UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to § 240.14a–12

|

AXOGEN, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and 0–11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:______________________

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies: _____________________

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined):________________

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐ Fee paid previously with preliminary materials.

|

|

|

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1) Amount Previously Paid: ________________________

|

|

|

(2) Form, Schedule or Registration Statement No.: ________________________

|

|

|

(3) Filing Party: ________________________

|

|

|

(4) Date Filed: _______________________

|

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

Dear Shareholder:

You are cordially invited to attend our 2019 Annual Meeting of Shareholders (the “Meeting”) of Axogen, Inc. (the “Company” or “Axogen”) which will be held at the Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, Florida, USA, 32827 in the Orly room beginning at 4:00 p.m. Eastern Time on Wednesday, August 14, 2019.

This booklet contains your official notice of the Meeting and a Proxy Statement that includes information about the matters to be acted upon at the Meeting. In addition to voting on the matters described in this Proxy Statement, we will use the Meeting as an opportunity to review our operations.

I sincerely hope that you will be able to attend the Meeting. Whether or not you plan to attend, your vote is important, and we urge you to complete and return the enclosed proxy in the accompanying envelope.

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

Karen Zaderej

|

|

|

Chairman, Chief Executive Officer and President

|

June 27, 2019

2019 ANNUAL MEETING OF SHAREHOLDERS

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

NOTICE OF 2019 ANNUAL MEETING OF SHAREHOLDERS

You are cordially invited to attend our 2019 Annual Meeting of Shareholders (the “Meeting”) of Axogen, Inc. (the “Company”, “Axogen”, “we” or “our”) which will be held on Wednesday, August 14, 2019 at 4:00 p.m. Eastern Time, at the Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, Florida, USA, 32827 in the Orly room for the following purposes:

1.To elect eight members to our board of directors (the “Board of Directors”) to hold office for the ensuing year and until their successors are elected and qualified;

2.To approve the Axogen, Inc. 2019 Long Term Incentive Plan;

3.To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2019;

4.To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s Proxy Statement;

5.To recommend by a non-binding advisory vote the frequency of future non-binding advisory votes on the compensation of the Company’s named executive officers; and

6.To consider and act upon any other matters that may properly come before the Meeting or any adjournment or postponement thereof.

Only holders of record of our common stock at the close of business on June 20, 2019 will be entitled to receive notice of and to vote at the Meeting. Our shareholders are not entitled to any appraisal or dissenters’ rights with respect to the matters to be acted upon at the Meeting.

You may vote your shares by telephone (1–800–690–6903) or internet (www.proxyvote.com) no later than 11:59 p.m. Eastern Time on Tuesday, August 13, 2019 (as directed on the enclosed proxy card) or vote by completing, signing and promptly returning the enclosed proxy card by mail. If you choose to submit your proxy by mail, we have enclosed an envelope for your use, which is prepaid if mailed in the United States. If you cannot attend the Meeting in person, you may attend the Meeting, submit questions and vote online until voting is closed at www.virtualshareholdermeeting.com/axogen19. If you are attending the Meeting in person and your shares are registered in your name, you may also vote at the meeting until voting is closed.

Your vote is important. Whether or not you plan to attend the Meeting, we urge you to complete and return the enclosed proxy in the accompanying envelope, vote online, or vote by telephone.

|

|

|

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Karen Zaderej

|

|

|

Chairman, Chief Executive Officer and President

|

June 27, 2019

PROXY STATEMENT

TABLE OF CONTENTS

Axogen, Inc.

13631 Progress Blvd.

Suite 400

Alachua, FL 32615

PROXY STATEMENT

2019 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 14, 2019

The board of directors (the “Board of Directors”) of Axogen, Inc. (the “Company”, “Axogen”, “we” or “our”) is soliciting proxies for use at our 2019 Annual Meeting of Shareholders (the “Meeting”) to be held on Wednesday, August 14, 2019 at 4:00 p.m. Eastern time at the Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Blvd., Orlando, Florida, USA, 32827 in the Orly room and at any adjournment or postponement thereof. This Proxy Statement and the enclosed proxy card are first being mailed to shareholders on or about July 1, 2019.

Our Board of Directors has set Tuesday, June 20, 2019 as the record date for the Meeting. Each shareholder of record at the close of business on Tuesday, June 20, 2019 will be entitled to vote at the Meeting. As of the record date, 39,205,173 shares of our common stock were issued and outstanding and, therefore, eligible to vote at the Meeting. Holders of our common stock are entitled to one vote per share. Therefore, a total of 39,205,173 votes are entitled to be cast at the Meeting. There is no cumulative voting in the election of directors.

Shareholders who sign and return a proxy may revoke it at any time before it is voted at the Meeting by giving written notice to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, Re: Axogen, Inc., by submitting a duly executed proxy with a later date or by attending the Meeting in person or by internet and withdrawing your proxy. If your shares are held in the name of a bank or brokerage firm, you must obtain a proxy, executed in your favor, from the bank or broker, to be able to vote at the Meeting.

Expenses in connection with this solicitation of proxies will be paid by us. Proxies are being solicited primarily by mail. In addition, our officers and directors, who will receive no extra compensation for their services, may solicit proxies by telephone or personally. We also will request that brokers or other nominees who hold shares of our common stock in their names for the benefit of others forward proxy materials to, and obtain voting instructions from, the beneficial owners of such stock at our expense.

Proxies that are completed, signed and returned to us prior to the Meeting will be voted as specified. If no direction is given, the proxy will be voted FOR the election of the nominees for director named in this Proxy Statement, FOR the Axogen, Inc. 2019 Long Term Incentive Plan (the “2019 Long Term Incentive Plan”), FOR the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the year ending December 31, 2019, FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement, and FOR “EVERY 3 YEARS” as the preferred frequency with which shareholders are provided an advisory vote to approve the compensation of the Company’s named executive officers as disclosed pursuant to Item 402 of Regulation S-K.

If a shareholder affirmatively abstains from voting as to any matter (or indicates a “withhold vote for” as to directors), then the shares held by such shareholder shall be deemed present at our Meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but shall not be deemed to have been voted in favor of such matter. Votes withheld from one or more director nominees will have no effect on the election of any director from whom votes are withheld.

Pursuant to New York Stock Exchange (NYSE) Rule 452 and corresponding Listed Company Manual Section 402.08, discretionary voting by brokers of shares held by their customers in "street name" is prohibited. If you do not give instructions to your bank or broker within ten days of the Meeting, it may vote on matters that the NYSE determines to be "routine," but will not be permitted to vote your shares with respect to "non-routine" items. Under the NYSE rules, the ratification of the appointment of our independent registered public accounting firm is a routine matter, while the election of our directors, the approval of the 2019 Long Term Incentive Plan, the approval of the compensation of our named

executive officers, and the recommendation for the frequency of the advisory vote on executive compensation are non-routine matters. When a bank or broker has not received instructions from the beneficial owners, or persons entitled to vote, and the bank or broker cannot vote on a particular matter because it is a non-routine matter, then there is a "broker non-vote" on that matter. Broker non-votes will be counted in determining whether there is a quorum for the Annual Meeting. As a result, if you hold shares in a brokerage account and wish to vote those shares on these proposals, we strongly encourage you to submit your voting instructions and exercise your right to vote as a shareholder.

Directors are elected by a plurality vote of the votes cast by the shareholders entitled to vote at the Meeting. A plurality vote means that the directors who receive the most votes in an election, though not necessarily a majority, will be elected. If you affirmatively abstain from voting, it will have no impact on the outcome of the vote for the proposal. Similarly, broker non-votes will have no impact on the outcome of the vote for the proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the 2019 Long Term Incentive Plan. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2019. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal. Because this proposal is a routine matter, broker non-votes will not occur with respect to this proposal.

