| As of December 31, 2019 nasdaq: axgn Corporate presentation |

| 2 This presentation contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward- looking statements. The forward-looking statements may include, without limitation, statements regarding our growth, our 2019 and 2020 guidance, product development, product potential, financial performance, sales growth, product adoption, market awareness of our products, data validation, our assessment of our internal controls over financial reporting, our visibility at and sponsorship of conferences and educational events. The forward-looking statements are and will be subject to risks and uncertainties, which may cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements contained in this presentation should be evaluated together with the many uncertainties that affect our business and our market, particularly those discussed under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as well as other risks and cautionary statements set forth in our filings with the U.S. Securities and Exchange Commission. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances, or otherwise. Safe harbor statement revolutionizing the science of nerve repair™ |

| 3 The Axogen platform for nerve repair revolutionizing the science of nerve repair™ |

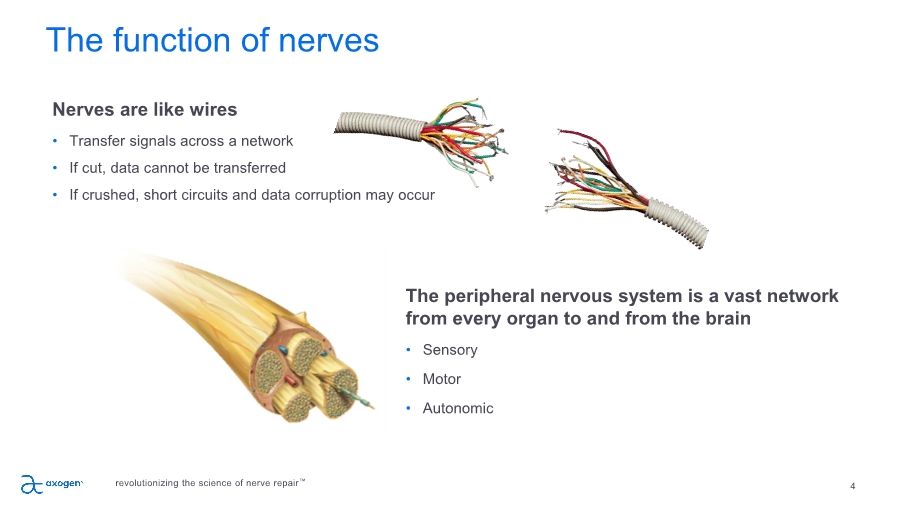

| 4 The function of nerves Nerves are like wires • Transfer signals across a network • If cut, data cannot be transferred • If crushed, short circuits and data corruption may occur The peripheral nervous system is a vast network from every organ to and from the brain • Sensory • Motor • Autonomic revolutionizing the science of nerve repair™ |

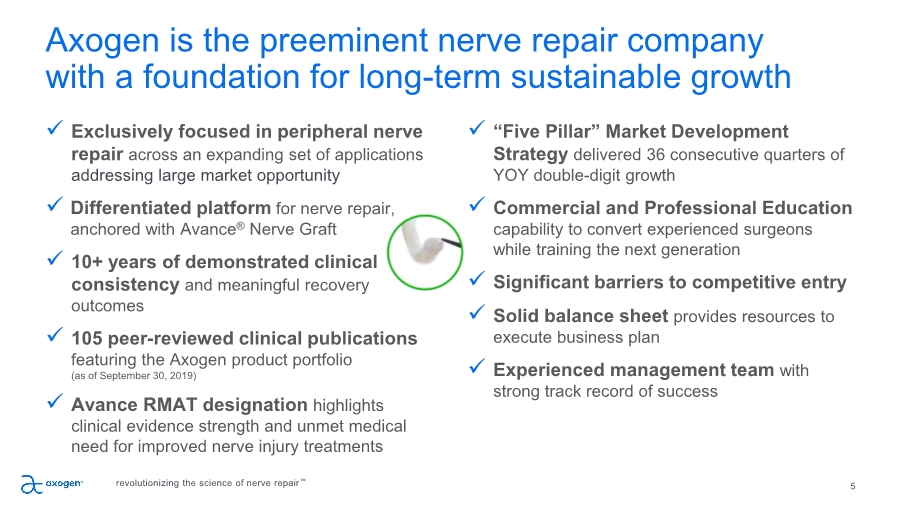

| Axogen is the preeminent nerve repair company with a foundation for long-term sustainable growth 5 ✓ Exclusively focused in peripheral nerve repair across an expanding set of applications addressing large market opportunity ✓ Differentiated platform for nerve repair, anchored with Avance® Nerve Graft ✓ 10+ years of demonstrated clinical consistency and meaningful recovery outcomes ✓ 105 peer-reviewed clinical publications featuring the Axogen product portfolio (as of September 30, 2019) ✓ Avance RMAT designation highlights clinical evidence strength and unmet medical need for improved nerve injury treatments ✓ “Five Pillar” Market Development Strategy delivered 36 consecutive quarters of YOY double-digit growth ✓ Commercial and Professional Education capability to convert experienced surgeons while training the next generation ✓ Significant barriers to competitive entry ✓ Solid balance sheet provides resources to execute business plan ✓ Experienced management team with strong track record of success revolutionizing the science of nerve repair™ |

| 6 84.2% Gross Margin for the quarter ended September 30, 2019 $23.4 $28.1 Q4 2018 Q4 2019 Q4 Revenue (a) 20% Growth U.S. $ in millions Delivering strong consistent revenue growth & gross margins revolutionizing the science of nerve repair™ a) Unaudited estimate of 2019 year-end and fourth quarter revenue. • Solid revenue growth in Q4 and 2019 • Continuing to rebalance and refocus our commercial efforts toward our largest market opportunity of extremity trauma • Completed conversion of 8 former OMF sales roles to full line reps in late Q4 • Solid commercial foundation in place to drive strong adoption of our technology over the next several years Operational Highlights |

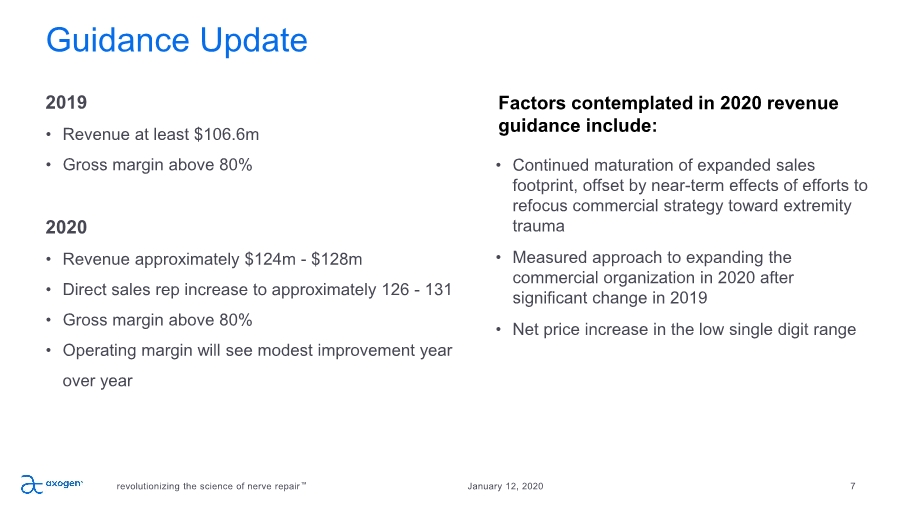

| Guidance Update January 12, 2020 revolutionizing the science of nerve repair™ 7 2019 • Revenue at least $106.6m • Gross margin above 80% 2020 • Revenue approximately $124m - $128m • Direct sales rep increase to approximately 126 - 131 • Gross margin above 80% • Operating margin will see modest improvement year over year • Continued maturation of expanded sales footprint, offset by near-term effects of efforts to refocus commercial strategy toward extremity trauma • Measured approach to expanding the commercial organization in 2020 after significant change in 2019 • Net price increase in the low single digit range Factors contemplated in 2020 revenue guidance include: |

