cost-effective and timely manner in order to meet customer demands. AxoGen may also be required to bear other costs or take other actions that may have an adverse impact on its future sales and its ability to generate profits. Furthermore, AxoGen key material suppliers, licensors and or other contractors may not continue to be in compliance with all applicable regulatory requirements, which could result in AxoGen’s failure to produce its products on a timely basis and in the required quantities, if at all.

17

Sales of AxoGen products outside the U.S. are subject to foreign regulatory requirements that vary from country to country. In the European Union (the “E.U.”), regulations, if applicable, differ from one E.U. member state to the next. Because of the absence of a harmonized regulatory framework and the proposed regulation for advanced therapy medicinal products in the E.U., as well as for other countries, the approval process for human derived cell or tissue based medical products may be extensive, lengthy, expensive and unpredictable. AxoGen products will be subject to E.U. member states’ regulations that govern the donation, procurement, testing, coding, traceability, processing, preservation, storage, and distribution of human tissues and cells and cellular or tissue-based products. In addition, some E.U. member states have their own tissue banking regulations. The inability to meet foreign regulatory requirements could materially affect AxoGen’s future growth and compliance with such requirements could place a significant financial burden on AxoGen.

Clinical trials can be long, expensive and ultimately uncertain which could jeopardize AxoGen’s ability to obtain regulatory approval and continue to market its Avance® Nerve Graft product.

AxoGen is required to perform a clinical trial for its Avance® Nerve Graft pursuant to requirements of the FDA to obtain approval of a BLA for the product. This trial is expensive, is expected to take several years to execute, and is subject to factors within and outside of AxoGen’s control. The outcome of this trial is uncertain.