The affirmative vote of a majority of the outstanding shares of our common stock entitled to vote and present in person or by proxy at the Meeting will be required to approve the non-binding advisory approval of the compensation of our named executive officers. If you affirmatively abstain from voting, it will have the same effect as a vote “AGAINST” this proposal.

For the non-binding advisory vote on the frequency of shareholder advisory votes on executive compensation, the frequency receiving the highest number of votes from the holders of shares either present in person or represented by proxy and entitled to vote will be considered the frequency preferred by the shareholders. Abstentions and broker non-votes will have no effect. Because this vote is non-binding, our Board of Directors may determine the frequency of future advisory votes on executive compensation in its discretion.

Our shareholders are not entitled to any appraisal or dissenters’ rights with respect to the matters to be acted upon at the Meeting.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on August 14, 2019:

This Proxy Statement, the accompanying Notice of Annual Meeting and proxy card are available on our website at http://www.axogeninc.com/proxy-statement.html, and our Annual Report on Form 10–K, as amended, are available in the “Investors” section of our website at https://www.axogeninc.com.

PROPOSAL 1 – ELECTION OF DIRECTORS

At the Meeting, shareholders will vote on the election of eight director nominees: Karen Zaderej, Gregory Freitag, Quentin Blackford, Dr. Mark Gold, Alan Levine, Guido Neels, Robert Rudelius and Amy Wendell. Our Board of Directors has nominated each of these individuals to serve a one-year term commencing at the Meeting and until each director’s successor is duly elected and qualified. All nominees are currently members of our Board of Directors and Mses. Zaderej and Wendell, Messrs. Freitag, Neels and Rudelius and Dr. Gold were elected by our shareholders at our 2018 Annual Meeting of Shareholders. In the event that any nominee becomes unable or unwilling to serve as a director for any reason, the persons named in the enclosed proxy will vote for a substitute nominee in accordance with their best judgment. Our Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve as a director if elected.

Our Board of Directors is currently comprised of nine (9) members. Jamie Grooms, a member of our Board of Directors, has decided not to run for re-election, and as a result there will be a vacancy on our Board of Directors following the Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Biographical information for each director nominee is included below. Included at the end of each director’s biography is a description of the particular experience, qualifications, attributes or skills that led our Board of Directors to conclude that each of these director nominees should serve as a member of our Board of Directors.

Karen Zaderej, Chairman, Chief Executive Officer and President (Age 57)

Ms. Zaderej has served as Axogen’s President, Chief Executive Officer (“CEO”), and a member of our Board of Directors since September 2011 and the Chairman of our Board of Directors since May 2018. Since May 2010, she has served as the Chief Executive Officer of Axogen’s wholly owned subsidiary, Axogen Corporation, and a member of the Board of Directors of Axogen Corporation. Ms. Zaderej joined Axogen Corporation in May 2006 and served as Vice President of Marketing and Sales from May 2006 to October 2007 and as Chief Operating Officer from October 2007 to May 2010. From October 2004 to May 2006, Ms. Zaderej worked for Zaderej Medical Consulting, a consulting firm she founded, which assisted medical device companies in building and executing successful commercialization plans. From 1987 to 2004, Ms. Zaderej worked at Ethicon, Inc., a Johnson & Johnson company, where she held senior positions in marketing, business development, research & development, as well as ran a manufacturing business. Ms. Zaderej is a Director of Viveve Medical, Inc., a public women’s intimate health company and SEBio, a non-profit supporting the life science industry in the southeastern United States. Ms. Zaderej has an M.B.A. from the Kellogg Graduate School of Business and a B.S. in Chemical Engineering from Purdue University. Ms. Zaderej’s qualifications to serve on our Board of Directors include her leadership and depth of knowledge of us, her extensive experience in the medical device industry, and her financial and management expertise.

Gregory Freitag, J.D., CPA, General Counsel and Director (Age 57)

Mr. Freitag has been Axogen’s General Counsel and a member of our Board of Directors since September 2011. He was our Chief Financial Officer from September 2011 to May 2014 and August 2015 to March 2016 and our Senior Vice President Business Development from May 2014 until October 2018. Mr. Freitag was the Chief Executive Officer, Chief Financial Officer and a board member of LecTec Corporation, an intellectual property licensing and holding company that merged with Axogen in September 2011, from June 2010 through September 2011. From May 2009 to the present, Mr. Freitag has been a principal of FreiMc, LLC, a healthcare and life science consulting and advisory firm he founded that provides strategic guidance and business development advisory services. Prior to founding FreiMc, LLC, Mr. Freitag was a Director of Business Development at Pfizer Health Solutions, a former subsidiary of Pfizer, Inc., from January 2006 to May 2009. From July 2005 to January 2006, Mr. Freitag worked for Guidant Corporation in their business development group. Prior to Guidant Corporation, Mr. Freitag was the Chief Executive Officer of HTS Biosystems, a biotechnology tools start-up company, from March 2000 until its sale in early 2005. Mr. Freitag was the Chief Operating Officer, Chief Financial Officer and General Counsel of Quantech, Ltd., a public point of care diagnostic company, from December 1995 to March 2000. Prior to that time, Mr. Freitag practiced corporate law in Minneapolis, Minnesota. Mr. Freitag is also a director of the Foundation Board of Fairview Health Services, a health care system in Minnesota, and PDS Biotechnology Corporation (Nasdaq: PDSB), a clinical stage biopharmaceutical company developing immunotherapies for cancer and other disease areas such as infectious disease. Mr. Freitag holds a J.D. from the University of Chicago and a B.A. in

Economics & Business and Law & Society from Macalester College, Minnesota. Mr. Freitag’s qualifications to serve on our Board of Directors include his proven leadership and experience as a senior level executive, his particular knowledge of public companies, including reporting, compliance and financial markets related thereto, his finance management and legal expertise and over 20 years of experience in the life sciences sector.

Quentin Blackford, Director (Age 40)

Mr. Blackford has served as a member of our Board of Directors since May 2019. Since September 2017, he has served as executive vice president and chief financial officer of Dexcom, Inc., a company that develops, manufactures and distributes continuous glucose monitoring systems for diabetes management. Prior to Dexcom, he held several executive leadership positions with NuVasive, Inc. (“NuVasive”), a med-tech company that designs, develops, and markets products for the surgical treatment of spine disorders, most recently executive vice president, chief financial officer, head of strategy and corporate integrity from August 2016 to August 2017. Previous roles with NuVasive include executive vice president and chief financial officer from August 2014 to August 2016, executive vice president of finance and investor relations from July 2012 to August 2014, and vice president of finance from January 2011 to June 2012. Prior to his roles at NuVasive, Mr. Blackford led the global financial planning & analysis group at Zimmer Holdings, Inc. (NYSE: ZBH), a publicly traded medical device company, in addition to serving as director of finance and controller for the company’s Dental Division. He has served as an independent board member of Alphatec Holdings, Inc. (Nasdaq: ATEC), a publicly traded medical technology company, since October 2017. Mr. Blackford earned Bachelor of Science degrees in Accounting and Business Administration from Grace College. Mr. Blackford’s qualifications to serve on our Board of Directors include his proven leadership and experience as a senior level medical technology executive, his particular knowledge of the medical technology market and public companies in this sector and his finance, accounting and public market experience.