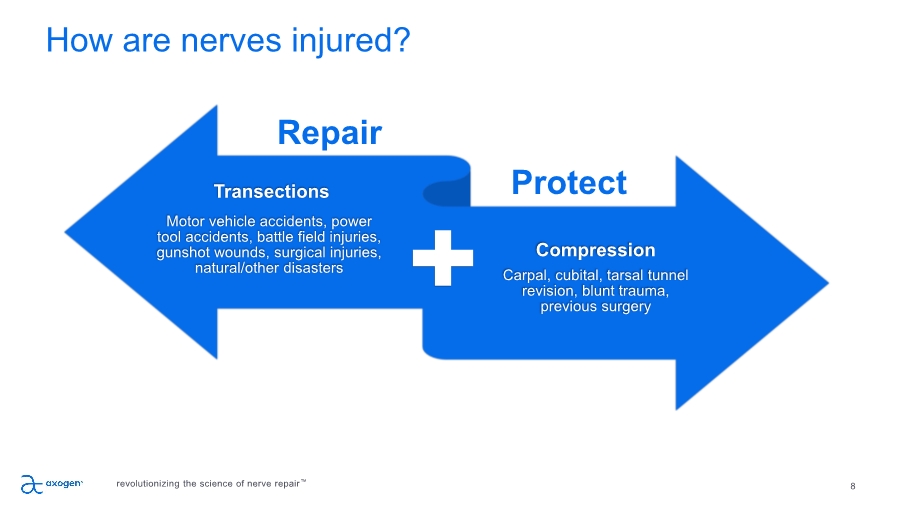

| 8 How are nerves injured? Transections Motor vehicle accidents, power tool accidents, battle field injuries, gunshot wounds, surgical injuries, natural/other disasters Compression Carpal, cubital, tarsal tunnel revision, blunt trauma, previous surgery Repair Protect revolutionizing the science of nerve repair™ |

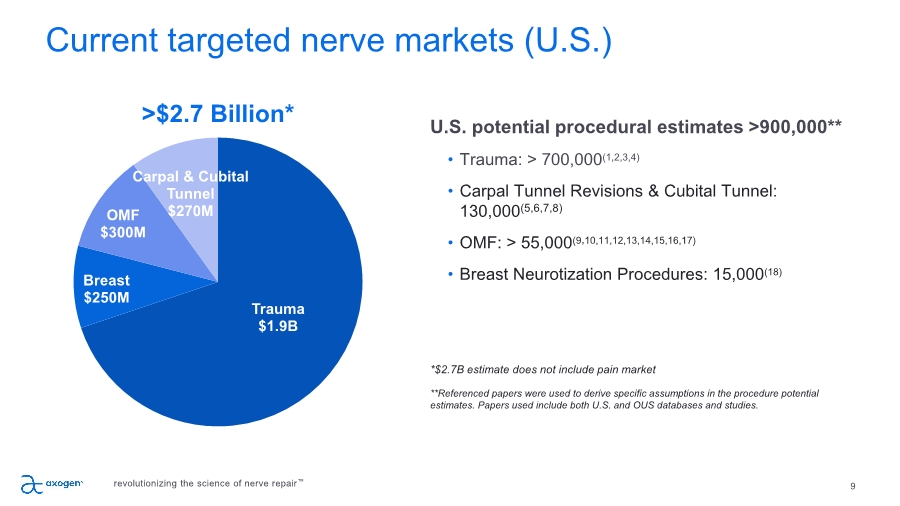

| Current targeted nerve markets (U.S.) 9 Trauma $1.9B Breast $250M OMF $300M Carpal & Cubital Tunnel $270M U.S. potential procedural estimates >900,000** • Trauma: > 700,000(1,2,3,4) • Carpal Tunnel Revisions & Cubital Tunnel: 130,000(5,6,7,8) • OMF: > 55,000(9,10,11,12,13,14,15,16,17) • Breast Neurotization Procedures: 15,000(18) *$2.7B estimate does not include pain market **Referenced papers were used to derive specific assumptions in the procedure potential estimates. Papers used include both U.S. and OUS databases and studies. >$2.7 Billion* revolutionizing the science of nerve repair™ |

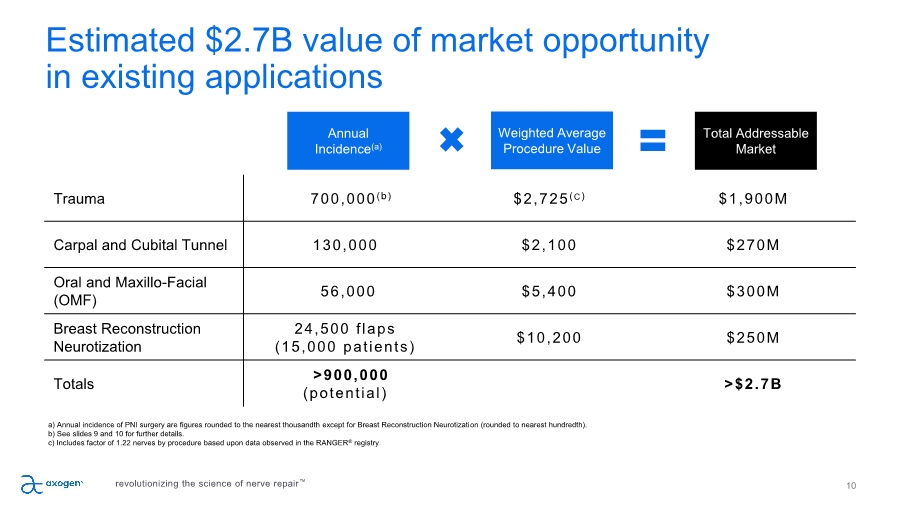

| Annual Incidence(a) Weighted Average Procedure Value Total Addressable Market Trauma 700,000(b) $2,725(C) $1,900M Carpal and Cubital Tunnel 130,000 $2,100 $270M Oral and Maxillo-Facial (OMF) 56,000 $5,400 $300M Breast Reconstruction Neurotization 24,500 flaps (15,000 patients) $10,200 $250M Totals >900,000 (potential) >$2.7B a) Annual incidence of PNI surgery are figures rounded to the nearest thousandth except for Breast Reconstruction Neurotization (rounded to nearest hundredth). b) See slides 9 and 10 for further details. c) Includes factor of 1.22 nerves by procedure based upon data observed in the RANGER® registry. 10 Estimated $2.7B value of market opportunity in existing applications revolutionizing the science of nerve repair™ |

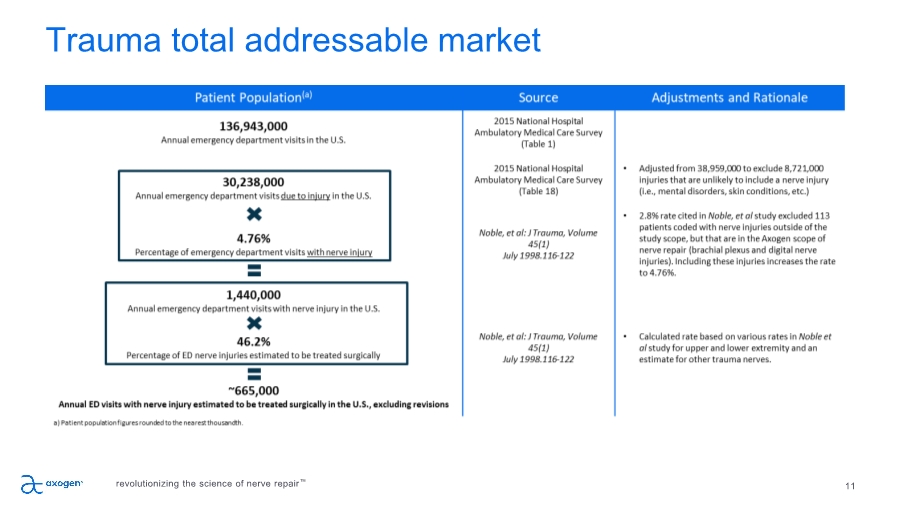

| 11 Trauma total addressable market revolutionizing the science of nerve repair™ |