Mark Gold, M.D., Director (Age 70)

Dr. Gold has served as a member of our Board of Directors since September 30, 2011 and Axogen Corporation’s board of directors since July 2007. From 1990 until his retirement in June 2014, Dr. Gold was a Professor at the University of Florida College of Medicine’s McKnight Brain Institute and was recognized as a Distinguished Professor and Eminent Scholar and was Chairman of the Department of Psychiatry. He has also been recognized as the 17th University of Florida Distinguished Alumni Professor and served in that capacity for 4 years. Dr. Gold taught neuroanatomy and medical neuroscience for four decades and has been a pioneer in translational neuroscience research. He has been a consultant and senior advisor to banks and private equity and venture capital firms on medical devices, pharmaceuticals and health care services throughout his career. Dr. Gold was also a Founding Director of the Somerset Valley Bank and Somerset Valley Financial (Nasdaq: SVBF) from 1991 to 1999 which was sold to Fulton Financial Corporation. Dr. Gold is a Director of The Magstim Company Ltd., a United Kingdom based global leader in brain stimulation, nerve modulation, and intraoperative nerve monitoring. He was a Founding Director at Viewray, a public commercial stage MR-Guided Radiotherapy company specializing in Cancer treatment. Dr. Gold earned his M.D. from the University of Florida College of Medicine and his [B.S.] from Washington University in St. Louis Dr. Gold’s qualifications to serve on our Board of Directors include his expertise in medical neuroscience and technology, in-depth knowledge of the pharmaceutical industry, and extensive experience in business and management.

Alan Levine, Director (Age 51)

Mr. Levine has served as a member of our Board of Directors since May 2019. Since February 2018, Mr. Levine has been the chairman, president, and chief executive officer of Ballad Health, an integrated health care delivery system. From January 2014 until January 2018, he served as the president and chief executive officer of Mountain States Health Alliance, the largest health system in upper east Tennessee and southwest Virginia. He served as a senior advisor to the Board of Directors, president of the Florida Group and corporate senior vice president during his July 2010 to January 2014 tenure at Health Management Associates, a hospital and health care facilities operator. From January 2008 until July 2010, Mr. Levine served as senior health policy advisor to Louisiana Governor Bobby Jindal, and as the Secretary of the Louisiana Department of Health and Hospitals on the Governor’s cabinet. He was the president and chief executive officer of the North Broward Hospital District, one of the largest public health and hospital systems in the nation, from July 2006 until January 2008. He also served as the secretary of the Florida Agency for Health Care Administration, the health

planning and regulatory agency for the State of Florida with responsibility for the oversight of more than 30,000 health care facilities, and the $17 billion state Medicaid program, from June 2004 until July 2006. Mr. Levine served as the deputy chief of staff and senior health policy advisor to Governor Jeb Bush from January 2003 until June 2004. Alan holds an M.B.A., M.S. in Health Science, and B.S. in Health Education/Community Health from the University of Florida. He currently serves on the Board of Governors of the State University System of Florida, where he has served as chair of the Audit and Compliance Committee, chair of the Research and Academic Excellence, Committee and chair of the Select Committee on 2+2 Education Attainment. He also served as chair of the State of Florida Higher Education Coordinating Council, a policy-setting body composed of all education entities from K-Post Secondary. Mr. Levine’s qualifications to serve on our Board of Directors include his broad healthcare management, policy and regulation and patient care delivery knowledge, executive level experience with integrated health care delivery systems and his knowledge as to budgeting and financial reporting.

Guido Neels, Director (Age 70)

Mr. Neels has served as a member of our Board of Directors since August 2015. He has been an operating partner of EW Healthcare Partners L.P. (“EW”) since February 2013. Mr. Neels joined EW as a Partner in August 2006, was promoted to Managing Director in 2008 and served in that position until being appointed to Operating Partner. From May 2004 until retiring in November 2005, Mr. Neels served as Chief Operating Officer of Guidant Corporation (“Guidant”), a world leader in the development of cardiovascular medical products, where he was responsible for the global operations of Guidant’s four operating units – Cardiac Rhythm Management, Vascular Intervention, Cardiac Surgery, and Endovascular Solutions. From December 2002 to May 2004, Mr. Neels was Group Chairman, Office of the President at Guidant, responsible for worldwide sales operations, corporate communications, corporate marketing, investor relations and government relations. From January 2000 to December 2002, Mr. Neels was President of Guidant for Europe, Middle East, Africa and Canada. Mr. Neels previously served as Vice President of Global Marketing for Vascular Intervention and as Managing Director for German and Central European operations. From 1982 to 1994, until Guidant was spun off as an independent public company from Eli Lilly and Co., Mr. Neels held general management, sales and marketing positions at Eli Lilly in the United States and Europe. From 1972 to 1980, he held positions in information technology, finance and manufacturing at Raychem Corporation in Belgium and the United States. Mr. Neels currently serves on the board of directors of certain portfolio companies of EW, including Entellus Medical, Endologix and Bioventus. In addition, Mr. Neels also serves on the board of directors for Christel House International and Amici Lovanienses, both not-for-profit organizations, and is an advisor for Novo Holdings in Denmark. Mr. Neels holds an M.B.A. from Stanford University and a business engineering degree from the University of Leuven in Belgium. Mr. Neels’ qualifications to serve on our Board of Directors include his extensive leadership experience in the medical device and biotechnology industries and his expertise in the commercialization of medical devices, corporate governance and the financial markets.

Robert Rudelius, Director (Age 63)

Mr. Rudelius has served as a member of our Board of Directors since September 2010. Since 2001, Mr. Rudelius has been the Managing Director and Chief Executive Officer of Noble Ventures, LLC, a company he founded that provides advisory and consulting services to early-stage companies in the information technology, medical technology and loyalty marketing fields. From April 1999 through May 2001, when it was acquired by StarNet L.P., Mr. Rudelius was the founder and Chief Executive Officer of Media DVX, Inc., a start-up business that provided a satellite-based, IP-multicasting alternative to transmitting television commercials via analog videotapes to television stations, networks and cable television operators throughout North America. From April 1998 to April 1999, Mr. Rudelius was the President and Chief Operating Officer of Control Data Systems, Inc., during which time Mr. Rudelius reorganized and repositioned the software company as a professional services company, which resulted in the successful sale of the company to British Telecom. From October 1995 through April 1998, Mr. Rudelius was the founding Managing Partner of AT&T Solution’s Media, Entertainment & Communications industry group. From January 1990 through September 1995, Mr. Rudelius was a partner in McKinsey & Company’s Information, Technology and Systems practice, during which time he headed the practice in Japan and the United Kingdom. Mr. Rudelius began his career at Arthur Andersen & Co. where he was a leader of the firm’s financial accounting systems consulting practice. Mr. Rudelius has an M.B.A. from the Kellogg School of Management at Northwestern University and a B.S. in mathematics and economics from Gustavus Adolphus College in St. Peter, Minnesota. Mr. Rudelius’ qualifications to serve on our Board of Directors include his extensive executive

leadership and financial experience, particularly in connection with rapid growth technology businesses, and his experience as a director of publicly traded companies.

Amy Wendell, Director (Age 58)

Ms. Wendell has served as a member of our Board of Directors since September 2016 and Lead Director since May 2018. She was a senior advisor for the healthcare investment banking practice of Perella Weinberg Partners (“PWP”) from January 2016 through April 2019. Her scope of responsibilities involved providing guidance and advice with respect to mergers and acquisitions and divestitures for clients and assisting PWP in connection with firm-level transactions. From 2015 until October 2018, Ms. Wendell served as a senior advisor for McKinsey and Company’s (“McKinsey”) strategy and corporate finance practice and as a member of McKinsey’s transactions advisory board to help define trends in mergers and acquisitions, as well as help shape McKinsey’s knowledge agenda. From 1986 until January 2015, Ms. Wendell held various roles of increasing responsibility at Covidien plc (“Covidien”) (including its predecessors, Tyco Healthcare and Kendall Healthcare Products), including in engineering, product management and business development. Most recently, from December 2006 until Covidien’s acquisition by Medtronic plc in January 2015, Ms. Wendell served as Covidien’s Senior Vice President of Strategy and Business Development, where she managed all business development, including acquisitions, equity investments, divestitures and licensing/distribution, and led Covidien’s strategy and portfolio management initiatives. Ms. Wendell is a member of the board of directors of Hologic, Inc. (Nasdaq: HOLX), a leading developer, manufacturer and supplier of premium diagnostic products, medical imaging systems and surgical products with a strong position in women’s health and Baxter International, Inc. (NYSE: BAX), a leading global medical products company. She is also a director of Por Cristo, a non-profit charitable medical service organization involved in health care work for at-risk women and children in Latin America. Ms. Wendell holds a M.S. in biomedical engineering from the University of Illinois and a B.S. in mechanical engineering from Lawrence Institute of Technology (n/k/a Lawrence Technological University). Ms. Wendell’s qualifications to serve on our Board of Directors include her broad healthcare management and governance experience, her knowledge of healthcare policy and regulation, patient care delivery and financing, and her knowledge of clinical research and medical technology assessment.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE EIGHT DIRECTOR NOMINEES, WHICH IS DESIGNATED AS PROPOSAL NO. 1.

CORPORATE GOVERNANCE

Director Independence

Our Board of Directors currently consists of nine directors: Karen Zaderej, Gregory Freitag, Quentin Blackford, Jamie Grooms, Dr. Mark Gold, Alan Levine, Guido Neels, Robert Rudelius and Amy Wendell.

In determining whether our directors and director nominees are independent, we use the definition of independence provided in Rule 5605(a)(2) of the Nasdaq Stock Market’s (“Nasdaq”) Marketplace Rules. Under this definition of independence, Messrs. Blackford, Grooms, Levine, Rudelius and Neels, Ms. Wendell and Dr. Gold are independent. Mr. Freitag and Ms. Zaderej are not independent because they serve as executive officers of the Company. Each member of our Audit Committee, Compensation Committee and Governance and Nominating Committee also meets the heightened independence standards under the applicable Nasdaq independence rules.

Attendance at Meetings

Our Board of Directors met ten times during 2018, either in person or by teleconference, and acted by written consent on nine occasions. During 2018, each of our then current directors attended at least 75% of the aggregate number of the meetings of the Board of Directors and the committees thereof on which they served. All of our then current directors were in attendance in person at our 2018 Annual Meeting of Shareholders. Members of our Board of Directors are encouraged, but not required, to attend each annual meeting of shareholders.

Board Leadership Structure

Our Board of Directors is responsible for overseeing the business, property and affairs of Axogen. Members of our Board of Directors are kept informed of our business through discussions with our CEO and other officers, by reviewing materials provided to them and by participating in meetings of our Board of Directors and its committees.

Our Board of Directors is currently composed of: (i) Karen Zaderej, who also serves as our Chairman, CEO and President, (ii) Gregory Freitag, who serves as our General Counsel, (iii) Amy Wendell, who serves as Lead Director, and (iv) six other directors. Our Board of Directors does not have a policy regarding the separation of the roles of Chairman of our Board of Directors and CEO because our Board of Directors believes that the determination of whether to separate the roles depends largely upon the identity of the CEO and the members of our Board of Directors from time to time, that there is no single best organizational model that is the most effective in all circumstances and that the shareholders’ interests are best served by allowing our Board of Directors to retain the flexibility to determine the optimal organizational structure for Axogen at a given time. At this time, we believe that we are currently best served by having the same individual serve as our CEO and Chairman of our Board of Directors.

Risk Oversight by our Board of Directors

Our Board of Directors takes an active role in risk oversight related to Axogen and primarily administers its role during Board of Directors and committee meetings. During regular meetings of our Board of Directors, members of our Board of Directors discuss the operating results for each fiscal quarter. These meetings allow the members of our Board of Directors to analyze any significant financial, operational, competitive, economic, regulatory and legal risks of our business model, as well as how effectively we implement our goals. During regular Audit Committee meetings, Audit Committee members discuss the financial results for the most recent fiscal quarter with our independent auditors and our Chief Financial Officer (“CFO”). Our Audit Committee also meets with, and provides guidance to, our independent auditors outside the presence of management and oversees and reviews with management the liquidity, capital needs and allocation of our capital, our funding needs and other finance matters. In addition, our Audit Committee reviews our legal, healthcare compliance, quality and regulatory risks and our procedures regarding the receipt, retention and treatment of whistleblower complaints regarding internal accounting, accounting controls or audit matters. These discussions and processes allow the members of our Audit Committee to analyze any significant risks that could materially impact the financial health of our business.

In furtherance of its risk oversight responsibilities, our Compensation Committee has evaluated our overall compensation policies and practices for our employees to determine whether such policies and practices create incentives that could reasonably be expected to affect the risks faced by us and our management has concluded that the risks arising from our policies and practices are not reasonably likely to have a material adverse effect on the Company.

Board Committees

The standing committees of Axogen’s Board of Directors include an Audit Committee, a Compensation Committee and a Governance and Nominating Committee. Messrs. Rudelius (Chairman), Blackford and Levine and Dr. Gold are the members of the Audit Committee. Messrs. Neels (Chairman) and Rudelius, Ms. Wendell and Dr. Gold are members of the Compensation Committee. Dr. Gold (Chairman) and Messrs. Levine and Neels and Ms. Wendell are members of the Governance and Nominating Committee. Mr. Grooms served on the Audit Committee and the Governance and Nominating Committee until May 2019. The Charters of each of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee can be found on our website under “Investors — Corporate Governance.” The information contained on our website, or on other websites linked to our website, is not part of this document. Reference herein to our website is an inactive text reference only.

Audit Committee

The Audit Committee was established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is responsible for review of audits, financial reporting and compliance, and accounting and internal controls policies. For audit services, the Audit Committee is responsible for the engagement and compensation of the registered independent accounting firms, oversight of their activities and evaluation of their independence. The Audit Committee has instituted procedures for receiving reports of improper record keeping, accounting or disclosure. In the opinion of the Board of Directors, each of the members of the Audit Committee has both business experience and an understanding of accounting principles generally accepted in the United States (“GAAP”) and financial statements enabling them to effectively discharge their responsibilities as members of the Audit Committee. Moreover, the Board of Directors has determined that each of Messrs. Rudelius, Blackford and Levine and Dr. Gold is an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC. Each of Messrs. Rudelius, Blackford, Grooms and Levine and Dr. Gold is an independent director. Our Audit Committee held nine meetings and acted by written consent on one occasion during 2018.

A current copy of the Company’s Audit Committee charter, which has been adopted by our Board of Directors, is posted on our website at http://ir.axogeninc.com/governance-docs.

Compensation Committee

Our Compensation Committee determines and periodically evaluates the various levels and methods of compensation for our directors, officers and employees, and is responsible for establishing executive compensation and administering the Axogen, Inc. 2010 Incentive Stock Plan (the “2010 Plan”) and the Axogen, Inc. 2017 Employee Stock Purchase Plan (the “2017 ESPP”). Our Compensation Committee held six meetings and acted by written consent on five occasions during 2018.

Under its charter, our Compensation Committee’s duties and responsibilities include, without limitation: (i) periodically review our compensation philosophy and the design of our compensation programs; (ii) establish and oversee our compensation plans; (iii) recommend to our Board of Directors a compensation and benefit package for directors; (iv) at least annually, establish and review our CEO’s management objectives, conduct the CEO’s performance evaluation and communicate the outcomes to our Board of Directors; (v) review and approve payouts to participants as proposed by our CEO under our compensation plans; (vi) review and approve, for our CEO and our other executive officers, when and if appropriate, employment agreements, severance agreements, change in control provisions/agreements and any severance or similar termination payments proposed to be made to any of our current or former executive officers; (vii) in consultation with senior management, oversee regulatory compliance with respect to compensation matters; and (viii) prepare the annual report on executive compensation required to be included in our annual

proxy statement. Our executive officers do not play a formal role in determining or recommending the amount or form of director compensation.