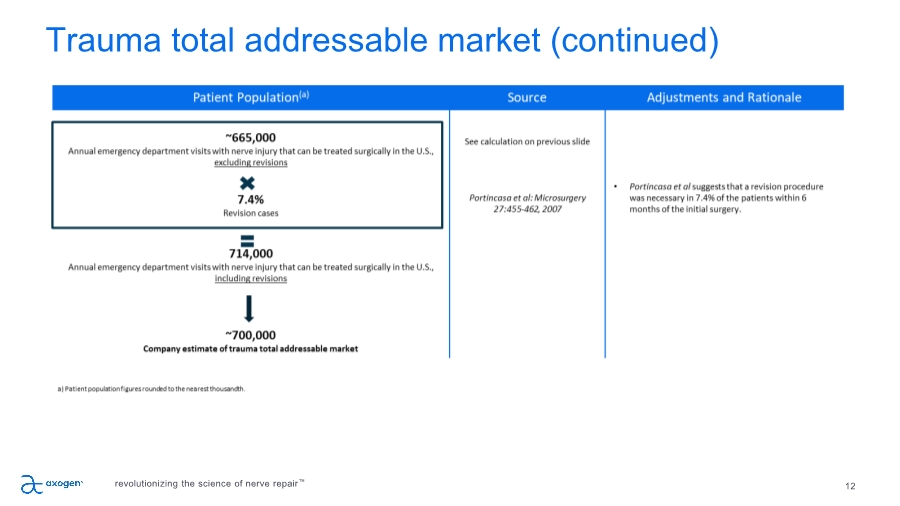

| Trauma total addressable market (continued) 12 revolutionizing the science of nerve repair™ |

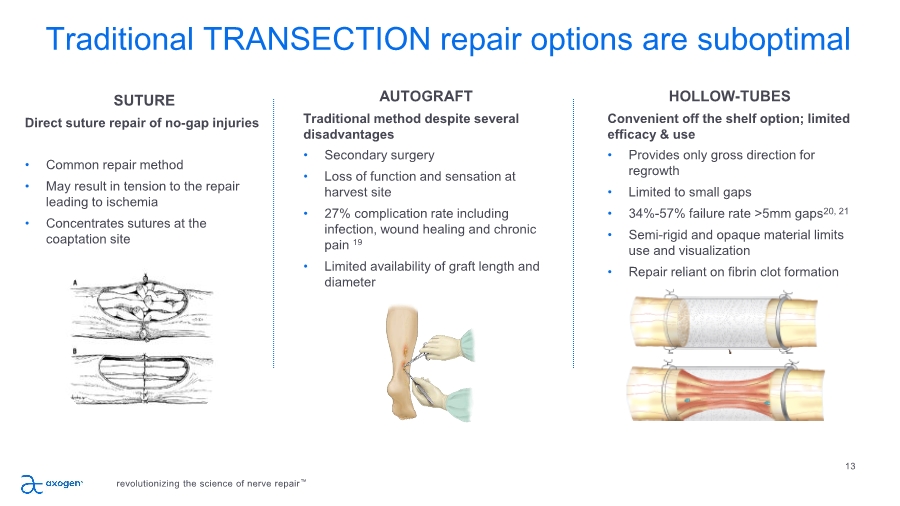

| Traditional TRANSECTION repair options are suboptimal 13 SUTURE Direct suture repair of no-gap injuries • Common repair method • May result in tension to the repair leading to ischemia • Concentrates sutures at the coaptation site AUTOGRAFT Traditional method despite several disadvantages • Secondary surgery • Loss of function and sensation at harvest site • 27% complication rate including infection, wound healing and chronic pain 19 • Limited availability of graft length and diameter HOLLOW-TUBES Convenient off the shelf option; limited efficacy & use • Provides only gross direction for regrowth • Limited to small gaps • 34%-57% failure rate >5mm gaps20, 21 • Semi-rigid and opaque material limits use and visualization • Repair reliant on fibrin clot formation revolutionizing the science of nerve repair™ |

| 14 25 µm Processed human nerve allograft for bridging nerve gaps Clinically studied off-the-shelf alternative • A biologically active nerve therapy with more than ten years of comprehensive clinical evidence • 84% meaningful recovery in sensory, mixed and motor nerve gaps in multi-center study22 • Eliminates need for an additional surgical site and risks of donor nerve harvest22 • May reduce OR time Structural support for regenerating axons • Cleansed and decellularized extracellular matrix (ECM) • Offers the benefits of human peripheral nerve micro-architecture and handling Revascularizes and remodels into patient’s own tissue similar to autologous nerve23 16 Size options in a variety of lengths (up to 70mm) and diameters (up to 5mm) Only minimally processed porcine ECM for connector-assisted coaptation Alternative to direct suture repair • Reduces the risk of forced fascicular mismatch24, 25 Alleviates tension at critical zone of regeneration • Disperses tension across repair site26 • Moves suture inflammation away from coaptation face27, 28 Revascularizes and remodels into patient’s own tissue28, 29, 30, 31 Axogen solutions for TRANSECTION repair revolutionizing the science of nerve repair™ |

| Traditional COMPRESSION repair options are suboptimal 15 VEIN WRAPPING Autologous vein • Barrier to attachment to surrounding tissue • Requires extra time and skill to perform spiral wrapping technique • Second surgery site HYPOTHENAR FAT PAD Autologous vascularization flap • Barrier to attachment to surrounding tissue • Only wraps part of the nerve circumference • Increases procedure time COLLAGEN WRAPS Off-the-shelf • Semi-rigid material limits use • Degrades over time and does not provide a lasting barrier to soft tissue attachment revolutionizing the science of nerve repair™ |

| 16 Axogen solution for COMPRESSION repair Minimally processed porcine extracellular matrix for wrapping and protecting injured peripheral nerve Protects repair site from surrounding tissue • Processing results in an implant that works with the body’s natural healing process32 • Minimizes soft tissue attachments33 Allows nerve gliding • Minimizes risk of entrapment33 • Creates a barrier between repair and surrounding tissue bed33 • ECM Revascularizes and remodels into patient’s own tissue29,34 Easy to use • Semi-translucent to allow visualization of underlying nerve • Conforms to nerve revolutionizing the science of nerve repair™ |

| 17 Processed human umbilical cord intended for surgical use as a resorbable soft tissue barrier Smart processing to preserve the natural properties of the umbilical cord amniotic membrane Designed with the surgeon in mind • Easy to handle, suture, or secure during a surgical procedure • Up to 8x thicker than placental amniotic membrane alone35 • Specifically designed as a resorbable soft tissue barrier to separate the tissue layers for at least 16 weeks36 Axogen resorbable solution to protect from the surrounding environment revolutionizing the science of nerve repair™ |

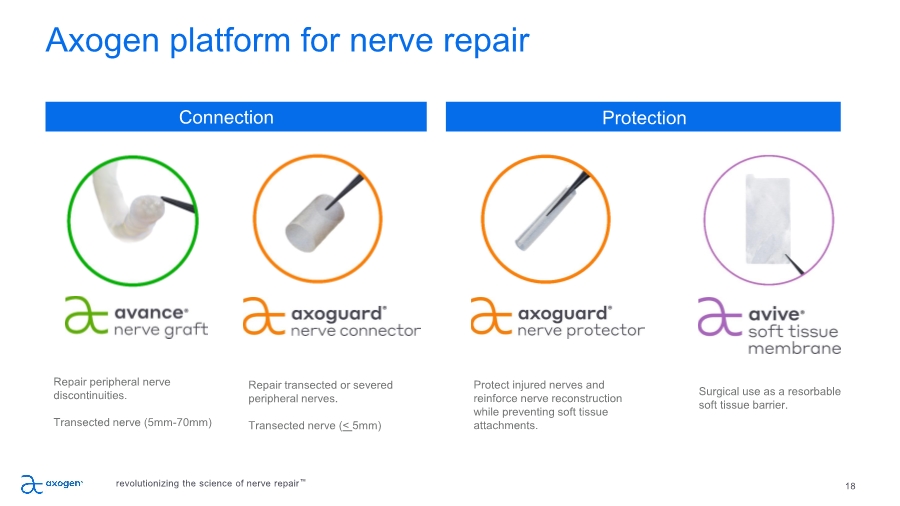

| Axogen platform for nerve repair 18 Repair peripheral nerve discontinuities. Transected nerve (5mm-70mm) Repair transected or severed peripheral nerves. Transected nerve (< 5mm) revolutionizing the science of nerve repair™ Connection Protection Protect injured nerves and reinforce nerve reconstruction while preventing soft tissue attachments. Surgical use as a resorbable soft tissue barrier. |