The Compensation Committee may delegate its powers under the 2010 Plan to one or more directors (including a director who is also one of our officers) and may authorize one or more officers to grant awards under the 2010 Plan, except that the Compensation Committee may not delegate its powers to grant awards to executive officers or directors who are subject to Section 16 of the Exchange Act, or in a way that would violate Section 162(m) of the Internal Revenue Code (the “Code”). Axogen’s Board of Directors may also exercise the powers of the Compensation Committee at any time, so long as its actions would not violate Section 162(m) of the Code. The Compensation Committee’s ability to delegate its powers is also limited by the rules of the Nasdaq Stock Market on which Axogen’s shares of common stock are listed.

In May of 2016, our Compensation Committee engaged Radford, a subsidiary of Aon Hewitt Limited (“Radford”), a compensation consultant, for the purpose of advising upon executive and director compensation. The Compensation Committee has reviewed the independence of Radford’s advisory role relative to the six consultant independence factors adopted by the SEC to guide listed companies in determining the independence of their compensation consultants, legal counsel and other advisors. Following its review, the Compensation Committee concluded that Radford did not have any conflicts of interest and provided the Compensation Committee with objective and independent executive compensation advisory services.

Radford was engaged to provide the Compensation Committee with an analysis of Axogen’s executive officers, officers and director compensation, focusing on all compensation components including base salary, bonus, equity, director retainers and fees and committee fees. Radford conducted a thorough proxy review of Axogen’s most relevant comparative companies, and analyzed base salary, bonus, equity, retainers, and all other compensation components in relation to Axogen’s peer group. In addition, as part of Radford’s compensation analysis, they reviewed the equity holdings of executive officers, officers and directors in relation to Axogen’s peer group.

As a result of Radford’s analysis, the Compensation Committee suggested compensation of Axogen executive officers, officers and directors, which suggestions were adopted by the Compensation Committee and took effect for the fiscal years 2017 and 2018.

The Company’s Chief Executive Officer is involved in the design and implementation of our executive compensation and is typically present at Compensation Committee meetings, except that the Chief Executive Officer is not present during any voting or deliberations on her compensation. In 2018, the Chief Executive Officer reviewed the analysis and recommendations of Radford with the Compensation Committee and made recommendations regarding proposed salary, equity awards and bonus for our officers (other than herself). The Compensation Committee exercises its discretion in accepting, rejecting and/or modifying any such executive compensation recommendations and approves all compensation and equity awards.

A current copy of the Company’s Compensation Committee charter, which has been adopted by our Board of Directors, is posted on our website at http://ir.axogeninc.com/governance-docs.

Governance and Nominating Committee

The Governance and Nominating Committee is responsible for providing oversight in relation to the corporate governance of Axogen and also identifies director nominees for election to fill vacancies on our Board of Directors. Nominees are approved by the Axogen Board of Directors on recommendation of the Governance and Nominating Committee. In evaluating nominees, the Governance and Nominating Committee particularly seeks candidates of high ethical character with significant business experience at the senior management level who have the time and energy to attend to board responsibilities. Candidates should also satisfy such other particular requirements that the Governance and Nominating Committee may consider important to Axogen’s business at the time. When a vacancy occurs on the Axogen Board of Directors, the Governance and Nominating Committee will consider nominees from all sources, including shareholders, nominees recommended by other parties, and candidates known to the directors or Axogen’s management. The best candidate from all evaluated will be recommended to the Axogen Board of Directors to consider for nomination.

No material changes have been made to the procedures by which shareholders may recommend nominees to Axogen’s Board of Directors. Our Governance and Nominating Committee held seven meetings and acted by written consent on two occasions during 2018.

A current copy of the Company’s Governance and Nominating Committee charter, which has been adopted by our Board of Directors, is posted on our website at http://ir.axogeninc.com/governance-docs.

Director Nominations

Director nominees are approved by our Board of Directors on recommendation of our Governance and Nominating Committee. In evaluating nominees, our Governance and Nominating Committee particularly seeks candidates of high ethical character with significant business experience at the senior management level who have the time and energy to attend to board responsibilities. Candidates should also satisfy such other particular requirements that our Governance and Nominating Committee may consider important to our business at the time. In accordance with our Governance and Nominating Committee charter and policies included therein, characteristics expected of all directors should include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to our Board of Directors. In evaluating the suitability of individual directors, our Board of Directors takes into account many factors, including: (i) general understanding of marketing, finance, and other disciplines relevant to the success of a small publicly traded medical device company in today’s business environment; (ii) understanding of the Company’s business and technology; (iii) educational and professional background; (iv) personal accomplishment; and (v) geographic, gender, age, and ethnic diversity. Our Board of Directors evaluates each individual in the context of our Board of Directors as a whole, with the objective of recommending a group that can best perpetuate the success of the Company’s business and represent shareholder interests through the exercise of sound judgment, using its diversity of experience.

In addition, in accordance with our Governance and Nominating Committee charter and policies included therein, when a vacancy occurs on our Board of Directors, our Governance and Nominating Committee will consider nominees from all sources, including shareholders, nominees recommended by other parties, and candidates known to our directors or our management. The best candidate(s) from all evaluated will be recommended to our Board of Directors to consider for nomination.

Shareholders wishing to recommend a director nominee to our Governance and Nominating Committee may do so by sending to our Governance and Nominating Committee, on or before January 1 of each year, the following information: (i) name of the candidate and a brief biographical sketch and resume; (ii) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and (iii) a signed statement as to the submitting shareholder’s current status as a shareholder and the number of shares currently held. No candidates for director nominations were submitted to our Governance and Nominating Committee by any shareholder in connection with our 2019 Annual Meeting of Shareholders. Such recommendation should be addressed to Governance and Nominating Committee, c/o General Counsel, Axogen, Inc., 13631 Progress Blvd., Suite 400, Alachua, FL 32615.

Shareholder Communications with our Board of Directors

Shareholders may send written communications to the attention of our Board of Directors. Any shareholder desiring to communicate with our Board of Directors, or one or more of our directors, may send a letter addressed to: Board of Directors, c/o General Counsel, Axogen, Inc., 13631 Progress Blvd., Suite 400, Alachua, FL 32615. Our General Counsel has been instructed by our Board of Directors to promptly forward all communications so received to our full Board of Directors or the individual members of our Board of Directors specifically addressed in the communication.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Director Stock Ownership Guidelines

On December 29, 2016, our Board of Directors adopted the Non-Employee Director Equity Ownership Guidelines (the “Guidelines”) under which each non-employee director is required to own, within five years of joining the Board of Directors, a specified dollar value of Axogen’s common stock, or common stock underlying vested stock options held by the non-employee director to the extent such options are "in-the-money". Value is to equal at least three times the director’s annual retainer, excluding any committee retainers or other fees the director may receive. As of January 1, 2019, the annual determination date under the Guidelines, all of Axogen’s non-employee directors were in compliance with the Guidelines.

A current copy of the Company’s Non-Employee Director Equity Ownership Guidelines is posted on our website at http://ir.axogeninc.com/governance-docs.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our employees (including our principal executive officer, chief financial officer and other members of our finance and administration department) and our directors.