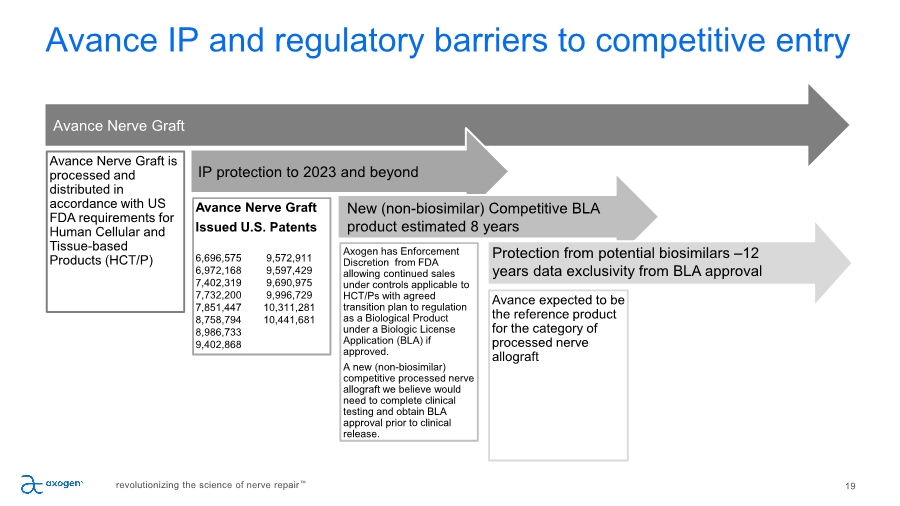

| 19 Avance IP and regulatory barriers to competitive entry Avance Nerve Graft is processed and distributed in accordance with US FDA requirements for Human Cellular and Tissue-based Products (HCT/P) Avance Nerve Graft Issued U.S. Patents 6,696,575 9,572,911 6,972,168 9,597,429 7,402,319 9,690,975 7,732,200 9,996,729 7,851,447 10,311,281 8,758,794 10,441,681 8,986,733 9,402,868 Axogen has Enforcement Discretion from FDA allowing continued sales under controls applicable to HCT/Ps with agreed transition plan to regulation as a Biological Product under a Biologic License Application (BLA) if approved. A new (non-biosimilar) competitive processed nerve allograft we believe would need to complete clinical testing and obtain BLA approval prior to clinical release. Avance expected to be the reference product for the category of processed nerve allograft Avance Nerve Graft IP protection to 2023 and beyond New (non-biosimilar) Competitive BLA product estimated 8 years Protection from potential biosimilars –12 years data exclusivity from BLA approval revolutionizing the science of nerve repair™ |

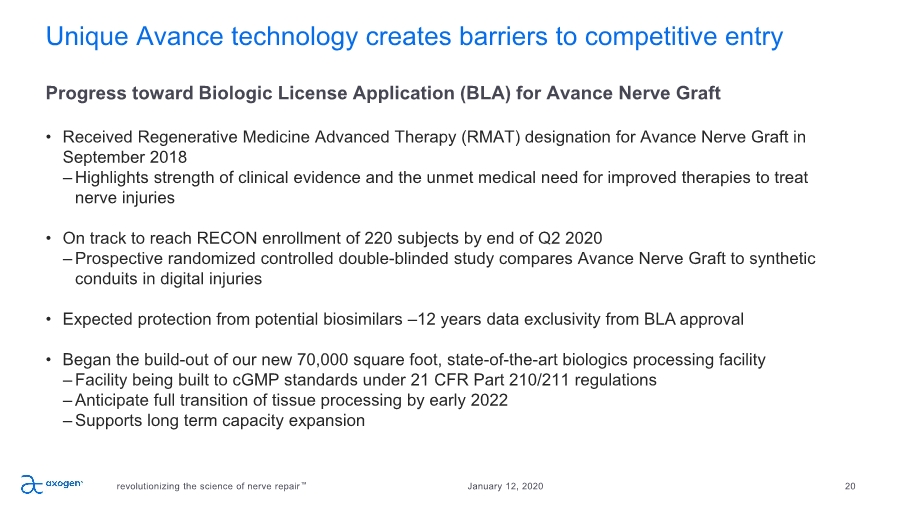

| Unique Avance technology creates barriers to competitive entry revolutionizing the science of nerve repair™ 20 January 12, 2020 Progress toward Biologic License Application (BLA) for Avance Nerve Graft • Received Regenerative Medicine Advanced Therapy (RMAT) designation for Avance Nerve Graft in September 2018 – Highlights strength of clinical evidence and the unmet medical need for improved therapies to treat nerve injuries • On track to reach RECON enrollment of 220 subjects by end of Q2 2020 – Prospective randomized controlled double-blinded study compares Avance Nerve Graft to synthetic conduits in digital injuries • Expected protection from potential biosimilars –12 years data exclusivity from BLA approval • Began the build-out of our new 70,000 square foot, state-of-the-art biologics processing facility – Facility being built to cGMP standards under 21 CFR Part 210/211 regulations – Anticipate full transition of tissue processing by early 2022 – Supports long term capacity expansion |

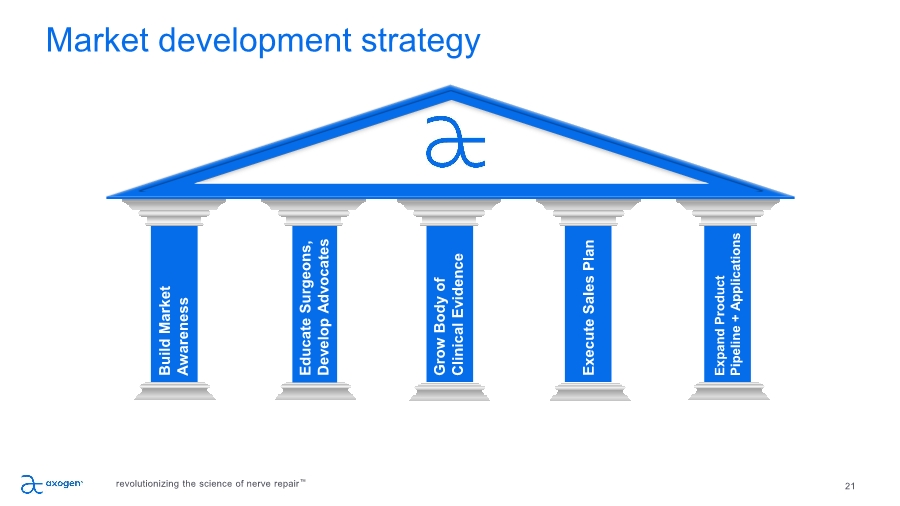

| 21 Market development strategy Build Market Awareness Educate Surgeons, Develop Advocates Grow Body of Clinical Evidence Execute Sales Plan Expand Product Pipeline + Applications revolutionizing the science of nerve repair™ |

| 22 Focus on building awareness among surgeons, patients, and investors Build Market Awareness Participate in clinical conferences • Exhibits, podium presentations, KOL panels Promote awareness among patients • Axogen patient ambassador program Garner positive media attention • National, regional and local broadcast, print and online revolutionizing the science of nerve repair™ |

| 23 P I L L A R 2 Emphasis on education Build Market Awareness Educate Surgeons, Develop Advocates • During the last 3 years, held 58 national programs including 25 in 2019 • Trained three-quarters of hand and microsurgery Fellows in 2019 • Expanded offering includes trauma, Breast, OMF, Pain and Fellows national programs as well as targeted regional programs • Expect to train three-quarters of hand and microsurgery Fellows in 2020 revolutionizing the science of nerve repair™ |

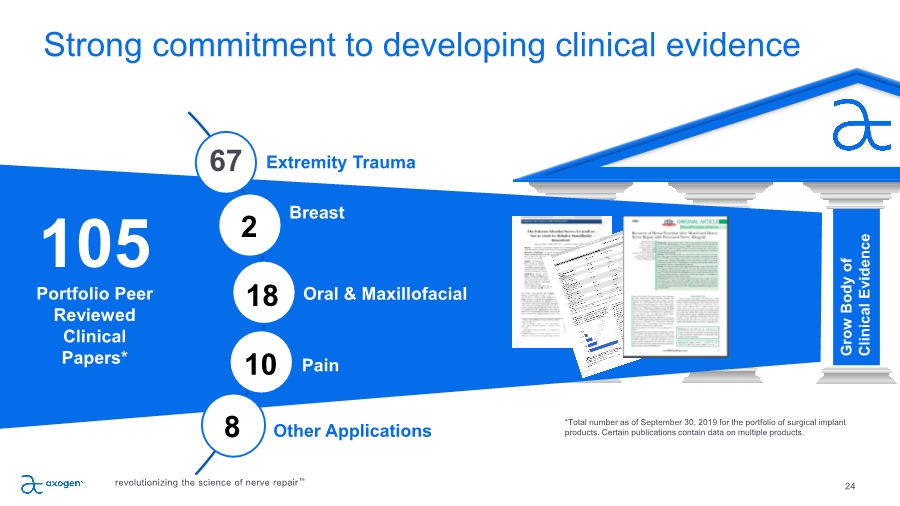

| 24 P I L L A R 3 *Total number as of September 30, 2019 for the portfolio of surgical implant products. Certain publications contain data on multiple products. Strong commitment to developing clinical evidence Build Market Awareness Educate Surgeons, Develop Advocates Grow Body of Clinical Evidence 105 Portfolio Peer Reviewed Clinical Papers* Extremity Trauma Breast Oral & Maxillofacial Other Applications 67 2 Pain 18 10 8 revolutionizing the science of nerve repair™ |

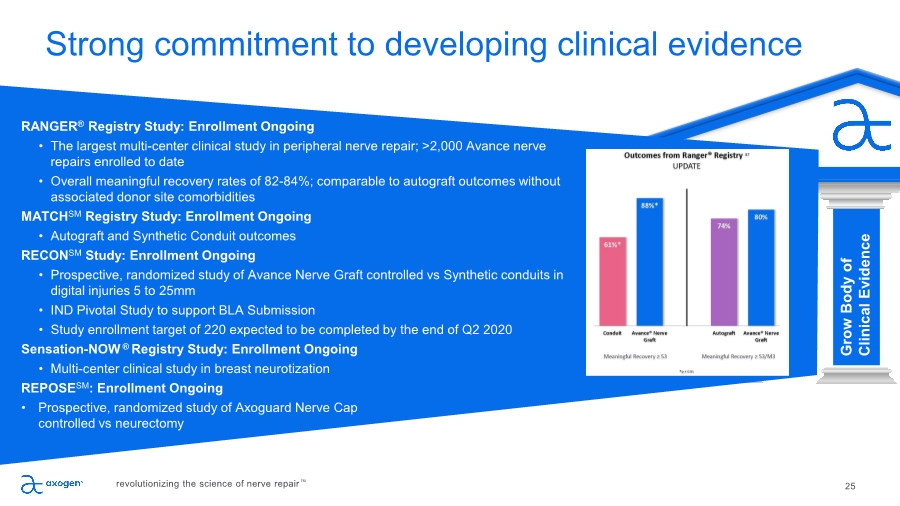

| 25 P I L L A R 3 Strong commitment to developing clinical evidence Build Market Awareness Educate Surgeons, Develop Advocates Grow Body of Clinical Evidence RANGER® Registry Study: Enrollment Ongoing • The largest multi-center clinical study in peripheral nerve repair; >2,000 Avance nerve repairs enrolled to date • Overall meaningful recovery rates of 82-84%; comparable to autograft outcomes without associated donor site comorbidities MATCHSM Registry Study: Enrollment Ongoing • Autograft and Synthetic Conduit outcomes RECONSM Study: Enrollment Ongoing • Prospective, randomized study of Avance Nerve Graft controlled vs Synthetic conduits in digital injuries 5 to 25mm • IND Pivotal Study to support BLA Submission • Study enrollment target of 220 expected to be completed by the end of Q2 2020 Sensation-NOW ® Registry Study: Enrollment Ongoing • Multi-center clinical study in breast neurotization REPOSESM: Enrollment Ongoing • Prospective, randomized study of Axoguard Nerve Cap controlled vs neurectomy revolutionizing the science of nerve repair™ |

| 26 P I L L A R 4 Focused sales execution, increasing market penetration Build Market Awareness Educate Surgeons, Develop Advocates Grow Body of Clinical Evidence Execute Sales Plan Sales execution focused on driving results • Continue expansion by driving penetration in active accounts and adding new active accounts • 5,100 potential U.S. accounts perform nerve repair • 797 active accounts as of December 31, 2019 o Top 10% of active accounts represent approximately 35% of total revenue Expanded sales reach • U.S. direct sales team o 85 direct sales professionals at end of 2018 o 109 direct sales professionals at end of 2019 o 126 - 131 direct sales professionals expected by end of 2020 • Supplemented by independent agencies • Revenue from direct sales channel represented approximately 90% of total revenue in Q4 revolutionizing the science of nerve repair™ |

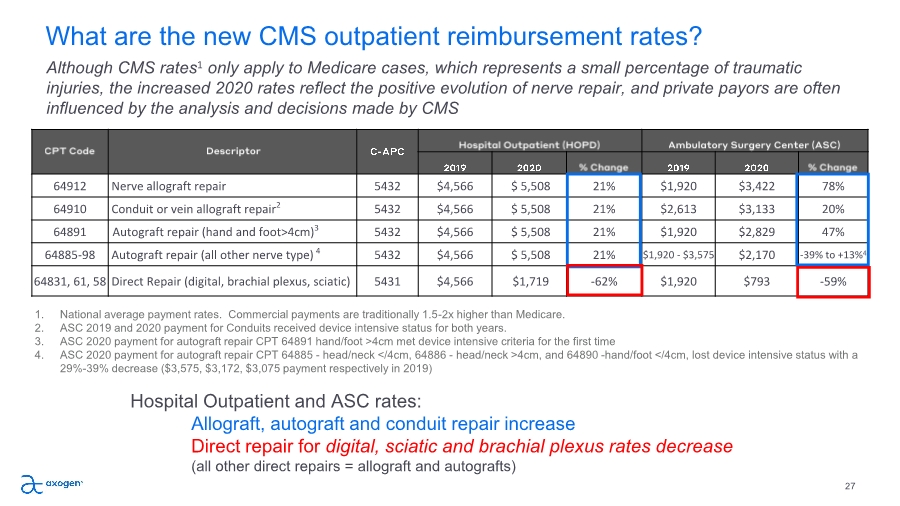

| 64912 Nerve allograft repair 5432 $4,566 $ 5,508 21% $1,920 $3,422 78% 64910 Conduit or vein allograft repair2 5432 $4,566 $ 5,508 21% $2,613 $3,133 20% 64891 Autograft repair (hand and foot>4cm)3 5432 $4,566 $ 5,508 21% $1,920 $2,829 47% 64885-98 Autograft repair (all other nerve type) 4 5432 $4,566 $ 5,508 21% $1,920 - $3,575 $2,170 -39% to +13%4 64831, 61, 58 Direct Repair (digital, brachial plexus, sciatic) 5431 $4,566 $1,719 -62% $1,920 $793 -59% What are the new CMS outpatient reimbursement rates? 27 Although CMS rates1 only apply to Medicare cases, which represents a small percentage of traumatic injuries, the increased 2020 rates reflect the positive evolution of nerve repair, and private payors are often influenced by the analysis and decisions made by CMS Hospital Outpatient and ASC rates: Allograft, autograft and conduit repair increase Direct repair for digital, sciatic and brachial plexus rates decrease (all other direct repairs = allograft and autografts) 1. National average payment rates. Commercial payments are traditionally 1.5-2x higher than Medicare. 2. ASC 2019 and 2020 payment for Conduits received device intensive status for both years. 3. ASC 2020 payment for autograft repair CPT 64891 hand/foot >4cm met device intensive criteria for the first time 4. ASC 2020 payment for autograft repair CPT 64885 - head/neck </4cm, 64886 - head/neck >4cm, and 64890 -hand/foot </4cm, lost device intensive status with a 29%-39% decrease ($3,575, $3,172, $3,075 payment respectively in 2019) |