Our Code of Business Conduct and Ethics is posted on our website at http://ir.axogeninc.com/governance-docs. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq Stock Market listing standards concerning any amendments to, or waivers from, any provision of our Code of Business Conduct and Ethics.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review and Approval of Related Person Transactions

In accordance with our Audit Committee Charter, our Audit Committee reviews and approves (with the concurrence of a majority of the disinterested members of our Board of Directors) any related-party and affiliated-party transactions. Our Code of Business Conduct and Ethics generally addresses such situations as to conflicts of interest and is the starting basis for disclosure and review. The Code of Business Conduct and Ethics provides that a conflict situation can arise when an employee or officer takes actions or has interests that may make it difficult to perform his or her Company work objectively and effectively. Conflicts of interest may also arise when an employee or officer, or a member of his or her family, receives improper personal benefits as a result of his or her position in the Company. Loans to, or guarantees of obligations of, employees and officers and their family members by the Company may create conflicts of interest.

In addition, the Code of Business Conduct and Ethics provides that all related person transactions that meet the minimum threshold for disclosure in a proxy statement under the relevant SEC rules must be reported to and approved by the Audit Committee. Company officers and directors are required to bring promptly to the attention of our CFO or General Counsel any transaction or series of transactions that may result in a conflict of interest between that person and the Company. The Company CFO on a continuous basis, and annually, reviews with Company accounting personnel any situations that appear to have a conflict. Following any disclosure or discovery, our CFO or General Counsel will then review with the Chairman of our Audit Committee the relevant facts disclosed by the officer or director in question or the uncovered situation. After this review, the Chairman of the Audit Committee and the CFO or General Counsel determines whether the matter should be brought to the Audit Committee or the full Board of Directors for approval. In considering any such transaction, the Audit Committee or the Board of Directors, as the case may be, will consider various relevant factors, including, among others, the reasoning for the Company to engage in the transaction, whether the terms of the transaction are arm’s length and the overall fairness of the transaction to the Company. If a member of the Audit Committee or the Board of Directors is involved in the transaction, he or she will not participate in any of the discussions or decisions about the transaction. The transaction must be approved in advance whenever practicable, and if not practicable, must be ratified as promptly as practicable.

Related Person Transactions

Until her hire in October 2018, Isabelle Billet, Chief Strategy and Business Development, served as a consultant to Axogen through IBHC Advisors LLC and was paid $220,645 in 2018. There were no other transactions, nor are there currently any other proposed transactions, which in accordance with SEC rules would require disclosure.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of June 20, 2019, by each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of our common stock, each of our directors, each of our executive officers named in the Summary Compensation Table in “Executive Compensation — Summary Compensation Table,” and all of our directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”). Except as otherwise noted, each shareholder named in the table has sole voting and investment power for the shares shown as beneficially owned by them, and such shares are not subject to any pledge. Shares of common stock underlying options held by a person that are currently exercisable, or exercisable within 60 days of June 20, 2019, are considered outstanding and to be beneficially owned by the person holding such option for purposes of computing such person’s percentage ownership, but are not considered outstanding for the purpose of computing the percentage ownership of any other person. Percentage of ownership is based on 39,205,173 shares of common stock outstanding on June 20, 2019.

|

|

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

Number of Shares

|

|

|

|

|

|

Beneficially Owned

|

|

Underlying Options

|

|

|

|

|

|

(including shares

|

|

Currently Exercisable or

|

|

|

|

|

|

reflected in the

|

|

Exercisable within 60 days

|

|

Percent of Shares

|

|

Name of Beneficial Owner

|

|

third column)(1)

|

|

of June 20, 2019(1)

|

|

Outstanding (%)

|

|

Entities associated with EW Healthcare Partners L.P. (2)

|

|

2,739,751

|

|

—

|

|

6.99

|

|

ArrowMark Colorado Holdings LLC

|

|

3,616,884

|

|

—

|

|

9.23

|

|

Blackrock, Inc.

|

|

2,465,231

|

|

—

|

|

6.29

|

|

Amerprise Financial, Inc.

|

|

2,035,332

|

|

—

|

|

5.19

|

|

Karen Zaderej

|

|

937,093

|

|

426,813

|

|

2.36

|

|

Jamie M. Grooms

|

|

210,462

|

|

191,769

|

|

0.53

|

|

Mark Gold, M.D. (3)

|

|

349,541

|

|

4,780

|

|

0.89

|

|

Guido J. Neels (2)

|

|

64,780

|

|

64,780

|

|

*

|

|

Amy Wendell

|

|

71,863

|

|

53,530

|

|

*

|

|

Robert J. Rudelius

|

|

117,371

|

|

82,780

|

|

*

|

|

Gregory Freitag

|

|

426,885

|

|

326,625

|

|

1.08

|

|

Peter Mariani

|

|

232,182

|

|

222,500

|

|

0.59

|

|

All directors and executive officers as a group (15 persons) (2)(3)(4)

|

|

2,765,237

|

|

1,635,544

|

|

6.77

|

* Less than 1%.

|

(1)

| |

Does not include shares of common stock underlying Restricted Stock Units or Performance Stock Units subject to vesting 60 days beyond June 20, 2019. |

|

(2)

| |

This information is based solely on a review of a Form 13(G) filed with the SEC on February 13, 2019 by EW, by Essex Woodlands Fund IX-GP, L.P. ("Fund IX-GP"), its General Partner, by Essex Woodlands IX, LLC (“Fund IX, LLC”), its General Partner, by Martin P. Sutter, Managing Director. The shares are held by EW. Fund IX-GP is the general partner of EW. Fund IX, LLC is the general partner of the Fund IX-GP. Fund IX, LLC holds sole voting and dispositive power over the shares held by EW. The managers of the Fund IX, LLC are Martin P. Sutter, R. Scott Barry, Ronald Eastman, Guido J. Neels (also a member of the Company’s Board of Directors), Petri Vainio and Steve Wiggins (collectively, the "Managers"), and may exercise voting and investment control over the shares only by the majority action of the Managers. Each individual Manager, the Fund-IX-GP and Fund IX, LLC disclaim beneficial ownership over the shares except to the extent of his or its respective pecuniary interest therein. The address for these entities is 21 Waterway Avenue, Suite 225, The Woodlands, TX 77380. |

|

(3)

| |

The shares of common stock for Dr. Gold include 197,761 shares held jointly by Dr. Gold and his wife, indirect ownership of 20,000 shares held by Dr. Gold’s spouse and indirect ownership of 122,487 shares held by MJSK, Ltd., a decedent investment trust held by Dr. Gold’s family. |

|

(4)

| |

Includes 1,560, 41,971, 18,974 and 25,288 shares of common stock held by Mark Friedman, Vice President of Regulatory and Quality, Erick DeVinney, Vice President of Clinical and Translational Sciences, Michael Donovan, Vice President, Operations, David Hansen, Vice President of Finance and Treasurer, respectively. Also, includes a number of shares of common stock underlying options equal to 30,687, 86,280, 66,500 and 78,500, for Messrs. Friedman, DeVinney, Donovan and Hansen, respectively, exercisable within 60 days of June 20, 2019. |

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of our company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. SEC regulations require us to identify in this report anyone who filed a required report late during our most recent fiscal year.

Based on our review of forms we received or written representations from reporting persons, we believe that all reports of securities ownerships and changes in such ownership required to be filed during the year ended December 31, 2018 were timely filed.