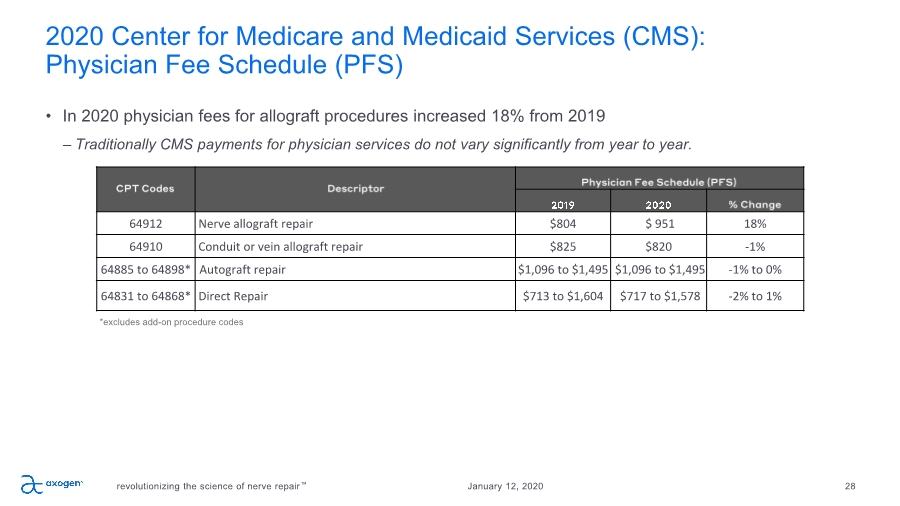

| 2020 Center for Medicare and Medicaid Services (CMS): Physician Fee Schedule (PFS) revolutionizing the science of nerve repair™ 28 January 12, 2020 • In 2020 physician fees for allograft procedures increased 18% from 2019 – Traditionally CMS payments for physician services do not vary significantly from year to year. 64912 Nerve allograft repair $804 $ 951 18% 64910 Conduit or vein allograft repair $825 $820 -1% 64885 to 64898* Autograft repair $1,096 to $1,495 $1,096 to $1,495 -1% to 0% 64831 to 64868* Direct Repair $713 to $1,604 $717 to $1,578 -2% to 1% *excludes add-on procedure codes |

| 29 P I L L A R 5 Expand the opportunity in nerve repair Build Market Awareness Educate Surgeons, Develop Advocates Grow Body of Clinical Evidence Execute Sales Plan Expand Product Pipeline + Applications International Expansion Product Pipeline Future Market Development Market Expansion Core Business revolutionizing the science of nerve repair™ |

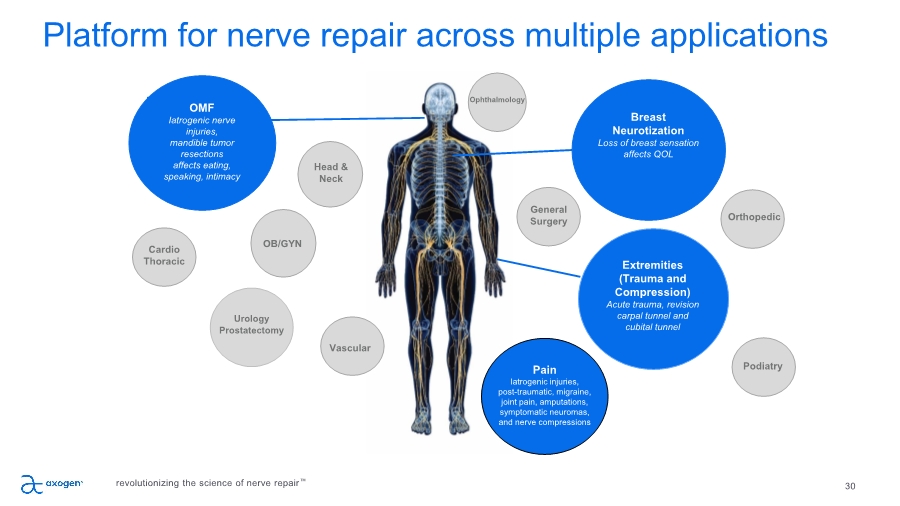

| 30 Platform for nerve repair across multiple applications Breast Neurotization Loss of breast sensation affects QOL Urology Prostatectomy OMF Iatrogenic nerve injuries, mandible tumor resections affects eating, speaking, intimacy Extremities (Trauma and Compression) Acute trauma, revision carpal tunnel and cubital tunnel Head & Neck OB/GYN Ophthalmology General Surgery Pain Iatrogenic injuries, post-traumatic, migraine, joint pain, amputations, symptomatic neuromas, and nerve compressions Cardio Thoracic Orthopedic Podiatry Vascular revolutionizing the science of nerve repair™ |

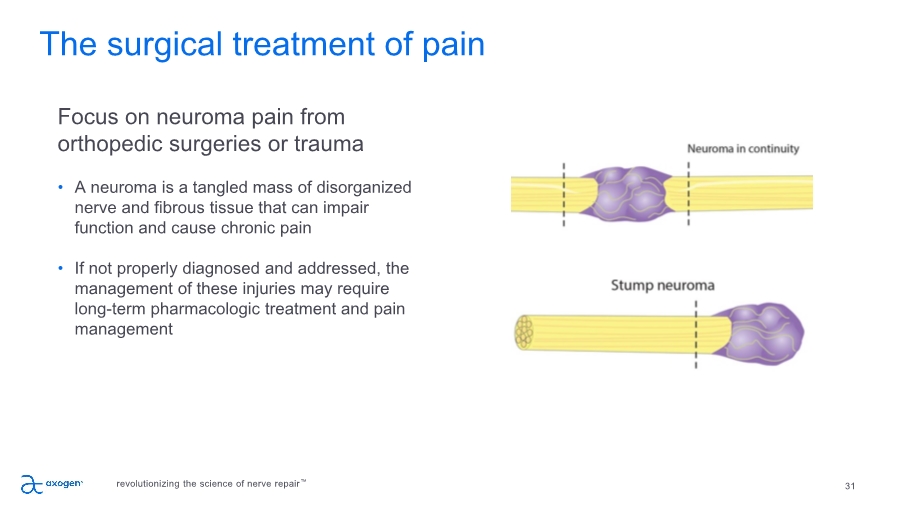

| 31 Focus on neuroma pain from orthopedic surgeries or trauma • A neuroma is a tangled mass of disorganized nerve and fibrous tissue that can impair function and cause chronic pain • If not properly diagnosed and addressed, the management of these injuries may require long-term pharmacologic treatment and pain management The surgical treatment of pain revolutionizing the science of nerve repair™ |

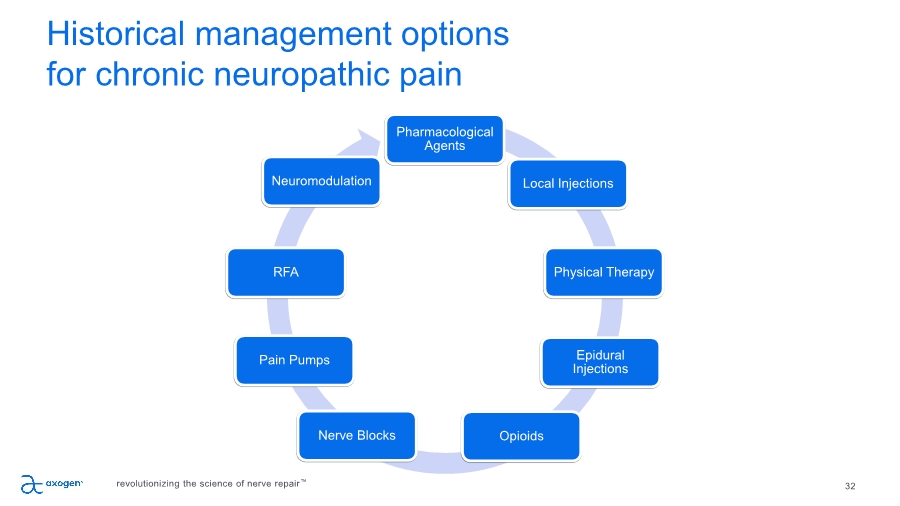

| 32 Pharmacological Agents Local Injections Physical Therapy Epidural Injections Opioids Nerve Blocks Pain Pumps RFA Neuromodulation Historical management options for chronic neuropathic pain revolutionizing the science of nerve repair™ |