Equity Compensation Plan Information

The following table summarizes, with respect to the Company’s equity compensation plans, the number of shares of the Company’s common stock to be issued upon exercise of outstanding options, warrants and other rights to acquire shares of common stock, the weighted-average exercise price of these outstanding options, warrants and rights and the number of shares of common stock remaining available for future issuance under the Company’s equity compensation plans as of December 31, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Securities

|

|

|

|

|

|

|

|

Remaining Available

|

|

|

|

|

|

|

|

for Future Issuance

|

|

|

|

|

|

|

|

Under Equity

|

|

|

|

Number of Securities to be

|

|

Weighted-Average

|

|

Compensation Plans

|

|

|

|

Issued Upon Exercise of

|

|

Exercise Price of

|

|

(Excluding Securities

|

|

|

|

Outstanding Options,

|

|

Outstanding Options,

|

|

Reflected in the

|

|

Plan Category

|

|

Warrants and Rights

|

|

Warrants and Rights ($)

|

|

First Column)

|

|

Equity compensation plans approved by security holders

|

|

4,999,534

|

|

14.11

|

|

418,943

|

|

Equity compensation plans not approved by security holders

|

|

—

|

|

—

|

|

—

|

|

Total

|

|

4,999,534

|

|

14.11

|

|

418,943

|

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) provides an overview of our executive compensation philosophy, the objectives of our executive compensation program and each compensation component that we provide. In addition, we explain how and why our Compensation Committee arrived at specific compensation policies and decisions involving our named executive officers for the fiscal year ended December 31, 2018. This CD&A is intended to be read in conjunction with the tables which immediately follow, which include historical context of pay.

The following executive officers constituted our Named Executive Officers (“NEOs”) in the past year:

|

|

|

|

Karen Zaderej

|

Chief Executive Officer and President

|

|

Gregory Freitag

|

General Counsel

|

|

Peter Mariani

|

Chief Financial Officer

|

|

Jon Gingrich1

|

Chief Commercial Officer

|

|

Shawn McCarrey2

|

SVP of Sales

|

|

(1)

| |

The Company and Mr. Gingrich entered into a separation agreement effective in February 2019. |

|

(2)

| |

The Company and Mr. McCarrey entered into a separation agreement effective in January 2019. |

This Compensation Discussion and Analysis contains forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. The actual compensation programs that we adopt in the future may differ materially from currently planned programs as summarized in this discussion.

Executive Summary

We are the leading company focused specifically on the science, development and commercialization of technologies for peripheral nerve regeneration and repair. We have had a tremendous growth in revenue over the last seven years while maintaining significant gross margin. Our efforts to increase market awareness, provide quality surgeon education programs, expand our commercial presence and effectiveness, and further develop clinical data are helping surgeons develop confidence in the adoption of the Axogen platform for nerve repair.

Axogen continues to see momentum in core trauma, oral and maxillofacial, and breast reconstruction neurotization markets. The investments made in 2018, including our strengthened and expanded commercial capabilities, will allow us to drive sharper and more consistent execution. We are well-positioned to deliver continued growth in our core markets and develop expansion markets. Some of our business highlights for the past year include:

2018 revenue of $83.9 million, an increase of 39% compared to the prior year.

Gross margin of 84.6%, consistent with gross margin in 2017.

Updated the total addressable market for current applications to $2.7 billion.

Announcement of market development and clinical initiatives for a new application, the surgical treatment of chronic neuropathic pain.

Receipt of Regenerative Medicine Advanced Therapy (“RMAT”) designation by U.S. Food and Drug Administration for Avance® Nerve Graft.

Completion of 18 national surgeon education programs.

Raise of $132.7 million in net proceeds through a public offering of common stock on May 9, 2018.

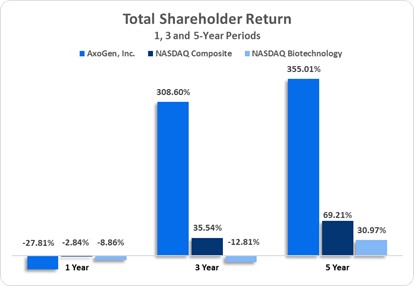

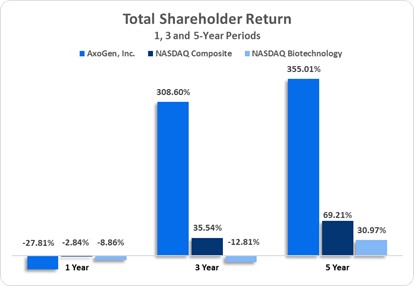

Further, our long-term shareholder returns have far outpaced our comparator indices:

As our company has continued to evolve with rapid growth and clinical success, it has been imperative that the Compensation Committee continually evaluate and transform the executive compensation program to appropriately structure pay packages in light of company size, investor expectations, and industry standards. Our Compensation Committee firmly believes that executive compensation should be linked to our overall performance. As such, our executive compensation program is designed to attract highly qualified individuals, retain those individuals in a competitive marketplace for executive talent and motivate performance in a manner that supports achievement of our corporate goals while ensuring that these programs do not encourage excessive risk-taking. We believe our executive compensation program, as presented in this CD&A, achieves these objectives.

Say on Pay Vote and Investor Feedback

At our 2016 annual meeting, we asked our shareholders to approve, on a non-binding advisory basis, the compensation paid to our named executive officers, commonly referred to as a say-on-pay vote. Our shareholders overwhelmingly approved, with over 95% of votes cast in favor of our say-on-pay resolution. The Compensation Committee believes this vote demonstrated our shareholders’ positive view of our executive compensation.

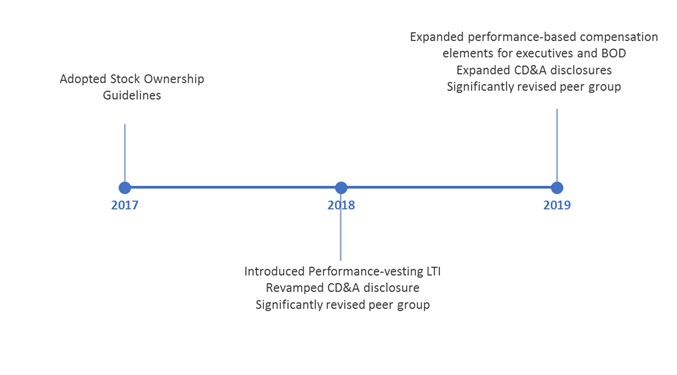

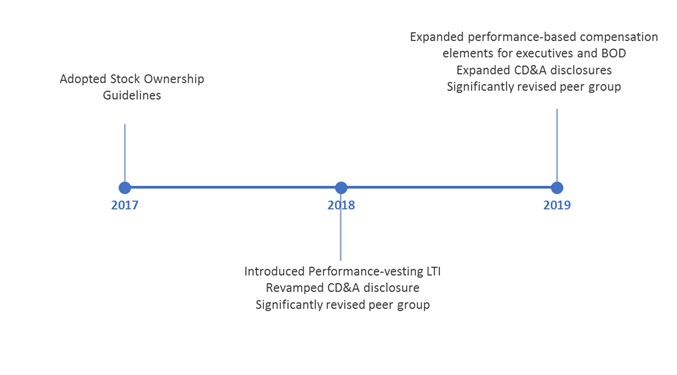

The Compensation Committee values and continues to consider shareholder input and feedback, including the results of say-on-pay votes, on our compensation program structure. Since our last say-on-pay vote in 2016, the Compensation Committee has continually improved our structure and disclosure to further align with market practices and investor expectations. Some changes in the past several years include:

Pay Program Overview

We believe that the design and structure of our pay program, and in particular our incentive plans, support our business strategy and organizational objectives while successfully aligning executive focus and interest with that of shareholders. Our compensation programs are designed to attract, motivate and retain qualified and talented executives, motivating them to achieve our business goals and rewarding them for superior short- and long-term performance. All pay elements, and the safeguards and governance features of the program, have been carefully chosen and implemented to align with our pay philosophy and objectives.

In doing so, we have selected the following framework to achieve these objectives:

|

|

|

|

Base Salary

|

Base salaries are set to be competitive within our industry and are important in attracting and retaining talented executives. Base salaries are fixed pay set with consideration for responsibilities, market data and individual contribution.

|

|

Annual Cash Incentives

|

The annual cash incentive award plan is intended to motivate and reward our executives for the achievement of certain strategic goals of the Company.