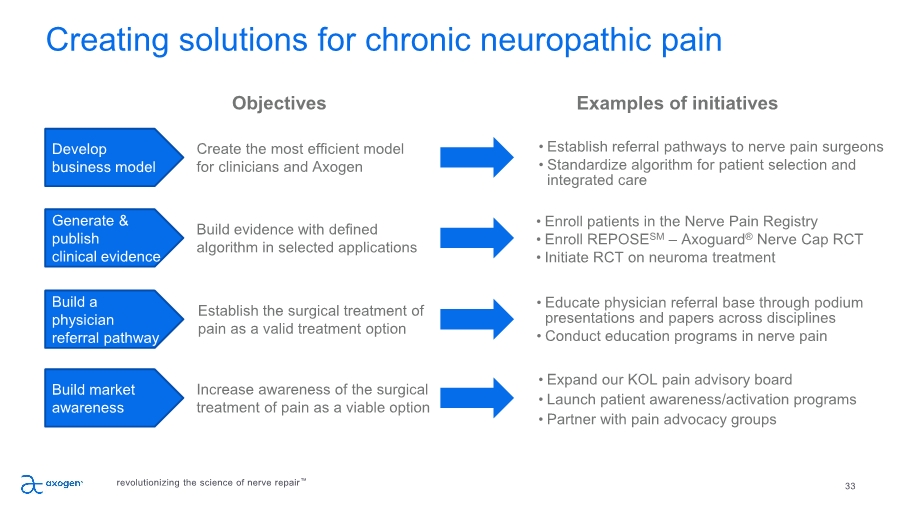

| Creating solutions for chronic neuropathic pain 33 Generate & publish clinical evidence Build a physician referral pathway Build market awareness Examples of initiatives Objectives Build evidence with defined algorithm in selected applications Increase awareness of the surgical treatment of pain as a viable option • Educate physician referral base through podium presentations and papers across disciplines • Conduct education programs in nerve pain Establish the surgical treatment of pain as a valid treatment option Develop business model Create the most efficient model for clinicians and Axogen • Establish referral pathways to nerve pain surgeons • Standardize algorithm for patient selection and integrated care • Expand our KOL pain advisory board • Launch patient awareness/activation programs • Partner with pain advocacy groups • Enroll patients in the Nerve Pain Registry • Enroll REPOSESM – Axoguard® Nerve Cap RCT • Initiate RCT on neuroma treatment revolutionizing the science of nerve repair™ |

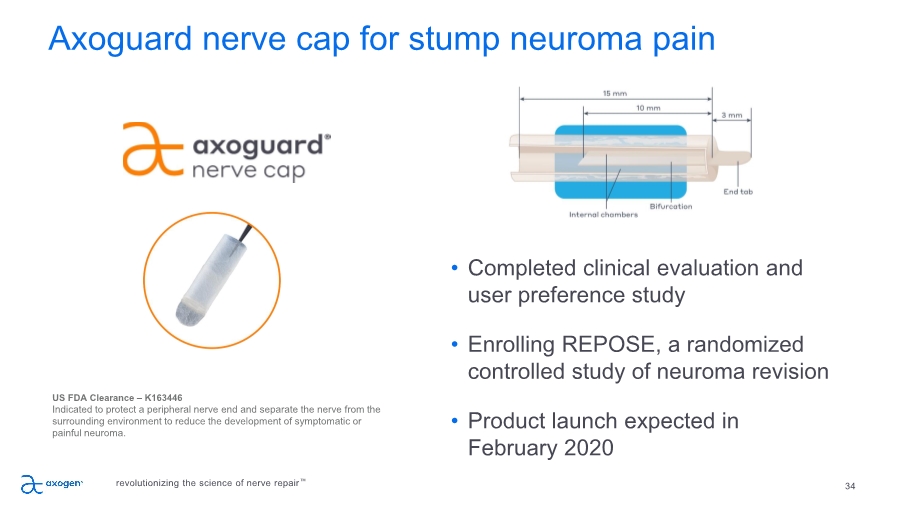

| 34 • Completed clinical evaluation and user preference study • Enrolling REPOSE, a randomized controlled study of neuroma revision • Product launch expected in February 2020 US FDA Clearance – K163446 Indicated to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma. Axoguard nerve cap for stump neuroma pain revolutionizing the science of nerve repair™ |

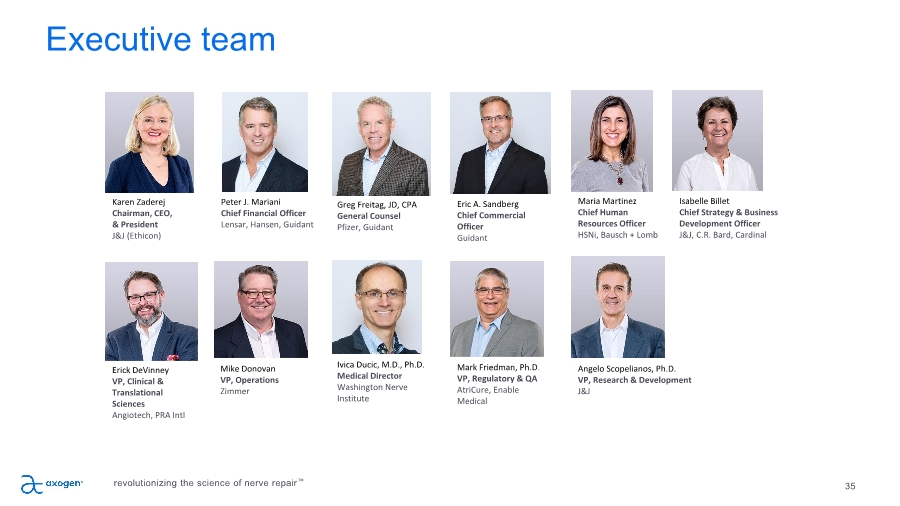

| Executive team 35 Karen Zaderej Chairman, CEO, & President J&J (Ethicon) Greg Freitag, JD, CPA General Counsel Pfizer, Guidant Erick DeVinney VP, Clinical & Translational Sciences Angiotech, PRA Intl Mike Donovan VP, Operations Zimmer Peter J. Mariani Chief Financial Officer Lensar, Hansen, Guidant Eric A. Sandberg Chief Commercial Officer Guidant Ivica Ducic, M.D., Ph.D. Medical Director Washington Nerve Institute Angelo Scopelianos, Ph.D. VP, Research & Development J&J Isabelle Billet Chief Strategy & Business Development Officer J&J, C.R. Bard, Cardinal Maria Martinez Chief Human Resources Officer HSNi, Bausch + Lomb Mark Friedman, Ph.D. VP, Regulatory & QA AtriCure, Enable Medical revolutionizing the science of nerve repair™ |

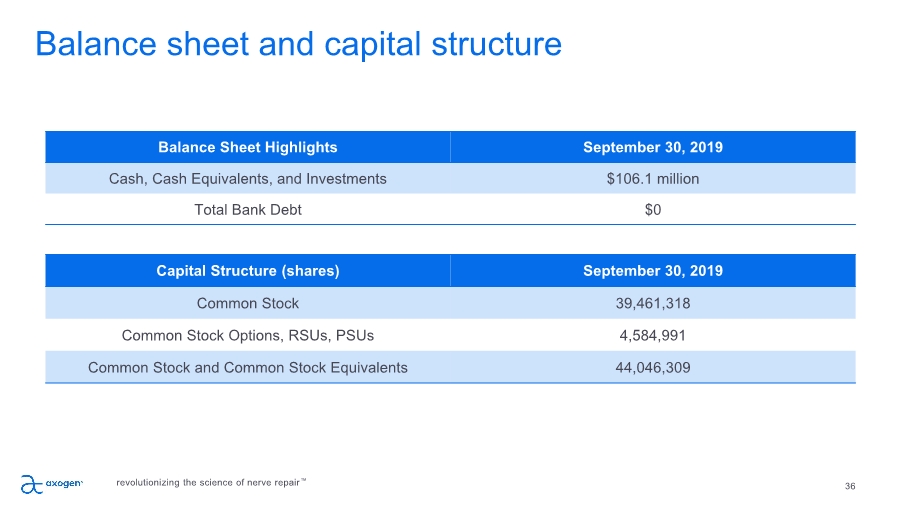

| 36 Balance Sheet Highlights September 30, 2019 Cash, Cash Equivalents, and Investments $106.1 million Total Bank Debt $0 Capital Structure (shares) September 30, 2019 Common Stock 39,461,318 Common Stock Options, RSUs, PSUs 4,584,991 Common Stock and Common Stock Equivalents 44,046,309 Balance sheet and capital structure revolutionizing the science of nerve repair™ |

| Axogen is the preeminent nerve repair company with a foundation for long-term sustainable growth 37 ✓ Exclusively focused in peripheral nerve repair across an expanding set of applications addressing large market opportunity ✓ Differentiated platform for nerve repair, anchored with Avance® Nerve Graft ✓ 10+ years of demonstrated clinical consistency and meaningful recovery outcomes ✓ 105 peer-reviewed clinical publications featuring the Axogen product portfolio (as of September 30, 2019) ✓ Avance RMAT designation highlights clinical evidence strength and unmet medical need for improved nerve injury treatments ✓ “Five Pillar” Market Development Strategy delivered 36 consecutive quarters of YOY double-digit growth ✓ Commercial and Professional Education capability to convert experienced surgeons while training the next generation ✓ Significant barriers to competitive entry ✓ Solid balance sheet provides resources to execute business plan ✓ Experienced management team with strong track record of success revolutionizing the science of nerve repair™ |

| nasdaq: axgn Deloitte Technology Fast 500 : 2014, 2015, 2016, 2017, 2018, 2019 Russell 2000 Index : June 2016 DecisionWise Intl Employee Engagement Best Practices Award Winner: 2018 38 revolutionizing the science of nerve repair™ |

| 39 Footnotes 1. National Hospital Ambulatory Medical Care Survey: 2015 Emergency Department Summary Tables – Table 18. https://www.cdc.gov/nchs/data/nhamcs/web_tables/2015_ed_web_tables.pdf 2. Noble, et al.. Analysis of Upper and Lower Extremity Peripheral Nerve Injuries in a Population of Patients with Multiple Injuries. J Trauma. 1998; 45(1): 116-122. 3. Uzun, et al., Traumatic peripheral nerve injuries: demographic and electrophysiologic findings of 802 patients from a developing country. J Clin Neuromusc Dis. 2006; 7(3): 97–103. 4. Portincasa, et al. Microsurgical treatment of injury to peripheral nerves in upper and lower limbs: a critical review of the last 8 years. Microsurgery. 2007; 27(5): 455–462. 5. Medicare National HCPS Aggregate Summary Table CY2016. https://data.cms.gov/Medicare-Physician-Supplier/Medicare-National-HCPCS-Aggregate-Summary-Table-CY/jtra-d83c/data 6. Sotereanos, et al. Vein wrapping for the treatment of recurrent carpal tunnel syndrome. Tech Hand Up Extrem Surg.1997; 1(1):35-40. 7. Seradge, et al. Cubital tunnel release with medial epicondylectomy factors influencing the outcome. J Hand Surg Am. 1998; 23(3): 483-491. 8. Papatheodorou, et al. Preliminary results of recurrent cubital tunnel syndrome treated with neurolysis and porcine extracellular matrix nerve wrap. J Hand Surg Am. 2015; 40(5): 987-992 9. Lin, et al. Systematic Review and Meta-Analysis on Incidence of Altered Sensation of Mandibular Implant Surgery - PLoS One. 2016; 11(4): e0154082. 10. Hussaini. Procedure frequency in the jaws related to implant location. Dent Oral Craniofac Res. 2016; 2(2): 230-233. 11. Nguyen, et al. Risk factors for permanent injury of inferior alveolar and lingual nerves during third molar surgery. J Oral Maxillofac Surg. 2014; 72(12): 2394-2401. 12. Cheung, et al. Incidence of neurosensory deficits and recovery after lower third molar surgery: a prospective clinical study of 4338 cases. Int J Oral Maxillofac Surg. 2010; 39(4): 320–326. 13. Dental Implants Market (Product - Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implants; Material - Titanium Implants, Zirconium Implants; End User - Hospitals, Dental Clinics, and Academic & Research Institutes) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2017 – 2025. https://www.transparencymarketresearch.com/dental-implants-market.html 14. Cha, et al. Frequency of bone graft in implant surgery. Maxillofac Plast and Reconstr Surg. 2016; 38(1): 19. 15. Miloro, M (ed). Trigeminal Nerve Injuries. Springer; 2013. 16. Pogrel et al. Permanent nerve involvement resulting: From inferior alveolar nerve blocks. J Am Dent Assoc. 2000; 131(7): 901-907. 17. Agbaje, et al. Systematic review of the incidence of inferior alveolar nerve injury in bilateral sagittal split osteotomy and the assessment of neurosensory disturbances. Int. J Oral Maxillofac. Surg. 2015; 44(4): 447-451. 18. ASPS 2017– Plastic Surgery Statistics Report. www.plasticsurgery.org/documents/News/Statistics/2017/plastic-surgery-statistics-full-report-2017.pdf 19. Rappaport, et al. Clinical utilization and complications of sural nerve biopsy. Am J Surg. 1993; 166(3): 252-256. 20. Weber, et al. A randomized prospective study of polyglycolic acid conduits for digital nerve reconstruction in humans. Plast Reconstr Surg. 2000; 106(5): 1036-1045. 21. Wangensteen, et al. Collagen tube conduits in peripheral nerve repair: A retrospective analysis. Hand. 2010; 5(3): 273-277. 22. Data on file at Axogen 23. Karabekmez, et al. Early clinical outcomes with the use of decellularized nerve allograft for repair of sensory defects within the hand. Hand. 2009; 4(3): 245-249. 24. Boeckstyns, et al. Collagen conduit versus microsurgical neurorrhaphy: 2-year follow-up of a prospective, blinded clinical and electrophysiological multicenter randomized, controlled trial. J hand Surg Am. 2013; 38(12): 2405-2411. 25. Brushart, et al. Selective reinnervation of distal motor stumps by peripheral motor axons. Exp Neurol. 1987; 97(2): 289-300. 26. Schmidhammer, et al. Alleviated tension at the repair site enhances functional regeneration: The effect of full range of motion mobilization on the regeneration of peripheral nerves--histologic, electrophysiologic, and functional results in a rat model. J Trauma. 2004; 56(3): 571-584. 27. Tang, et al. The optimal number and location of sutures in conduit-assisted primary digital nerve repair. J Hand Surg Eur Vol. 2018; 43(6): 621-625. 28. Data on file at Axogen 29. Badylak, et al. Small intestinal submucosa: A substrate for in vitro cell growth. J Biomater Sci Polym Ed. 1998; 9(8): 863-878. 30. Hodde, et al. Effects of sterilization on an extracellular matrix scaffold: Part II. Bioactivity and matrix interaction. J Mater Sci Mater Med. 2007; 18(4): 545-550. 31. Nihsen, et al. Bioactivity of small intestinal submucosa and oxidized regenerated cellulose/collagen. Adv Skin Wound Care. 2008; 21(10): 479-486. 32. Hodde, et al. Vascular endothelial growth factor in porcine-derived extracellular matrix. Endothelium. 2001; 8(1): 11-24. 33. Data on file at Axogen 34. Kokkalis, et al. Assessment of processed porcine extracellular matrix as a protective barrier in a rabbit nerve wrap model. J Recon MicroSurg. 2011; 27(1): 19-28. 35. Data on file at Axogen 36. Data on file at Axogen 37. Data on file at Axogen. American Society for Surgery of the Hand. 2019. revolutionizing the science of nerve repair™ Avance Nerve Graft, Axoguard Nerve Protector, Axoguard Nerve Connector, Axoguard Nerve Cap, Avive Soft Tissue Membrane, RANGER, revolutionizing the science of nerve repair, and their logos are trademarks of Axogen Corporation. Axoguard Nerve Connector and Axoguard Nerve Protector are manufactured in the United States by Cook Biotech Incorporated, West Lafayette, Indiana, and are distributed exclusively by Axogen Corporation. LB 588 |