In 2018, our annual incentives were based on key corporate objectives, including revenue, spending and certain operational, clinical and/or development goals.

|

|

Long-Term Equity Incentives

|

Long-term equity awards incentivize executives to deliver long-term shareholder value, while also providing a retention vehicle for our top executive talent.

In 2018, equity awards were delivered as:

Performance-based PSUs

RSUs

Stock options

|

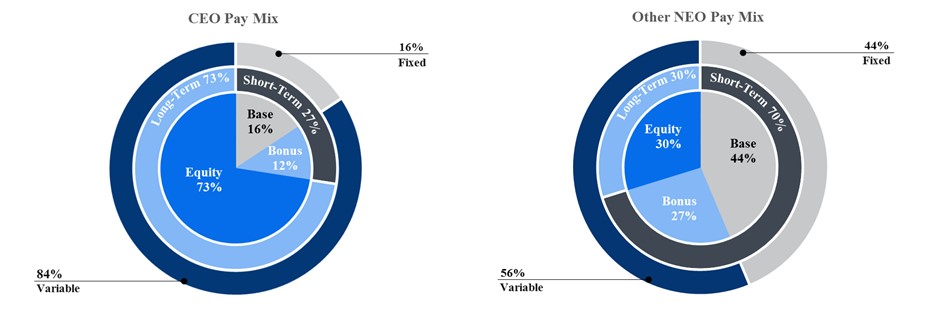

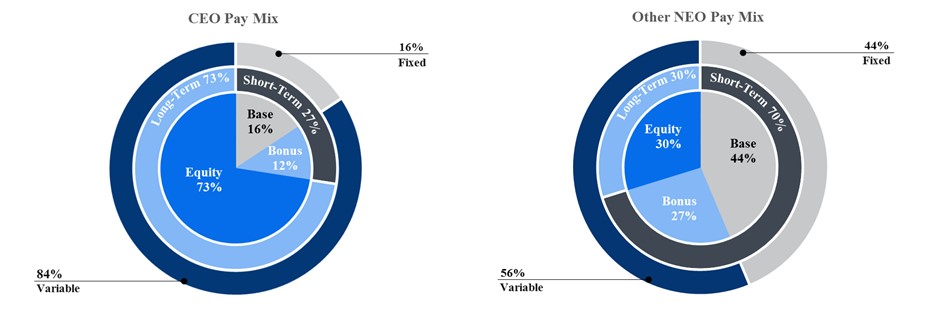

2018 Target Pay Mix

Consistent with our philosophy of aligning executive pay with the short- and long-term performance of the Company, and to align the interests of management and shareholders, the Company’s compensation programs are designed to provide the majority of executive compensation in the form of variable, at-risk, incentive pay as shown in the graphics below:

Compensation Governance

Our Compensation Committee is responsible for oversight of the Company’s compensation program and practices. A significant part of this responsibility is aligning management interests with the Company’s business strategies and goals, as well as the interest of our shareholders, while also mitigating excessive risk taking. To that end, the Company has committed to numerous governance practices and safeguards to ensure the compensation program does not misalign those interests.

|

What We Do

|

Pay-for-performance philosophy and culture

|

|

Provide an appropriate mix of performance-based and time-vesting awards to executives

|

|

Strong emphasis on performance-based incentive awards

|

|

Responsible use of shares under our long-term incentive program

|

|

Appropriate stock ownership requirements for all executives and non-executive directors

|

|

Engage an independent compensation consultant

|

|

Perform an annual risk assessment of our compensation program

|

|

What We Don’t Do

|

X No hedging or pledging of Company securities

|

|

X No excise tax gross-ups

|

|

X No backdating or repricing of stock option awards

|

|

X No resetting of financial targets for performance-based incentive awards

|

|

X No excessive perquisites

|

Executive Compensation Philosophy and Objectives

Axogen’s compensation philosophy is designed to pay for performance and achieve the following principal objectives:

align our executive officers’ compensation with our business objectives and the interests of our shareholders;

enable us to attract, motivate and retain the level of successful, qualified senior executive leadership talent necessary to achieve our long-term goals; and

reward performance, company growth and advancement of our long-term strategic initiatives.

We carefully construct pay packages to appropriately balance fixed and variable elements to achieve the aforementioned objectives.

Compensation-Setting Process

Role of the Compensation Committee

Our Compensation Committee is responsible for, among other things, overseeing our executive compensation philosophy and our executive compensation program, determining and approving the compensation for our named executive officers, negotiating executive employment contracts, and helping to establish appropriate compensation for directors and other key employees. Our Compensation Committee regularly reports to our Board of Directors on its deliberations, but is ultimately responsible for compensation decisions, as described in the Compensation Committee’s Charter.

Our Compensation Committee reviews, on at least an annual basis, our executive compensation program, including our incentive compensation plans, to determine whether they are appropriate, properly coordinated, and achieve their intended purposes, and recommends to our Board of Directors any modifications or new plans or programs. It also reviews the compensation of our named executive officers and makes decisions about the various components that comprise their compensation packages.

Role of Management

The Company’s Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and Chief Human Resources Officer (“CHRO”) are involved in the design and implementation of our executive compensation and, along with our General Counsel, are typically present at Compensation Committee meetings, except that the CEO, CFO, CHRO and General Counsel are not present during any voting or deliberations on their salary and equity compensation. In 2018, the CEO, CFO and CHRO reviewed the analysis and recommendations of Radford with the Compensation Committee and made recommendations regarding proposed salary, equity awards and bonus for our officers (other than themselves). The Compensation Committee exercises its discretion in accepting, rejecting and/or modifying any such executive compensation recommendations and approves all compensation and equity awards.

Role of Consultants

Since May 2016, our Compensation Committee has engaged Radford, an Aon company, to provide the Compensation Committee with a thorough analysis of our executive compensation, focusing on all compensation components.

In 2018, Radford assisted the Compensation Committee with, among other things:

Executive and director market pay analysis;

Reviewing and modifying the compensation peer group;

Development of executive and director pay programs; and

Revising and augmenting our Compensation, Discussion and Analysis disclosure in this Proxy Statement.

The Compensation Committee annually evaluates the independent compensation consultant’s independence and performance under the applicable SEC and Nasdaq listing standards. The Compensation Committee believes that working with an independent compensation consultant furthers the Company’s objectives to recruit and retain qualified executives, align their interests with those of shareholders and ensure that their compensation packages will appropriately motivate and reward ongoing achievement of business goals. The Compensation Committee conducted a specific review of its relationship with Radford in 2018 and determined that Radford’s work for the Compensation Committee did not raise any conflicts of interest.

Use of Competitive Data

To assess the competitiveness of our executive compensation program and compensation levels, our Compensation Committee, with the assistance of Radford, examines the competitive compensation data for senior executives of our peer companies.

The Compensation Committee uses the peer group to reference recent market data and understand the marketplace. However, the Committee also recognizes the importance of flexibility and considers other factors as well, such as individual performance, experience, history and scope of responsibility, current market conditions and the specific needs of the business at critical points in time.

2018 Peer Group

For our 2018 Peer Group, Radford helped the Compensation Committee identify companies similar to us with respect to sector and market capitalization, as well as revenue and headcount to provide a broad perspective on competitive pay levels and practices.

Sector – Health Care Equipment & Supplies companies

Market Capitalization – 0.5x to 3x Axogen’s market capitalization

Revenue – 1/3x to 3x Axogen’s revenue

Headcount – 1/3x to 3x Axogen’s current headcount

Using these criteria, the following 15 companies were determined to comprise the Company’s 2018 peer group:

|

|

|

|

|

Antares Pharma

|

Entellus Medical

|

NanoString Technologies

|

|

AtriCure

|

GenMark Diagnostics

|

Osiris Therapeutics

|

|